Spencer Platt

Investment Thesis

Take-Two (NASDAQ:TTWO) has an excellent reputation in the industry and trades with a premium valuation compared to the competition. But several points do not look entirely positive. Costs are rising as fast as revenues, and the Zynga acquisition has yet to prove itself. At the same time, shareholders are slowly but steadily burdened by stock dilution and stock-based compensation. Plus, the CEO sold 21% of his shares in April. Yes, eventually, GTA 6 will be released, but if that’s the main argument for the investment, you might as well wait another six months and possibly get in at a cheaper price.

Is gaming a megatrend?

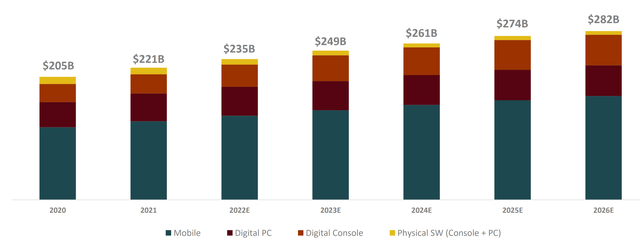

Gaming is said to as a megatrend, but is this true? I looked into many sources to put this statement to the test. According to Newzoo, the global gaming market rose by only 1.4% in 2021 vs. 2020, despite the Corona pandemic still going on. That does not sound like a megatrend.

Mordor Intelligence estimates that the games industry will grow by 8.9% annually up to 2027. The market is still growing but is already reasonably saturated in some regions. How topics like virtual reality and metaverse will play into this in the long term cannot be predicted quite yet. Overall, we can’t call gaming a megatrend. It is one of many possible hobbies and thus competes with music and movies. It is also not a megatrend because gaming is nothing new but has existed for decades. The difference is that now the average age of the players is higher than before. When I was young, no 50-year-old played video games, but today this may well be because the person is almost already grown up with it.

Take-Two expects the market to grow, especially for console and mobile games, in the next few years.

Recent results & financials

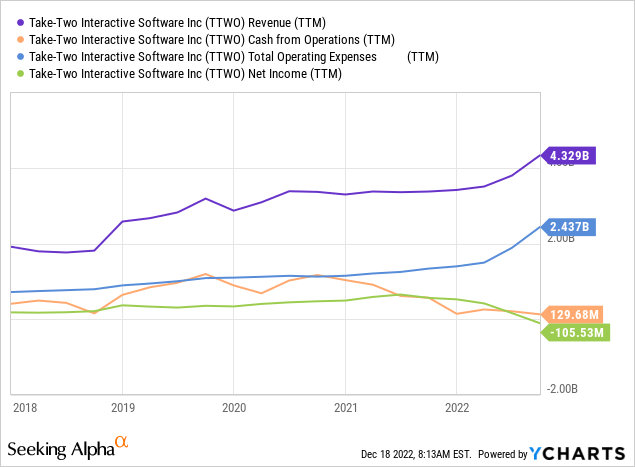

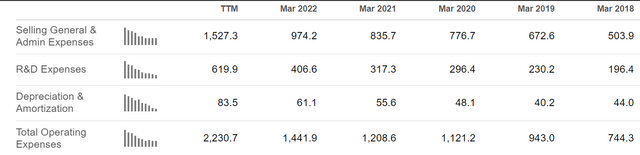

The last quarter was not very successful for the company. Revenue was $1.4B but missed expectations by $140M. On a GAAP basis, there was a significant loss per share of -$1.54. They also lowered FY 2023 revenue guidance from $5.8B to $5.4B. The chart below shows the evolution of some metrics over the last five years. Here we see that revenues are increasing strongly, but costs are increasing almost at the same rate, so real profits are not growing.

In Seeking Alpha’s financial data, we can see which areas cost so much money in more detail. I don’t want to judge this as bad because this year is an investment in the future. But from a purely objective point of view, the bottom line is that there is no more left over for the company, even though revenues are rising strongly.

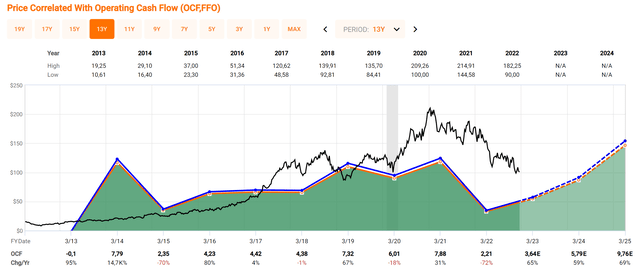

The fastgraphs over the last 13 years show huge operating cash flow fluctuations but not a clear positive trend. Of course, this is also explained by the fact that a blockbuster title is only released once every few years.

