dgdimension

Driving Home Values

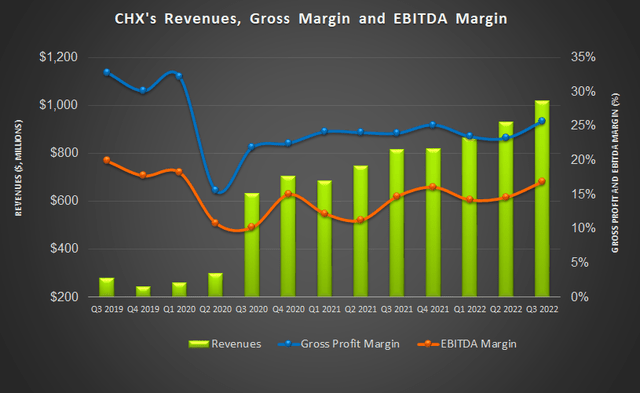

I discussed in my previous article on ChampionX (NASDAQ:CHX) how the company’s operating margin benefited from implementing pricing traction and the Ecolab merger earlier in 2022. I expect revenue headwinds in Q4 following the restructuring of reservoir chemical technologies and holiday-related slowdowns in North America. However, higher revenues from international operations may offset the fall.

Although the company’s growth drivers are robust, the economic indicators appear to head for a run down, which can steal the energy industry’s current steam. Nonetheless, its debt reduction and shareholder return initiatives can expand its valuation. The stock is reasonably valued at this level with a negative bias. I consider it apt for a “hold,” although investors may expect some weaknesses in its returns in the short term.

Key Strategies

CHX has a capital-light business portfolio, which, along with debt refinancing and operating margin expansion, would allow it to generate 50% to 60% free cash flow to EBITDA conversion. In Q3, the company’s $167 million in free cash flow was 1.01x of the adjusted EBITDA. The management expects capex to remain at 3%-3.5% of revenues.

The other key strategy involves increasing the shareholders’ returns. In Q3, it paid $15 million in dividends and $80 million in share repurchases. Combined, it repaid 57% of the FCF generated to shareholders. It targets to increase the return rate to 60%.

Q4 2022 and FY2022 Outlook

In Q4, CHX’s management expects revenues to decrease marginally (at the guidance mid-point) compared to Q3. Higher revenues from international operations can nearly offset the holiday-related slowdowns in North America in Q4, though. On top of that, restructuring the reservoir chemical technologies can reduce the end-quarter topline for the company.

In FY2022, the management expects to record an 18% EBITDA margin, which would be higher than the Q3 rate (~17%). In 2023, the management believes that the concept of energy security in the backdrop of the Russia-Ukraine war will assume importance and ignite demand for oilfield products and services.

Understanding The Industry Dynamics

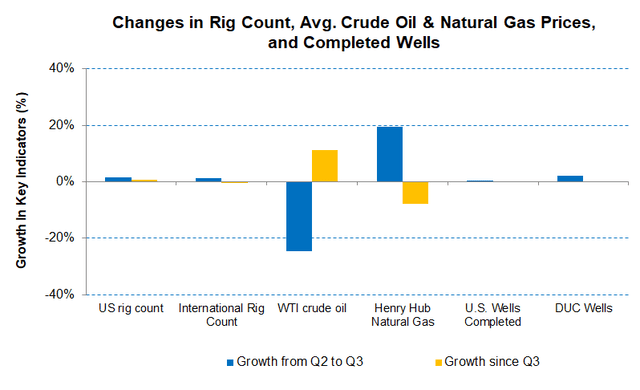

EIA and Baker Hughes’s rig count data

In Q4, there is uncertainty over the direction of crude oil prices. It appears to be recovering after a fall in Q3. The US rig count growth stalled in Q3 (2% up, quarter-over-quarter). The international energy activity followed suit. However, the completion activity and drilled-but-uncompleted did hold their course, suggesting that energy production will not slow in the near term.

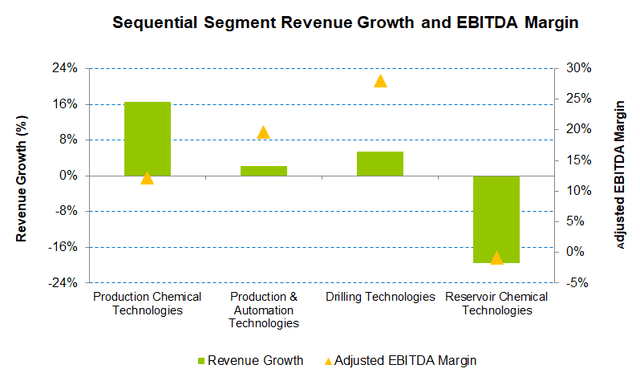

Segments: Performance And Outlook

During Q3, CHX’s Production Chemical Technologies segment revenues increased by 16.5% compared to Q2. Here, the sales growth in international operations outpaced North America. The EBITDA margin (adjusted) in the segment also expanded due to volume growth and selling price increases.

