Justin Sullivan/Getty Images News

By Brian Nelson, CFA

It’s just one of those things, as they say. When it comes to Coca-Cola (NYSE:KO), it’s just difficult to get one’s head around the company’s price these days. For starters, the company is trading at ~23.3x next year’s consensus earnings expectations, with the market expecting only modest sales growth in the mid-single-digits for 2023. Certainly, Coca-Cola has a fantastic and very valuable brand, but 23x+ next year’s earnings is stretching it quite a bit.

One might jump to conclude that perhaps Coca-Cola has a massive net cash position that might help bridge the multiple-gap between it and the average S&P 500 company that is trading at 15-16x next year’s earnings, according to FactSet (FDS), but no. In fact, at the end of its calendar first quarter, Coca-Cola had $41.7 billion in loans and notes payable and short and long-term debt against a total cash and cash equivalents balance of $8.4 billion. That’s a net debt position of $33.3 billion.

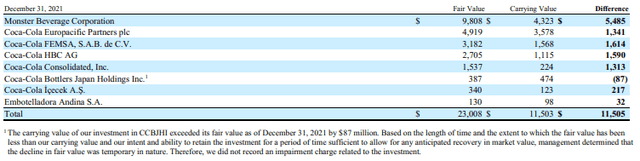

But what about the number of holdings accounted for under the equity method that don’t flow directly into the free cash flow calculation such as its ~$9.8 billion stake in Monster Beverage (MNST), a ~$4.9 billion stake in Coca-Cola Europacific Partners plc (CCEP), a ~$3.1 billion stake in Coca-Cola FEMSA, S.A.B. (KOF), a $2.7 billion stake in Coca-Cola HBC AG, and various other investments? Well, these all tally up to about $23 billion, or only about $5.30 per share and still fall short, in aggregate, of the company’s net debt position by over $10 billion.

Coca-Cola has a number of investments totaling $23 billion, but such exposure still does close the valuation gap versus the average S&P 500 company. (Image Source: Coca-Cola’s latest 10-K)

What are we trying to say? Well, even after considering the fair market value of its investments that are accounted for under the equity method and netting the aggregate value of these investments versus its net debt position on the balance sheet, one still arrives at a company that is growing only modestly, but is still trading at more than 23x next year’s earnings! This premium valuation isn’t new for Coca-Cola as it seems to have always traded at a lofty multiple, but is such a multiple fair? Not exactly, in our view.

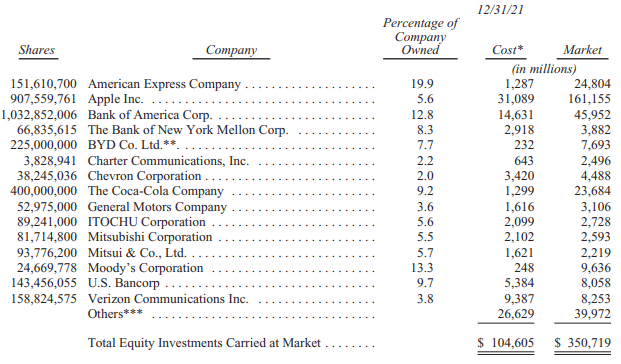

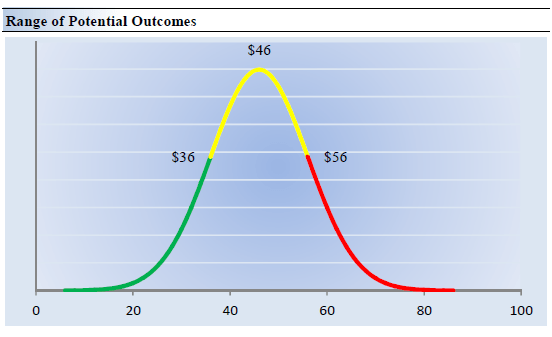

On the basis of our discounted cash-flow process, we value shares of Coca-Cola at just $46 each, and that represents a forward multiple of about 17.4x, which we think is more than fair. For optimists, the high end of our fair value estimate range, which we talk about later in this article, stands at $56, but that, too, is still below where shares of Coca-Cola are trading (~$62 per share at the time of this writing). Shares of Coca-Cola aren’t cheap, and if it weren’t for Berkshire Hathaway’s (BRK.B) 9%+ stake and implicit backing in the name, we would expect them to fall back down to our fair value estimate, or at least to the high end of our fair value estimate range, in rather short order.

