Oselote

I recently wrote positive articles on MAG Silver Corp. (MAG), a silver mine developer, and SSR Mining Inc. (SSRM), a precious metals producer. In this article, I will highlight a royalty and streaming company, Wheaton Precious Metals Corp. (NYSE:WPM).

WPM is a defensive way to play the precious metals. WPM acquires precious metal byproducts at first quartile equivalent costs, giving the company plenty of margin. Over the past decade, WPM has consistently outperformed the underlying precious metals and gold miners.

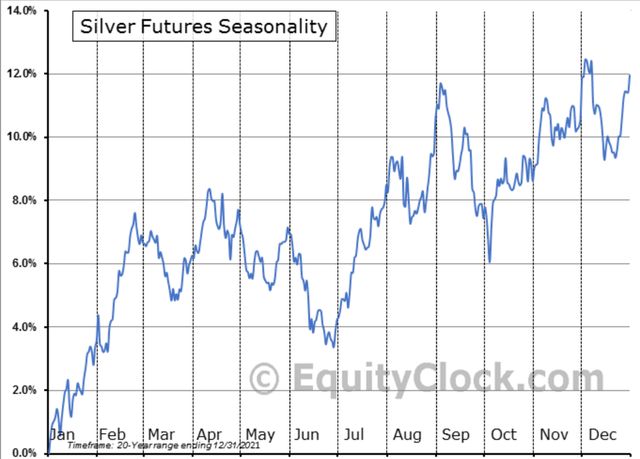

Precious Metal Seasonality A Tailwind

One of the catalysts I highlighted in my previous articles on MAG and SSRM was the strong seasonality of precious metals. The silver seasonality chart is reproduced below in Figure 1.

Figure 1 – Silver Seasonality Equityclock.com

I wrote in my prior articles that the FOMC meeting on July 26-27 was an important catalyst that could mark a near-term low in precious metals. Since the FOMC meeting, gold has rallied by over $90 per oz. (5%) and silver has rallied by almost 12% to $20.67 (Note: Investors who want to receive my timely macro updates should follow me on Twitter).

A more defensive way to play the expected rally in precious metals is through a royalty and streaming company like Wheaton Precious Metals.

Royalty Companies Have A Differentiated Business Model

Depending on investors’ risk appetite, there are pros and cons to owning explorers, developers, producers, and royalty companies. Generally, I favor producers and royalty companies, as my views are often macro-driven and affect the commodity prices in the short to medium term.

Of course, speculators who correctly bet on the right explorer/developer can earn outsized returns (5x, 10x, even sometimes 100x). However, as my mentor (a geologist turned portfolio manager) taught me many years ago, only one in a thousand mining projects go from project to mine, so the chances are not in speculators’ favor.

Royalty and Streaming companies, for those who aren’t familiar, provide mining companies with a non-dilutive form of financing that is different from traditional equity and debt.

Traditionally, when a mining company needs capital to build a mine, the company would either raise equity (diluting existing shareholders) or debt (putting the company at risk of fixed payments). However, in a streaming transaction, the streamer provides the mining company with capital upfront, in exchange for the right to purchase a certain percentage of the mine’s output at below market rates.

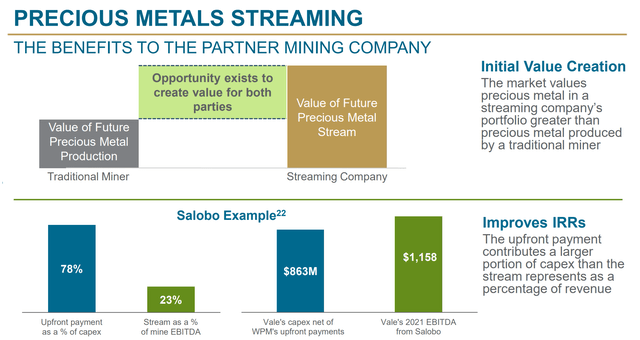

Using a real-life example of WPM’s streaming deal with Vale S.A. (VALE) on the Salobo copper mine in Brazil, for upfront consideration of $3.1 billion, WPM is able to purchase 75% of Salobo’s gold production at US$400 / oz (plus a 1% per annum inflation adjustment). This transaction is a win/win for both parties (Figure 2).

