Bill Oxford/E+ via Getty Images

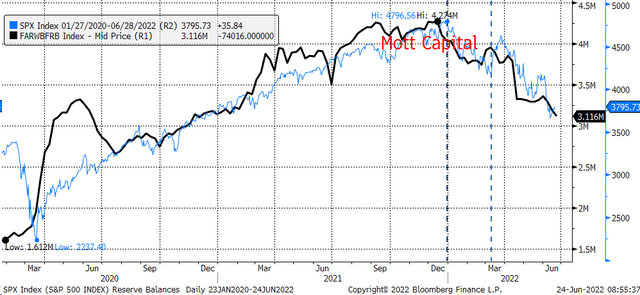

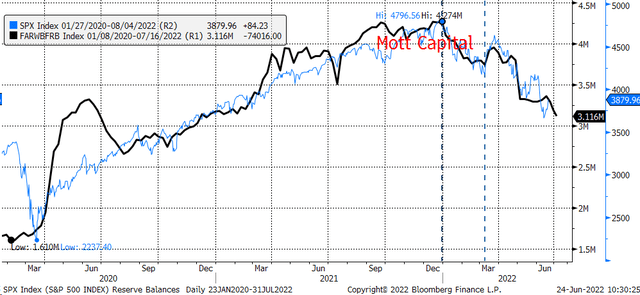

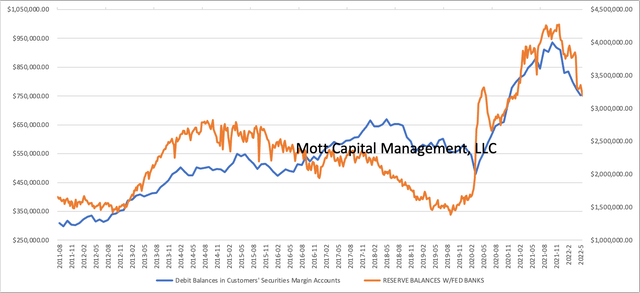

Liquidity has continued to be sucked out of the equity market and diverted to the Fed’s reverse repurchase facility, sending reserve balances to new lows. Changes in reserve balances have been one of the best indicators of future market direction since March 2020.

With reserve balances falling to a fresh low the week of June 23, it suggests that the S&P 500 ETF (NYSEARCA:SPY) also is likely to be on a path to make a new low, probably over the next two weeks. Changes in reserve balances have tracked about two weeks ahead of change in the S&P 500 for some time.

The Timing

When pulling reserve balances backward by 15 days, one can see how the index and reserve balance changes line up in the chart below. The recent uptick in the S&P 500 appears to follow an uptick in reserve balances during the week of June 3.

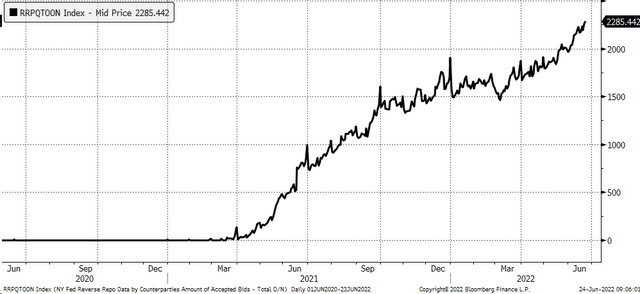

The Fed’s Quantitative Tightening effects are not to blame for the decline in reserve balances. The majority of the decline in reserve balances is due to the increasing demand for the Fed’s Reverse Repo facility, which climbs to a new all-time high almost daily. The facility’s usage has been building up for well over a year, but the effects of the facility have not been felt until after the Fed ended QE.

More Demand Due To Higher Rates

That is because, as the QE was ongoing, whatever money was heading to the Repo facility was instantly replaced with QE, keeping reserve balances moving higher and providing fresh liquidity to the equity market. But now that QE is over, as money leaves to go into the Repo facility, there’s nothing to replace it.

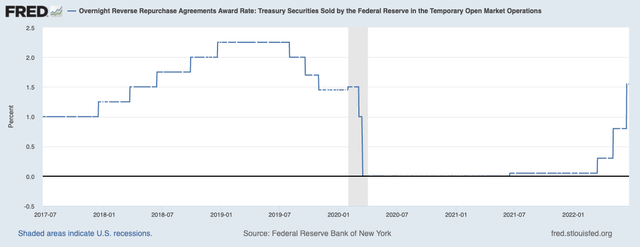

Additionally, now that the Fed is raising rates, the annualized overnight rate for the Repo facility is climbing too, which is only likely to attract even more money going forward. That rate has now risen to 1.55%

Stocks Are A Source Of Funds

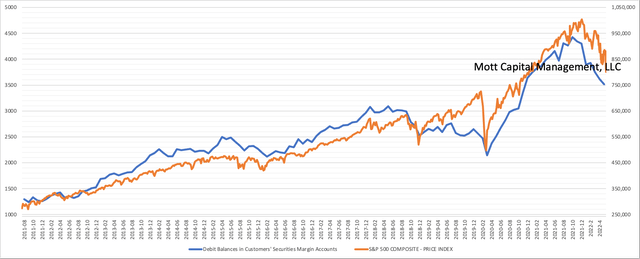

Essentially, the S&P 500 and the entire equity market now serve as a source of funds for the reverse repo facility. This, in turn, is helping de-lever the equity market over time. The latest data from FINRA shows that debit balances have fallen to their lowest levels since November 2020. It’s pretty easy to see in the chart below that as reserve balances dropped in 2018, so did margin balances. The chart also shows the more recent decline in margin balances and the recent decline in reserve balances.

The decline in margin levels also correlates with changes in the S&P 500 over time. It’s important to remember that most of the money that goes into the Reverse Repo facility comes from money market accounts. When cash leaves those money market accounts, less money can be committed to the equity market.

Removing liquidity from the equity market is perhaps the most significant reason stocks may only struggle to rise. On top of that, as the Fed pushes rates higher, the interest rate on the reverse repo facility will only continue to rise. The QT ramp will only add to the removal of reserve balances in the future as Treasury and MBS holdings begin to roll off the Fed balance sheet, further reducing the reserve balances.

The recent declines in the reserve balances data suggest that any movement in the SPY upward over the short term will likely not last and that lower lows will not be far behind as more liquidity gets drained from the markets.

Join Reading The Markets Risk-Free With A Two-Week Trial!

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Be the first to comment