Justin Sullivan

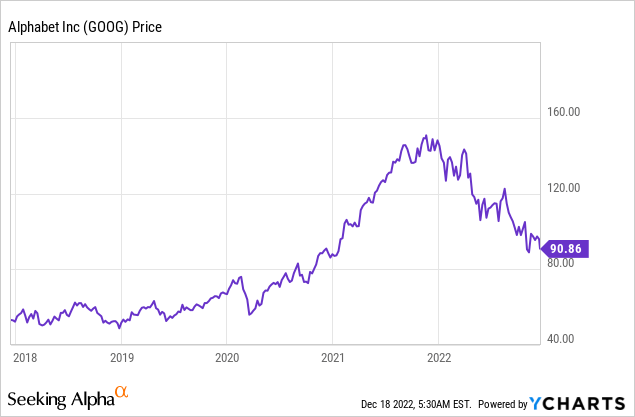

Alphabet or Google (NASDAQ:GOOG, NASDAQ:GOOGL) is a technology titan which has acted as the backbone of the internet, through its leading search engine. The company has monetized its vast connections to websites, through its global advertising business. This revenue source has recently come under fire, as advertisers are pulling spending due to macroeconomic uncertainty. Then we also have competition from TikTok, which is competing for “attention” on platforms such as Youtube with its Shorts video format. In addition, there is an existential threat from a viral Artificial Intelligence platform called ChatGPT. Given these factors Google’s stock price is down by 39% from its all-time high in November 2021. In this post I’m going to break down ChatGPT vs Google and Google’s valuation, let’s dive in.

The Evolution Of Internet Search

Google was not the first to develop a search engine, but it did develop one of the best. In 1996, the company’s original search engine was humorously named “BackRub” it utilized backlinks from other websites to determine page authority and ranking. This was a great solution as reasoning would say that people would backlink to websites they found were the most valuable and trustworthy. Flash forward to today, and the search engine ranking system still uses backlinks as a primary measure of page authority. Other metrics include webpage speed load time and “bounce rate”, which is the percentage of “no click” visits to a website. The mission of Google is to “organize the world’s information” and the idea is to provide you will the best answers to your questions, as fast as possible. Over time, Google has aimed to improve its process by offering search results directly on the Google ecosystem, without the need to click through to websites. This includes its “People also ask” tab, weather reports, and even stock market earnings information. This does improve the user experience but it is also quite controversial. Google originally acted as an enabler of websites, ranking them at the top spot. These websites can then run adverts or monetize the website traffic in other ways. However, as the company keeps people more in its ecosystem, the content creator’s website doesn’t gain the benefit. Google has also been at the forefront of controversy in the past. For example, the company had a multi-year battle with Yelp, which accused Google of scraping its content such as restaurant locations, word by word. Google is trying to evolve its search model, but facing headwinds (and for good reason). However, recently a new Artificial Intelligence platform called ChatGPT has effectively created Google 2.0, without legal pushback. I will explain more on this in the next section and if it is a threat to Google.

Is ChatGPT A Threat To Google?

