Apriori1

During turbulent times like what we have seen, sometimes a win is owning a stock that drops, but not quite as much as what the market does. An example of this can be seen by looking at MSC Industrial Direct (NYSE:MSM), a supplier of metalworking, as well as maintenance, repair, and operations, products and services throughout North America. Although the market has been successful in pushing shares of the company down, this comes at a time when the firm’s fundamental performance remains quite robust. Add on top of this the fact that shares of the enterprise look quite affordable, and I would make the case that continued outperformance compared to the S&P 500 should continue for the foreseeable future.

A solid prospect

In January of this year, I wrote a bullish article about MSC Industrial Direct. In that article, I talked about how the company had done well over the prior few years if we ignore the pandemic year of 2020. Even after that year, the company continued to see some pain. But the overall trend exhibited by the enterprise was positive. Ultimately, I felt as though shares were pricey compared to similar firms. But on an absolute basis, they were cheap enough to warrant a ‘buy’ rating, reflecting my belief at the time that shares should outperform what the broader market should achieve moving forward. Although it would have been nice to see shares of the company rise, I still count the drop the firm experienced as a slight win. After all, while shares have generated a loss for investors of 7.1%, that’s far better than the 17.9% decline experienced by the S&P 500 over the same timeframe.

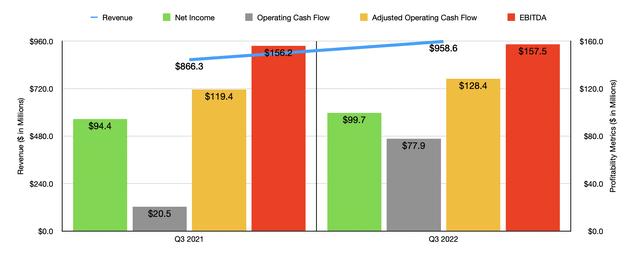

To see why MSC Industrial Direct has continued to outperform the market, we need only look at its results covering the 2022 fiscal year. You see, when I last wrote about the company, we only had data covering through the first quarter of this year. Today, that data now covers through the third quarter. In the latest quarter alone, revenue came in strong at $958.6 million. This represents an increase of 10.7% compared to the $866.3 million generated in the third quarter of 2021. Of the $92.3 million rise in revenue, $54.1 million was attributed to improved pricing on its offerings. $33.9 million of the increase was driven by a rise in sales volume. And the company also benefited to the tune of $5.8 million thanks to acquisitions. Unfortunately, this was offset to some degree by a foreign exchange impact amounting to $1.5 million.

On the bottom line, results have also been positive. Net income for the company rose from $94.4 million in the third quarter of 2021 to $99.7 million the same time this year. Operating cash flow surged from $20.5 million to $77.9 million. Even if we adjust for changes in working capital, the picture would have been attractive, with the metric rising from $119.4 million to $128.4 million. The smallest increase came from EBITDA, with that metric inching up from $156.2 million to $157.5 million.

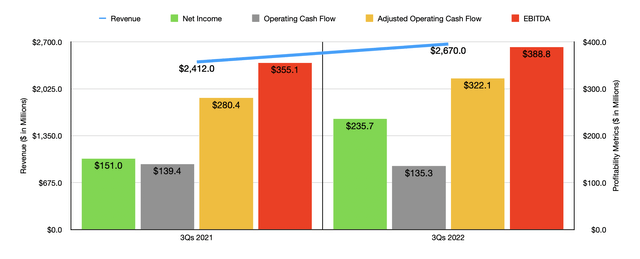

The third quarter was not the only quarter that was positive for the company. So far, the entirety of the first three quarters has proven to be bullish. Revenue of $2.67 billion is 10.7% higher than the $2.41 billion reported the same time last year. What’s interesting is that, while higher pricing did account for a significant portion of the sales increase for the first three quarters, it was actually sales volume that made up most of the difference. This shows strong demand for the company’s offerings even as higher pricing should normally blunt demand. Net income rose from $151 million last year to $235.7 million this year. Operating cash flow did decrease, dropping from $139.4 million to $135.3 million. But if we adjust for changes in working capital, it would have risen from $280.4 million to $322.1 million. Meanwhile, EBITDA for the company also improved, rising from $355.1 million to $388.8 million.

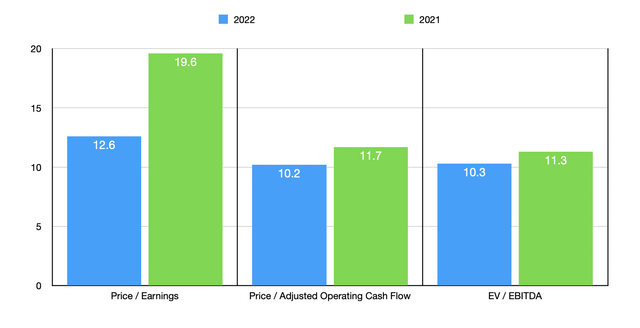

Unfortunately, we don’t really know what to expect for the rest of the year. But if we were to annualize results seen so far, we should anticipate net income of $338.7 million, adjusted operating cash flow of $419.3 million, and EBITDA of $486.1 million. These numbers compare favorably to the $217 million, the $365 million, and the $444 million, respectively, that the firm generated in 2021. Based on these numbers, the firm is trading at a forward price-to-earnings multiple of 12.6. The price to adjusted operating cash flow multiple is 10.2, while the EV to EBITDA multiple should come in at 10.3. By comparison, using data from the 2021 fiscal year, these results would be 19.6, 11.7, and 11.3, respectively.

As I do in many of my other articles, I decided to compare MSC Industrial Direct to five similar companies. On a price-to-earnings basis, these companies ranged from a low of 2.1 to a high of 16.4. And on an EV to EBITDA approach, the range was from 1.6 to 11.4. In both of these cases, four of the five companies were cheaper than our prospect. When it comes to the price to operating cash flow approach, the picture is flipped, with only one of the five companies being cheaper than our target with a range for these firms of between 3 and 101.4.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| MSC Industrial Direct | 12.6 | 10.2 | 10.3 |

| Applied Industrial Technologies (AIT) | 16.4 | 22.5 | 11.4 |

| Univar Solutions (UNVR) | 6.9 | 19.0 | 5.8 |

| Beacon Roofing Supply (BECN) | 12.4 | 58.4 | 8.1 |

| WESCO International (WCC) | 10.3 | 101.4 | 8.6 |

| BlueLinx Holdings (BXC) | 2.1 | 3.0 | 1.6 |

Takeaway

What data we have in front of us today tells me is that MSC Industrial Direct continues to generate strong performance on both its top and bottom lines. Admittedly, shares of the company do look a bit pricey compared to similar firms. But on an absolute basis, they look quite affordable. I do think that the stock would be closer to fair value should its fundamental condition deteriorate because of the economy. But so far, we haven’t seen any real impact there. And until we do or until the picture changes in some other way, I do still think that a ‘buy’ rating on the company makes sense for now.

Be the first to comment