Edwin Tan

In this article, we examine ONE Gas (NYSE:OGS), a 100% regulated gas utility. I enjoy investing in simple-to-understand companies with comprehensible business models and growth opportunities. Regulated utilities provide protection and other is usually a mechanism to increase earnings with time. Customers are often sticky and competition can be scarce because of the nature of the utility. In the article, I explain why I like the company and its strengths and benefits. I look at the valuation and investment opportunities to explain why I think OGS is a solid investment and company but a Hold at this price.

The other week I looked at Southwest Gas; I found it to be wracked by the previous acquisitions as it attempted to transition away from a 100% regulated utility and, now, finding itself in disputes with activist shareholders and in the middle of a strategic review. Sometimes, less is more and there is beauty and elegance to a straightforward business that allows you to grow your wealth. I will come back to this point later – but such a business requires investment at the right time/price to enable long-term compounding of wealth and we see that here.

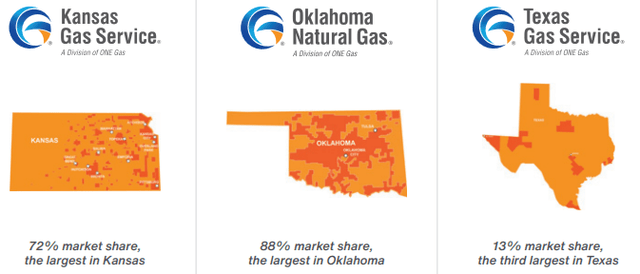

ONE Gas has around 2.3 million customers and 64,200 miles of distribution mains and transmission pipelines, serving three states (Figure 1). They have planned investments over a 20-year investment runway for the vintage pipeline replacement program, replacing 5,000 miles of pipes and approximately 750 miles from 2022 to 2026.

Figure 1. ONE Gas geographic service over three states (ONE Gas 2021 Annual Report (p. 3))

In early 2022, Moody’s revised ONE Gas outlook to stable, affirming ratings, and is now at an “A3” rating and stable. OGS has an SA&P Credit rating of “A-“, reflecting a strong and secure company (Source: September Investor Update).

ONE Gas has performed well, and has an 8.6% five-year revenue average growth rate and a 5.0% five-year EPS growth rate (Source: Stock Rover). There is a relatively short history here, but OGS seems to grow consistently and steadily.

Operational considerations for ONE Gas

There are, as always, increasing considerations for investing in future developments and more green energy. As such, ONE Gas has turned their attention to renewable natural gas:

One Gas is focusing almost exclusively on building pipeline interconnections that link sources of renewable natural gas, or RNG, with large-volume gas buyers on its systems in Kansas, Oklahoma and Texas, executives told S&P Global Commodity Insights in an interview. The strategy will mean that the uptake of RNG, a pipeline-quality gas processed from captured methane waste, will largely depend on customers deciding that the fuel is their best option for achieving climate goals.

[…]

Balancing cost impacts with opportunity. It will avoid the risks of investing in RNG production facilities or purchasing the fuel directly […] It also will not require much investment.

We can see a company focused on careful capital expenditure and with an eye to future customer demand for more renewable sources.

The company remains committed to operational efficiency. As well as metrics, they have also been focused on innovative approaches, and have received a patent for an approach that allows them to respond to a disaster by prioritizing inspection of their assets. As they note in the Q2 earnings call,

we wanted to demonstrate the fact that we’ve got employees all across the company who are focused on trying to find innovative ways to address problems, but in a way that also introduces efficiency into the organization.

That’s one of many examples of projects that are underway, as we are focused on affordability, being very conscious of customer bills, and being dedicated to continued activity around efficiency programs and communicating with our customers in a meaningful way around how we might work together to get through this environment.

The ONE Gas Dividend

Seeking Alpha reports a 3.11 forward dividend yield and a five-year DGR of 8.67%. Like many utilities, the starting yield is lower now than at other times, but the DGR should make up for this. OGS scores a B+ for dividend safety and a B for growth.

Further, in the September Investor Update, the importance of the dividends is stressed, with an annual dividend increase of 6-8% per annum guided through 2026 while targeting an annual payout ratio of 55 to 65% of net income. They are also guiding for net income increases of 8-10% and earnings per diluted share of 6-8%.

How ONE Gas compares to its Peers

For the comparison with peers, I’ve used a range of gas utilities:

- Chesapeake Utilities (CPK)

- New Fortress Energy (NFE)

- NiSource (NI)

- New Jersey Resources (NJR)

- Northwest Natural Holding (NWN)

- RGC Resources (RGCO)

- Southwest Gas (SWX); I have previously covered Southwest Gas

- Spire (SR); I have previously covered Spire.

- UGI (UGI)

In terms of valuation, ONE Gas appears to hold an average valuation. Table 1 includes the top two metrics in each column bolded. We can see that OGS about an average EV/Sales multiple, below the average of 3.8x. The EV/EBITDA is on the high side, with the second highest valuation by this metric. The Price / Sales multiple appears more favorable, where OGS is just above the average valuation.

