Michael Vi/iStock via Getty Images

I first saw Tesla (NASDAQ:TSLA) cars in 2011 in a showroom in Menlo Park, CA, in Tesla’s early days under Elon Musk. The headquarters of USGS – the world’s leading authority on earthquakes – were nearby. An unknown guy called Mark Zuckerberg was about to cause a social media earthquake with a startup company called Facebook (META) based in Menlo Park. Likewise Elon Musk caused an earthquake in the car making industry by focusing on EVs at a time when world leading car makers – and especially the German ones – were touting “clean” diesel and had no idea how wrong they would prove to be despite Toyota (TM) having long seen the light with its development of electric/petrol(gasoline) hybrids.

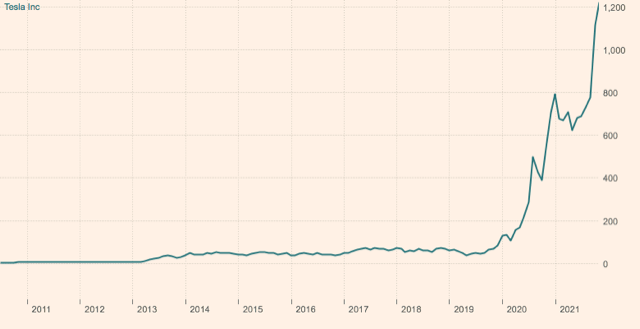

It took until late 2019 before the stock market saw the light for EVs and Tesla’s share price resembled a tsunami bringing in a very high tide of investors at high speed as this chart shows…

Financial Times

Then in November 2021 the tide turned and could become an outward tsunami as more and more investors start to realise that many of the aspirations of Tesla’s CEO – Elon Musk – are unlikely to be achieved.

One trend that I notice is the change of tone in comments to my first article on Tesla titled “Tesla’s Ticking Time Bomb” on November 16, 2021, and the most recent one on June 2, 2022, titled “Tesla’s Continuing Crash“. In the first article the overwhelming majority of commenters rejected my views – some rudely – and in the last the mood was swinging to agreeing that the share price remains too high.

In my articles I try to paint the big picture that includes positives and negatives and the latter are now rapidly overtaking the former. I shall go into those negatives later but first will make a brief look at the unquestionably incredible achievements of Tesla under Elon Musk.

Tesla history

Britannica has good look at this telling us, among other things, that it was founded in 2003 by American entrepreneurs Martin Eberhard and Marc Tarpenning and was named after Serbian American inventor Nikola Tesla. Full report here.

I do not know who actually designed today’s models but they are nice looking car and in my home country – Switzerland – according to CleanTechnica “Tesla is the most purchased new car.“

Elon Musk was involved from the early days and then took a hands-on role in 2008 as CEO leading it to an IPO in 2010. The chart above shows the stock price did little more than move sideways from then until late 2019.

But during that time Musk was building huge factories in anticipation of demand to come. Once evidence of success started to become apparent he also showed talents as a super salesman for himself and also built a near cult gathering of worshippers who helped send Tesla’s stock price into orbit.

One very important should be mentioned about history that many of those do not know or, worse, do not want to know, is that Tesla – meaning Musk to them – did not invent EVs.

If he did he is slightly older than photos of him suggest because this London electric taxi was on the road 125 years ago:

getty images

Many EVs were built in later years but battery technology did not improve so ICEs took over and remained the main mover until Tesla used modern battery technology. For example, Ford (F) had its Comuta model on UK’s roads in the 1960s…

Pierre Manevy/Hulton Archive via Getty Images

Musk led Tesla on to lead the EV world and to a super financial performance…

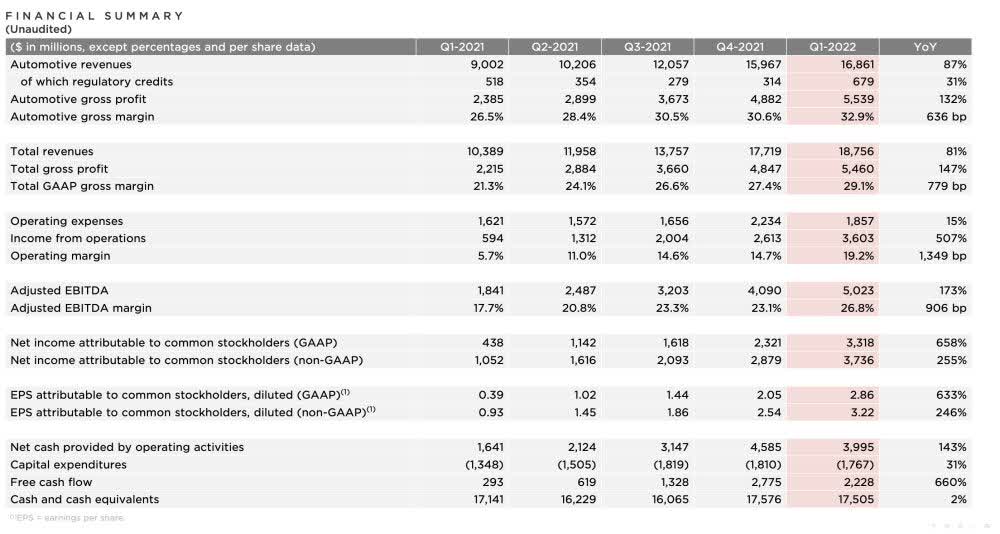

Tesla’s financial results

Tesla

Those are for the quarter ending March 31, 2022. The figures are very good, especially the automotive gross margins at 32.9%. That is well above the gross margins achieved by traditional car makers. Material cost increases have been recovered through selling price increases.

My reading of things suggests that cash flow was super, too, leaving Tesla with approximately $17.5 billion in cash at the end of the last quarter. However SA article writer RD Barris has questioned that in “Tesla’s Free Cash Flow: Less Than Meets The Eye.“

Events since then also suggest that …

The tide is now turning on Tesla’s financial results

I suspect that is the last quarter for a long time – maybe ever – that we see results like that. There are a number of reasons, including China.

The China threat.

China is the world’s largest car market, including EVs. According to tradingeconomics latest report on car registrations, overall sales dropped 36% in April. Tesla did worse. It only sold 1,700 cars there in April, down 85% from a year earlier. Things bounced back in May but have not recovered completely and more Covid lockdowns are possible.

There are also around 30 EV makers in China. BYD (OTCPK:BYDDF) is the largest. Tesla is number three. A recent report from Merics says “Europe is now the main target for electric vehicle exports from China.“

Tesla makes the Model Y in both its German and Chinese factories so I doubt it will sell its cheaper made in China cars in Germany while those lower cost competitors will be taking a share of that huge market.

China is close to recession for the first time in decades. In some major cities rent absorbs 50% of income. Passenger car sales in China fell 17.3% Y/Y to 1.37M in May.

China and SpaceX

Elon Musk’s SpaceX company may also compound Tesla’s potential problems in China. The South China Morning Post recently had an article titled “China military must be able to destroy Elon Musk’s Starlink satellites if they threaten national security”.

Solar

This is a US only market for Tesla. Elon Musk likes to claim that Tesla is a vertically integrated car maker yet solar panels for house roof tops has nothing to do with car making. He got into solar by buying a troubled company founded by his cousins and on whose board he sat. That was paid for with Tesla shareholders’ money and led to a failed lawsuit by them according to this Business Insider report. Its policy has been to offer lowest price guarantees which is suicidal in such a commodity product market sector and now – to reduce costs in the US further – President Biden has waived tariffs on solar panels imported from Cambodia, Malaysia, Thailand and Vietnam. That may soon be the case for China too.

A CNET report also claims that “Tesla is skimping on customer service”. This activity will be a constant drain on Tesla profits until closed!

Bitcoin

What buying these things has to do with car making I know not because it cannot be used to pay suppliers etc., but Elon Musk made a big gamble on these with Tesla shareholders’ money. This SA article tells more; “Tesla could take a big loss on its bitcoin bets“. From its high point in November 2021 – also Tesla’s stock price high point – Bitcoin is down over 70%!

Legal and recall problems continue to grow

The National Highway Traffic Safety Administration (NHTSA) said Friday that it has filed a formal inquiry to Tesla about its Model 3 and Model Y after receiving complaints from more than 750 owners of the models about sudden and unexpected braking with no immediate cause.

This is an issue the NHTSA has been examining since February, after receiving over 350 complaints about similar issues to that point.

Costs for these obviously grow too and so must customer dissatisfaction.

Recession and inflation

“I said there’s storm clouds, they’re big storm clouds, it’s a hurricane…right now it’s kind of sunny, things are doing fine, everyone thinks the Fed can handle this. That hurricane is right out there down the road coming our way” – Jaime Dimon, CEO of JP Morgan

Recession has arrived in Britain at a time of high inflation. Other countries in Europe have high inflation and are close to recession. China’s long-term rapid growth has ended. This Bloomberg report says “US consumer sentiment has fallen to a decade low“.

House prices are falling in many countries. Incomes have been squeezed by inflation and cars are a consumer discretionary. This will hit all car makers but of the more important ones Tesla’s inflated stock price will take the biggest hit.

Competition threat

Chinese company Geely – owner of the Swedish Volvo car company and with a big stake in Germany’s Daimler (Mercedes-Benz maker) – is getting into space to drive cars autonomously according to this report from Automotive News Europe.

