lindsay_imagery/E+ via Getty Images

Atlas Technical Consultants (NASDAQ:ATCX) is a niche provider of technical consultation services for private and public organizations. It’s one of the beneficiaries of increasing public spending on infrastructure and ESG initiatives. Technical consultation provides an asset-light exposure to infrastructure sector without many of the risks and downsides involved with infrastructure investments.

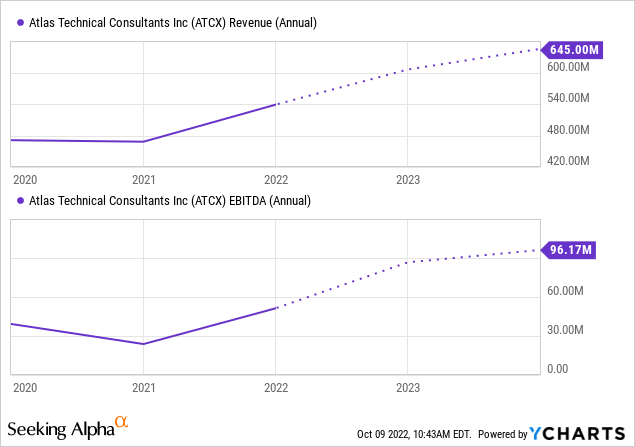

The company has delivered an impressive 17% CAGR of gross revenue and 57% CAGR of adjusted EBITDA since 2017. In Q2 the gross revenue grew 19% and organic growth was 8%. Adjusted EBITDA grew 16.7%. Currently, the company has a record-high backlog and several recent acquisitions to boost its revenue and EBITDA.

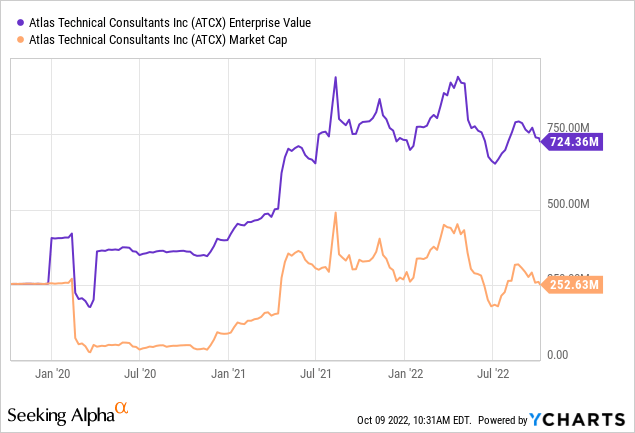

The company has come into existence through a merger of several companies, SPAC-listing and combination of numerous acquisitions. This has resulted in a high debt load muting its revenue and EBITDA growth. If Atlas accomplishes to duplicate its successful integration of acquisitions there’s a path to deleverage and share price appreciation.

Company overview

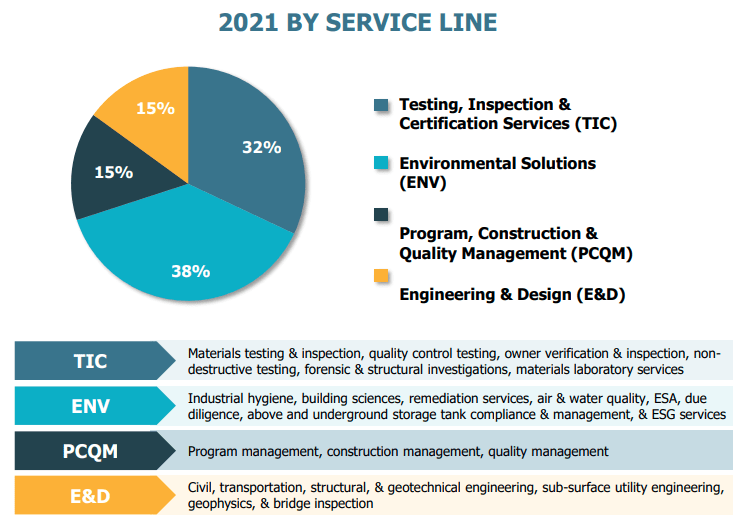

Atlas strives to be, in its own words, a leading national provider of mission-critical technical services to both infrastructure and environmental markets. The company offers testing, inspection and certification services, environmental services, engineering and design, management of construction projects. In 2021 Atlas had a revenue of $538 million and projects to reach $580-$620 million in the current year.

Business segments of Atlas. (Investor presentation.)

Atlas was created in 2017 by a combination of three engineering companies. In February 2020 the company was listed on NASDAQ through a SPAC by Boxwood Merger Corporation. Today Atlas operates in 43 states and employs more than 3600 people. Some of its 10,000 customers are blue chip companies such as Apple (AAPL), Chevron (CVX) and Google (GOOG) (GOOGL) and plenty of different governmental agencies.

All the Acts providing tailwind

The bullish thesis lays on top of the underlying fundamental trends. The U.S. government is heavily boosting investments into areas where Atlas operates. Bipartisan Infrastructure Law, Inflation Reduction Act and Infrastructure Investment and Jobs Act are all boosting demand for Atlas’ services. The management expects their impact to be visible in 2023. Already, the company has a record-high backlog of $855 million.

In 2021 the company performed approximately 40,500 projects, with average revenue per project of $10,000. Increasingly, the company has been reporting on larger project awards that encourages to think that the larger scale has its benefits. A significant proportion of Atlas’ business is mandatory or required to be performed by different regulations: bridges need to be inspected, construction sites require supervision and water networks require monitoring.

The pricing model of Atlas provides protection from inflation. 90% of its revenue comes from cost-plus contracts or the customer is charged based on the time and materials spent on the project. Naturally, the highest risk comes from wage inflation. One fifth of the revenues is spent on subcontractor costs, which are not under full control of the company.

This year Atlas has made three acquisitions. The company is acquiring customer relationships, personnel, expertise and access to new geographies. The industry is fragmented which ensures that Atlas will have a long runway for acquisitions. Growing the company organically would be extremely slow. There are some synergies, the company had 145 offices at the end of 2021 and 124 offices in the Q2.

Most importantly, widening service offering and access to new customers enables the company to cross-sell new offerings to existing customers. The company promotes the acquisition of Alta Vista as a success story. According to the investor presentation the first year after the acquisition delivered 26% revenue growth and 200% EBITDA growth. If the company accomplishes to repeat the performance with other acquisitions, there is a great likelihood for fast fading of the bear thesis.

Debt load acts as a price cap

Due to its financing position, Atlas is promoting adjusted EBITDA and EPS figures. Looking at the EBITDA hides the unpleasant fact that the company spends nearly 8% of its gross revenue on interest expenses. Atlas has close to $500 million of long-term debt.

The capital structure of the company is not an optimal one in the rising interest rate environment. Since 2020 the amount of debt has doubled and simultaneously the amount of shares outstanding has more than doubled. Although the operating income has also doubled, the interest expenses ($39.6 million) are higher than the operating income ($27.6 million) and cash flow from operating activities ($29.1 million). As a result, from increasing indebtedness and share issuance, the enterprise value has more than tripled.

