Maximusnd/iStock via Getty Images

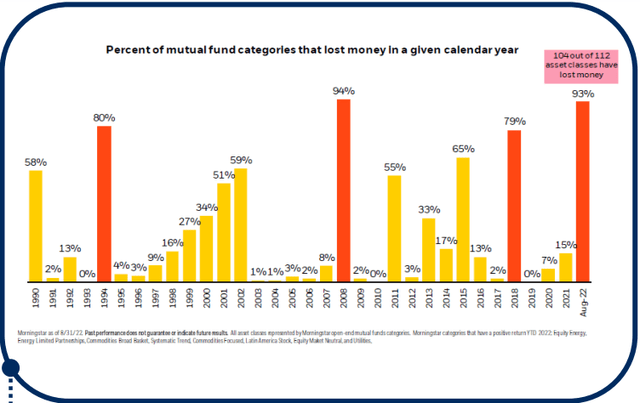

Nowhere To Hide

The current investing environment has been especially challenging due to the fact most investment vehicles have generated a negative return this year. Historically, investors in a diversified portfolio of stocks and bonds would be insulated in an equity market decline with the bond or fixed income holdings rising in value. BlackRock’s Rick Rieder, chief investment officer of global fixed income and head of their global allocation team, was quoted in a recent Wall Street Journal article noting, “In 50 years we haven’t seen debt and equity markets fall this much in unison.” As of August 2022, 104 out of 112 asset classes have generated a negative return according to Morningstar data.

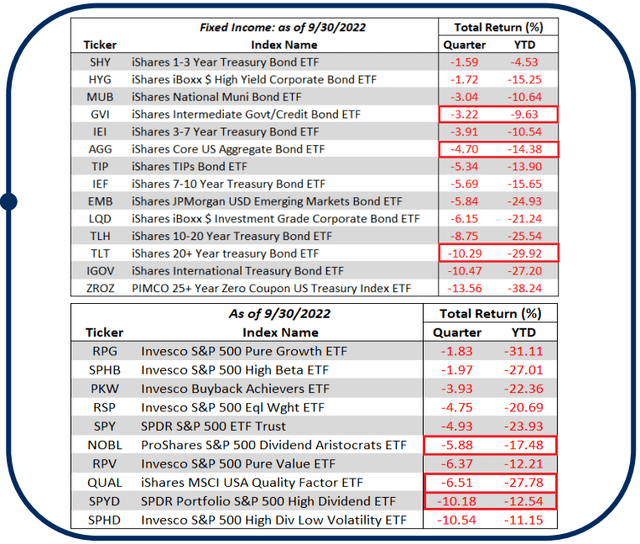

The magnitude of the negative returns can be seen in the two near tables. Intermediate and core bonds are down year to date, 9.63% and 14.38%, respectively.

For stocks/equities, the more defensive stocks like S&P’s Dividend Aristocrats, High Yielding Dividend Payers, and High-Quality equities are down year to date, 17.48%, 11.15%, and 27.78%, respectively.