For Vale, Salobo is a primary copper mine (meaning the primary output of the mine is copper and gold is a byproduct), so by agreeing to sell 75% of the gold byproduct production at US$400 / oz, Vale was able to reduce the upfront capital expenditures of the project by 78%. For WPM, by paying $3.1 billion upfront, they get more than 280k oz of gold production (according to the Salobo technical report, Salobo produced over 380k oz of gold in 2019) at a US$400 ‘production’ cost.

Figure 2 – Benefit of Streaming (WPM Investor Presentation)

Royalty and Streamers Protected From Inflation

With rising inflation hitting everything from fuel to labor, the royalty and streaming business model really shines through. For example, while reading through Lundin Mining Corporation (OTCPK:LUNMF)’s recent Q2/2022 earnings release, with respect to Neves-Corvo, their copper/zinc mine in Portugal, the company noted (emphasis added):

Neves-Corvo (100% owned): Neves-Corvo produced 7,867 tonnes of copper for the quarter and 20,647 tonnes of zinc. Copper production was lower than the prior year comparable period, due to throughput. Zinc production was higher primarily due to increased throughput driven by the ramp-up of the Zinc Expansion Project (“ZEP”). Production costs were higher due to inflationary cost increases. Copper cash cost of $2.39/lb for the quarter was higher than the prior year quarter primarily due to inflationary increases, primarily electricity, as well as lower sales volumes.

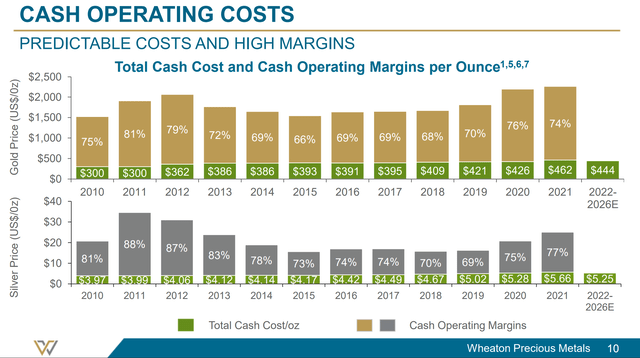

However, for Wheaton Precious Metals who own 100% of the silver production from Neves-Corvo (for upfront payment of US$35 million in 2007), the cost to acquire the silver production is protected at US$4.38 per oz.

This important point really hits home when we look at the predictability of WPM’s ‘production’ costs and margins (Figure 3). Since inception, WPM has consistently ‘produced’ gold and silver at first quartile cash costs. For 2022 to 2026, WPM has estimated contractual costs of ~$440 per ounce of gold while gold miners like Barrick Gold Corporation (GOLD), one of the largest gold miners in the world, are seeing cash costs rise by over 10% in 2022 alone (GOLD had 2021 cash costs of $725 / oz, but is expecting over $800 / oz cash costs in 2022) due to the “impact of higher energy prices.”

Figure 3 – WPM Margins (WPM Investor Presentation)

