Andrii Dodonov

We have written on the iShares 1-3 Year Treasury Bond ETF (SHY) a few times now. The ETF holds 1- to 3-year U.S. Treasuries. We started covering this ETF in the golden era of almost zero interest rates and remained unimpressed with its cash parking abilities until the beginning of this year. Our stance on it softened once the Federal Reserve took inflation seriously and started raising rates. While earlier we thought of SHY as reward-free risk, we concluded our last article on a relatively more positive note.

SHY now pays you to park cash and fixed income in general is becoming more attractive. After having an extremely bearish stance on bonds for 2021, we are starting to see some better opportunities and recently bumped up fixed income to 2.5% of our portfolio. Keep in mind though, that we expect the Fed to unleash the most aggressive tightening if the S&P 500 stays elevated. SHY offers too little for parking cash but we still think it outperforms the broader equity indices from here. So it is now a legitimate investment, albeit with little reward.

Source: SHY: Cash Parking Becomes More Attractive

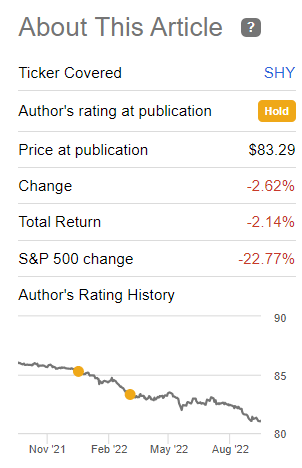

As expected, the Federal Reserve continued its tightening and while SHY has provided negative returns to its investors since then, it has handily beaten the broader market.

Returns Since Last Article [Seeking Alpha]

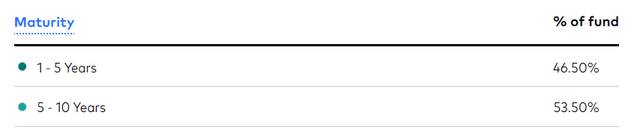

Today we will cover another Treasury ETF, albeit a longer duration one than SHY. Vanguard Intermediate-Term Treasury ETF (NASDAQ:VGIT) invests in 5- to 10-year U.S. Treasury Bonds to provide its investors with a “moderate and sustainable level of current income”. The fund webpage mentions that it is exposed to a moderate level of interest rate risk owing to the medium-term holdings.

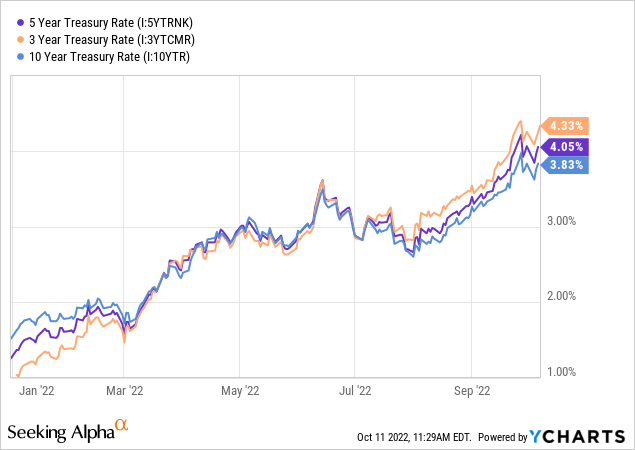

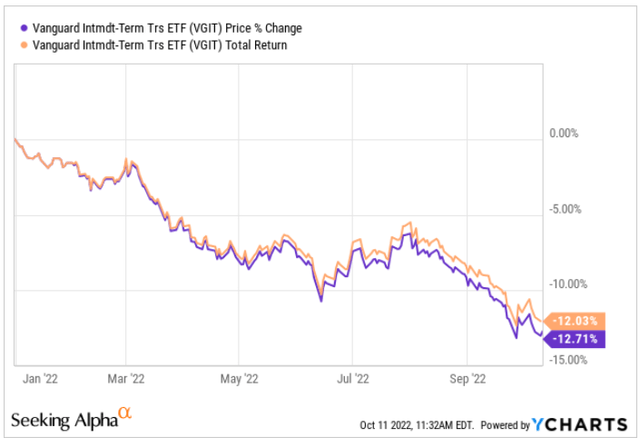

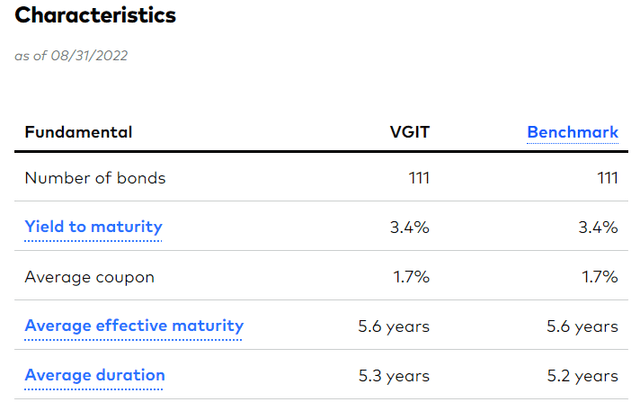

The average effective maturity of its portfolio is 5.6 years, with the average duration coming in slightly lower at 5.3 years. The duration broadly indicates the extent to which the value of the portfolio will fall with every percentage increase in the risk-free rate and vice versa. Since the beginning of the year, the average rates have increased by around 2.8%.

Data by YCharts

VGIT’s price, as expected, has shown a close inverse correlation.

There are other factors that come into play like convexity of the yield curve and hence the relation between the duration and price change is not an exact science. In this illustration, we have equated the price with the NAV of the underlying holdings since the two follow each other closely in the case of ETFs unlike that for closed end funds.

Performance Versus The Benchmark

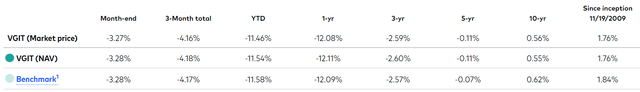

VGIT is benchmarked against the Spliced Bloomberg US Treasury 3-10 Year Index in USD. The ETF has pretty much kept up with the benchmark net of expenses, which in VGIT’s case is a negligible 0.04%.

Earnings Versus Distributions

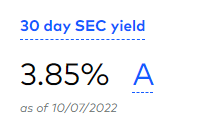

VGIT’s 30-Day SEC Yield is noted as 3.85% on its website. This yield signifies what the incoming investors can expect to earn over the course of the next little while if there are no further changes to the interest rates. This is computed taking the interest earned in the past 30 days net of expenses.

Vanguard Website

There is usually a lag between the SEC yield catching up to the yield to maturity. In VGIT’s case, we have the yield to maturity or YTM lagging the former, but that is because the most recent data for the YTM (Aug 31) predates that of the SEC yield (Oct 7). We expect the next update on the fund website to show YTM closer to the 5-year treasury rate which is 4%.

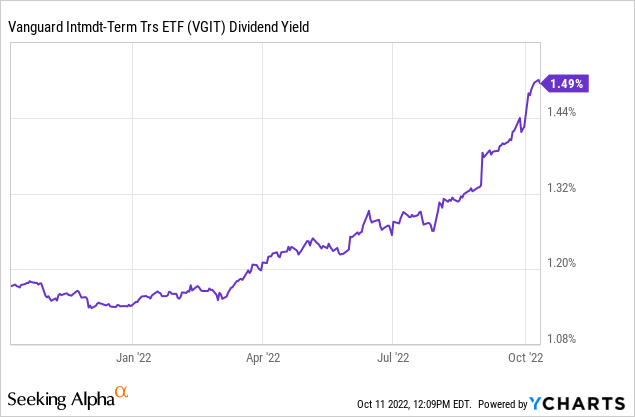

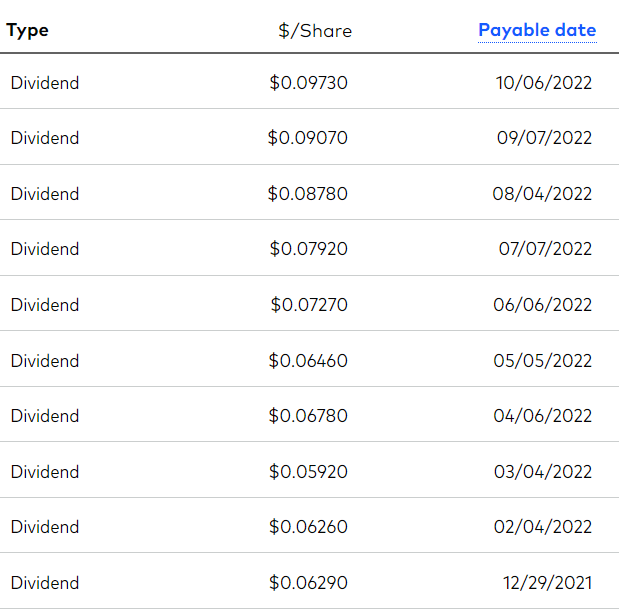

This brings us to the raison d’etre of income investors, the distributions. The trailing 12-month yield is 1.49%.

Data by YCharts

However, as we can see along with the earnings of the fund, the distributions are also showing an uptick month after month.

Vanguard Website

Based on the most recent distribution, the yield is already over 2% (at the current price of $58.03). We expect this to keep increasing rapidly and meet the 30-Day SEC yield down the line. Just like SHY, VGIT too is showing signs of providing an actual income to its investors, however, this one comes with a higher duration or interest rate risk.

Verdict

As our regular readers may have now come to expect, while we cover these funds and provide insight into their workings, we usually steer clear unless the opportunity is very compelling. We have not found one as yet in the Bond ETF area, but at this yield level, we are not outright bearish on VGIT either.

You just have to look how far we’ve come from the late 2021 levels where the whole world had gone buying horrid instruments at stupid yields.

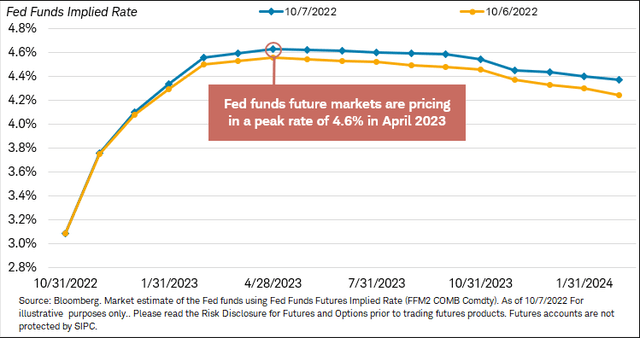

This level of duration risk for this level of yield is fair play for treasuries. For investors that prefer funds over handpicked individual securities, this may not be a bad time to lock in a potential 4% yield over the longer term. The current value of VGIT is pricing in the expected interest rate trajectory over the next few years.

So by buying this fund you are making an implicit bet on a peak in Fed Funds Rates followed by a slow decline. The fund could outperform expectations if we have a deflationary bust followed by rapid interest rate cuts. That is not our outlook at present and hence we rate this as Neutral.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment