golibtolibov

The race is not always to the swift nor the battle to the strong, but that’s the way to bet. (Damon Runyon)

During the past 9 months or so, the overall asset mix in the stock market has rotated from growth to value and from the technology sector to more defensive asset mixes such as energy and commodities. Now, as the fears of inflation and rising rates are starting to recede somewhat, the trend is heading back to growth again as investors are gradually willing to take on more risk. I am seeing an opportunity to pick up some undervalued growth stocks in the semiconductor (“chip”) industry as investor sentiment shifts back toward growth and with the oncoming EV (electric vehicle) revolution.

My strategy as I build out my No Guts No Glory IRA portfolio is to use swing trades in growth stocks to raise capital that I then use to supplement my investments in various high yield income producing closed end funds, BDCs, and REITs. This strategy worked well during the 5-year period from 2017 until about October 2021. Then the market shifted and sold off most of the technology sector picks in favor of energy, commodities, and more defensive plays. I shifted my asset mix accordingly in the first half the year, but I am now looking to take advantage of the values being offered in the chip sector in the second half of 2022.

Meanwhile, the shift toward development of electric vehicles (“EVs”) continues to gain traction and is likely to ramp up considerably in the years ahead as more countries are phasing out gasoline-powered internal combustion engine (“ICE”) vehicles in favor of low to no-emission EVs. Whether you agree with it or not, that trend is occurring in many parts of the world and more emphasis will be placed on the technology behind improving EVs in the coming 5 years. The demand for more and better chips will continue to increase as EVs require far more chips than ICE vehicles in the production process, which is a big part of the reason for the chip shortage that we have been witnessing in the auto industry in particular over the past year or so.

This trend towards chip technology advancements is not just occurring in the auto industry. There is rising demand for power, memory, logic, image sensors and other applications in a variety of industries such as energy infrastructure, industrial automation, 5G and cloud computing, defense, aerospace, and medical to name a few. On the other hand, the EV industry is driving a lot of the innovation in chips.

New semiconductor innovations offer the potential for longer and more efficient battery life. Semiconductor chemistries like Gallium Nitride (GAN) and Silicon Carbide (SIC) allow EV batteries to operate at higher voltages than traditional silicon wafers. Semiconductors are also crucial for vehicle safety, intelligence, and efficiency.

In previous articles on Seeking Alpha, I covered two chip stocks that I like and that appear to be growing and undervalued. Those two include Alpha and Omega Semiconductor Limited (AOSL) and SGH Corp (SGH), formerly known as Smart Global Holdings. In this article, I would also like to review two additional chip stocks that I feel offer excellent buying opportunities for technology growth stocks over the next 5 years and are particularly poised to benefit from the innovations in the EV industry. Those two include ON Semiconductor Corporation (ON) (“onsemi”) and Axcelis Technologies, Inc. (ACLS).

How is AOSL doing?

I last wrote about AOSL in May 2022 and discussed how the company is growing and profitable and should offer better returns than Advanced Micro Devices (AMD) over the next 5 years. At that time, the share price was near $45 and was trading at an historically low valuation, while AMD was getting somewhat overvalued. Since then, AOSL has slightly outperformed AMD and has underperformed the overall tech sector (XLK), as illustrated in this price chart.

AOSL vs AMD 6-month comparison (Seeking Alpha)

AOSL primarily offers chips like MOSFETs and ICs for powering devices in the industrial, communications, consumer, and computing sectors. The target market (estimated at over $40B) and demand for those devices continues to grow and with the stock trading at a forward P/E of less than 8 there is an opportunity to buy shares at a good price of about $35 as of July 15, 2022. Despite the recent slowdown due to market forces that have impacted nearly every sector of the economy, growth is accelerating for AOSL and is expected to continue to as shown in this slide from the May 2022 investor presentation.

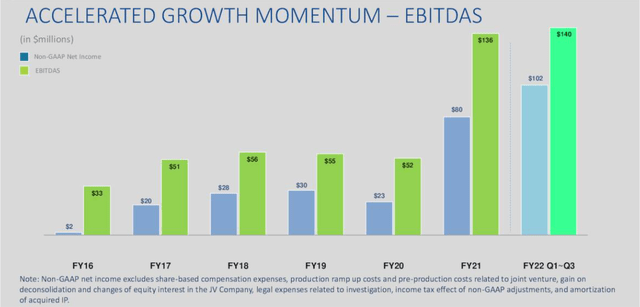

AOSL Accelerated Growth Momentum (May 2022 investor presentation)

What are the growth prospects for SGH?