Peer-Leading Leverage To Precious Metals

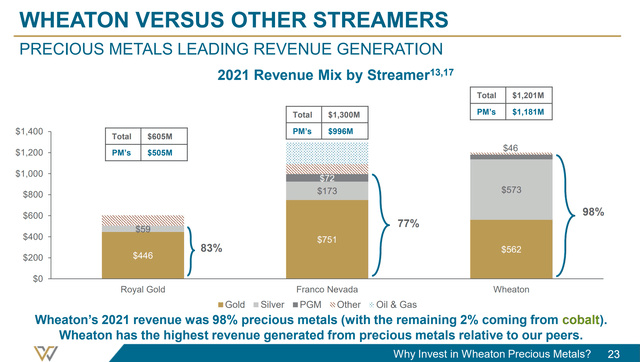

Wheaton Precious Metals has two main competitors with approximately the same scale, Franco-Nevada Corporation (FNV) and Royal Gold, Inc. (RGLD). What sets WPM apart from these two peers is that Wheaton Precious is almost 100% geared towards precious metals streaming, whereas FNV and RGLD have other revenue sources (FNV has a sizeable energy royalties portfolio, while RGLD derives 12% of revenues from copper; Figure 4).

Figure 4 – WPM has peer leading leverage to precious metals (WPM Investor Presentation)

On the other hand, while the majority of FNV and RGLD’s royalty and streaming portfolio is geared towards gold, over 50% of WPM’s streams are from silver. As silver is traditionally more volatile than gold, that likewise increases WPM’s volatility.

There are also a host of smaller royalty companies in the space such as Sandstorm Gold Ltd. (SAND) and Osisko Gold Royalties Ltd. (OR), but they generally cannot match the big 3 in terms of scale and cost of capital.

Diversified High-Quality Asset Base

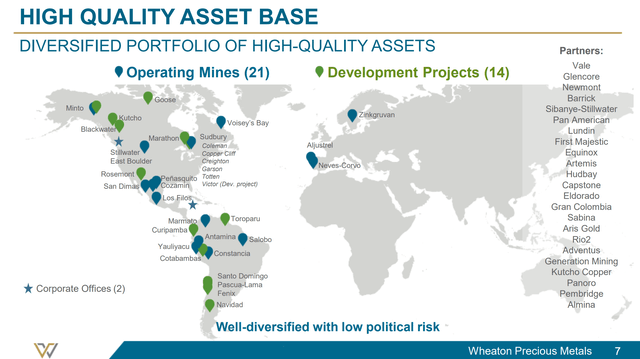

WPM currently has streams on 21 operating mines and 14 development projects (Figure 5). Unlike traditional mining companies where exploration and development projects could take years or decades to come to fruition, WPM’s development portfolio is generally expected to start construction/production in the next few years.

Figure 5 – WPM Stream Portfolio (WPM Investor Presentation)

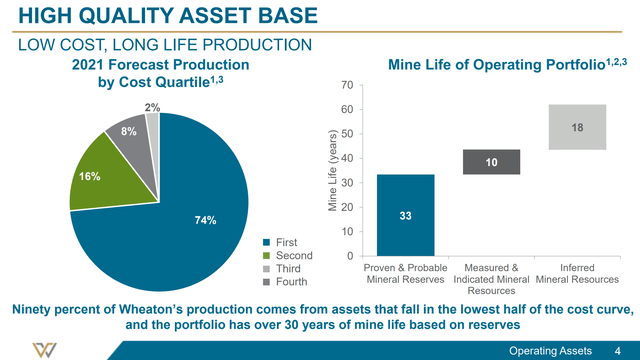

Looking at the producing assets, the vast majority of WPM’s production comes from mines that have production costs in the first two quartiles of the cost curve (Figure 6). This means that even in a negative commodity price scenario, these mines should still produce their primary metals, and hence, WPM should still get its byproduct streams.

Figure 6 – 90% of assets in first 2 quartiles of production cost (WPM Investor Presentation)

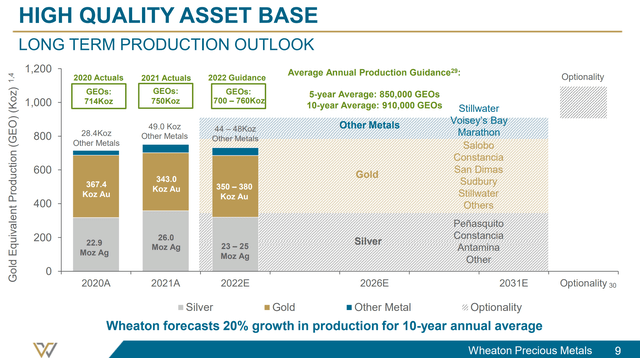

Overall, WPM is expecting to produce 850k to 910k oz of gold equivalent ounces (“GEO”) over the next decade from producing mines and mines in development (Figure 7). This is an important point that should be emphasized.