Table 1. ONE Gas compared to its peers over multiple valuation metrics

| Ticker | EV / Sales (LTM) | EV / EBITDA | Price / Sales (LTM) |

| CPK | 4.8 | 13.8 | 3.6 |

| NFE | 7.1 | 38.1 | 5.1 |

| NI | 4.3 | 11.8 | 2.3 |

| NJR | 2.7 | 15.3 | 1.6 |

| NWN | 3.2 | 11.3 | 1.6 |

| OGS | 3.7 | 15.8 | 1.9 |

| RGCO | 4.1 | -23.3 | 2.3 |

| SR | 3.6 | 12.5 | 1.7 |

| SWX | 2.6 | 14.5 | 1.1 |

| UGI | 1.4 | 5.1 | 0.8 |

| Summary | 3.7 | 11.5 | 1.7 |

Source: Author, with data from Stock Rover

Valuation and investment opportunities in ONE Gas

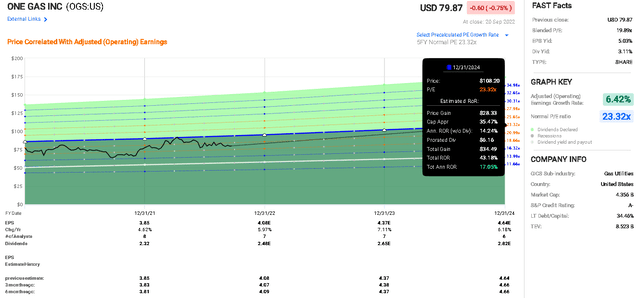

To assess the valuation and opportunities for investing in ONE Gas, I will turn to FAST Graphs. The software allows me to use analysts’ estimates of earnings and a target P/E multiple to assess likely returns if prices reach that multiple and that earnings level. The calculator enables an assessment of likely outcomes, using consensus estimates and historically achieved P/E ratios to assess what would happen if prices move in line with the expectations.

This requires two specific outcomes to understand the likely rate of return: the analyst estimates must be accurate and the P/E must be reasonable.

The FAST Graphs analyst scorecard suggests a 71% hit and 29% beat over one-year forward estimates with a 10% margin of error and an 83% hit and 17% beat over two-year estimates (20% margin of error). This is good, stable, and steady, and suggests that there is good guidance in place and it is an easily understood business.

If we assume that the PE returns to the normalized P/E of 23.32x (as achieved over the last five years), then this would suggest that at the end of 2024, based on the analysts’ estimates of earnings that prices would reach 108.20, giving a total rate of return of 43.18% and an annualized rate of return of 17% (Figure 2).

Figure 2. ONE Gas analysts’ estimates and P/E ratios used to estimate the rate of return (FAST Graphs)

Such a P/E multiple is, I feel, rather rich. If we assume a more moderated P/E of 15x (P/E=G), using the FAST Graphs forecasting calculator, this would give us a total RoR by 2024 of -5.15% or an annualized RoR of -2.29%. I think this is a conservative and unlikely outcome given the quality of the company. Since 2015 (commencement of trading), OGS has traded above the 15x P/E, reading points such as 19x in 2015 and in early 2020, with the lowest point I see being 16.78x in September 2021.

Realistically, I see an 18x P/E multiple as a reasonable outcome here, and the FAST Graphs forecasting calculator suggests that by the end of 2024, this would give a total RoR of 12.28% or an annualized RoR of 5.21%.

We can also look at the bottom panel of Figure 2 and get a sense of how much the analysts’ estimates of earnings have changed over the last six months. In general, we see reasonable stability of the estimates, providing assurance of the stability of the underlying business.

I like the business but see the price as reasonable. Analysts seem to have a similar perspective and I see 3 Buy and 4 Hold amongst the analysts’ recommendations with a median analyst target of $90 (Source: Finbox.io), suggesting about 12.6% upside from the current price.

So, whether OGS is a good investment does not appear to be in doubt – This is a solid company and much of the upside return simply rests from when you enter your positions or investment tranches. For instance, if you bought at the low P/E in September 2021 and held to the end of 2024, and a 15x P/E resulted, this would still be a total RoR of 22.44% or an annualized RoR of 6.4% (Source: FAST Graphs calculator).

Looking at OGS, therefore, and assessing the investment opportunity requires considering the price and value at the time of the investment. At the present time, as I suggest, I think there is still some potential for downside (for example, if a 15x P/E eventuated in several years) but, largely, this should be secure and provide upside. If prices declined during this period, I would see this as a good opportunity to dollar cost average into the position and lower the cost basis.

Therefore, at the present time, there is no margin of safety but some upside potential.

A summary of my thoughts on ONE Gas

I have started to include a brief summary section that might be useful when my thoughts were for a Hold or tentatively edging into a Buy.

Business: Very solid, good ratings by credit agencies, simple business, and 100% regulated. Should compound and grow steadily over time.

Valuation: no margin of safety but not over-priced. Some upside here is based on expected revenue growths if normalized P/E is maintained.

Financial safety: A- rated by S&P, solid and safe.

Dividend: A reasonable 3.11% yield is about 2x the market average; dividend raises have been guided to be strong. Good dividend coverage and security.

Catalysts: none apparent.

Recent moves – some exploration into RNG. A strong focus on efficiencies.

Thesis

ONE Gas is, in my opinion, the quintessential gas utility. The business is 100% regulated and has solid, steady growth prospects. There are steady plans for capital expenditures (e.g., the vintage pipeline replacement program) and a strong awareness of the role of dividends and dividend raises for investors.

I rate ONE Gas as a Hold as I continue to like the business and management.

There is upside potential, and the valuation is reasonable; however, no margin of safety exists and there is a reasonable potential for prices to decline further. Note, however, that if prices decline (a disconnect from the underlying growth of the business), this would represent increasingly attractive buying opportunities. As an investment, ONE Gas should compound returns for years, but buying at the right price will maximize potential returns.

I suggest OGS goes on the watch list while we wait for better prices.

Be the first to comment