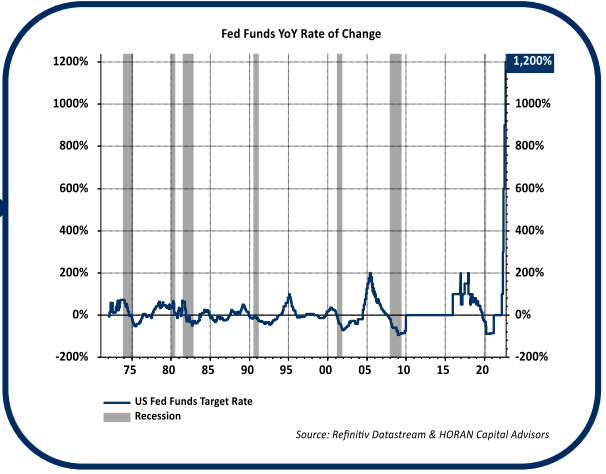

Don’t Fight The Fed

The most significant factor driving the negative investment returns is the Federal Reserve’s effort to rein in inflation by employing a tighter monetary policy, in part by raising short-term interest rates. The Fed has raised the target Fed Funds rate by 0.75% in each of the last three rate announcements and a total of 3% this year. The pace of the recent Fed hiking cycle is faster than any other time. Additionally, there has been little to no coupon (interest) support to offset the decline in the price of fixed income holdings due to interest rates increasing from near zero for short-term bond maturities and low levels for longer maturities. Higher rates are used by the Fed to reduce economic activity by creating a headwind for business and consumer borrowers. The Fed’s preferred inflation measure is the Personal Consumption Expenditure (PCE) reading. The August reading for Core PCE, which excludes food and energy, was reported at 0.6% month-over-month. The year-over-year reading was 4.9% and far above the Fed’s 2% target. Additionally, the August 0.6% reading was higher than the 0% reading for July. Thus far, the Fed has not been able to put the inflation genie back in the bottle. While there are some signs inflation is peaking, more time will be necessary to measure the success of the tightening to date.

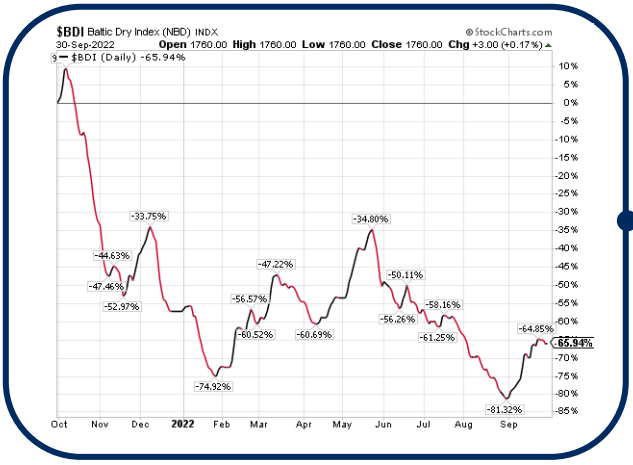

Evidence Of An Economic Slowdown

If one goes by the technical definition of a recession (two consecutive quarters of negative real GDP growth), the U.S. economy is in a recession. Real GDP declined at an annual rate of 1.6% in the first quarter and declined 0.6% in the second quarter. Other economic variables are also showing the U.S. economy is at least slowing. Weakness is seen in the August imports moving through the largest U.S. port located in Los Angeles. The L.A. port saw its largest decline since May 2020 as inbound containers fell 17% in August. The import weakness is also showing up in broader global shipping data. The Baltic Dry Index (BDI) measures global freight rates for dry bulk shippers. When global demand for shipping rises, the BDI rises as well. The BDI peaked in October of last year and is down over 65%, an indication of less demand for shipping. The lower shipping demand makes some sense as inventories at retailers and wholesalers have been trending higher.

Additionally, the Wholesale Inventory to Sales ratio is nearing its pre-pandemic level and the Retail Inventories to Sales ratio is rising as well. In both ratios, the sales components are declining while the inventories’ components are increasing.

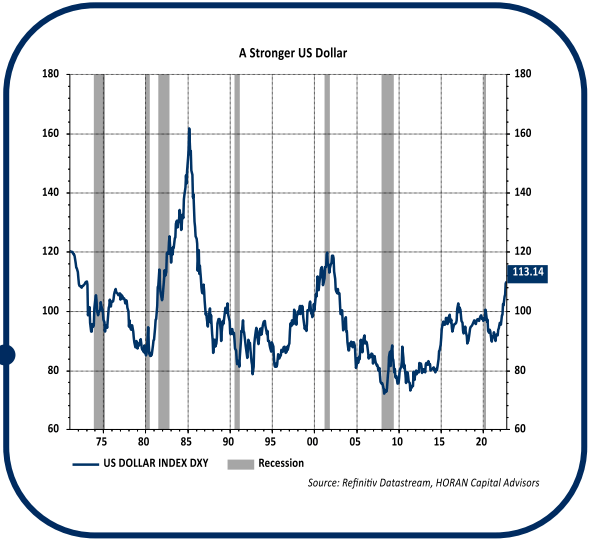

International Markets & The Dollar

As noted earlier, the Federal Reserve’s pace of rate increases is the quickest on record. Out of 34 global central banks, 30 are tightening monetary policy which creates a headwind for global economic activity. With the pace of U.S. tightening, the U.S. Dollar is approaching a level last reached in 2001. A stronger Dollar can be problematic for countries with debt borrowed in U.S. Dollars, such as emerging market economies. With the U.S. Dollar being strong, it takes more of a country’s currency to buy Dollars. The strong Dollar is also a headwind for U.S. multinational companies as it makes their goods and services more expensive for foreign buyers.