In the Production and Automation Technologies segment, revenues increased marginally in Q3 versus Q2, primarily because of flat sales growth in digital operations. However, demand for digital services does not show weakness as it leverages its expertise to reduce emissions and drive cost efficiencies for its customers. So, revenues will likely increase in the coming quarters in this segment.

The Reservoir Chemical Technologies segment saw the weakest performance in Q3 (19.6% revenue fall) compared to Q2. During Q3, it exited certain RCT product lines and the associated manufacturing capacity, which resulted in a revenue decline. The EBITDA margin, however, held up. The company expects the RCT segment margin to improve and become accretive in 2023.

Cash Flows And Debt

Increased accounts receivable and higher inventory led to a rise in cash outflows. In 9M 2022, CHX’s cash flow from operations decreased despite having recorded higher revenues in the past year. However, compared to a quarter ago, the cash flow gained much ground. Free cash flows (or FCF) also declined in 9M 2022.

CHX’s debt-to-equity ratio was 0.38x as of September 30, 2022, while the net debt-to-adjusted EBITDA improved to 0.8x from 1x in the previous quarter. It had $811 million in liquidity as of that date. Its liquidity increased by $71 million while it repaid $51 million in debt during the quarter.

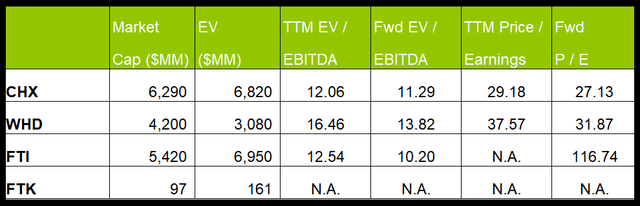

CHX’s forward dividend yield is 0.73%, which is lower than its peer, Cactus’s (WHD) dividend yield of 0.83%.

Relative Valuation And Analyst Rating

According to data provided by Seeking Alpha, eight sell-side analysts rated CHX a “buy” in the past 90 days (including “strong buy”), while two recommended a “hold.” Only one of the analysts rated it a “sell.” The Wall Street analysts’ estimates suggest a mere 1% upside at the current price.

I believe the stock is reasonably valued, with a mild negative bias, at the current level. The stock’s EV/EBITDA is lower than the average of its peers (WHD, FTI, and FTK). Its EV/EBITDA multiple compression is less steep than its peers, which typically reflects in a lower EV/EBITDA multiple than peers.

Why Is My Recommendation Unchanged?

I was cautiously optimistic regarding CHX’s outlook because I expected the production chemical technologies topline to exceed the previous guidance from the Ecolab merger. I also thought the stock would benefit from a favorable multi-year outlook despite tight relative valuation multiples. I wrote:

Its Production Chemicals business has started exploring the chemicals-intensive offshore energy market with a modular fit-for-purpose approach. The Ecolab merger’s revenue synergies and cost reduction initiatives will continue to push its bottom line higher. One of the critical challenges in the near term is the cross-supply sales headwind related to Ecolab.

After Q3, the management appears to have gone mildly conservative. Instead of sales growth, it emphasizes free cash flow to EBITDA conversion and shareholders’ returns. Despite the current economic headwinds, energy security in the backdrop of the Russia-Ukraine war will gain traction in the industry.

What’s The Take On CHX?

The cost reduction initiatives from the Ecolab merger will aid in CHX’s bottom-line gains in the near term. After implementing a round of pricing traction that benefited margin earlier in the year, the company’s revenues can decrease marginally in Q4. The restructuring of the reservoir chemical technologies and holiday-related slowdowns in North America can reduce the end-quarter topline for the company. Besides, revenues will likely increase in digital services because these technologies help reduce emissions and drive cost efficiencies for its customers.

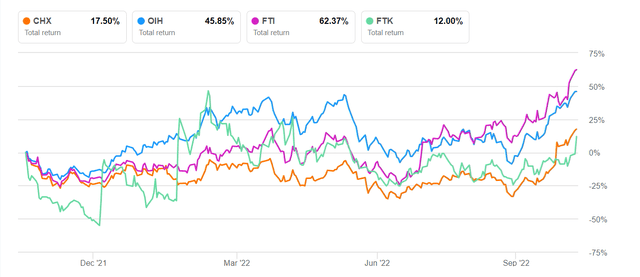

In 9M 2022, CHX’s cash flow from operations decreased because its working capital requirements increased. So, the VanEck Vectors Oil Services ETF (OIH) outperformed the stock in the past year. As a part of the strategy, it has continued to reduce debt and increase shareholders’ returns. I expect the stock to produce moderately negative returns in the medium term.

Be the first to comment