Sundry Photography

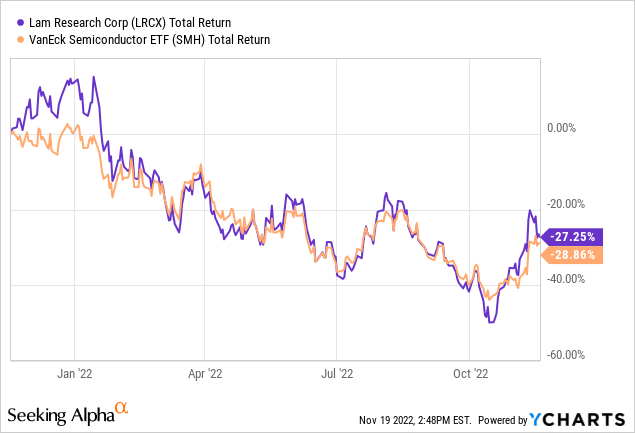

The stock of semiconductor equipment maker Lam Research (NASDAQ:LRCX) has been pummeled over the past-year (-28%) as the company has faced a plethora of headwinds: the higher inflationary/interest rate macro-environment causing a market rotation out of tech/growth and into value; ongoing pandemic impacted supply chains and shut downs in China; and export restrictions due to the ongoing U.S./China high-tech trade war. Lam Research was not immune to these challenges and has traded down in line with the overall semiconductor sector as represented by the VanEck Semiconductor ETF (SMH). However, last month Lam released its Q1 FY23 earnings report, and it may have been an inflection point in the company’s fortunes going forward. That being the case, the stock appears poised to gain back as much as $50-100/share of the ~$275/share it has given up over the past year.

Earnings

There was much for investors to like in Lam’s last month’s Q1 FY23 EPS report. Highlights included:

- Revenue of $5.07 billion was +17.9% yoy and +9.5% sequentially.

- Gross margin of 46.1% was +20 basis points yoy and +80 bp sequentially.

- EPS of $10.39 was +25.6% yoy.

- The fully-diluted share count was 137.2 million, down from 142.6 million in Q1 of last year (-3.8%).

- The quarterly dividend of $1.725/share compared to $1.50 last year.

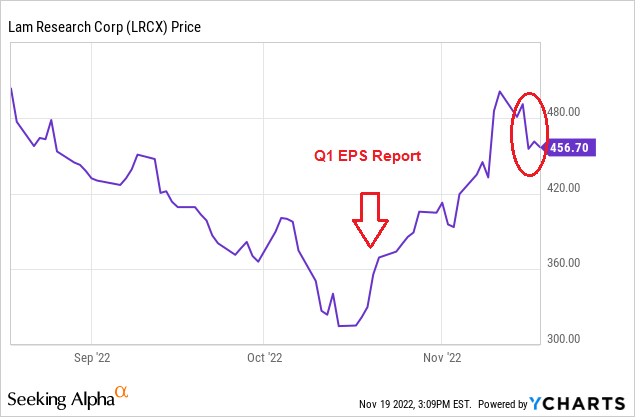

The results were a big surprise on Wall Street, and a bottom-line beat of $0.88/share and a top-line beat of $160 million. As a result, the shares popped ~10% higher after the report and worked their way higher for a month before giving up almost 9% last week:

YCharts

NOTE: Red annotations by the author.

However, I think the selloff last week was simple profit taking after a nice run, and believe the stock still has significant room to the upside. Here’s why.

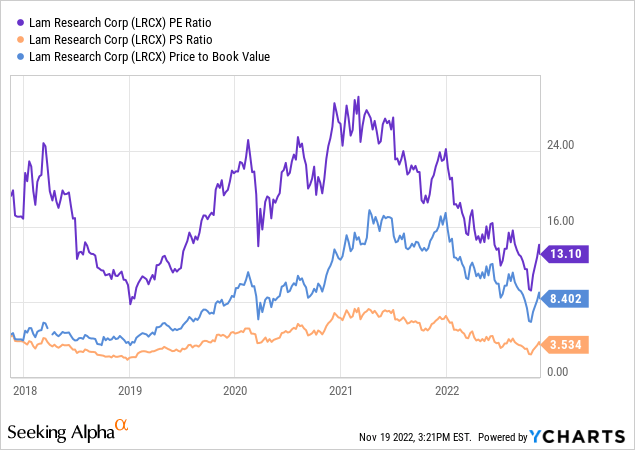

First, despite the excellent Q1 financial returns previously mentioned, LRCX’s valuation metrics have all been cut in half since the spring of 2021 (not 2022, but 2021) and are now generally trading significantly below their historical pre-pandemic levels:

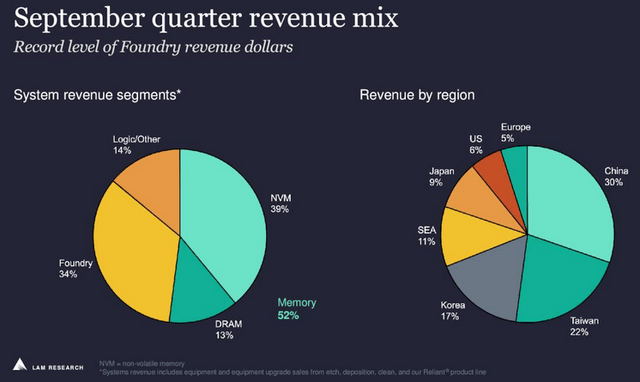

Secondly, going forward, the future for Lam Research looks as bright as ever. Lam, which specializes in wafer fab equipment (“WFE”) and customer support services (i.e., the CSBG Segment) to an installed base of 80,000 fab chambers (+30% since 2019), has a nicely diversified portfolio – both regionally and across the semiconductor technology space:

While the WFE business is expected to decline 20%+ in CL2023 due to lower overall demand and the China export restrictions, CSBG revenue was a $1.9 billion in Q1 – another record (+37% yoy) and roughly 37% of total revenue. What this indicates is that Lam’s large installed customer base – and its services business – have become so large as to significantly counteract a downturn in WFE sales.

