Stephen Brashear/Getty Images Entertainment

Elevator Pitch

I assign a Hold rating to Redfin Corporation (NASDAQ:RDFN).

RDFN’s share price has dropped sharply this year thus far as compared with its peer Zillow Group, Inc. (Z) and the broader market. This suggests that its valuations have become more favorable now, especially with respect to the company’s long-term growth prospects. But Redfin doesn’t warrant a Buy rating now, as its financial performance is likely to disappoint investors in the near term. As such, I have a Neutral view or Hold rating for RDFN.

How Has Redfin Performed Compared To Zillow?

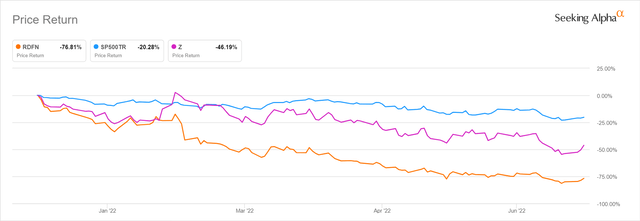

In 2022 year-to-date, Redfin has underperformed both the broader market and its listed peer, Zillow.

Redfin’s and Zillow’s Share Price Performance For The 2022 Year-to-date Period

As per the chart above, RDFN’s shares have fallen by -76.8% so far this year, while Z’s stock price decline over the same period was a relatively narrower -46.2%. Both the shares of Redfin and Zillow have done much more poorly than the S&P 500 which has only pulled back by -20.3% in the past couple of months.

I outline the reasons for Redfin’s absolute and relative stock price underperformance in the subsequent section.

Why Has Redfin Stock Been Going Down?

Redfin’s most recent press release and the company management’s comments at an investor conference in early-June 2022 provide investors with an indication of the current status of the US residential property market and its impact on RDFN.

RDFN published a media release on June 23, 2022, which highlighted that the “Redfin Homebuyer Demand Index” (a home buyer interest metric) decreased by “16% year over year during the week ending June 19” which “was the largest decline since April 2020.” In the June 23, 2022 press release, it was also highlighted that the “30-year mortgage rates” reached a 13-year peak of “5.81%” for the June 17-23 2022 week.

Earlier at the Global Technology Conference hosted by Bank of America (BAC) on June 8, 2022, RDFN already acknowledged that it is likely that “industry volumes are down year-over-year”, as it noted that “homebuyers, with mortgage interest rates up so much, are being pressed on affordability.” This is also validated by data from the National Association of Realtors, which indicates that homebuyers’ principal and interest payments for their homes as a proportion of family income have jumped from 16.2% in April 2021 to 22.9% in April 2022. The National Association of Realtors also noted that the mortgage rate has surged from 3.11% to 5.05% during this period.

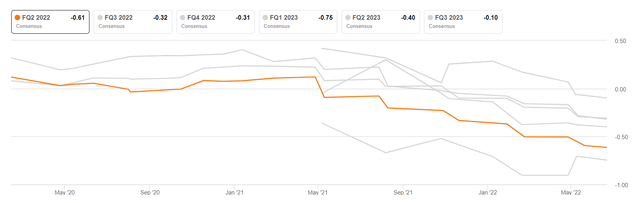

The current negative view of the US housing market is also reflected in the change in Redfin’s consensus Q2 2022 earnings per share or EPS forecast in the past one year. As per the chart below, the sell-side analysts were of the view that Redfin could be profitable in the second quarter of 2022. Since May 2021, Wall Street analysts have changed their views expecting RDFN to be loss-making, and the projected losses have been widening in recent months.

Revisions To RDFN’s Q2 2022 EPS Estimate

Separately, it is also worth spending time to understand why Redfin’s shares have corrected by a much larger degree as compared to Zillow as highlighted in the preceding section. The key is that the two companies have different business models, despite the fact that both of them are categorized as PropTech (Property Technology) stocks.

Redfin is a discount brokerage; it highlights in its FY 2021 10-K filing that “we pair our own agents with our own technology to create a service that is faster, better, and costs less.” On the other hand, Zillow noted in its 10-K that it operates “real estate marketplaces”, and it boasts “the most visited real estate website in the United States” as per its press releases. This explains the relatively weaker share price performance for RDFN vis-a-vis Z.

In the current challenging environment for the US residential property market, it is natural that people would be willing to pay a higher price to engage full-service brokerages (as opposed to a discount brokerage like RDFN) and rely more on agents to advise and assist on their real estate transactions. In other words, Redfin might lose market share to full-service brokerages during this housing market downturn, on top of reduced transaction volumes for the property market as a whole. In contrast, Zillow works on a marketplace business model as mentioned earlier, so any potential shift in market share from discount brokerages to full-service brokerages won’t have a meaningful impact on Z’s business operations.

RDFN Stock Key Metrics

For investors watching RDFN’s stock, the profitability metrics for Redfin are the numbers worth paying attention to.

As per S&P Capital IQ’s financial data, Redfin has been loss-making in every year between fiscal 2014 and FY 2021. Even if one lowers the bar by considering profitability at the EBITDA level, RDFN has only generated positive EBITDA in one (FY 2020) out of the past eight years.

Looking ahead, RDFN mentioned at the recent June 8, 2022 Bank of America Global Technology Conference that there are no changes to its goal of achieving positive earnings by FY 2024. But this does not seem to be a view shared by the market, with Wall Street’s consensus financial projections obtained from S&P Capital IQ pointing to Redfin only becoming profitable by FY 2026. Given expectations of slower revenue growth in the near future considering the weak housing market, RDFN’s path to profitability could take a longer time, as it will be more challenging to drive margin expansion via positive operating leverage.

More importantly, investors have a preference for recession-resistant, profitable companies now, and Redfin doesn’t fall into this category of favored stocks.

Is Now A Good Time To Consider RDFN Stock?

This isn’t a good time to consider investing in RDFN stock for two key reasons.

The first reason is that RDFN is loss-making and investors don’t favor non-profitable companies in this current market environment, which I have discussed in the previous section.

The second reason is that things could get much worse before they get better, as evidenced by Redfin’s recent announcement on reducing its staff strength. RDFN announced on June 14, 2022 that the company will cut its “number of employees by approximately 470 employees” or around 6% of its workforce due to “market conditions.”

There are two key takeaways from Redfin’s recent announcement. Firstly, this is a signal that the US residential real estate market has weakened considerably, and it might take some time to recover. Secondly, RDFN will have fewer agents following this layoff, and this makes it even more difficult for Redfin to compete with full-service brokerages.

In a nutshell, the near-term outlook for RDFN is poor, and it appears to be too early to consider a potential investment in Redfin.

Is Redfin Stock Worth Buying Long-Term?

A stock is worth buying long-term if its valuations are not reflective of its future growth potential, and I think this is the case with Redfin.

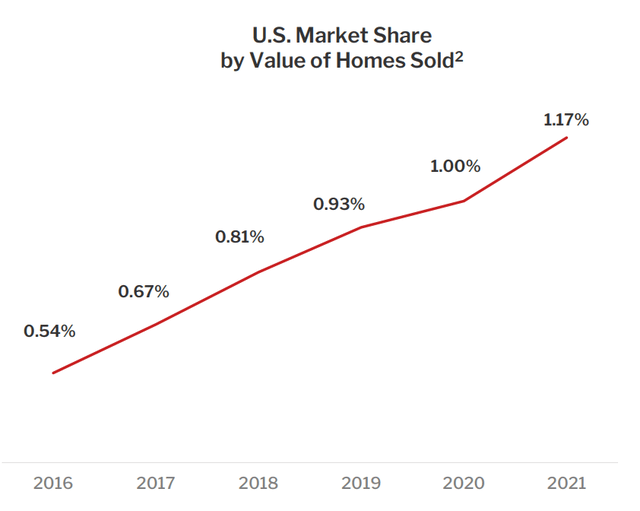

RDFN’s market share in the US has more than doubled in the past six years as per the chart presented below. But Redfin’s market share was still only a mere 1.17% market share as of the end of 2021. Assuming that more people focus on factors like cost, speed and convenience when they carry out their residential property transactions going forward, Redfin does have a long growth runway ahead in terms of potential market share expansion.

Redfin’s Historical Market Share

RDFN’s February 2022 Investor Presentation

In terms of valuations, RDFN shares aren’t that expensive if one takes the long view. Redfin’s last traded share price of $9.03 as of June 23, 2022 implies that the stock is currently valued at a reasonably appealing implied forward fiscal 2026 P/E of 17 times, based on a consensus FY 2026 EPS of $0.93 and a discount rate of 15% for a four-year period.

In conclusion, Redfin is a long-term candidate worth considering; but buying RDFN shares now is not a good investment decision as I explained in the preceding section.

Is RDFN Stock A Buy, Sell, Or Hold?

RDFN stock is a Hold. There could potentially be further downside to Redfin’s financial performance and valuation multiple compression in the near term, which means that it isn’t a good Buy now. But RDFN isn’t a Sell either, as it is attractively valued relative to its long-term growth potential.

Be the first to comment