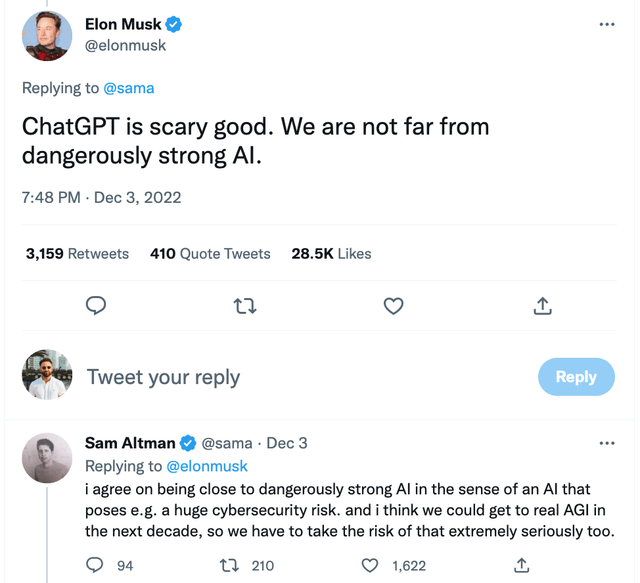

ChatGPT or ChatGPT is an Artificial Intelligence [AI] model, with a conversational interface that uses natural language processing. The platform was developed by the Open AI institute, a supposedly free and non-profit organization. This company was backed by major players such as Elon Musk and Sam Altman of Y Combinator, one of the world’s greatest Venture capital firms. Elon Musk recently stated on Twitter, that “ChatGPT is scary good. We are not far from dangerously strong AI”.

Elon Musk Chat GPT Tweet (Elon Musk Twitter)

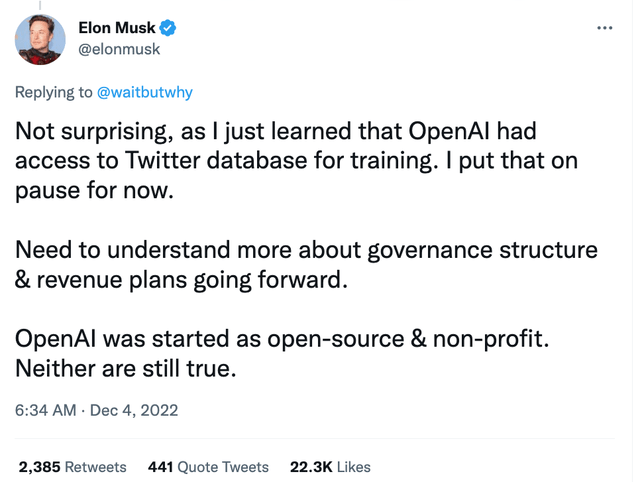

In prior Tweets, Elon Musk has stated he has distanced himself from the company as it is acting in a commercial manner and also scraped data from Twitter, which he has “paused for now”. This usage of training data from various sources could be a major issue for ChatGPT, which I will discuss later in this section.

Elon Musk ChatGPT Tweet (Elon Musk Twitter)

What does ChatGPT do?

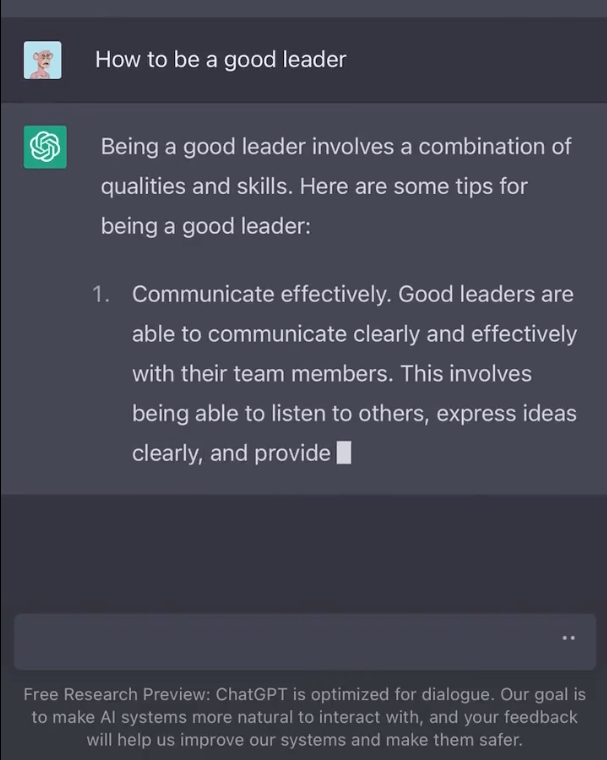

You can basically ask the ChatGPT questions (like a search engine), but rather than giving you a link to a website that a human has written, it gives you the answer directly. The platform is also immensely powerful in that you can ask it complex questions and do tasks. For example, “write me an essay about how an atom is split”. You can also ask it to write code and even ask follow-up questions. In the example below you can see a screenshot of a question on “How to be a good leader”, the ChatGPT answered this with a series of 10 points, with the first shown below.

