D-Keine

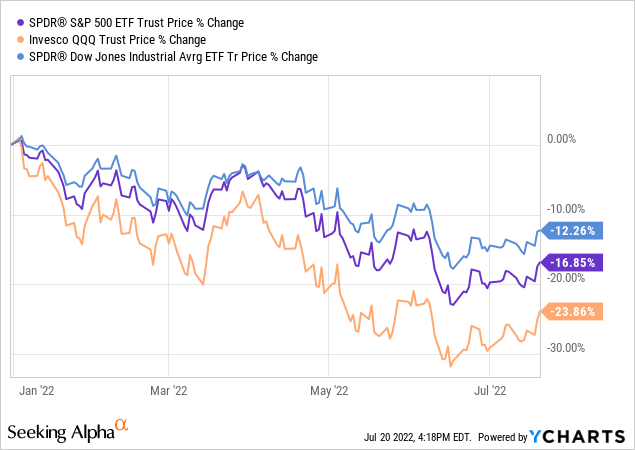

Year-to-date, the major stock market indexes like the S&P 500 (SPY), Nasdaq (QQQ), and Dow Jones Industrial Average (DIA) are all meaningfully down:

We believe that this was generally warranted after the market’s epic post-COVID run-up that seemed to carelessly disregard the negative impacts of lockdowns, reckless government spending and money printing, and rising risks of inflation, interest rates, and geopolitical turmoil. Now, with the global economy increasingly likely to be headed towards recession, investors are entirely validated in taking a more skeptical approach to markets and stock valuations.

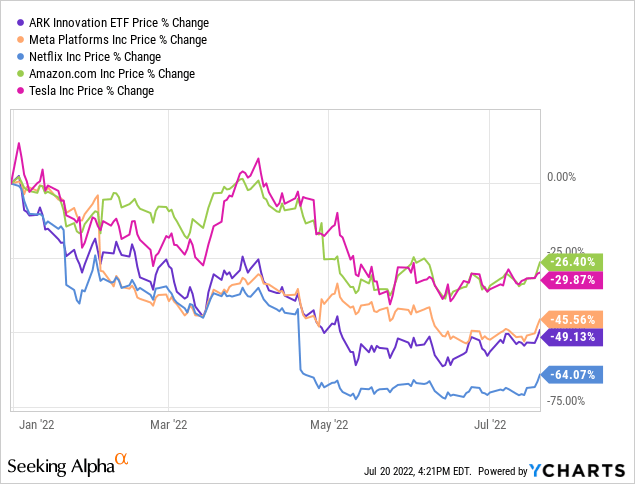

A sector that has been particularly hammered is high growth tech (ARKK) and even some mega cap tech names like Tesla (TSLA), Netflix (NFLX), Meta (META), and Amazon (AMZN):

While we believe that each of these selloffs were warranted as market euphoria had gotten too extreme on high growth futuristic names, we also believe that the market has overreacted in some cases. This is particularly true in several high yielding sectors like REITs (VNQ) and midstream energy (AMLP).

We like many REITs right now because while inflation and interest rates are soaring, many of the REITs that we invest in are actually benefiting from these negative trends as much as – if not more than – they are being hurt by them:

- Their significant levels of debt on their balance sheet are being inflated away and the fixed interest rates attached to that debt means that the value of the liabilities on their balance sheets are declining.

- Meanwhile, high inflation means that rents are rising, increasing the replacement cost and intrinsic value of their assets.

- Even if cap rates rise, it simply means that REITs can reinvest retained cash flows at more attractive rates of return. Meanwhile, most of their debt and revolving credit facilities are already locked in for years at fixed rates.

Despite all of these benefits, REIT public valuations have tumbled, meaning that investors can snatch up shares at deep discounts to NAV.

Midstream energy is probably our favorite opportunity at the moment because equity valuations remain at suppressed levels despite the market for North American energy arguably never being better than it is right now. On top of that, their balance sheets are stronger than ever with debt maturities largely cleared out for the foreseeable future in most cases, leverage levels at historic lows, and interest rates almost entirely fixed. Last, but not least, midstream businesses – most of which are seeing CapEx budgets declining rapidly – are very inflation resistant with inflation indexes linked to almost all pipeline contracts and are also quite recession resistant with very stable cash flow profiles. With free cash flow gushing, distributions growing, and many businesses buying back equity and debt hand over fist, midstream appears poised to deliver phenomenal risk-adjusted returns for years to come.