Back in January of this year, I last wrote about SGH and discussed the global growth in a variety of industries that they were making advances in. The business solutions that SGH provides include Memory solutions, LED lighting, and Intelligent Platform solutions. The business improved considerably after the current CEO, Mark Adams, took over in 2020. At the time I wrote about them, the company had just reported the 7th consecutive quarter of YOY growth. In the most recent earnings report on June 29, the company reported another strong quarter marking the 9th consecutive quarter of YOY growth. However, the guidance for the upcoming quarter (the company’s fiscal fourth quarter) was reduced slightly from previous estimates, sending the share price crashing nearly 20% the following day.

6-month price chart for SGH (Seeking Alpha)

The stock is now trading more than 45% lower than 6 months ago, and I believe that the market over-reacted to the downside offering a compelling buying opportunity in the $17 price range with a forward P/E of around 5. As one commenter pointed out, the last quarter’s guidance was reduced prior to the earnings report, and they beat consensus anyway. I see no reason for the growth to slow down much more in the second half of 2022 than it did in the first half, but that is certainly a risk to consider.

The CEO had these remarks during the earnings call regarding growth prospects going forward:

Our consolidated results for the third quarter demonstrate the benefits of our growth and diversification strategy. We believe we are in the right markets, benefiting from long-term secular growth drivers such as AI, machine learning, data analytics, cloud and high-performance computing.

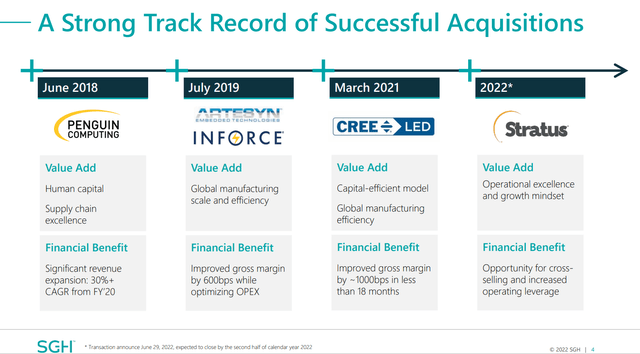

In addition, the company announced an acquisition during the quarter of Stratus Technologies, to add to their Intelligent Platform solutions business, which has been growing at about 30% YOY. The acquisition is expected to be immediately accretive to SGH’s gross margin, non-GAAP EPS, and free cash flow. This is the company’s 4th acquisition since 2018 and each of them have been successful in growing the business.

SGH Successful Acquisition History (Stratus acquisition presentation)

I feel that SGH is a strong buy at a price below $18 and should outperform over the next 5 years or more, given the long-term secular trends in technology that we are seeing.

Axcelis Technologies – Innovator in Ion Implantation

The chip manufacturing industry has experienced many years of innovation, and for over 40 years Axcelis has been leading the way in that industry sector. From the company’s investor relations website, this is the company profile:

For over forty years, Axcelis Technologies has delivered vital equipment, services and process expertise to the semiconductor manufacturing industry, helping customers reach higher levels of productivity with each new technology generation. Today, chipmakers from around the globe rely on our tools and technology insights to produce the transistors that power all electronics. Our equipment portfolio comprises a powerful suite of manufacturing technologies for ion implantation – one of the most critical and enabling steps in the IC manufacturing process.

Over the past 5 years the stock price has nearly doubled the return of the S&P 500, despite the downturn in tech stocks over the past 9 months. And prospects for the second half of 2022 are improving.

ACLS 5-year price chart (Seeking Alpha)

On July 12, the company provided 2nd quarter guidance that exceeds the high end of previous estimates for revenues, gross margin and EPS, despite the challenging macroeconomic conditions across the globe. That previous guidance included:

revenue of $205-215 million, gross margin of approximately 41%, operating profit of approximately $41 million and earnings per diluted share of approximately $1.00.

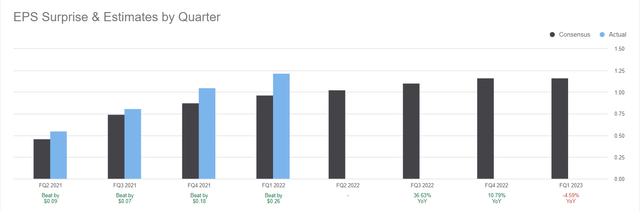

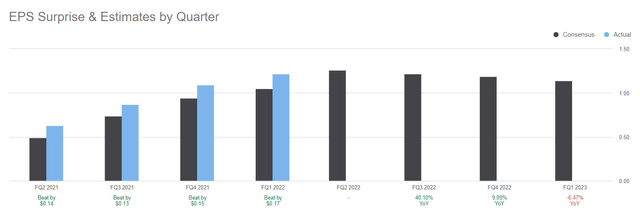

If that earnings beat does occur, it will be the 5th consecutive quarter of increasing earnings and beats on the bottom line.

