sb2010

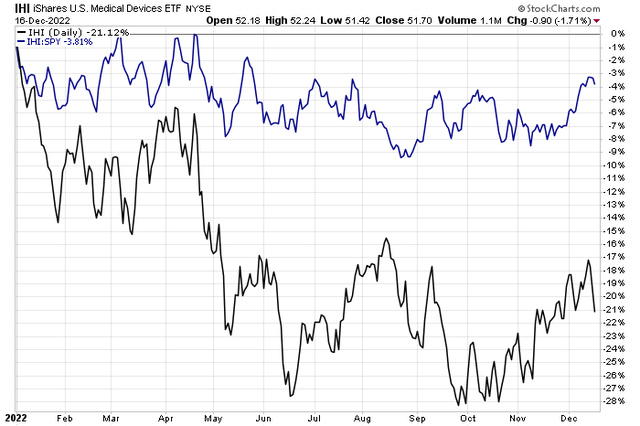

Healthcare stocks continue to work well on a relative basis to the broad market. The sector is complex, though, as there are defensive parts as well as cyclical niches. One economically sensitive area is the medical devices industry. The iShares U.S. Medical Devices ETF (IHI) has tread water since May and has recently perked up both on its own and against the broad market. One healthcare component maker is down more than 50% from its high – is it a value here? Let’s check it out.

Medical Device Stocks Sideways Lately

According to Bank of America Global Research, West Pharmaceutical Services (NYSE:WST) is a manufacturer of packaging components and delivery systems for injectable drugs and healthcare products. Through its expertise in drug containment, drug delivery system development, and contract manufacturing services, WST seeks to improve the safety and supply reliability of injectable drugs and healthcare products.

The Pennsylvania-based $16.7 billion market cap Life Sciences Tools & Services industry company within the Health Care sector trades at a high 27.4 trailing 12-month GAAP price-to-earnings ratio and pays a small 0.3% dividend yield, according to The Wall Street Journal. Following an earnings miss back in October, BofA cut the stock to Neutral as capacity constraints may negatively impact growth and margins. Shares cratered 19% after the company issued its Q3 report which included a bleak outlook.

There’s upside potential with WST given its position as a global leader in supplying rubber primary packaging components. It has decent organic revenue growth and some margin expansion due to product mix changes in the industries in which WST operates. Downside risks include lower testing volumes post-Covid and margin compression in the coming quarters. Volatility in raw material prices is another risk.

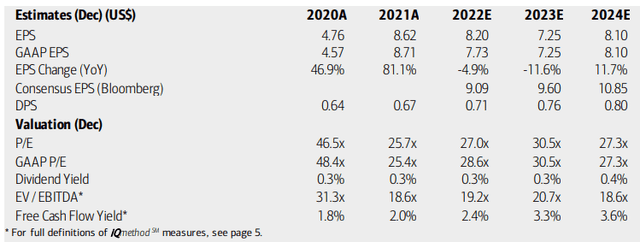

On valuation, analysts at BofA see earnings having fallen modestly this year after a big surge in 2020 and 2021. Per-share profit declines are expected to linger into next year before a rebound in 2024. The Bloomberg consensus forecast is more optimistic than what BofA sees. Even with earnings growth two years from now, the stock trades at elevated P/Es, a high EV/EBITDA multiple, and a low free cash flow yield. Overall, I don’t like the valuation given earnings volatility ahead.

West Pharma: Earnings, Valuation, Free Cash Flow Forecasts

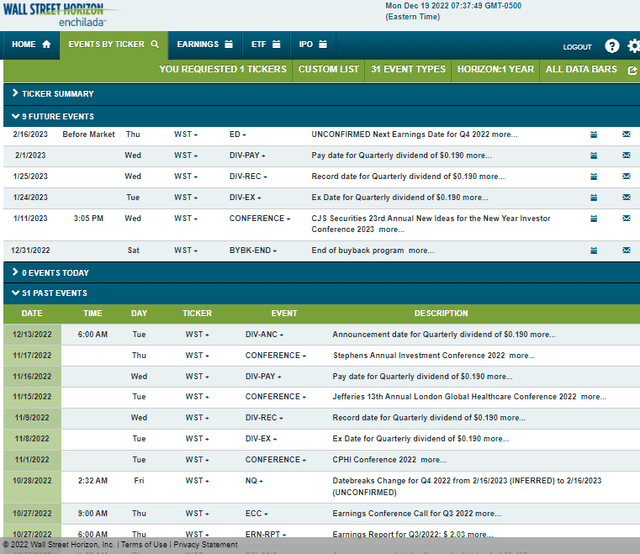

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 16 BMO. Before that, the firm’s buyback program will end on December 31. In early January, the company’s management team will speak at the CJS Securities 23rd Annual New Ideas for the New Year Investor Conference 2023.

Corporate Event Calendar

The Technical Take

After putting in a bearish double-top pattern about a year ago, the stock is down more than 50% from its all-time high. Shares remain stuck in a downtrend channel with a bearish declining 200-day moving average. Notice in the chart below that there’s resistance in the $263 to $264 range and a high amount of volume by price lies just above that line – so the bulls will have their work cut out to rally the stock through there. On the downside, I see support back at the pre-Covid high near $176 – that’s also where the downtrend channel could attract some buyers. Overall, the trend is sharply down, so I would not try to catch this falling knife here.

WST: A Persistent Downtrend With Overhead Supply

Stockcharts.com

The Bottom Line

WST’s valuation still does not look favorable given earnings declines seen next year. Moreover, a bearish chart and price trend make me very cautious about the name. Perhaps buying on a dip toward $176 is the play.

Be the first to comment