JHVEPhoto/iStock Editorial via Getty Images

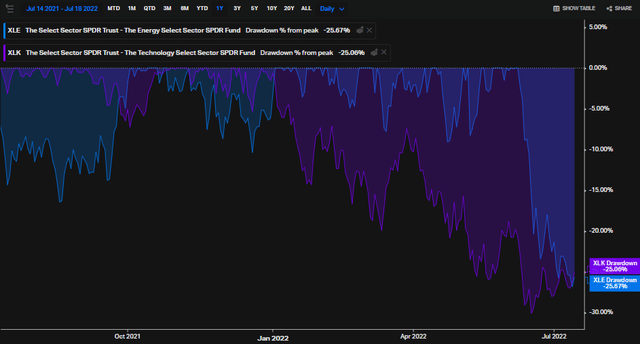

The energy sector has come under attack over the last six weeks. After peaking above $93 on June 8, the Energy Select Sector SPDR ETF (XLE) is down more than 25%. That current drawdown is remarkably more than the decline seen in the Technology sector fund (XLK). Oil and gas stocks’ fall from grace comes as inflation fears cool somewhat and recession risks become top of mind.

A Bigger Drawdown in XLE Than XLK

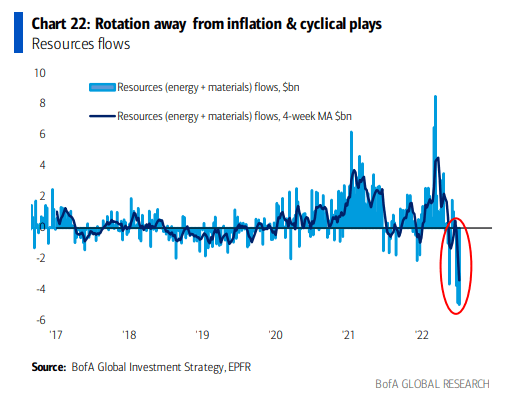

Resource-related areas, namely energy and materials equities, have also seen major fund outflows, according to Bank of America Global Research and EPFR data. Investors have fled inflation plays and stocks exposed to the cyclical area of the global market.

Drastic Outflows from Resource Sectors

BofA Global Research

Within the recently-battered-down group of energy stocks is Baker Hughes Co (NASDAQ:BKR). The Houston-based $27 billion market cap energy sector company sports a 2.7% dividend yield but has missed on earnings estimates in each of the past four quarters, according to data from The Wall Street Journal.

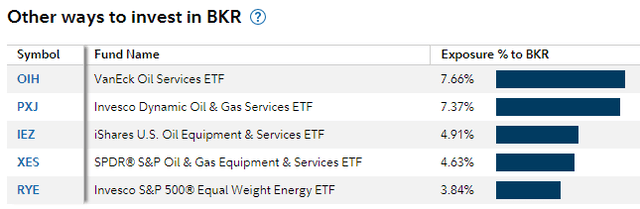

BKR was formed through the merger of Baker Hughes and GE Oil & Gas in July 2017. It is the second-largest oilfield services and equipment company in the world by market cap behind Schlumberger (SLB), according to BofA Global Research. The stock is a large holding in several popular energy ETFs.

ETFs with the Biggest BKR Positions

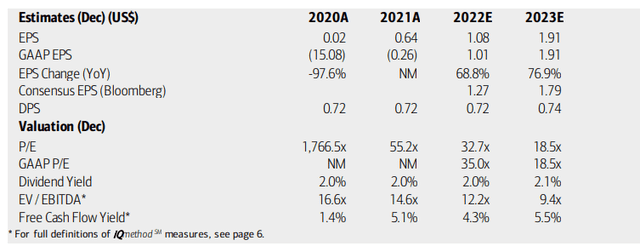

Turning to the valuation, the BofA and the Bloomberg consensus EPS forecasts are robust. Both outlooks take BKR’s earnings from negative in 2020 and last year to solidly in the black for fiscal years 2022 and 2023. As a result, the stock’s P/E ratio should improve to attractive levels by the end of next year (depending on the stock price), though its EV/EBITDA multiple still looks elevated while the FCF is low compared to some of its energy sector peers. So, BKR might not be the best bargain in the sector.

BKR Earnings, Valuation, and Dividend Forecasts

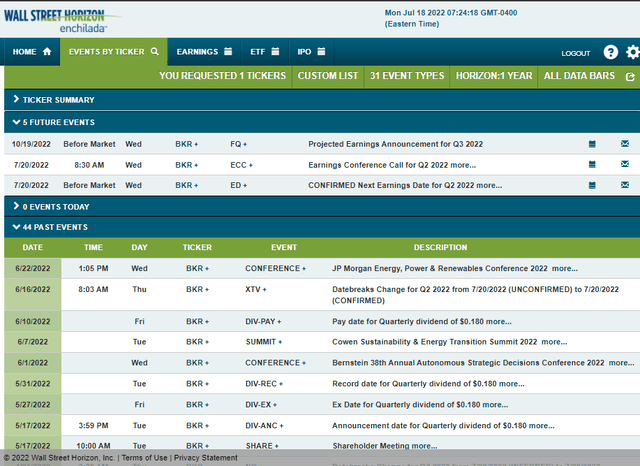

Investors might be nervous ahead of Q2 earnings confirmed to be reported on Wednesday BMO, according to Wall Street Horizon. A conference call begins at 8:30 a.m., too. As of Friday’s market close last week, the options market prices in a 12% move, up or down, between now and the August 19, 2022, options expiration date (using the at-the-money straddle).

Baker Hughes Corporate Event Calendar: Earnings & Conference Call Wednesday Morning

The Technical Take on Baker Hughes Stock

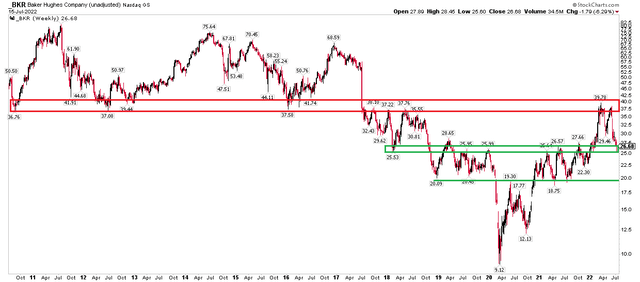

While the valuation is not as strong as so many other cheap energy stocks and as BKR’s poor recent earnings figures are certainly negative factors to consider, I actually like what I see in the chart right now.

BKR has pulled back to long-term support dating back to early 2018. The stock rallied huge off the early 2020 low, eventually hitting resistance in the upper-$30s (that level had been support from 2010 through 2015 before a bearish breakdown in 2017). The upper-$30s was then resistance in late 2017 and 2018. After again finding sellers there and putting in a bearish double top between April and June this year, the stock pulled back nearly 40% to its July low. But I think a long position here makes sense with a tight stop under $25. The next layer of support comes into play in the $18 to $20 range – that could be a very favorable entry for long-term investors.

BKR Declines to Support Ahead of Q2 Earnings

The Bottom Line

BKR, like so many energy equities, has endured big-time selling over the last month and a half. This company does not have the best earnings track record, so be on guard for volatility this Wednesday once Q2 earnings hit the tape. Still, the technical setup offers a solid risk/reward play heading into its earnings report.

Be the first to comment