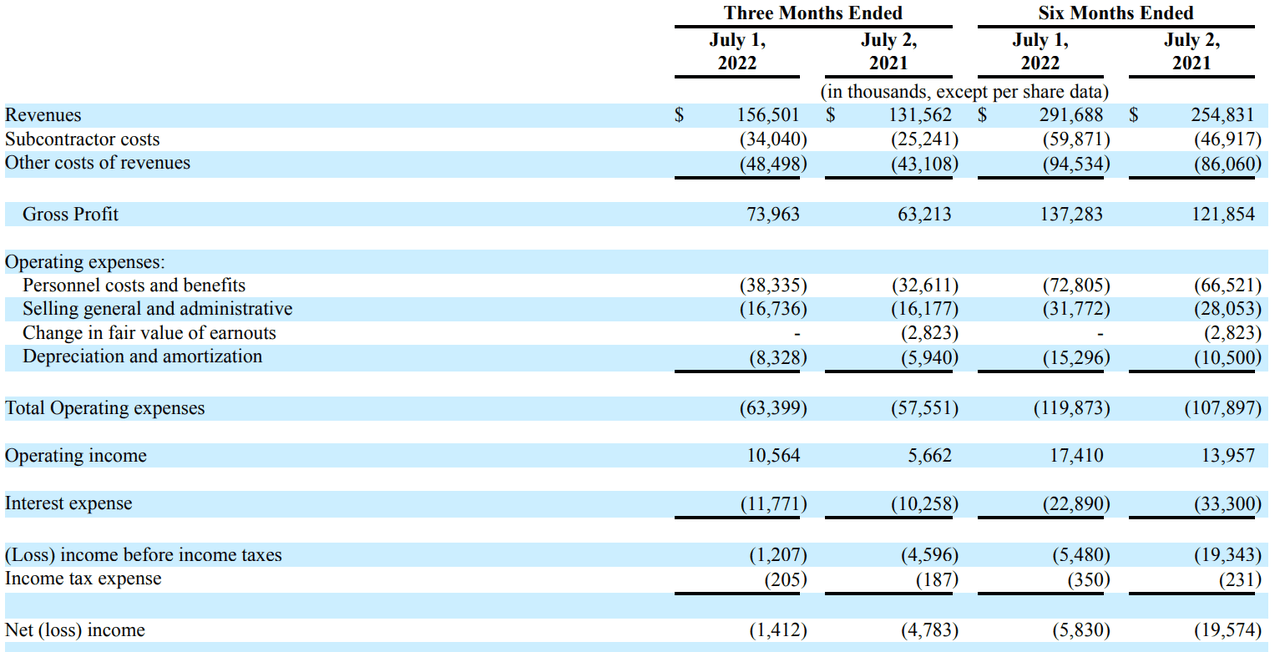

In the second quarter, the company’s operating income was $10.5 million versus interest expenses of $11.8 million. Excluding the depreciation and amortization of $8.3 million, the business generated some cash. Compared to the year before, operating income plus D&A was barely higher than interest expense. Fortunately, the financial situation is quickly improving.

Atlas income statement Q2 and H1 2022. (10-Q)

Pursuing an aggressive path to deleveraging our balance sheet and improving our overall capital structure remains a top priority for Atlas, and we’re continually looking for avenues to do so. Consistent with this, on June 1st, we entered into an interest rate hedge agreement with JPMorgan Chase, which caps the variable portion of our interest rate to 3%. This agreement eliminates the uncertainty of extreme downside risk in a rising interest rate environment. -David Quinn, Q2 earnings call

Even though the debt load of the company is high, 5.6x EBITDA, the debt load looks manageable. The variable part of the interest rate is now capped to 3% for the next three years. Average interest rate was 8.2% in 2021 and 95.6% of the company’s debt is due after 2026. Nevertheless, an investor should look for signs and actions on how the company plans to deleverage. Further dilution of shareholders is a significant risk.

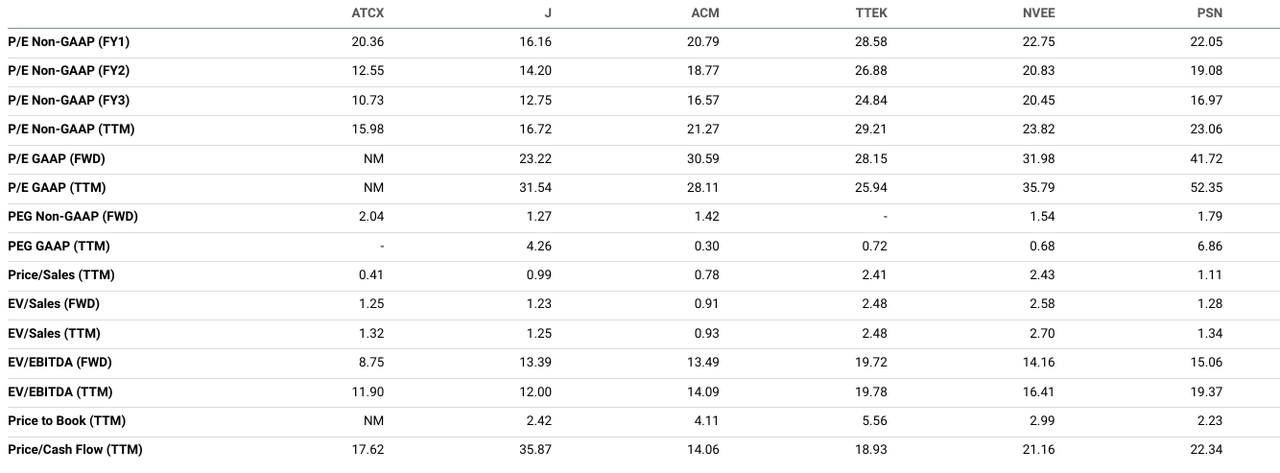

Peer group has a slightly higher valuation

On a GAAP basis, Atlas is producing a net loss. In the first half year amortization of intangible assets was 5% of revenues and amortization is expected to be around $20-22 million per year for the following five years. Therefore, traditional metrics are difficult to use and EV/EBITDA multiple is the most relevant when comparing Atlas to its peers. Full comparison to the peer group is available here.

Valuation of the peer group. (Seeking Alpha.)

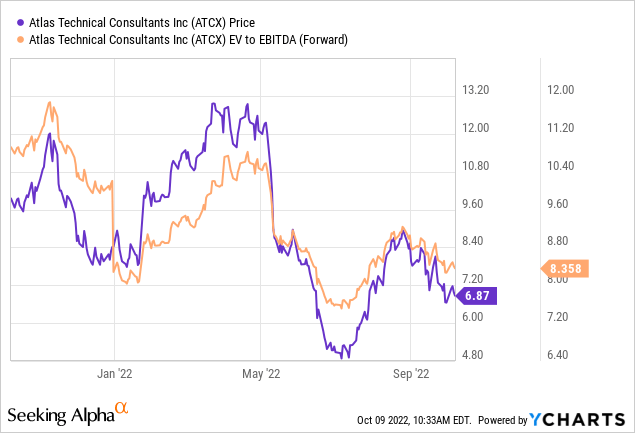

On a forward EV/EBITDA multiple Atlas looks attractively valued. The whole peer group has achieved impressive growth figures in the past years. However, the much larger size of the companies in the peer group could present a challenge for the growth to continue when the macro economy is cooling down. Whereas Atlas being significantly smaller, it could continue its growth supported by the acquisitions and infrastructure spending.

The average target price of five analysts is $15 per share for Atlas. In the light of the peer group, it is difficult to see the stock climbing that high without significant reduction of debt. If the company would be valued by the lower end of adjusted EBITDA guidance, $84 million, and a multiple of 12x, slightly lower than more established peers, the enterprise value would be approximately $1 billion, translating to a share price of $9.

Conclusion

Atlas is a beneficiary of current public and private spending on infrastructure and ESG initiatives. Its position in the value chain and pricing model has built-in protection from inflation. The company has a good track record of growth and during the current year, the financials are showing healthier signs.

If Atlas is successful in the integration of the recent acquisitions and interest expenses decrease the company has a path to profitability. Although the peers have slightly higher multiples, the high debt load places a cap for share price appreciation as too much value is being transferred to the bankers instead of shareholders.

Be the first to comment