energyy

Radius Global Infrastructure (NASDAQ:RADI) shares have been on a wild ride thus far in 2022. Early in the year, the stock sold off along with the broad decline in the market before rebounding strongly in May as sale rumors emerged sent shares surging. Now five months have passed since sale rumors broke and the deal financing environment has significantly deteriorated making a near-term sale unlikely. With shares having fallen 40% in the past month alone, I believe that RADI is an interesting opportunity for shareholders with a long term time horizon.

What is Radius Global Infrastructure?

RADI is an aggregator and lessor of the land which sits under cell phone towers primarily in the US, Europe, UK, Australia and Brazil. It typically acquires the land from families or mom and pop operators under both purchase and long term lease contracts (see below). It leases the land to creditworthy tower operators like American Tower (AMT) or Cellnex (OTCPK:CLLNY) in Europe.

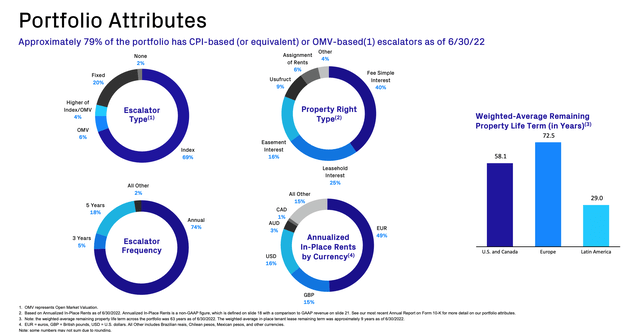

Escalators, Countries (Company Presentation)

Why is Radius out of favor?

There are no shortage of reasons that RADI shares have performed poorly including:

-

Seemingly aborted sales process

-

High debt levels – this is mitigated by VERY stable cash flow, limited near term maturities, currency matching, and fixed low interest rates

-

REITs (note: RADI is not a REIT but is very REIT-like) have been decimated thus far in 2022 falling over 30% year to date

-

Radius is a former SPAC – most SPACs have proven to be terrible investments for investors.

-

While RADI is tremendously cash generative, the company expenses site acquisitions costs (in my perfect world this would run through the investing section of the cash flow statement), making investment analysis a bit more cumbersome.

-

Currency – As shown above, RADI earns most of its revenue in Europe/UK and these currencies have weakened materially versus the dollar. Fortunately management had the foresight to borrow in EUR and GBP to match its revenue exposure.

Why should investors be interested in Radius Global Infrastructure?

A. The company owns/ has long-term rights to critical infrastructure assets which is leased to creditworthy tenants (tower operators and in some cases national telecoms) contracted under long term leases. There is no economic sensitivity – these leases will be paid rain or shine.

B. In addition to having highly certain cash flows from creditworthy counter parties, ~70% these cash flows are CPI linked. Essentially, RADI is akin to a very high grade, inflation linked bond.

C. The company has a platform to continue to acquire more of these critical infrastructure assets at attractive cap rates (nearly 7%) and ample attractively priced funds to do so. This will allow for the creation of additional shareholder value over the medium term.

Valuation

Here is my valuation estimate for RADI:

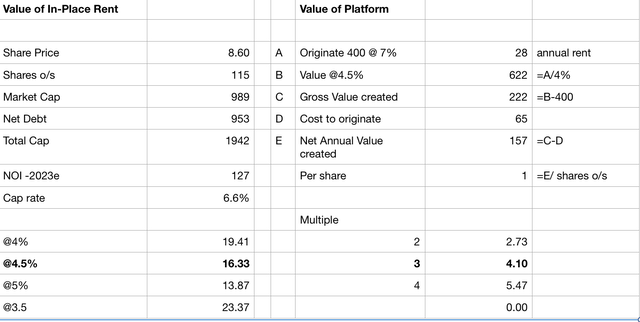

Valuation Model (Author Model)

On the left side, I value the existing portfolio of assets RADI management has assembled. In thinking about the correct capitalization rate for the business, I mainly consider the cap rates at which net lease REITs focused on investment grade tenants trade. Currently VICI (VICI), Realty Income (O), Agree Realty (ADC) all trade at cap rates of 5.5-6%. However, these REITs have annual escalators ranging from 0.8-2.5%, which are significantly lower than RADI. As such I assume RADI trades at 100-125 bp premium reflective of the higher embedded growth which gets me to $16/share which is 87% above the most recent trade.

On the right side, I show the potential value of RADI’s lease origination platform. While the company would likely not receive full value for this in today’s strained market (I believe this may have been a key point of contention in selling the business) which I think could add another $4 in value. Adding this to the existing portfolio gives me a bull case valuation of $20/share.

Risks

1. Investors continue to shun REITs and by extension RADI

2. Euro and GBP further weaken

Conclusion

While a number of factors have negatively impacted RADI’s share price, it is rare to find a collection of mission-critical assets long-term leased to creditworthy tenants at a ~50% discount to fair value. Further, continued acquisition should lead to meaningful NAV/share growth in the medium term. Given the large disconnect between share price and intrinsic value, I’ve been adding to my position.

Be the first to comment