Berkshire Hathaway owns a 9%+ stake in Coca-Cola, offering substantial implicit support to shares, which we think are overpriced. (Image Source: Berkshire Hathaway’s Latest 10-K)

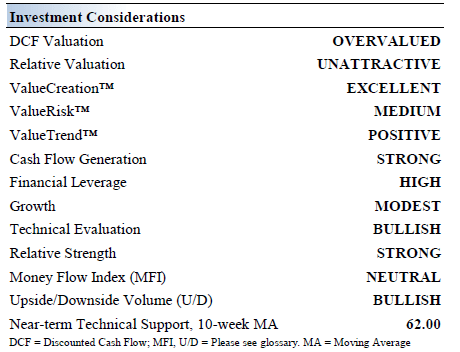

Coca-Cola‘s Investment Considerations

Image source: Valuentum. The key investment considerations we look at when it comes to evaluating shares of Coca-Cola. (Image source: Valuentum)

Coca-Cola is the world’s largest beverage company. The firm owns and markets four of the world’s top five nonalcoholic sparkling beverage brands: Coca-Cola, Diet Coke, Fanta, and Sprite. In 2021, Coca-Cola launched hard seltzer products under the Topo Chico brand in the U.S. Coca-Cola was founded in 1886 and is based in Atlanta, Georgia.

The company boasts a number of competitive advantages: its brands, financial strength, distribution system, and global reach. Coca-Cola decided to directly enter the domestic energy drink market by launching its Coca-Cola Energy offering nationwide in 2020.

Coca-Cola plans to list its Coca-Cola Beverages Africa business as an independent bottler via an IPO in 2023 as part of its broader bottler refranchising pivot over the past few years. The company has also been consolidating its vast brand portfolio in recent years. These efforts along with various other initiatives support Coca-Cola’s margin expansion outlook.

We are big fans of Coca-Cola’s business model and ability to generate significant free cash flows. The firm “refranchised” its bottling operations in the U.S. and we like the strategic pivot. Additionally, Coca-Cola has steadily been divesting its international bottling operations over the years.

Coca-Cola has raised its dividend in each of the past ~60 years. Investors, however, should be cognizant of the generosity embedded in its fair value estimate, originating from a low discount rate and elevated expected top-line growth and margin enhancement. You read that correct — we’re even generous with our assumptions in arriving at our $46 per share fair value estimate.

Inflationary pressures are present, but Coca-Cola seems to be handling the market environment well, at least as it relates to performance in its most recently-reported quarter. Nonetheless, according to the firm, for fiscal 2022, commodity price inflation is expected “to be a mid single-digit percentage headwind on comparable cost of goods sold (non-GAAP), based on the current rates and including the impact of hedged positions.” We’ll see if this talk intensifies when Coca-Cola’s reports second-quarter 2022 results.

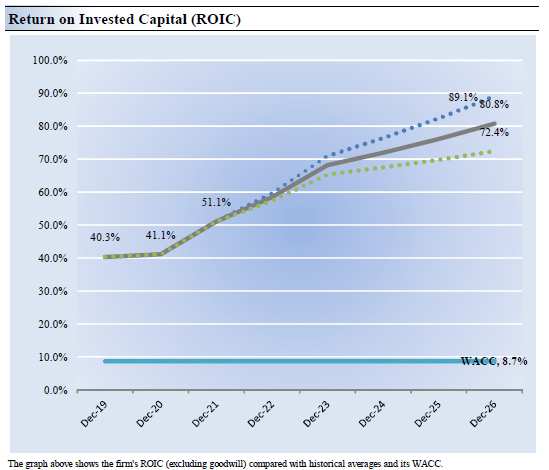

Coca-Cola’s Economic Profit Analysis

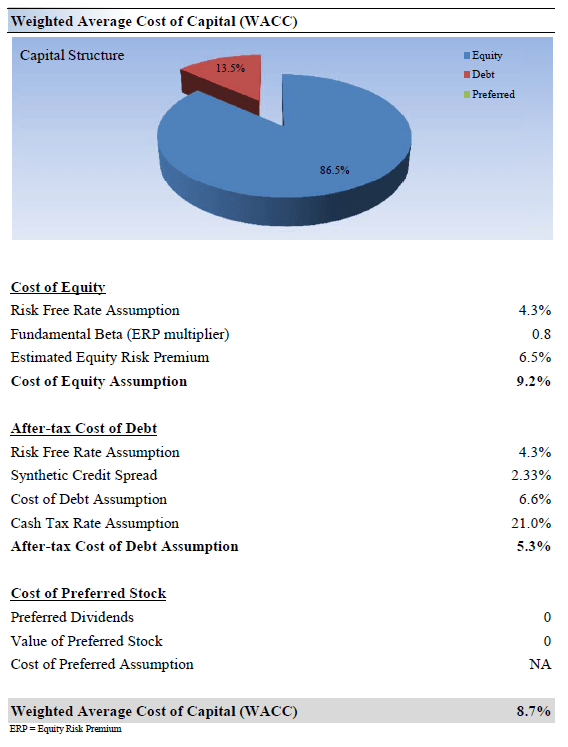

The best measure of a company’s ability to create value for shareholders is expressed by comparing its return on invested capital with its weighted average cost of capital. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Coca-Cola’s 3-year historical return on invested capital (without goodwill) is 44.2%, which is above the estimate of its cost of capital of 8.7%.

As such, we assign Coca-Cola a ValueCreation rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. We expect Coca-Cola to remain a fantastic economic-profit generator.

Image source: Valuentum. We expect Coca-Cola to continue to generate outsize economic profits. (Image source: Valuentum) Image source: Valuentum. How we calculate the weighted average cost of capital for Coca-Cola. (Image source: Valuentum)

Coca-Cola’s Cash Flow and Valuation Analysis

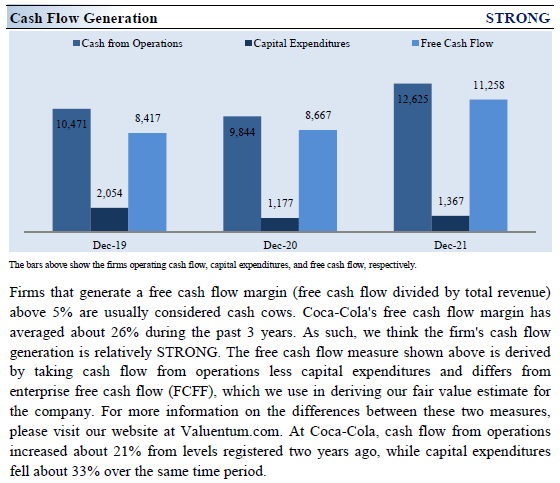

Image source: Valuentum. Coca-Cola is a fantastic generator of free cash flow. (Image source: Valuentum)

We think Coca-Cola is worth $46 per share with a fair value range of $36-$56. Within our enterprise valuation construct, we sum up the present value of the company’s future expected enterprise free cash flows, add the fair value of entities that are accounted for in the equity method and subtract its net debt position before dividing by shares outstanding to arrive at a fair value estimate per share. For more on our enterprise valuation process, please read the book Value Trap.

Our near-term operating forecasts, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 5.7% during the next five years, a pace that is lower than the firm’s 3- year historical compound annual growth rate of 6.7%. Our valuation model reflects a 5-year projected average operating margin of 36.2%, which is above Coca-Cola’s trailing 3-year average.

Beyond year 5, we assume free cash flow will grow at an annual rate of 2.7% for the next 15 years and 3% in perpetuity. For Coca-Cola, we use a 8.7% weighted average cost of capital to discount future free cash flows. All things considered, we think Coca-Cola’s market cap should be roughly $50-$60 billion lower than the $257 billion mark it registered at the last closing pricing prior to this writing.

Coca-Cola’s Margin of Safety Analysis

Image source: Valuentum. Coca-Cola’s fair value estimate range. Shares fall in the overpriced area at current prices. (Image source: Valuentum)

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate Coca-Cola’s fair value at about $46 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

Our ValueRisk rating sets the margin of safety or the fair value range we assign to each stock. In the graph above, we show this probable range of fair values for Coca-Cola. We think the firm is attractive below $36 per share (the green line), but quite expensive above $56 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. No matter how we slice it or dice it, shares of Coca-Cola simply are not cheap, by our estimates.

Concluding Thoughts

The steady demand for Coca-Cola’s products and nearly incomparable brand recognition allow it to generate strong and consistent free cash flows. Its strong business profile has allowed the Dividend Aristocrat to increase its payout over the past 60 consecutive years as of 2022. Coca-Cola’s dividend policy calls for it to pay out ~75% of its free cash flows as dividends. Over the long haul, Coca-Cola targets an adjusted free cash flow conversion ratio of ~95%-100%, and it aims to grow its coffee and energy drink business, while also pushing into the alcoholic beverage market. We are expecting continued dividend increases for the foreseeable future.

That said, the single biggest risk to Coca-Cola’s dividend program is its large net debt load, which also weighs on its equity value within the enterprise valuation construct. Coca-Cola has a solid handle on that burden for now given that the beverage giant is a tremendous generator of free cash flow. Coca-Cola has been highly acquisitive and potential M&A activity needs to be monitored, while Coca-Cola’s share repurchase program competes for capital against its dividend program. Nevertheless, the company remains committed to rewarding income seeking shareholders, and we expect the Dividend Aristocrat will continue to steadily increase its dividend going forward.

Inflationary pressures and supply chain hurdles have been significant of late, but we think the main point of our investment thesis on Coca-Cola has more to do with the vastly overpriced nature of its stock due in part to a “Berkshire premium” than anything else. We don’t expect Coca-Cola to trade down to our fair value estimate or the high end of our fair value estimate range anytime soon, given Berkshire’s implicit backing of shares, but that doesn’t change our view that shares aren’t cheap. We continue to remain on the sidelines, but dividend growth investors have a lot to like with the company’s dividend track record and ~2.9% dividend yield.

This article or report and any links within are for information purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Be the first to comment