gorodenkoff

Galapagos NV (NASDAQ:GLPG) is a biotech with a market cap of $2.9 billion that’s been around for a while with a storied history. It managed to raise a lot of money in the past and currently has a bunch of early-stage assets to show for all its investments in R&D over the years. It was incorporated in 1999 and is headquartered in Mechelen, Belgium. I like this biotech at $43.55 because it holds billions of dollars of cash (over $4 billion) and virtually no debt. There’s cash burn, but that’s becoming more manageable as the company now has an asset that’s being marketed in JYSELECA. For now, operating cash burn is at a run-rate of around ~$400/year. Paul Stoffels took over as CEO in April 2022. The new management is contemplating how to run the business best, but meanwhile executed two small acquisitions (that increased cash burn a bit for the year).

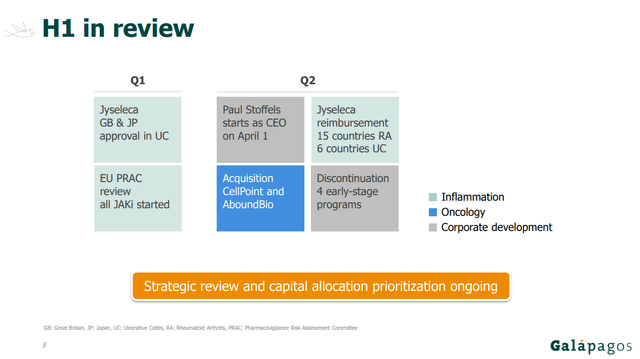

Galapagos strategic review (Galapagos)

Stoffels commented on the strategic review as follows on the recent earnings call (emphasis mine):

Let me say, we have the internal review where we look internally but we have also a very extensive external review on what business opportunities we can bring in at the moment. So it goes in parallel, we’re looking strategically, what are the assets and the portfolio prioritization internally as well as looking at additional potential short-term acquisitions as the market now is very — looking for very — many biotech companies are looking for partnerships now and it’s a great opportunity for us to evaluate that.

We will mainly focus on — at the moment on oncology and — in oncology and inflammation. In the past, we have said we are looking at select infectious disease opportunities if they would be there. But oncology and inflammation will be the key. And we’ll evaluate internally our fibrosis assets and see whether there are still compounds which are valuable and word in the acquisition — in capital allocation. Where we are is like, let’s say, we are in the middle of the review as I’m — we are in the middle of the review and one-by-one, this is the first reporting to you. And on the Capital Markets Day, we’ll be able to give you further insights on long-term strategy, both on oncology and inflammation, other assets in the company as hopefully by then but maybe not yet next opportunities in acquisitions or licensing.

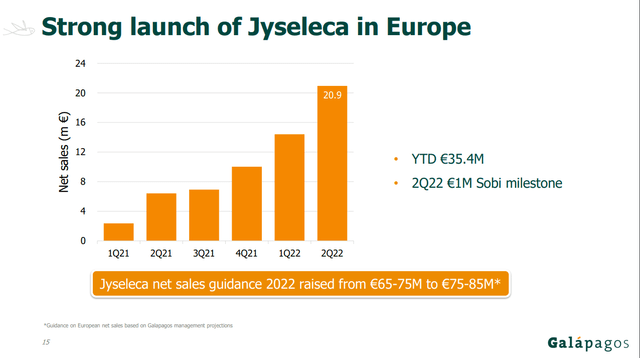

Meanwhile, Jyseleca is performing quite well:

The company expects to top out at ~$500 million in annual sales in Europe. That’s still years away, but it will still be a powerful force in bringing operating cash burn down.

With the market cap well below the net cash on the balance sheet and this growing revenue stream, and no debt, I think the shares are definitely on the cheap side. Management will need to make some disastrous decisions or be very unlucky to wreck future returns from this position and share price.

There are option angles that I think are worth contemplating.

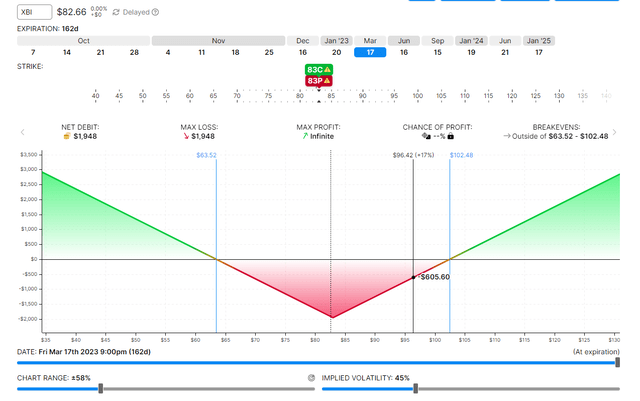

For a long time, Galapagos has been a huge bag of cash with some cash burn and not a lot happening. Large amounts of cash are volatility dampening and its options market has relatively muted implied volatility. Its implied volatility is still higher than a biotech index like the iShares Biotechnology ETF (IBB), but not by that much. See SPDR S&P Biotech ETF (XBI) below:

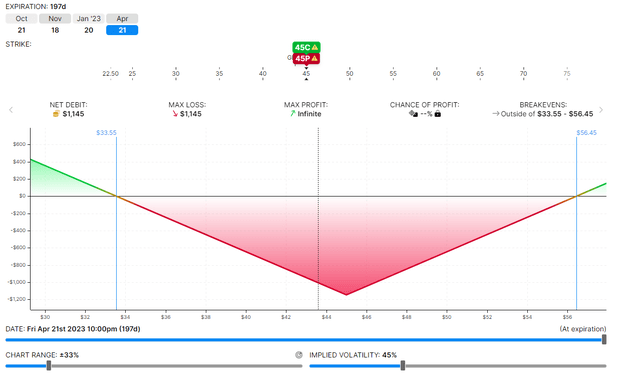

compared to Galapagos:

The timeframes are slightly different because there were no April strikes on XBI.

Because Galapagos is, over time, transforming itself from a cash bank to more typical biotech with marketed assets, potentially increasing cash burn (on acquisitions and operations) and a more active pipeline, its volatility is likely to increase. I’d prefer it if this were upside volatility and the stock is a big winner, but alternate outcomes are imaginable.

If volatility is set to increase over time, that suggests a strangle or straddle position could be interesting. As management seems to be taking some time with its acquisitions, very long-dated are most interesting. These only trade in Europe (and these are European options), but they go out until June 24. I mixed common stock with a long-dated straddle position (European options).

Be the first to comment