Figure 7 – Long Term Production Profile (WPM Investor Presentation)

All producing mining companies have reserves that will get depleted over time as ore is produced. In fact, many mid-to-large miners are on a constant treadmill and must constantly look for the next project (greenfield or brownfield expansion) to backfill production reserves, lest the market starts to think they will run out.

However, for royalty and streaming companies, brownfield expansions are very beneficial since streaming agreements tend to be on the life of the mine while brownfield expansions tend to be funded by the mining company themselves.

Furthermore, royalty and streaming transactions are usually struck after an exploration project has been significantly ‘de-risked’ (which means they skip funding exploration and development of projects that are non-economic.)

For example, the streaming transaction struck with Generation Mining (OTCQB:GENMF) in December 2021 was on the feasibility stage Marathon Palladium project that is on the cusp of construction. This effectively skips the 60+ years of exploration and development that other companies have spent to bring the project to that point.

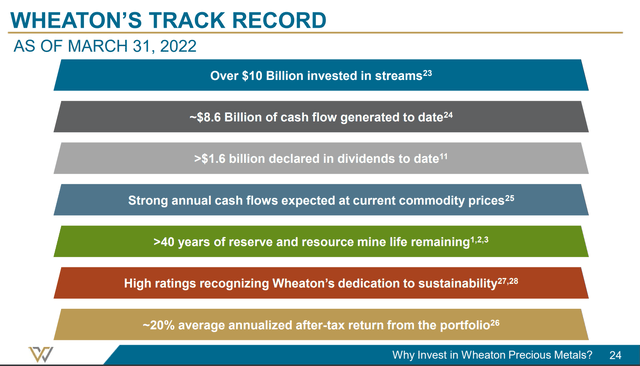

Over the time WPM has been in operation, it has invested over $10 billion in streams while generating $8.6 billion in cash flows while still maintaining reserves and resources that can sustain production for decades to come (Figure 8).

Figure 8 – WPM’s Track Record (WPM Investor Presentation)

Valuation & Returns

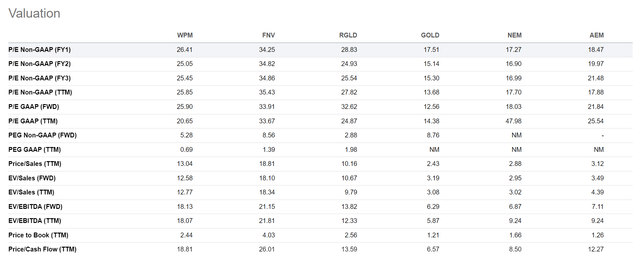

WPM current trades at a 2022 P/E multiple of 26.4x, which is expensive when compared to the average large-cap gold miner trading at ~17.8x (Figure 9). However, it does trade at a discount to the royalty peers RGLD and FNV, which trade at 28.8x and 34.3x respectively.

Figure 9 – WPM Valuation Multiple to Peers (Seeking Alpha)

I think royalty and streaming companies should trade at a premium multiple, since the business model is inherently less risky with higher margins.