ACLS EPS estimates and surprises (Seeking Alpha)

In a presentation on July 14, the key takeaways that explain why the ACLS business is growing and profitable include a greatly expanding TAM (total addressable market) for their ion implant technology, increased spending on mature process technology, and the only company that offers a complete family of implant products for the highly specialized device market segments.

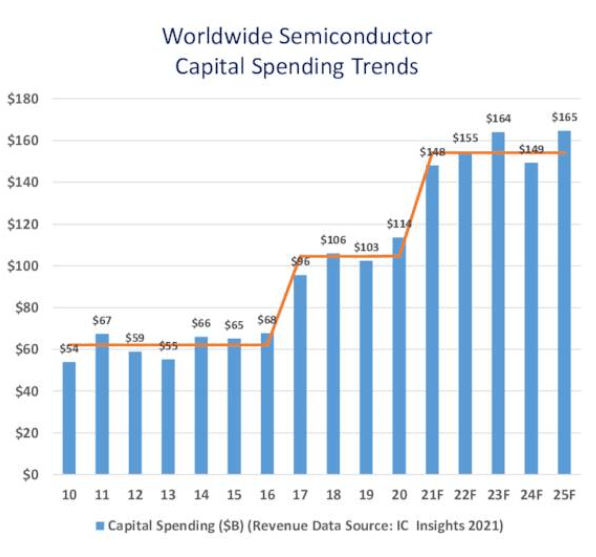

Worldwide capital spending on mature process technology for chip manufacturing, being driven in large part by the EV market, is expanding the TAM for ACLS solutions as depicted in this chart from the July 14 presentation.

Worldwide capital spending trend (ACLS July presentation)

According to the same presentation, greater than 90% of automotive chip applications utilize the mature process technology that ACLS specializes in. The ion implant TAM has more than doubled in the past 3 years and is expected to continue growing in large part due to the EV chip innovations that I mentioned earlier.

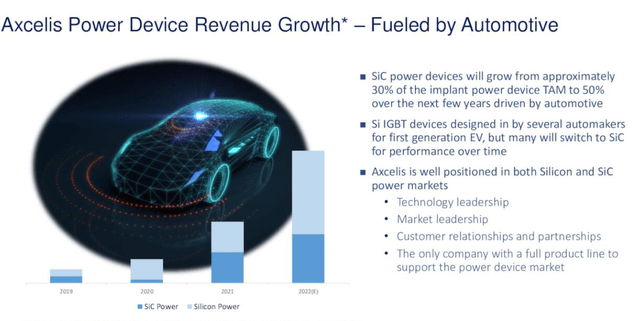

The SiC (silicon carbide) device market is growing at greater than 30% CAGR, driven primarily by the EV industry. That growth in SiC devices is expected to increase to 50% of the implant power device TAM over the next few years, driven by the automotive industry.

ACLS Revenue Growth (ACLS July presentation)

The mature process technology segment accounted for 82% of 2021 revenues and is expected to make up more than 80% of revenues for ACLS in 2022. This means that not only should the second half of 2022 be good for earnings, but longer-term it also bodes well for continued growth and profitability.

At market close on 7/15/22 the stock price ended the day at $56.20 and is trading at a forward P/E of 12.38. This looks like a very good price given the expected increase in earnings when Q2 results are announced on August 3, and which should be even higher than currently estimated.

Onsemi – Creating Intelligent Power and Sensing technologies

The company that now calls themselves onsemi is a leading chip manufacturer of over 80,000 different parts using a global supply chain serving tens of thousands of customers in hundreds of markets. Those markets include:

onsemi end markets (onsemi website)

The automotive market is the largest by revenues, with 37% of the total revenue in Q122. The Industrial market segment was next with 28%, and the remaining 35% was spread among “other” markets.

From the company’s website, a brief overview of the company’s history helps to explain why the EV industrial revolution has become essential to the improving growth and profitability of onsemi.

Though there is a new look and feel, the company’s roots are foundational. In 1999, Motorola spun off its standard products semiconductor business into an independent company called ON Semiconductor. Motorola had been a pioneer in transistors, especially for commercial applications. In fact, a Motorola transponder relayed the first words from the moon to Earth in July 1969. Motorola also pioneered the automotive electronics industry, from the first mobile radios in police cars in the 1940s to automotive electric controls and semiconductors in the 1970s.

Onsemi was spun off from Motorola in July 1999, did an IPO in 2000, then acquired Fairchild Semiconductor in 2016. The rest is history, as they say.

Fast forward to July 2022 and ON is now (as of June 21, 2022) a member of the S&P 500 index. From the company’s 2021 Annual Report it becomes immediately clear why the EV revolution has been instrumental in the company’s success.

We serve a broad base of end-user markets, including automotive, industrial and others which include communications, computing and consumer. We believe the evolution of automotive with advancements in autonomous driving, ADAS, vehicle electrification, and the increase in electronics content for vehicle platforms is reshaping the boundaries of transportation. With our extensive portfolio of AEC-qualified products, onsemi helps customers design high reliability solutions while delivering top performance. And within the industrial space, onsemi is helping OEMs develop innovative products to navigate the ongoing transformation across energy infrastructure, factory automation and power conversion.

As of December 31, 2021, we were organized into the following three operating and reportable segments: the Power Solutions Group (“PSG”), the Advanced Solutions Group (“ASG”) and the Intelligent Sensing Group (“ISG”).

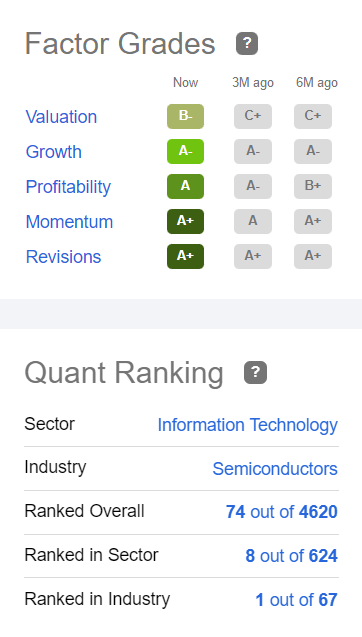

According to the SA Quant ratings, ON is currently #1 out of 67 chip stocks, and for good reason.

ON quant grades (Seeking Alpha)

Similar to ACLS, the earnings estimates over the past 4 quarters have been exceeded even as earnings continue to grow on a YOY basis, at least thru the end of 2022.

ON earnings estimates and beats (Seeking Alpha)

One risk to the future stock performance of ON is their exposure to China. According to a recent news item, they have about 25% of their revenues coming from China. As the economy opens up again in China, this could have a positive impact on the top end for ON but does pose a risk if the slowdown in their economy continues or resumes again later this year.

As the move to SiC components in the chip industry continues (and EVs specifically), the forward-thinking management team at onsemi decided to acquire GT Advanced Technologies (OTCPK:GTAT).

From the 2021 annual report:

On October 28, 2021, we completed our acquisition of GT Advanced Technologies Inc. (“GTAT”), a producer of SiC. Pursuant to the terms and subject to the conditions set forth in the Agreement and Plan of Merger, the purchase price for the acquisition was $434.9 million, which included cash consideration of $424.6 million and effective settlement of pre-acquisition balances (non-cash) of approximately $10 million, in exchange for all of the outstanding equity interests of GTAT. We believe the GTAT acquisition will act as a building block to fuel growth and accelerate innovation in disruptive intelligent power technologies and secure supply of SiC to meet rapidly growing customer demand for SiC-based solutions in the sustainable ecosystem.

The automotive and industrial segments are expected to grow to 75% of revenues from 60% in 2021. Electrification, image sensors and Lidar, and power components are the specific drivers for revenue growth in Automotive. Alternative energy, factory automation, and EV fast charging stations are the key drivers for Industrial.

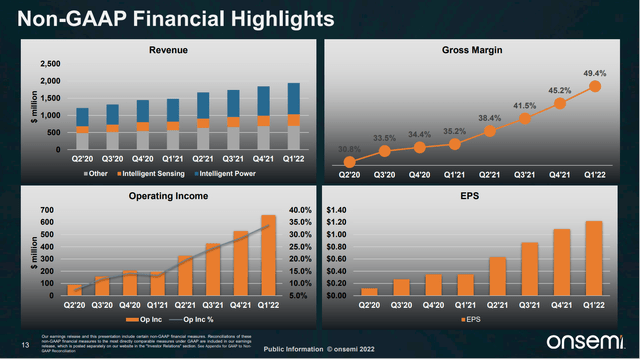

This slide from the Q122 earnings presentation on Financials encapsulates the success they have been experiencing over the past several years.

ON Q122 Financial Highlights (ON Q122 earnings presentation)

At a closing price of $56.02 on July 15, 2022, the stock is trading at a forward P/E of 11.49. I would be a buyer below $60 but if the price should drop below $55 again, then I would call it a strong buy. The prospect for this stock to outperform over the next several years strongly outweighs further downside potential, unless the world economy goes into full-blown 2009 style recession.

Concluding Thoughts

I hold long positions in all the stocks mentioned – those are my chips on the table, well mostly. I also own shares of Advanced Micro Devices (AMD) and Micron (MU), along with Apple (AAPL), to round out my tech picks. I feel quite strongly that all of them will perform well from here over the next 5 to 10 years as this secular long-term technology evolution continues.

Always try to rub up against money, for if you rub against money long enough, some of it may rub off on you. (Damon Runyon)

Be the first to comment