Here are some of our favorite picks of the moment from each of these sectors.

REITs

- STORE Capital (STOR) is a leading triple net lease REIT with strong dividend growth momentum and a very attractive 5.6% dividend yield. When combining its BBB investment grade balance sheet, impressive portfolio occupancy and rent collection performance – including during the COVID-19 lockdowns – and well-diversified and conservatively structured triple net leases, STOR combines a double-digit total return profile with low risk, making it a very attractive buy on the dip.

- Spirit Realty (SRC) is another triple net lease that we really like right now. Despite boasting an investment grade balance sheet and impressive portfolio metrics, the market has remained quite bearish on this stock as it continues to trade below NAV despite strong management execution. Its current dividend yield of 6.1% meanwhile offers investors a very safe and lucrative income stream that combines with low recession risk, likely multiple expansion, and solid growth to provide a very attractive risk-reward profile for shareholders.

- AvalonBay (AVB) is a leading multifamily REIT with a bulletproof balance sheet, strong rental growth performance, and a terrific development business that generates strong growth and returns for shareholders. AVB is positioned to thrive in good times or bad and investors have a great opportunity to buy shares on the cheap after the selloff this year.

- STAG Industrial (STAG) is a rapidly growing industrial and logistics REIT that is down significantly year-to-date on recession fears, rising interest rates, and concerns that ecommerce players like AMZN might be reducing demand for industrial and logistics properties. Nevertheless, rents are growing by double digits for the REIT and is continues to grow AFFO per share at high single digit annualized rates, combining with the 4.7% dividend yield and a steep discount to NAV to provide investors with a very attractive risk-adjusted total return profile.

Midstream

- Energy Transfer (ET) is one of the largest and best diversified midstream businesses. On top of that, its investment grade balance sheet has arguably never been stronger as management has paid off billions of dollars in debt over the past two years. Meanwhile, its CapEx budget is declining as new projects are coming online, resulting in substantial free cash flow that it is using to further deleverage and grow its distribution. Trading at one of the cheapest valuations in the midstream sector – particularly among investment grade businesses – ET is simply an incredible deal right now.

- Enterprise Products Partners (EPD) EPD is the quintessential sleep well night investment for income investors as it combines a very well covered 7.4% distribution yield with an industry-best BBB+ credit rating, phenomenal assets, investor-aligned management, recession and inflation resistance, and solid growth prospects to provide everything an income investor could ever want.

- Western Midstream Partners (WES) is another cheap investment grade midstream business similar to ET. However, given that its balance sheet has been largely right-sized already, management is poised to buy back units hand-over-fist and is also looking at hiking its distribution further in 2023. Overall, total returns look highly compelling here.

- Plains All American (PAA)(PAGP) is another very cheap investment grade midstream business. It is still focused on aggressively paying down debt, but management expects to achieve its deleveraging goals by the middle of 2023, which should then free it up to accelerate unit buybacks and distribution growth. With a minimal capital expenditure budget, it is a free cash flow machine that should combine significant appreciation with lucrative income in the coming years.

Investor Takeaway

The current selloff – while largely warranted by macroeconomic factors and stock market valuations – has also created some highly compelling opportunities. By investing in those opportunities that are poised to be relatively immune or even benefit from current macro trends that are largely deemed headwinds by Mr. Market, while also trading at highly compelling valuations, investors can position themselves for massive outperformance in the coming months and years.

While we recently released our list of our very top picks to members of High Yield Investor, we believe the picks that we shared with you today also offer compelling value at the moment and should combine high current yields with significant outperformance in the years to come.

If you want access to our Portfolio that has crushed the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest growing high yield-seeking investment service on Seeking Alpha with ~1,350 members on board and a perfect 5/5 rating from 145 reviews.

Our members are profiting from our high-yielding strategies, and you can join them today at our lowest rate ever offered.

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Be the first to comment