Chat GPT leader question example (Chat GPT)

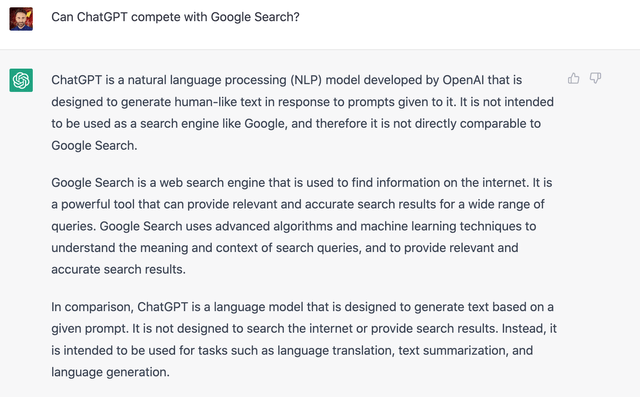

There is no doubt, that ChatGPT performs a more “human-like” and creative job of answering questions than Google search. However, there is an elephant in the room that nobody is talking about, all this training data must come from somewhere. ChatGPT has effectively scraped the entire internet and all the content written by human beings. However, the individual writers aren’t being credited, this is a similar issue to the Yelp lawsuit with Google, but on a much larger scale. This is fine for now, as Open AI is a “non-profit” but should the company wish to commercialize its platform, I believe this will be an issue. For example, I myself have written over 1,000 blogs on everything from technology to travel. I have also “filled the gaps” in Google by providing answers to questions that hadn’t been answered previously. I would have to give my consent for my data to be scraped, just as a book author would have to allow its information to be used. Therefore I believe ChatGPT is a “threat” to Google from a technology standpoint, but not commercially due to many legal issues. As an extra data point, ChatGPT is built on Microsoft (MSFT) Azure and its AI supercomputing infrastructure. Thus, Open AI could compete with Google, without crossing wires. As a final fun example, I asked ChatGPT if it competes with Google and the AI model seems to think they are very different.

Does ChatGPT compete with Google Search (ChatGPT)

Google Financials

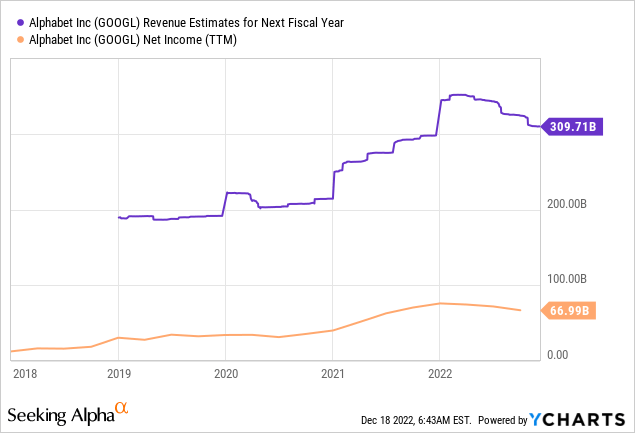

Google reported mixed financial results, the third quarter of 2022. Revenue was $69.1 billion which grew at just 6% year over year. This was much slower than prior growth rates of ~41%, between 2020 and 2021. However, if we take into account foreign exchange headwinds, from a strong dollar the revenue growth was actually closer to 11%. In addition, the “recessionary” environment has stricken fear into the hearts of advertisers, which has caused them to pull back spending. Google makes approximately 90% of its revenue from advertising and thus is sensitive to economic volatility. A positive is, a similar advertiser pullback occurred during the uncertainty of 2020, but Google rebounded soon after. Alphabet has also built out one of the most advanced advertising systems in the world, along with Meta (META). Thus for advertisers, it offers extremely low cost per click and advanced targeting. Its relatively new “Shorts” short-form video platform on Youtube which competes with TikTok, is currently going through monetization issues. However, this is expected as Meta Platforms also announced a similar issue with its Reels format. A positive is, Google announced that its Shorts had achieved over 1.5 billion views each month.

