Justin Sullivan

Overview

Advanced Micro Devices, Inc. (NASDAQ:AMD) is my top pick in the semi segment. AMD is an industry-leading high-performance and adaptive computing semiconductor giant. AMD processors power people to lead their fields at the cutting edge. From healthcare and entertainment to science and autonomous driving, AMD is helping solve the world’s most important challenges.

As the high-performance computing chip leader, AMD delivers technologies to accelerate a full range of data center workloads from general-purpose computing to technical computing, cloud-native computing, and accelerated computing. AMD provides scientists, engineers, and designers faster insights and more accurate results. CEO Dr. Lisa Su stated on the latest conference call:

“For the last several years, we have been on a journey to both scale and transform AMD. We have consistently executed our strategy, expanded our portfolio of leadership products and diversified our business, all while driving best-in-class growth.

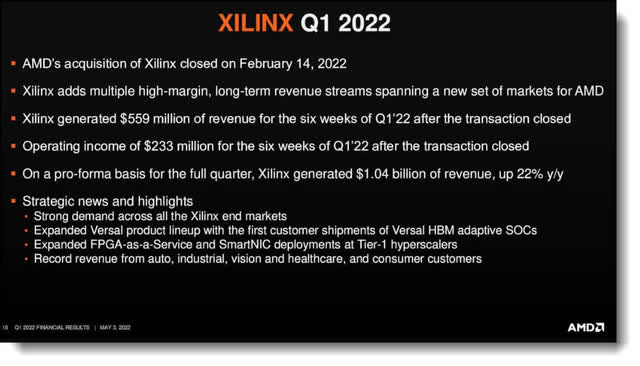

We reached a significant inflection point in our journey during the first few months of 2022, as we took several major steps that fundamentally reshape our business. In addition to delivering record financial results, we closed our strategic acquisition of Xilinx and announced our plans to acquire Pensando.

The strategic importance of the Xilinx acquisition to our long-term goals cannot be overstated. As the industry’s number one provider of FPGA and adaptive computing solutions, Xilinx significantly expands our technology and product portfolio.

Xilinx also adds multiple high-margin long-term revenue streams spending a new set of markets and customers, further strengthening and diversifying our business model. Importantly, Xilinx has successfully executed its own growth strategy in recent years with the increased adoption of adaptive silicon across data center, communications, automotive and other large embedded markets.”

AMD is my biggest winner over the past decade

AMD has been my biggest winner over the past decade. I originally bought the stock at $3.41 in May 2013 for $3.40 for a 2916% gain after being stopped out in January of this year at $120. After large outsized gains in a position, I always set up an automated exit strategy to protect my gains. I wrote an article detailing my buy in 2013, “5 Tech Stocks To Buy With Solid Growth Trading Near Lows.” The following is an excerpt from the article regarding the general premise:

“I believe all these stocks have organic growth forthcoming based on secular catalysts in their respective businesses. These are long term buys. In the following section I will discuss why I think now is the time to buy and hold these five tech stocks for the long haul.”

Why I sold

Once I have substantial gain in a growth stock position and trend reversal is confirmed, which it was in December 2021 for AMD, I will set up an exit strategy to ensure I don’t lose back all my gains. I set up an automatic sell stop limit order at a point where I feel I want to take profits. This takes the emotions out of it for me, and I can stop staring at the screen all day watching it crater, hoping for a turnaround.

Just FYI, on retirement income-generating positions, I do the exact opposite. On my sleep well at night (“SWAN”) income positions, I set buy limit orders when the stock drops substantially below my cost basis, effectively increasing my yield on cost and payout. I rarely, if ever, sell my income-producing stocks. Now, let’s get into why I bought back into AMD.

Why I bought back in

The fundamental story for AMD remains strong. I will cover this in detail in the next section. The primary reason I bought back the stock was that it bounced off major technical support and has taken the first few steps in fulfilling a well-defined trend reversal pattern. Plus, it should get a boost from the expected passing of the CHIPS Act. NVIDIA Corporation (NVDA), Advanced Micro Devices, and QUALCOMM Incorporated (QCOM) were some of the biggest gainers on Wednesday, July 20, as legislation to aid the semiconductor industry passed a key procedural vote in the U.S. Senate. On Tuesday, the Senate voted 64-34 to advance the bill some have called Chips-plus. Additional details of the legislation are still being worked out, as Seeking Alpha reported, but it has won the support from other lawmakers, including, apparently, Speaker of the House Nancy Pelosi. What’s more, the stock has pulled back to major support at $80 and since bounced significantly.

AMD Long-term Chart (Finviz)

Plus, the stock is down by nearly 50% YTD.

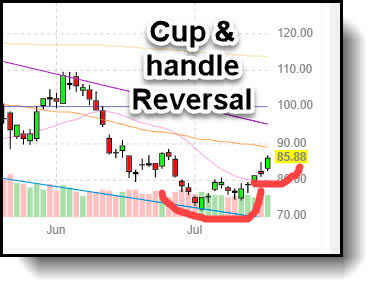

On top of this, the stock has performed a nice cup and handle reversal pattern bouncing off the bottom of the downtrend line.

AMD Trend Reversal Pattern (Finviz)

The fact I owned it previously and the solid cup and handle reversal pattern off of major support at $80 were the primary reasons I started the position prior to the stock breaching the 50-day simple moving average (“sma”). By banking the profits from $120 to $80, in my mind that gave me 40 points of cushion in the position, so I can take on slightly more risk. I have developed this technique of setting up automated exit strategies for growth positions and entry strategies for income positions over time after making the mistake of letting profits get away from me over the years.

It’s not about attempting to time the market, it’s about managing the position and risk. Nevertheless, the bottom line is AMD is growing like a weed and has been sold off indiscriminately as of late. A case of the baby being thrown out with the bath water. Let’s get into the fundamentals.

AMD Fundamental Analysis

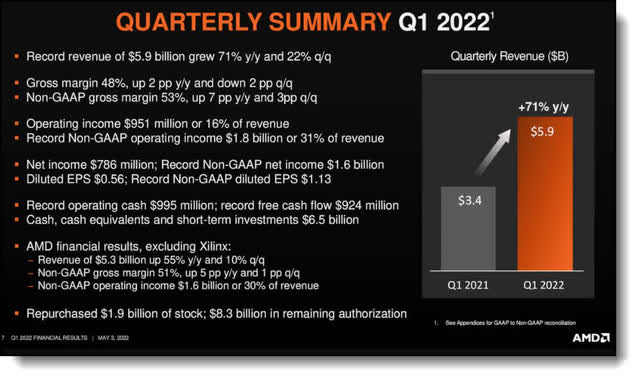

Record Quarter (AMD Presentation)

AMD announced revenue for the first quarter of 2022 of $5.9 billion, gross margin of 48%, operating income of $951 million, operating margin of 16%, net income of $786 million and diluted earnings per share of $0.56. First quarter 2022 results include partial quarter financial results from the recently completed acquisition of Xilinx, which closed on February 14, 2022.

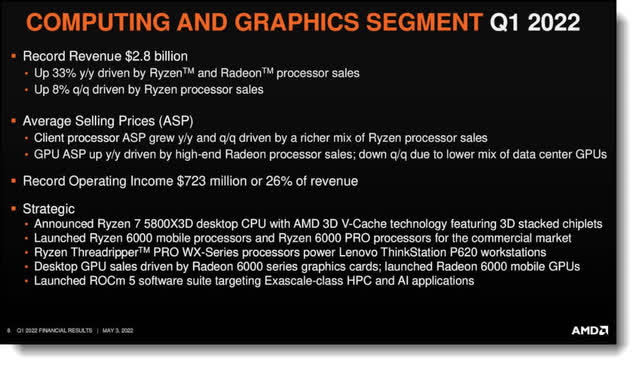

Q1 Computing and Graphics record results

Computing and Graphics Segment Results (AMD Presentation)

Q1 Highlights

- Operating income was $951 million compared to $662 million a year ago and $1.2 billion in the prior quarter. The year-over-year increase was primarily driven by higher revenue and gross profit, partially offset by amortization of intangible assets and acquisition-related costs. The quarter-over-quarter decrease was primarily due to amortization of intangible assets and acquisition-related costs.

- Record non-GAAP operating income was $1.8 billion compared to $762 million a year ago and $1.3 billion in the prior quarter. The year-over-year and quarter-over-quarter increases were primarily driven by higher gross profit.

- Net income was $786 million compared to $555 million a year ago and $974 million in the prior quarter. The year-over-year increase was primarily driven by higher operating income. The quarter-over-quarter decrease was primarily due to lower operating income related to amortization of intangible assets and acquisition-related costs.

- Record non-GAAP net income was $1.6 billion compared to $642 million a year ago and $1.1 billion in the prior quarter. The year-over-year and quarter-over-quarter increases were primarily driven by higher operating income.

- Diluted earnings per share was $0.56 compared to $0.45 a year ago and $0.80 in the prior quarter. Record non-GAAP diluted earnings per share was $1.13 compared to $0.52 a year ago and $0.92 in the prior quarter.

- Cash, cash equivalents and short-term investments were $6.5 billion at the end of the quarter. The company repurchased $1.9 billion of common stock during the quarter.

- Record cash from operations was $995 million in the quarter compared to $898 million a year ago and $822 million in the prior quarter. Record free cash flow was $924 million in the quarter compared to $832 million a year ago and $736 million in the prior quarter.

- AMD’s balance sheet reflects $49.6 billion of goodwill and acquisition-related intangible assets associated with the acquisition of Xilinx.

2022 Guidance

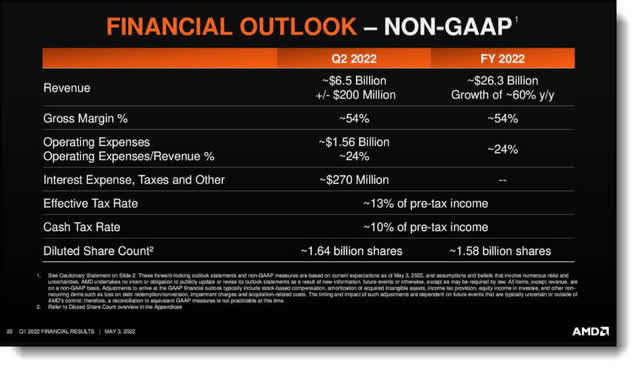

2022 Guidance (AMD Presentation)

For the second quarter of 2022, AMD expects revenue to be approximately $6.5 billion, plus or minus $200 million, an increase of approximately 69% year-over-year and approximately 10% quarter-over-quarter. The year-over-year increase is expected to be driven by the addition of Xilinx and higher server, semi-custom and client revenue. The quarter-over-quarter increase is expected to be primarily driven by Xilinx and higher server revenue. AMD expects non-GAAP gross margin to be approximately 54% in the second quarter of 2022.

For the full year 2022, AMD now expects revenue to be approximately $26.3 billion, an increase of approximately 60% over 2021, up from prior guidance of approximately 31%, driven by the addition of Xilinx and higher server and semi-custom revenue. AMD expects non-GAAP gross margin to be approximately 54% for 2022, up from prior guidance of approximately 51%. The bottom line is that AMD is a best-in-class company in its field. Now let’s wrap this piece up!

The Wrap Up

With the 50% YTD selloff and the stock bouncing off major support at $80, AMD is a compelling buying opportunity. The semiconductor chip industry is and will remain a cornerstone to the United States and every government on the planet’s ability to remain competitive. The Chip Act current going through Congress is a huge sign the government “gets it.” The fact this one issue apparently has been able to bring the Republicans and Democrats together to pass the CHIPS Act in a bipartisan manner is telling of the considerable importance of semiconductors to the survival of our Republic.

I have complete faith that AMD will be much higher in another decade from now. It may not be up another 3000%, but it’d definitely be a fantastic wealth creation vehicle for my retirement portfolio.

Final Note

There’s a fine art to investing during highly volatile markets such as these. It entails layering into positions over time to reduce risk. As a Veteran Winter Warrior of the US Army’s 10th Mountain Division, the attributes of patience and perseverance were instilled in me, hence my investing motto “patience equals profits.” Here’s a picture of my unit loaded into the back of a C141 heading for home after spending a few months in the jungles of Panama in 1989, a vacation I thought would never end.

Panama 89 C141 Flight (US Army 10th Mountain Division)

Those are my thoughts on the matter! I look forward to reading yours! The true value of my articles is provided by the prescient remarks from Seeking Alpha members in the comments section below. Do you believe AMD is a Buy here? Why or why not?

Be the first to comment