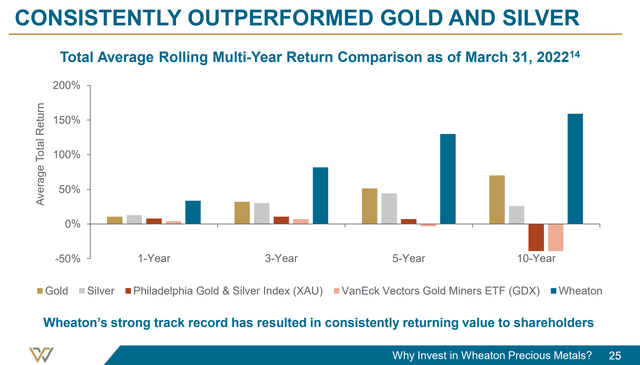

Another way to think about WPM is to look at historical share performance. In this regard, WPM has vastly outperformed the precious metals and gold miners on a 1, 3, 5, and 10-year basis (Figure 10).

Figure 10 – Long-term Outperformance (WPM Investor Presentation)

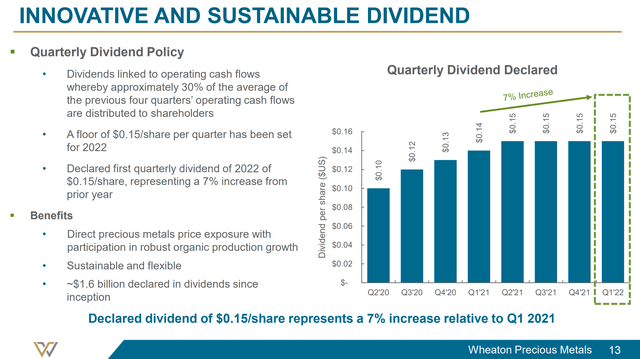

In addition to price return, WPM also provides investors with a dividend (Figure 11). Currently, it is set at $0.15 per quarter, for 1.75% yield. However, the dividend is linked to operating cash flows, where approximately 30% of the trailing 12-month operating cash flows are distributed to shareholders. This means in a period of strong precious metals pricing, shareholders could be rewarded for special dividends.

Figure 11 – WPM dividend linked to operating cash flows (WPM Investor Presentation)

Risks To Wheaton

One of the risks to owning a commodity producer is the underlying commodity price. WPM is better protected than most as its “production” costs are usually first quartile, giving the company plenty of margin. Furthermore, royalty and streaming companies are protected from inflation negatively impacting margins. However, for WPM specifically, as ~50% of its revenues are from silver, it does have higher commodity risk than its royalty peers FNV and RGLD.

Another risk is that royalty companies depend on the operating miners to develop and mine efficiently. This can be a problem if the mine runs into operating difficulties, as the royalty and stream owner usually has no operating control.

Technicals Attractive

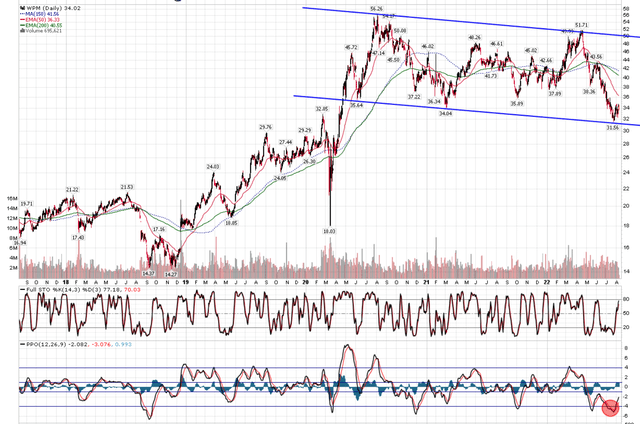

Technically, WPM is currently reversing at the lower end of a long 2-year sideways correction (Figure 12). MACD has recently triggered a mechanical buy signal. Reward/risk is attractive at current levels.

Figure 12 – Favourable Reward/Risk (Author created with price chart from StockCharts.com)

Conclusion

In summary, another way to play the developing rally in precious metals is through a precious metal royalty and streaming company like Wheaton Precious Metals. The streaming business model is highly defensive, as WPM acquires precious metal byproducts at first quartile equivalent costs, giving the company plenty of margin. Over the past decade, WPM has consistently outperformed the underlying precious metals and gold miners.

Be the first to comment