Automotive News Europe

Geely Technology’s center in Taizhou, China, is building low-orbit satellites to support high-speed data connectivity, highly precise navigation, and cloud computing capabilities in future vehicles.

That means one more of Tesla’s early mover advantages is going fast. Others are doing similar things. Newcomers such as Apple (AAPL) are expected to further ensure Tesla’s tide keeps going out. MacRumors tells us more about that.

Traditional car makers too…

General Motors (GM). GM’s EV investments with plans to spend $7billion in the US to build a battery plant and convert an existing factory to EV production. The latter shows another advantage traditional makers have over Tesla – they can convert existing factories. Tesla has the cost of buying land and building from scratch, getting approvals and training workers.

A recent SA report told us that GM “on Wednesday slashed the price of its 2023 Chevrolet Bolt EV, making it the cheapest electric vehicle in the US”. Tesla has just increased prices.

Ford (F). According to this Financial Times report Ford will invest $3.7 bn and add more than 6,200 manufacturing jobs throughout the US Midwest. It has a target of 600,000 EVs in 2023 and 2 million per year by the end of 2026

Daimler. Mercedes-Benz has announced that its EV SUV will hit US roads this summer. The style and price look good too. The starting price for the compact GLA model is $36,400. The Model Y, Tesla’s long range compact SUV, starts at $65,990.

Mercedes has an upmarket image and I suspect a lot of buyers would choose to drive one rather than a Tesla. That price difference makes it an achievable choice.

Mercedes Benz

Volkswagen (OTCPK:VWAGY) the world’s second largest car maker after Toyota – the number one – is expanding its EV production in the US according to this report on SA.

Hydrogen powered cars are another form of competition and threat. They are on the road and Toyota is leading with its Mirai model.

The German car makers once scorned Toyota when its hybrids hit the road. When it was discovered their “clean” diesel cars were not clean they scrambled to catch up.

Yahoo Finance told us last year that Tesla CEO Elon Musk has previously called hydrogen fuel cell vehicles “extremely silly,” referring to the technology as “fool sells.”

Perhaps that was another sign that…

Elon Musk is becoming a threat

Ventures into solar and bitcoin have been bad decisions for shareholders. Now his attitude towards employees leaves much to be desired. Those in the Shanghai factory had to stay on site 24/7 living in slum conditions working 12 hours per day 6 days per week so they could keep working during the recent Covid lockdown. This Fortune article tells more. On release recently many showed signs of distress.

Nor is this new or confined to China. The Guardian has this report headed “Tesla factory workers reveal pain, injury and stress” about earlier happenings at the Fremont, CA, factory.

Recently he again treated his US employees poorly. He megaphoned publicly that the Covid working from home era must end and he demanded that Tesla’s salaried workers be in the office at least 40 hours per week or find another employer. He inferred that home workers are lazy workers according to this Business Insider report. He would also cut their number by 10%. Those people have probably been proud to say they worked for Tesla and Elon Musk, most worked hard at home and might actually have increased their productivity so much he can now lay off 10% of them! Loyalty is a two way street and some of those employees may now choose to drive one way – out.

If he tries similar things in Germany, he will face both cultural and German and EU employment law issues.

His potential acquisition of Twitter and other activities means he has less possibility to be working for Tesla “in the office at least 40 hours per week”!

Joining those many dots leads me to one conclusion…

Tesla’s Tide Has Turned

Inflation without pay increases puts Tesla’s expensive cars even more out of the reach of many. Owners are now keeping their cars for over 12 years according to this WSJ report. Recession, low consumer confidence and supply chain shortages means new buys will be delayed even further. During that time some of the vast investments in EV making by other car makers will be completed or nearing completion, supply chain shortages will be fixed and those competing vehicles will be available around the same time that demand returns. Maybe there will be too much supply then so price and profit cutting will return too.

The threats could be reduced, in my view, if Elon Musk trimmed his grand plans for volume growth and instead focused on making Tesla a niche, high end car maker. It also would help if he changed his approach: less competitive hubris and more cooperative humility especially with employees.

Those points do not seem likely so the tide will keep going out as it has in recent months resembling a tsunami in reverse. The P/E is one indicator of that. In mid November last year Tesla’s P/E was 332. It had been over 1,000 earlier that year. Today it is around 88.

In the weeks and months ahead it has no other way to go but down further.

I see no reason why it will not join the other car makers perhaps by year end.

Their figures are:

- Ford (F) P/E 3.95

- General Motors (GM) P/E 5.3

- VW (OTCPK:VLKAF) P/E 3.91

- Toyota (TM) P/E 10

It is not a pretty picture and I would strongly advise staying away because a different kind in autopilot to Tesla’s on board one will keep the tide going out.

Be the first to comment