Eric Francis

Charlie Munger – Warren Buffett’s right hand man at Berkshire Hathaway (BRK.A)(BRK.B) – is a proven master investor who has helped Warren Buffett generate returns that have crushed the S&P 500’s (SPY) for many decades. Additionally, he has made a wildly successful concentrated bet on Costco (COST) and also runs a successful investment portfolio at The Daily Journal (DJCO), though it includes one of his more controversial and worst-performing investments to date in Alibaba (BABA).

As a result, we pay close attention to his investing wisdom when crafting our own portfolios. In this article we look at three specific pieces of his investing advice and some high yielding picks that fit in with his wisdom.

Munger Tip #1: Buy Stocks That Are Easy To Value

The first of Munger’s investing gems that we will look at today is:

YOU’RE LOOKING FOR A MISPRICED GAMBLE. THAT’S WHAT INVESTING IS. AND YOU HAVE TO KNOW ENOUGH TO KNOW WHETHER THE GAMBLE IS MISPRICED. THAT’S VALUE INVESTING.

Essentially what this boils down to is finding a stock where the risk-reward is asymmetrically in favor of whatever position you are looking to take in it. To be able to do this repeatedly and successfully, the stock needs to be easy to value.

This all comes down to the circle of competence that Warren Buffett loves to talk about. While some investors have in-depth insight into certain complicated sectors like semiconductors (NVDA) or biotechnology (PFE), for the average retail investor without unique insight into technical fields, it is best to stick with very easy to understand investment theses.

For us, defensive businesses that generate very stable cash flows and grow within a very predictable range year after year and then pass on the majority of their cash flow to shareholders via dividends and/or buybacks are the easiest to value because the variables are much fewer and estimates of future cash flows are much easier to arrive at. Some of our favorite industries to mine for these opportunities include REITs (VNQ) like W. P. Carey (WPC), midstream energy (AMLP) companies like Enbridge (ENB), utilities (XLU) like Algonquin Power & Utilities (AQN), and BDCs (BIZD) like Ares Capital (ARCC). Even some high quality asset managers like Blackstone (BX) fit this bill as well.

Munger Tip #2: Buy High Quality Businesses

Munger tip number two is:

A GREAT BUSINESS AT A FAIR PRICE IS SUPERIOR TO A FAIR BUSINESS AT A GREAT PRICE.

Great businesses make superior investments to fair businesses for two big reasons:

(1) Great businesses by definition have superior competitive advantages, which makes applying Munger Tip #1 easier as there is less uncertainty about its future earnings stream.

(2) Great businesses often surprise to the upside because they have an established track record of building a great corporate culture and employee team that can innovate to overcome unforeseen challenges and create new exciting growth opportunities. This what has helped to drive the superior long-term results of companies like Amazon (AMZN) and Apple (AAPL), and literally given new life time and again to companies like Tesla (TSLA).

Munger Tip #3: Buy Businesses That Play The Long Game

Munger tip number three is:

TODAY, IT SEEMS TO BE REGARDED AS THE DUTY OF CEOS TO MAKE THE STOCK GO UP. THIS LEADS TO ALL SORTS OF FOOLISH BEHAVIOR. WE WANT TO TELL IT LIKE IT IS.

While many management teams become enamored with financial engineering techniques to appease Wall Street analysts in the short term, true value is created by investing in the long-term wellbeing of the company. Two tragic examples of this are International Business Machines (IBM) and AT&T (T). Both of these companies repurchased shares hand-over-fist at elevated valuations in order to excite shareholders and appease analysts at the expense of making aggressive and necessary investments in their future. As a result, both businesses fell into stagnant growth and underwhelming performance. As a result, shareholder value was destroyed.

Investor Takeaway

When Charlie Munger speaks about investing, we sit up and take notice. We believe that the three nuggets of investing wisdom we went over in this article – stocks that are easy to value, great businesses, and playing the long game – should play a particularly important role in shaping an investor’s assessment of a potential investment opportunity. In particular, there are two high yielding opportunities at the moment that we think are especially attractive based on these metrics:

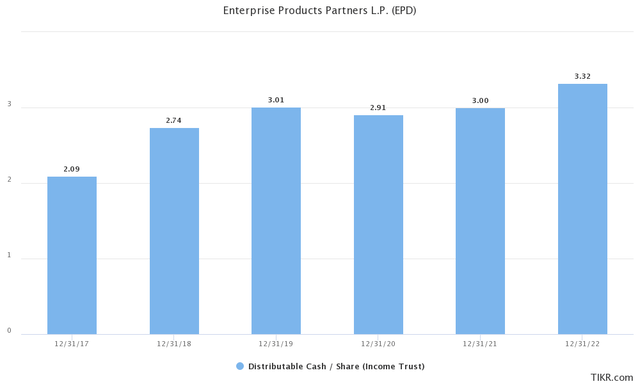

7.4% yielding EPD is probably the most clear-cut example of these traits in the current market. It is remarkably easy to value because it is an extremely stable cash flowing business. With its well-diversified asset portfolio and very stable, recession and commodity price resistant cash flowing profile, it is very predictable how much distributable cash flow it will generate each year:

Even during the most hostile environment imaginable for the business – the 2020 COVID-19 pandemic and energy market crash – EPD’s distributable cash flow per unit proved to be remarkably resilient. Furthermore, it pays out a very large percentage of its cash flows via distributions and buybacks, and reinvests the remainder into low-risk, high-return growth projects, giving it a very predictable future cash flow stream.

With all that said, it is pretty clear cut that EPD is undervalued at the moment as its rock-solid 7.4% distribution yield combines with its expected 3.6% distribution CAGR over the next half decade to provide a highly probably double-digit annualized total return picture, especially given that multiple expansion is more likely than multiple compression with its 9.55x EV/EBITDA multiple trading below 5-year and all-time averages of 10.93x and 12.59x, respectively.

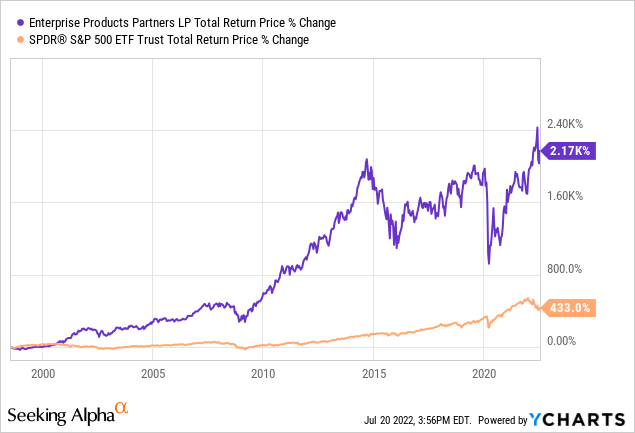

Meanwhile, it is unquestionably a great business as it has generated strong double-digit returns on equity throughout its existence, has delivered distribution growth for 24 consecutive years, has some of the very best assets in the industry, is fully aligned with unitholders with a third of the partnership owned by insiders, has an industry-leading BBB+ balance sheet, and has crushed the market over the course of its existence:

Last, but not least, management is investing in the long game by allocating cash flow towards developing renewable fuels technologies and cash flow streams while also making strategic acquisitions and low-risk high-reward organic growth investments instead of following analyst banter and industry trends by trying ramp up the unit buyback program at lower rates of return. We believe that over the long-term, EPD’s current investments will pay rich dividends (or in this case, distributions) to patient unit holders at current prices.

STOR is also a great example of this type of business – and is in fact owned by Berkshire Hathaway – with its very conservatively structured and well-diversified triple net lease real estate portfolio. With a business model similar to peers who weathered the Great Recession with flying colors and a dividend growth streak that continued unfettered through the 2020 COVID-19 lockdowns, STOR is a very reliable dividend growth machine. Its current 5.6% dividend yield and very predictable mid-single digit annualized growth rate make it an easy business to model and should generate double-digit annualized returns, especially when considering its P/AFFO multiple of 12.28x lies well below five-year and all-time averages of 15.52x and 15.43x, respectively.

Meanwhile, STOR is a great business with its very stable earnings stream and its unique method of underwriting which enables it to earn superior cap rates relative to peers while still getting similar underwriting performance thanks to a lot of self-sourced deals and focusing on asset-level metrics.

Finally, STOR is focused on investing for the long-term by keeping a fairly low payout ratio which enables it to retain cash flow and reinvest in opportunistic deals to take advantage of its massive growth runway and deliver outsized shareholder returns.

These are the sorts of opportunities that we are filling our portfolio with at High Yield Investor and enable us to generate strong outperformance while also taking in a weighted average 6% dividend yield.

Be the first to comment