That is likely one reason that, despite the strong headwinds in the WFE market, the company issued Q2 FY23 revenue guidance of $5.1 billion, +/- $300 million. At the midpoint ($5.25 billion), that implies a 24% yoy increase over Q2 FY22 revenue of $4.23 billion (of which $1.49 billion was CSBG revenue). The midpoint of EPS guidance ($10/share) would equate to a yoy increase of 17.2% as compared to the $8.53/share the company reported in Q2 of last year. The point is, the short-term looks pretty strong to me.

In addition, Lam is likely to be a beneficiary of technology movements within the semiconductor industry – specifically, higher-layer counts in 3D NAND and evolving etch and deposition technologies to help address challenges in implementing extreme ultra-violet (“EUV”) lithography. The recent SEMSYSCO acquisition – which closed last week – positions LRCS well in wet-processing equipment and advanced chip packaging, both of which are nicely complementary to Lam’s existing offerings.

Mid- to longer-term, the Biden Administration’s CHIPS & Science Act has targeted $50 billion to help jump-start a massive re-shoring of high-tech semiconductor supply-chains back to the United States (and to a lesser extent in Europe). This is a powerful catalyst for Lam Research and most all of the top semi-equip companies going forward. Indeed, Micron (MU), Intel (INTC), and Taiwan Semiconductor (TSM) have all announced new multi-billion dollar fabs in the U.S. and LRCX’s equipment will likely be found in each and every one of them. I say that because in its 2022 Annual Report, Lam lists Intel, Micron, and TSMC among its “most significant customers”, which also include Samsung, SKY Huynix, and Yangtze Memory Technologies (“YMTC”).

Shareholder Returns

Lam Research CFO Doug Bettinger discussed shareholder returns on the Q1 conference call:

From a capital return perspective, we allocated approximately $105 million to share repurchases during the September quarter. The cash was deployed in open market repurchases. The ASR from the June quarter also continued to execute in the September quarter. We paid $206 million in dividends during the quarter. And just to remind you, we continue to target returning 75% to 100% of free cash flow as our long-term capital return plan.

I expect to Lam Research to generated ~$6 billion of free-cash-flow in FY23. Given the current dividend obligation, the low-end of the target (75%) would leave an estimated ~$3.6 billion for share repurchases, or roughly 5.8% of the company’s current $62.9 billion market-cap.

Risks

Risks include a loss of market share to competitors like Applied Materials (AMAT) and Tokyo Electron (OTCPK:TOELF), increased leading-edge tech export-controls on China in FY23, and a weaker than expected global economy.

Summary & Conclusion

Lam Research’s stock has been overly beaten down in my opinion, with the negative impact of restrictions on China (Investor’s Business Daily reported an estimated $2-$2.5 billion in 2023) already being more than priced into the stock while ex-China global demand remains strong. As a result, the company trades at an irrational forward P/E of only 13.1x. After all, sales and EPS are still growing at greater than 15% a year. That being the case, and all else being equal (but recognizing it never is …), the stock should double every 5-years, right?

Next year’s earnings are expected to come in at $28.15. If we put an S&P 500 multiple (20.6x) on that, we get a $579 stock. That said, given the bright future, the CHIPS Act, and the strategic importance of the semiconductor industry, I would argue LRCX actually deserves an above market multiple. However, even if we back-off the multiple, and bring the price target down to $500, that is still a 10% above where the stock closed on Friday. Heck, LRCX was trading over $500 just a couple of weeks ago.

Meanwhile, LRCX’s $6.90/share annual dividend is good enough for 1.52% yield and provides for a modicum of income and some downside protection for investors. In addition, Lam’s strong FCF profile and shareholder friendly management means the outstanding share count should continue to be meaningfully reduced via share repurchases.

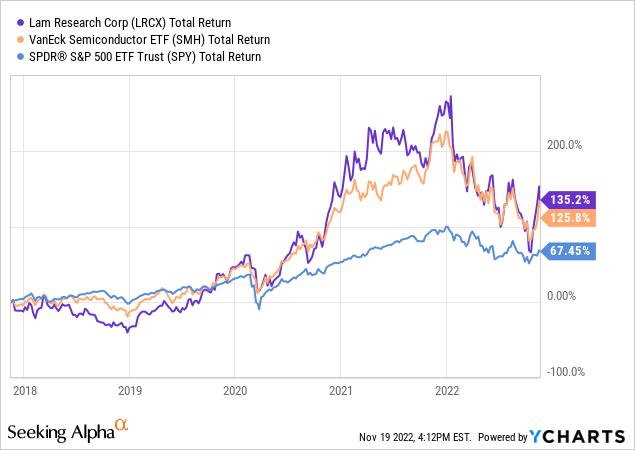

I’ll end with a 5-year price chart of Lam Research versus the broad semiconductor sector as represented by the SMH ETF and note that despite the bear-market beating the semiconductor sector has taken, it still has significantly outperformed the broad S&P 500 over the past 5-years. My opinion is that both (LRCX and SMH) will likely do so over the next 5-years as well.

Be the first to comment