Valuation

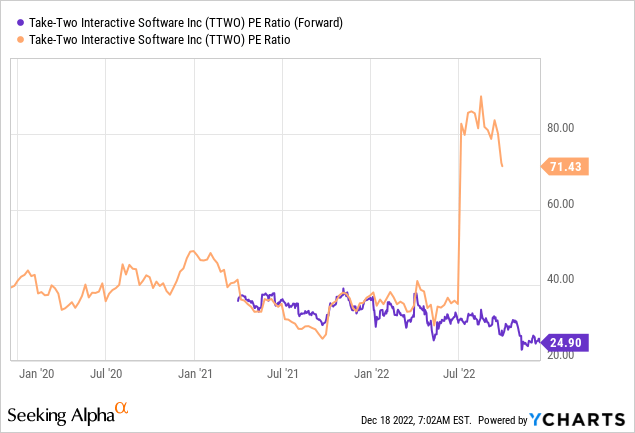

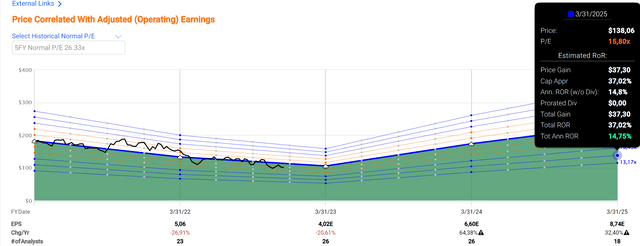

The company is currently valued at an enterprise value of $19.2B. The market cap is $16.9B, and the total debt is $3.7B. The P/S ratio is 4.4, and the forward P/E ratio is approx. 25. The share is thus more cheaply valued than the last few years’ averages.

According to fastgraphs, the stock’s average P/E is 26. Still, even if the stock does not return to this historical valuation but trades significantly lower at a P/E of 16 in 2025, an annualized return of 15% per year would be possible (of course, only if the estimates are correct, which is not always the case).

With game companies, there is generally a lot of uncertainty because future profits depend on the quality of the future games. And this quality cannot be predicted by analysts or private investors. The market expects GTA 6 to be released sometime in the next few years, which will certainly lead to a boom in sales. But what happens if the game doesn’t deliver the quality gamers expect? And there is hardly any other game where expectations are as high as with the GTA series.

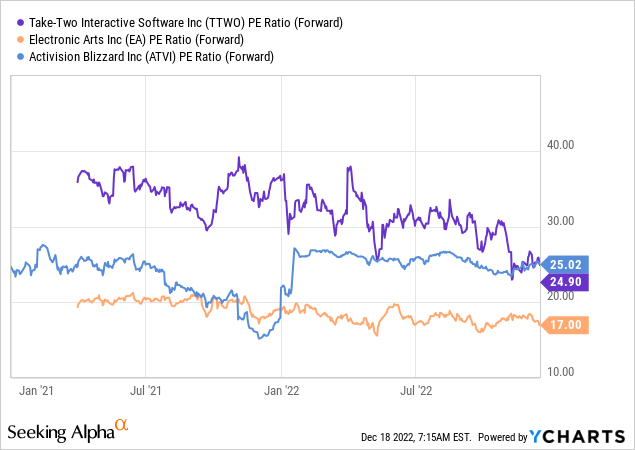

Valuation compared to the competition

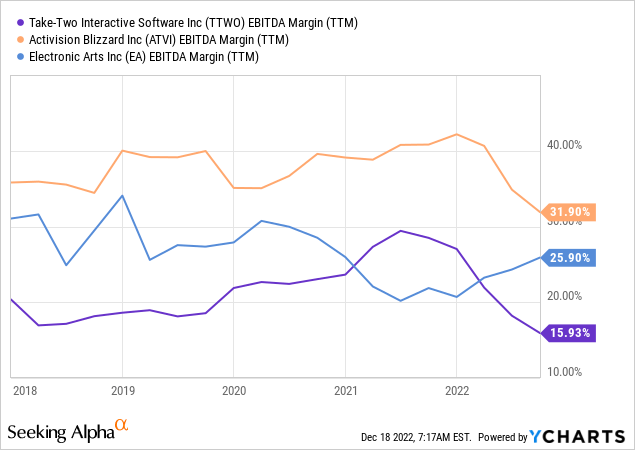

Activision’s (ATVI) figures are, of course, distorted by the takeover bid from Microsoft (MSFT). Before this offer, the valuation was significantly lower, and overall you can see that Take-Two has been the most expensive company of these three for years.

And that although the company also has the lowest margins. Overall, it’s fair to say that Take-Two is receiving, or at least has received, premium status from the market.

Risks

The main risk with this company is easy to identify. The valuation is relatively high, but it is justified by the fact that GTA 6 should provide very high profits in the next few years. And probably that will happen because this is a very popular game. The real risk is still that the game disappoints. In that case, it would damage the reputation and brand of GTA in the long run, and with it, Take-Two. In this case, the company might receive a lower average valuation from the market in the future.

And this risk is not entirely unfounded. There are rumors that the next GTA will deviate from its long-standing politically incorrect line. It would be a big disappointment for gamers if the woke madness also took over GTA.

Another risk is that the Zynga acquisition does not pay off as hoped. In May 2022, the company paid $12.7 billion for it. But mobile gaming has an even greater risk since the number of games grows even faster, and it is also more challenging to build a long-term brand that excites players for years.

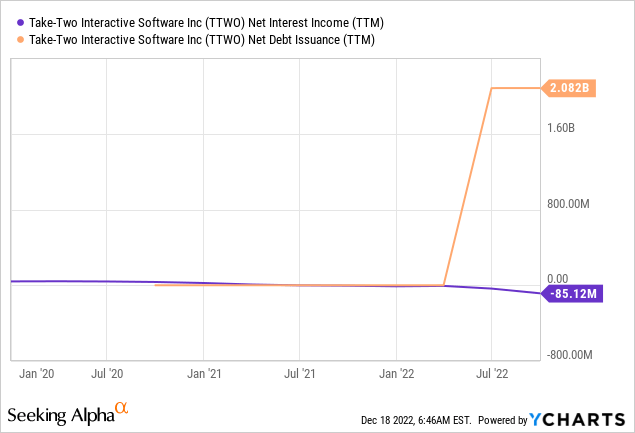

Debt

Because of the debt, we can observe how the interest payments start. Since, on this chart, interest payments don’t begin until April, we can assume that the company will be paying triple-digit millions in interest next year.

Share dilution and insider selling

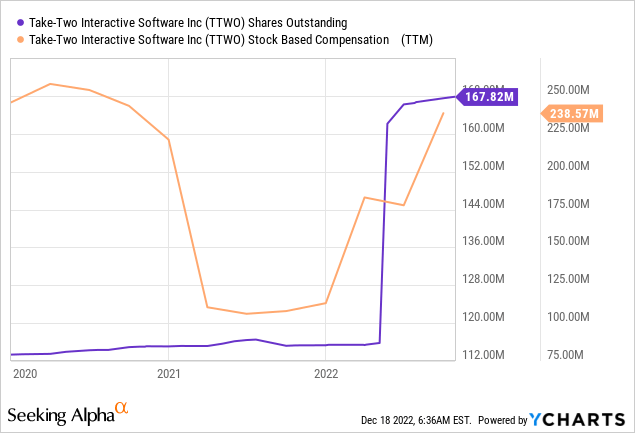

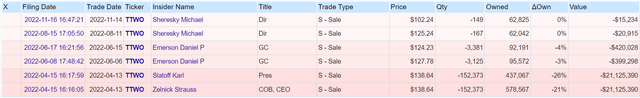

I always want to look at stock dilution and whether there is insider selling. Zelnick Strauss is the largest single shareholder, and it is certainly not a good sign that he sold 21% of his shares in April. However, the stock market was generally in a downward trend, so it could be that it didn’t have so much to do with Take-Two, but he reduced his investments in general.

The share dilution continued even after the Zynga acquisition. Also, at the time of the acquisition, there was a substantial increase in stock-based compensation-$ 240M currently equals $31.7K in SBC per employee. Also, this is not little in relation to the operating cash flow.

Conclusion

Overall, it seems that an investment in the company is currently a pure bet on the massive success of GTA 6. But if that’s the investment thesis, why invest now and not in half a year? We don’t even know when the game will be released but at the very earliest, at the end of 2023.

Overall, an investment is not particularly attractive to me. As an investor, you would pay for share dilution and stock-based compensation while you get nothing back from the profits in the form of dividends. And all this while the stock is already more expensive than the competition. Of course, GTA 6 is an excellent argument, but even this is not without risk; after all, it is not guaranteed that every new GTA is of the highest quality. The production of each new game is a new challenge. For all these reasons, I am reluctant to invest here.

Be the first to comment