Alphabet also owns “Google Cloud” which is the third largest cloud infrastructure provider in the world with approximately a 10% market share. Digital Transformation is a secular trend, as large organizations move their “on-premises” IT to the “cloud” for many reasons such as flexibility and lower operating costs long term.

In the third quarter of 2022, Google Cloud reported super revenue growth of 38% year over year to $6.9 billion. I forecast this growth trend to continue given secular growth trends. The cloud industry was valued at $429.5 billion in 2021 and is forecasted to grow at a 15.8% Compounded Annual Growth Rate [CAGR] reaching over $1 trillion by 2028.

Profitability, Expenses and Balance Sheet

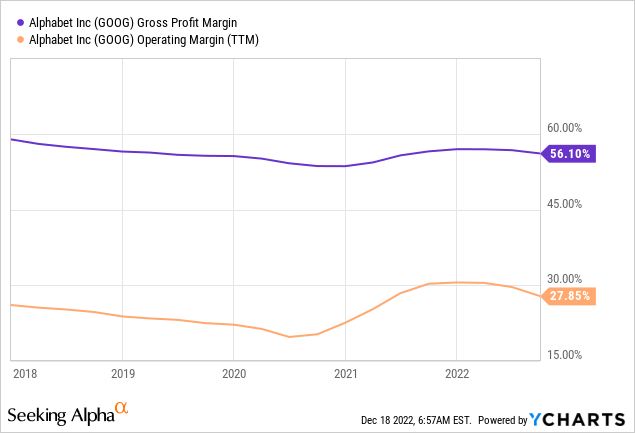

Alphabet reported an Operating Income of $17.1 billion, which declined by 19% year over year. This may seem terrible at first glance but was primarily driven by an increase of investments into its Data centers, R&D, and marketing, all of which a long term benefit is expected. Overall Operating expenses increased by 26% year over year to $20.8 billion.

Operating Income (Q3,22 report)

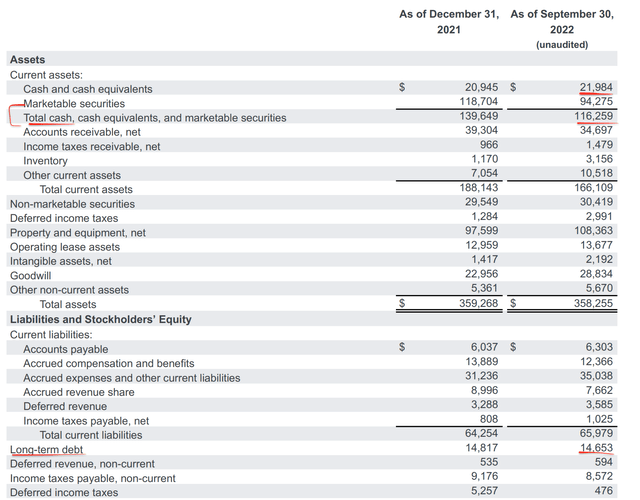

Alphabet has a fortress balance sheet with $116.3 billion in cash, cash equivalents and short term investments. The business does have $14.7 billion in long-term debt, but this is manageable as “long term”.

Google Balance Sheet (Q3,22 report)

Advanced Valuation

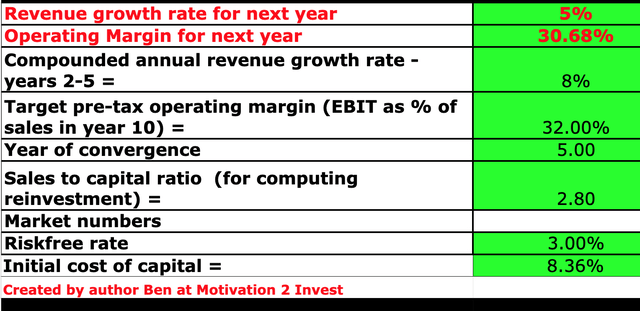

To value Alphabet, I have plugged its latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted a conservative 5% revenue growth for next year, given advertiser and economic uncertainty. However, in years 2 to 5, I have forecasted an 8% growth rate per year, as I expect advertisers to resume spending.

Google stock valuation (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses which has lifted the net income. In addition, I have forecasted it to grow to 32% over the next 5 years, driven by the continued growth of its cloud business.

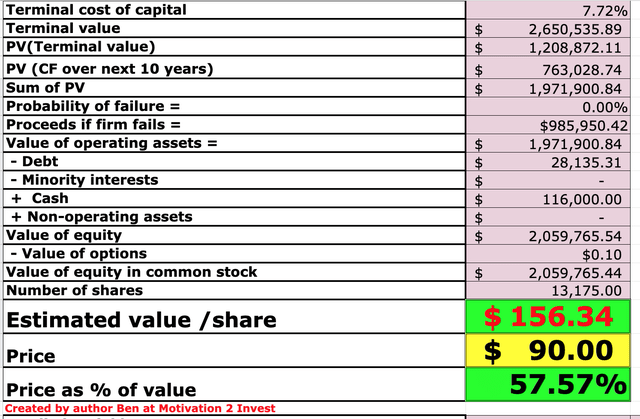

Google stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $156 per share, the stock is trading at $90 per share at the time of writing and thus is ~42% undervalued.

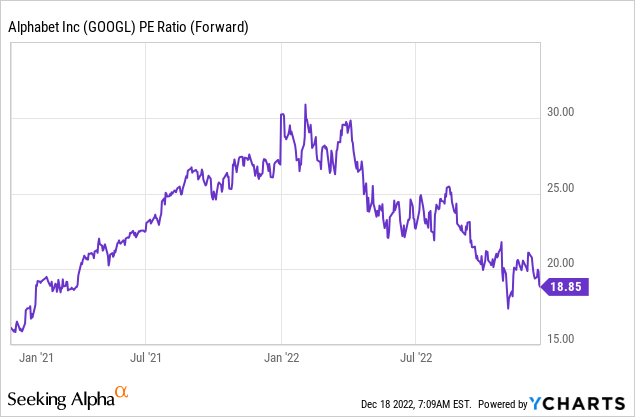

Alphabet also trades at a Price to Earnings ratio = 18.85 which is 30% cheaper than its 5 year average.

Risks

Competition (ChatGPT, TikTok, Netflix)

Alphabet is facing “theoretical” competition from ChatGPT as discussed extensively prior. From an innovation standpoint, I feel Google should have showcased something similar to ChatGPT before they did. On the advertising front, Netflix (NFLX) has partnered with Microsoft to offer connected TV advertising, which gives advertisers another place to spend ad dollars. Then of course we have TikTok which competes with Youtube Shorts. All these are threats but still on a small scale, relative to Alphabet’s gigantic size.

Advertising Spend Pullback/Recession

Throughout this post, I discussed the pullback in advertising spending and forecasted recession. Although I believe this is only a short-term issue, it does highlight Alphabet’s reliance on the Advertising model, ~90% of revenue.

Final Thoughts

Alphabet, or Google, is a fantastic company and a true technology titan. The company is facing a number of headwinds, but I believe it is still in an extremely dominant position. You can think of Alphabet like a gigantic iceberg and we only see the tip. ChatGPT may look to offer a better alternative but it doesn’t have the depth, scale, and regulatory clout just yet. Alphabet stock is undervalued intrinsically and could be a great long term investment.

Be the first to comment