Additionally, a stronger Dollar negatively impacts the return U.S. investors receive on their foreign investments. A U.S. investor’s YTD return for the developed international asset class, EAFE in this case, was a negative 26.8%. For an investor hedged against the Dollar, the return was nearly 13 percentage points better at -13.2%. In fact, developed and emerging international markets have outperformed the S&P 500 Index YTD in their local currencies.

So What’s The Good News

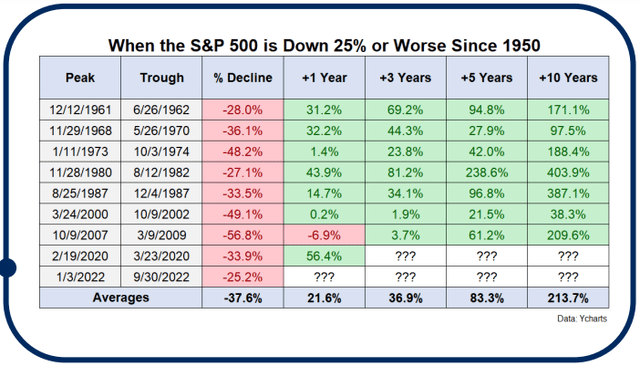

It is difficult to predict the market’s day-to-day or month-to-month move. At current equity market levels and given the extent of the three-quarter decline this year, historical market performance suggests investors with a one to three-year time horizon could experience positive returns in the future years. To the right is a return table from an article published by Ben Carlson at A Wealth of Common Sense titled Getting Long-Term Bullish. The table details future returns for the S&P 500 Index after a decline of 25% or worse going back to 1950. As shown, there is a lot of green in the out years. One important factor for investors during volatile market periods is to have an asset allocation that contains more protected assets that can be sold to maintain one’s lifestyle during difficult environments. The largest damage to long-term investment returns is selling stocks or assets when they are down.

Earnings

As the economy slows, corporate earnings will be front and center for the markets. Consumer preferences have shifted from retail companies that benefited from the pandemic shutdown to spending associated with travel and leisure, i.e., spending on experiences. In NIKE’s (NKE) earnings report at the end of September, it was noted company inventory was up 44% overall and 65% in North America. To reduce inventory NKE will likely reduce selling prices; thus, reducing earnings growth. Those companies impacted disproportionately by higher costs will likely experience earnings headwinds. Many companies are already feeling the effects of a slowing economy. Companies in the Consumer Discretionary sector saw earnings decline 12% in the second quarter of 2022. Although the overall direction of earnings was positive for the market in the second quarter, that earnings growth was supported largely by energy companies. Excluding energy stocks, S&P 500 earnings fell by 2.1%. Another earnings issue companies face going forward is the strong U.S. Dollar discussed above. As multinational companies convert foreign earnings back into Dollars, it takes more of the foreign currency when converting to the Dollar; thus, lowering reported earnings. In addition, a stronger dollar increases the competitive cost of U.S. export goods as compared to equivalent foreign goods. The market has recently favored companies that have a high percentage of their business based in the U.S. as multi-national companies have underperformed those with higher domestic revenues.

The Other Side

While the short-run environment could continue to be challenging, we believe valuation adjustments are occurring that are beginning to present opportunities for attractive long-term investments. Excess liquidity and economic stimulus during the pandemic distorted asset prices in many areas of the economy. From bond prices to highly speculative IPOs (remember SPACs?), economic incentives for taking risk had become lopsided. While recent market action is painful, bringing incentives back in line, eliminating irresponsible and excess risk-taking via lower valuations will ultimately reward the disciplined investor. The markets are placing more emphasis on company fundamentals. Asset prices are lower across most major asset class categories. There could very well be more downside to come as markets tend to overreact on both the upside and downside. Whether the market has touched the low for this cycle or not, opportunities are surfacing for long-term investors to accumulate great businesses and investments at lower prices. A continued disciplined approach to investing will win out.

Thank you for your continued confidence and support in HORAN Capital Advisors.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment