monticelllo/iStock Editorial via Getty Images

The Procter & Gamble Company (NYSE:PG) provides branded consumer packaged goods worldwide. It operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care.

Today, we are going to highlight the key takeaways from the firm’s 2022 Investor Day, which took place on the 17th of November. This Investor Day 2022 is kind of a special event as this is the first investor day that the firm has held since 2018.

This year, we have already published two articles on Seeking Alpha, rating the company’s stock as a “buy” in both cases. In our first article, we have highlighted the firm’s strong performance during times of low consumer confidence, its loyal customer base and its solid track record of returning value to shareholders as advantages. In our second article, we have elaborated on how the demand for PG’s products may develop in the near future.

Our analysis on PG (Seeking Alpha)

The aim of this article is to see, whether our previously developed thesis and our “buy” rating is still intact.

Investor Day 2022 highlights

1.) Growth strategy

The firm foresees quite a change in its growth strategy in the near future. It has been announced that the firm is aiming for organic growth and the number of acquisitions is likely to be limited.

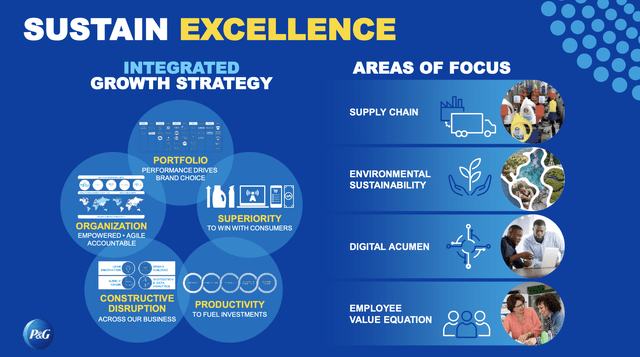

The growth strategy of the firm is planned to be integrated, ranging from the portfolio of products to the organisational setup. The primary areas of focus are supply chain, environmental sustainability, digital acumen and employee value creation.

Growth strategy (PG)

As P&G has acquired a large number of firms in the past, including Gillette in 2005 and the prestige brand Tula Beauty in 2022, we believe this is a quite substantial shift in the strategy going forward.

Many analysts have had a positive opinion on the changes after the presentation. Bank of America analysts have stated:

[…] the organization and strategy changes are working, as evidenced by 6% organic sales growth CAGR and broad improvements across their 10 category segments.

Currently, BofA analysts have a $170 per share price target.

Wells Fargo analysts have commented:

As for the stock? We like it—in our view one of the few names in the Staples sector to offer upside to numbers, and potential to shift narrative […]

Well Fargo has a price target of $155 per share.

Deutsche Bank analysts were also pleased by the presentation:

PG’s first Investor Day since 2018 reaffirmed the company’s strategic choices over the past several years, and underscored management’s commitment to strengthening the execution of these choices to deliver “balanced growth” and value creation in the years ahead.

Productivity

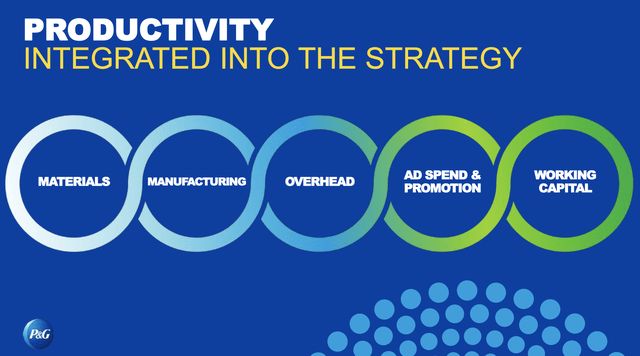

Initiatives focused on productivity improvements are being planned and implemented from materials through manufacturing to working capital investments.

Productivity (PG)

Portfolio transformation

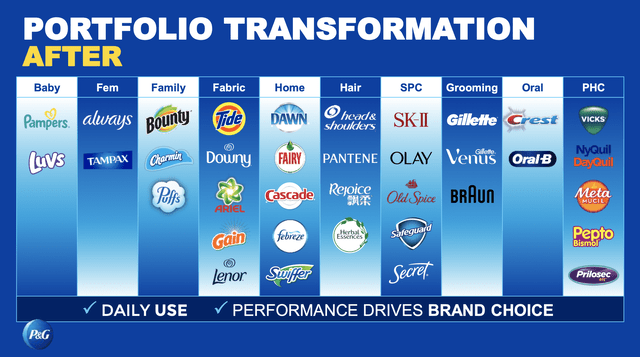

PG has gone through a significant portfolio transformation in the recent years, reducing their number of brands to 65 from 170 in 2017.

Portfolio transformation (PG)

The choice of brands has been decided based on daily use and performance.

Superiority

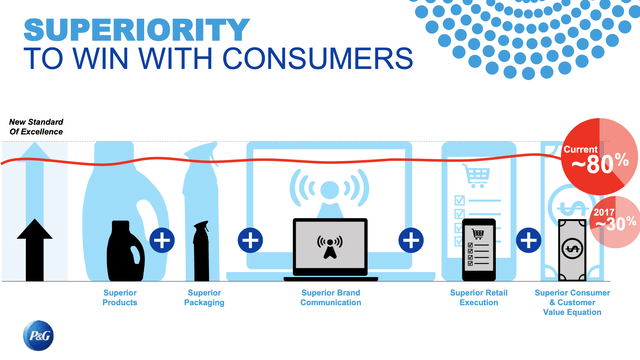

PG aims to grow market share and sales by achieving superiority. Not only the superiority of products is meant in this context, but also the superiority of packaging, brand communications, retail execution and customer value equation.

Superiority (PG)

Constructive disruption

To achieve the so-called constructive disruption, the company is aiming to improve their supply chain and brand building. Lean innovation, combined with digitisation and data analytics are playing a crucial role in the process as well.

Constructive disruption (PG)

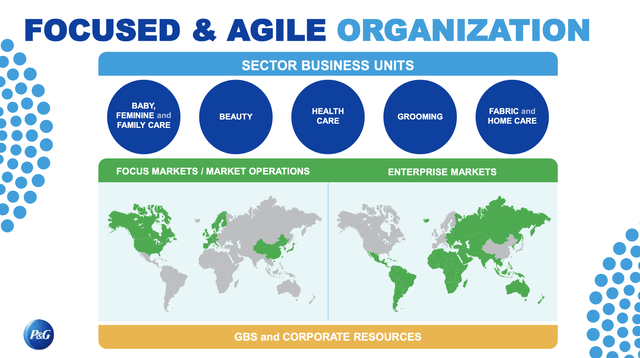

Organization

Last, but not least, we have to mention the organisational changes as well.

The firm is in the process of creating a focused and agile organization, with business units including: baby, feminine and family care, beauty, health care, grooming and fabric and home care.

Organization (PG)

Focus market have been also identified and highlighted, including: Canada, the United States, Europe, China and Japan.

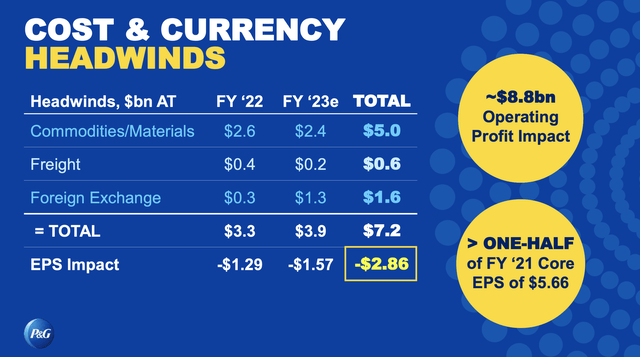

2.) Headwinds

The firm has also given more insight into the key headwinds that they have to deal with.

Headwinds (PG)

We have also highlighted elevated commodity prices and freight costs as substantial headwinds in our previous articles. While commodity and freight headwinds are expected to remain high in 2023, they are likely to decline next year, as no dramatic increase in oil and raw material prices are foreseen in the near future. On the other hand, the unfavourable FX environment is likely to influence the firm’s financial performance even more negatively in the near future. The combined negative effect of these headwinds to the earnings are estimated to be $1.57 per share in 2023.

Other headwinds, which have been highlighted, but not quantified, are the inflationary pressure, inventory management and the weak consumer confidence combined with potential COVID lockdowns.

Other headwinds (PG)

3.) Environment

More and more investors are paying much closer attention to the ESG initiatives of firms before taking a position. Not only investors, but also consumers are becoming more conscious about the products they buy.

Sustainability (PG)

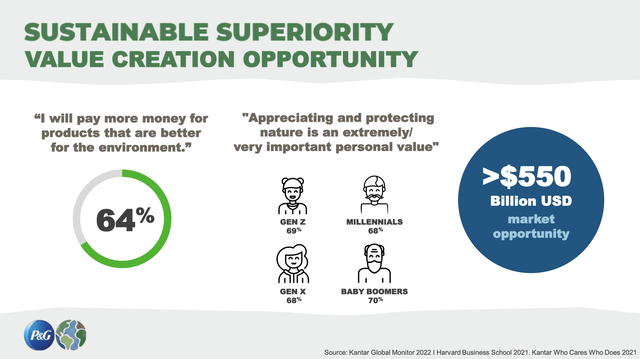

According to Kantar Global Monitor 2022, the majority of people asked said that “protecting nature is an extremely important personal value” for them. 64% of the people have also said that they were willing to pay more for environment friendly products.

Therefore, we are happy that PG is putting a significant focus on their environmental efforts. This could also enable them to get access to this $550+ billion market opportunity.

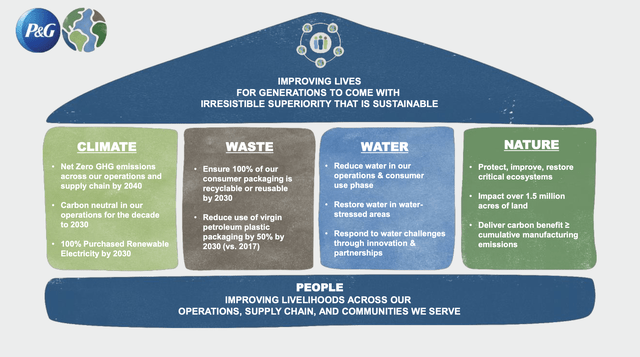

Environmental initiatives (PG)

These efforts include, but are not limited to:

- Developing products that work using cold water

- Destining product formulas that help reduce water use

- Reduce, reuse and recycle packaging

- Addressing gaps in waste management systems

To remember

P&G is aiming to limit the number of acquisitions and is aiming to grow organically. The enablers of this growth are: portfolio transformation, superiority, improved productivity, constructive disruption and an agile and focused organisation.

The main macroeconomic headwinds hurting PG’s financial performance are: elevated commodity and freight costs, unfavourable FX environment, weak consumer confidence and inflationary pressure on the consumers.

PG is also paying more attention to environmental initiatives, which could enable the company to get a share of a $550+ billion market opportunity.

We reiterate our “buy” rating.

Be the first to comment