Erik Khalitov

Overview

Investopedia defines contrarian investing thusly:

“Contrarian investing is an investment strategy that involves bucking against existing market trends to generate profits.”

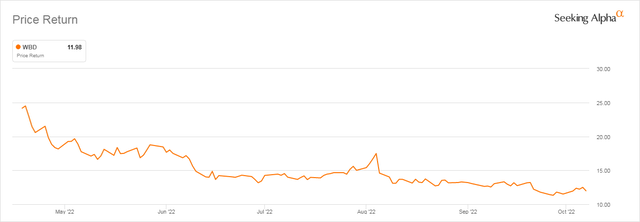

In this article, I will explain why I think Warner Bros. Discovery (NASDAQ:WBD) is an excellent contrarian investment right now. WBD’s price has declined by more than 50% in the last 6 months as seen in the chart below.

Why I think WBD is an excellent contrarian investment right now

On April 11, 2022, AT&T (T) spun off its Warner Bros. media empire to Discovery forming a new company called Warner Bros. Discovery. At that time, I recommended selling the .27 shares of WBD received by AT&T shareholders for each T share and buying more T with it.

My thought at the time was that T would go up after the split but WBD would go down.

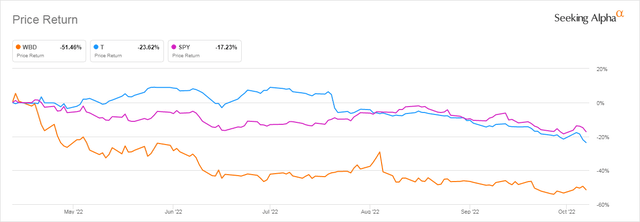

But unfortunately, we have seen the market tumble considerably since April but T is down much less than WBD, 24% to 51% respectively. The S&P 500 is down 17% during that period.

Well, now’s the time to get back into the WBD saddle. I think it is at or near a bottom and as more good news comes out about WBD’s plans, the more likely that WBD will start going back up.

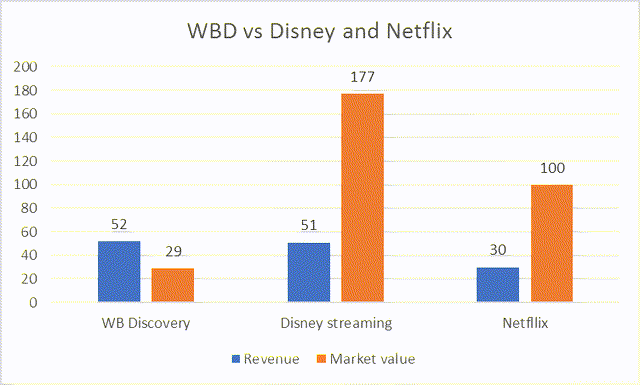

If we compare WBD to the other two big streamers i.e., Disney (DIS) and Netflix (NFLX), we can see that WBD is vastly undervalued.

Here they are on a 2023 estimated revenue basis. Note that WBD has the most revenue of the three.

However, on an MV (Market Value) basis, WBD is selling at 16% of the value of Disney and 29% of the value of Netflix, even though WBD has 73% more revenue than NFLX.

Note that to match Netflix’s current MV would require WBD to more than triple and that’s with WBD exceeding NFLX’s projected revenue by 73%. To get to Disney’s MV would require a price increase of 6x.

Assuming WBD does an even mediocre job of competing with the other two, it should have a huge upside coming over the next few years.

WBD took on an enormous $43 billion in debt to complete the deal with AT&T

Now one thing to be aware of is the huge $43 billion debt WBD took on to complete the deal. Obviously, debt has to be cut significantly but WBD has plans for that.

Here is Gunnar Wiedenfels, CFO:

Out of the gate as a combined company, we have been focused on debt pay-down and I am pleased to report that by the end of this month, we will have paid down $6 billion of debt since closing the transaction. Source: Seeking Alpha

I would say that is a great start to the debt issue.

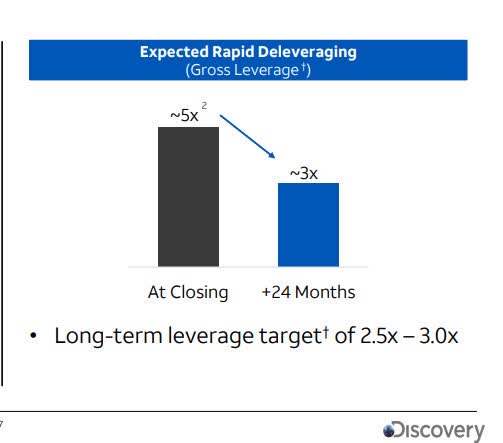

Warner Bros. Discovery

So at the end of 24 months say Q1 2024 WBD’s leverage should be at a reasonable 3x from the current 5X. At that point, WBD shares should be much higher. But it is a risk if they don’t come close to or exceed those expectations.

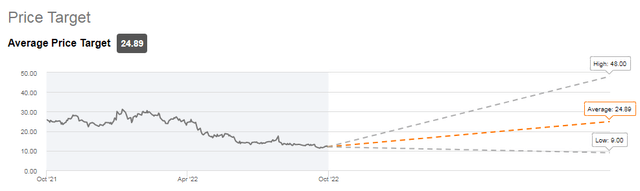

My estimate is that WBD will easily get back to or near the closing price on April 12 ($24.78) by the end of 2023 as WBD plans become clearer and predicted year-end results are shown to be reasonably accurate. If it does, that will give me a more than 100% increase over the October 7, 2022 price of $11.98 in a little over 12 months.

Note that price projections are very similar to my 2023 estimate with the average price estimate at $24.89.

There is an enormous upside to WBD’s price over the next 2-3 years if they come anywhere near their predicted results.

And if more inflation and perhaps a recession looms, what are people more likely to do?

Watch cable and streaming of course because it’s cheap compared to everything else.

The deal’s secret sauce is John Malone

John Malone is the Warren Buffett of the media business and has put together literally dozens of media deals that generated capital gains for himself and other shareholders. He is not worth $8 billion by accident.

Some very well-known media success stories have revolved around John Malone including but not limited to Discovery, Time Warner (now and before the recent transaction), Encore, Starz, QVC, Sirius XM, and News Corp. John actually started his career at AT&T as an engineer and over the ensuing decades has made several media deals with AT&T itself.

Here’s John’s resume from the WBD website.

I feel very comfortable with this deal because John Malone is involved.

Malone thinks the new firm could join Netflix and Disney+ as a true global powerhouse.

“I think we are not only going to be the third such platform, but I think we’ll be very competitive with the other two in terms of being able to satisfy the entertainment and curiosity and information needs of the world, basically, a worldwide platform,” Malone said. Source: CNBC

With a Ph.D. in Operations Research, John is almost always the smartest guy in the room.

So who knows, maybe you’re getting a Disney on the cheap. I guarantee you, John Malone knows a lot more about WBD’s opportunities and possibilities than anyone else on the planet. Expect something dramatic from John Malone in the near future.

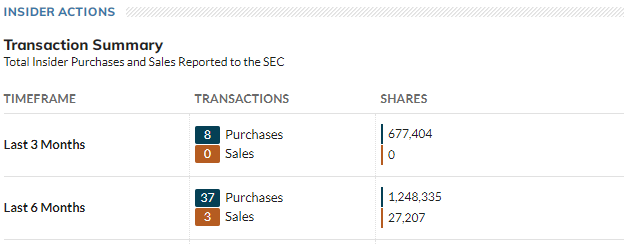

Insiders are buying stock hand over fist

In the last 6 months, insider buys have outpaced insider sales by a count of 37 Buys to only 3 Sells, a ratio of more than 10 to 1.

Who knows more about WBD’s prospects than these people whose future wealth depends directly on WBD’s future results?

MarketWatch

Source: MarketWatch

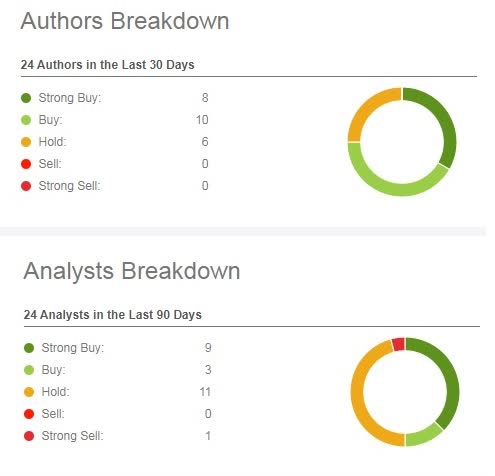

Market analysts really like WBD too

If we look at how Seeking Alpha contributors and Wall Street analysts rate, we see 30 Buy recommendations and only 1 Sell. Those are very positive numbers for WBD’s future price action.

Seeking Alpha

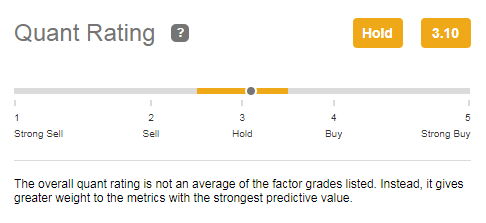

On the other hand, Quants have WBD as a Hold which I would say reflects the need for quantitative analysts to have access to much more historical data than simply 6 months after a deal is consummated.

Seeking Alpha

Risks

Of course with any contrarian investment, you have the risk of choosing the wrong time frame to invest and ending up catching a falling knife rather than seeing a rapid turnaround. That is easy to see in WBD’s rather steady downward price action since April as shown in the chart in the Overview section above.

In addition, even though WBD has made progress in reducing debt, it still has a long way to go to get to manageable levels and there is no guarantee it will be able to meet its reduction targets.

The world itself is a risk with war and inflation roaring, so a more suitable investment for some investors might be cash by way of CDs which are now paying up to a guaranteed 3.6%.

Conclusion

Warner Bros. Discovery has some of the most valuable streaming assets in the world including:

And there are more than 50 other WBD brands available too.

It is hard to imagine that going forward the world is going to spend less time streaming than they do now, especially in non-western countries.

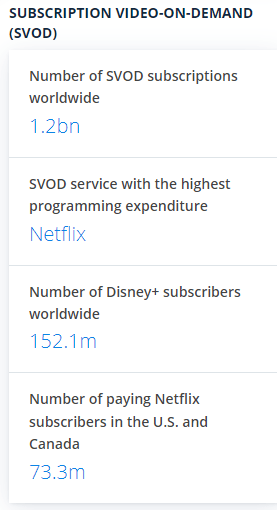

Statista

The 1.2 billion subscriptions will be going up for years and years to come and WBD with its enhanced channel menu will, I think, get more than their share.

Warner Bros. Discovery is a strong buy for long-term capital gains.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment