shulz

Alteryx, Inc. (NYSE:AYX) is one of the leading cloud-based software companies that provides data analytics solutions. Despite today’s more difficult operating environment, it is constantly expanding, and in fact, just made a new strategic investment in MANTA, with the goal of creating an end-to-end data lineage solution. In fact, the company secured a partnership with EY this year, which will help the latter with their digital transformation.

AYX continued to expand its customer base and increased its Global 2,000 penetration to 46%. Despite this, the company has become inefficient, as seen by its declining operating margin. Finally, AYX trades at a premium to its peers, making it an unappealing investment as of this writing.

Company Overview

During its Q3 ‘22, AYX recorded a $215.7 million total revenue, up 74.66% YoY on a comparable quarter basis. This is thanks to its growing subscription-based software license revenue, amounting to $111.59 million, up 197.8% YoY. The key driver of this growth comes from its improving customer base.

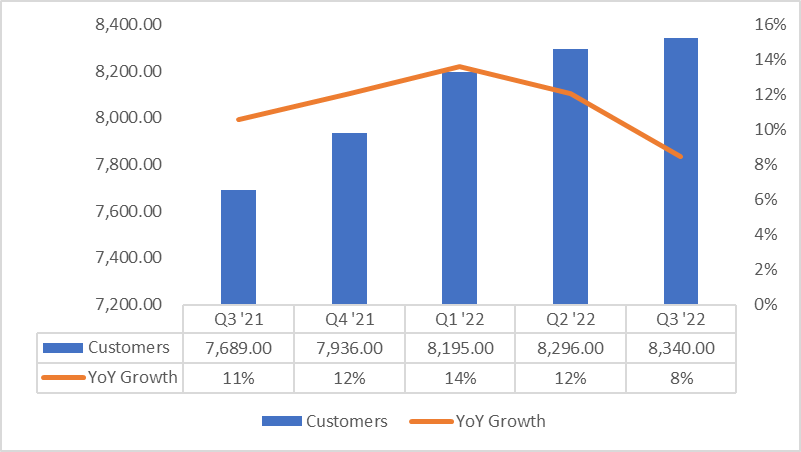

AYX: Customer base (Source: Company Filings, Prepared by the Author)

However, looking at its YoY growth rates as shown in the image below, we can see a slowing growth figure despite the completion of its Trifacta acquisition. Furthermore, this rising top line is failing to transfer into higher gross and operating margins. In fact, AYX suffered from operational inefficiencies as shown in its declining margins.

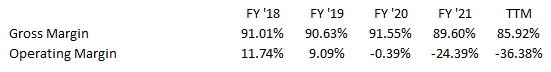

AYX: Declining Gross and Operating Margin (Source: Data from SeekingAlpha. Prepared by the Author)

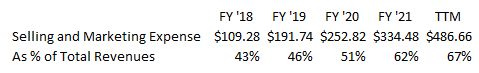

We can link its recent acquisition to one of the key factors slowing gross margin, as shown in the image above. Another aspect influencing this is the increasing expenses related to its growing staff base count of 2,824, up from 2,000 in FY ’21. This snowballed to its declining operating margin, and in fact, AYX is constantly increasing its selling and marketing investment, putting pressure on its operating margin as well.

AYX: Selling and Marketing Expense Trend. Amounts are in Millions ( Source: Company Filings. Prepared by the Author. Amounts are in Millions)

To sum it up, its slowing YoY growth in customer base and declining margin makes this stock unattractive.

Unattractive Vs Peers

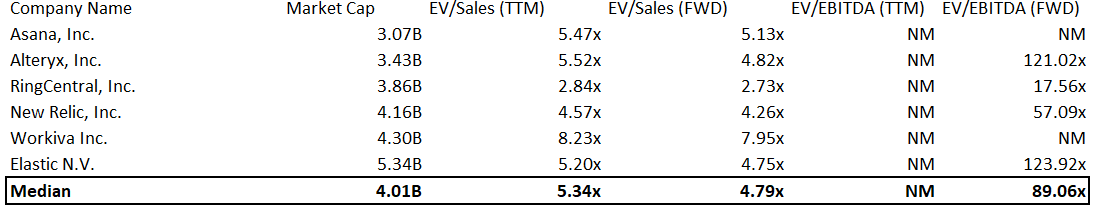

AYX: Relative Valuation (Source: Data from SeekingAlpha. Prepared by the Author)

Peers are: Asana, Inc. (NYSE:ASAN), RingCentral, Inc. (NYSE:RNG), New Relic, Inc. (NYSE:NEWR), Workiva Inc. (NYSE:WK), Elastic N.V. (NYSE:ESTC).

AYX is trading unattractively against its peers as shown in its 121.02x forward EV/EBITDA compared to its peers’ median of 89.06x. On top of this, the company’s trailing EV/Sales is relatively more expensive than its peers’ median of 5.34x, while its forward EV/Sales of 4.82x will remain elevated above its peers’ median of 4.79x.

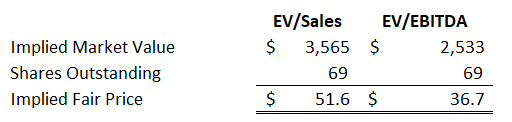

AYX: Relative Valuation (Source: Prepared by the Author)

At an implied EV/EBITDA of 89.06x and EV/Sales of 4.79x and an estimated EBITDA amounting to $33.19 million and total revenue of $833.35 million in FY ‘22, we can arrive at a blended fair price of $44. This provides no margin of safety, making it an unattractive long candidate, as of this writing.

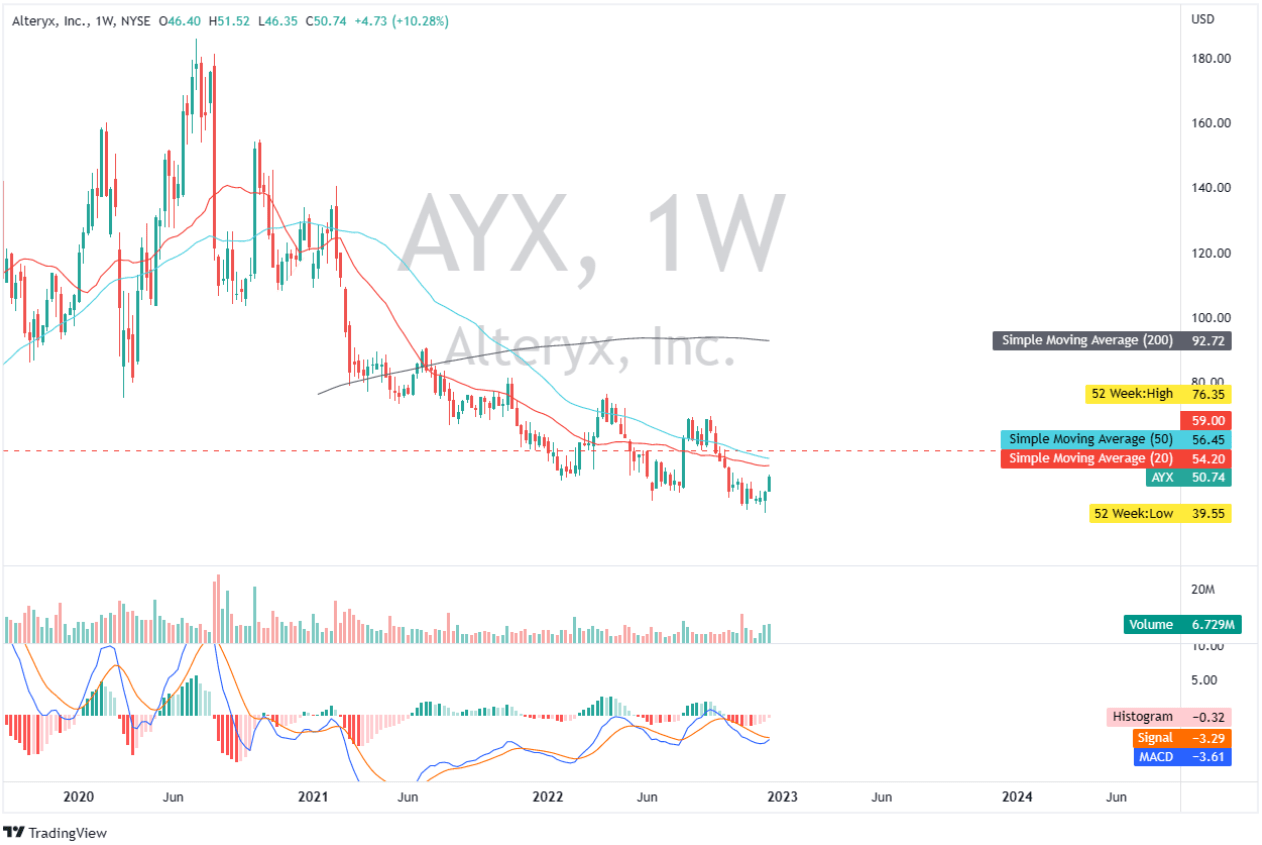

Printing A Potential Lower Highs

AYX: Weekly Chart (Source: Author’s Tradingview Account)

On the weekly chart, the price of AYX has recovered at around $39 level and is on the way to re-testing its psychological resistance around $59 per share. This is especially true given the possibility of a bullish crossover on its MACD signal, as indicated in the chart above. On the other hand, AYX is trading below its 20-, 50-, and 200-day simple moving averages, indicating significant negative momentum. If price trades near its 20- and 50-day moving averages, I believe it will attract bears and induce price action to make lower highs.

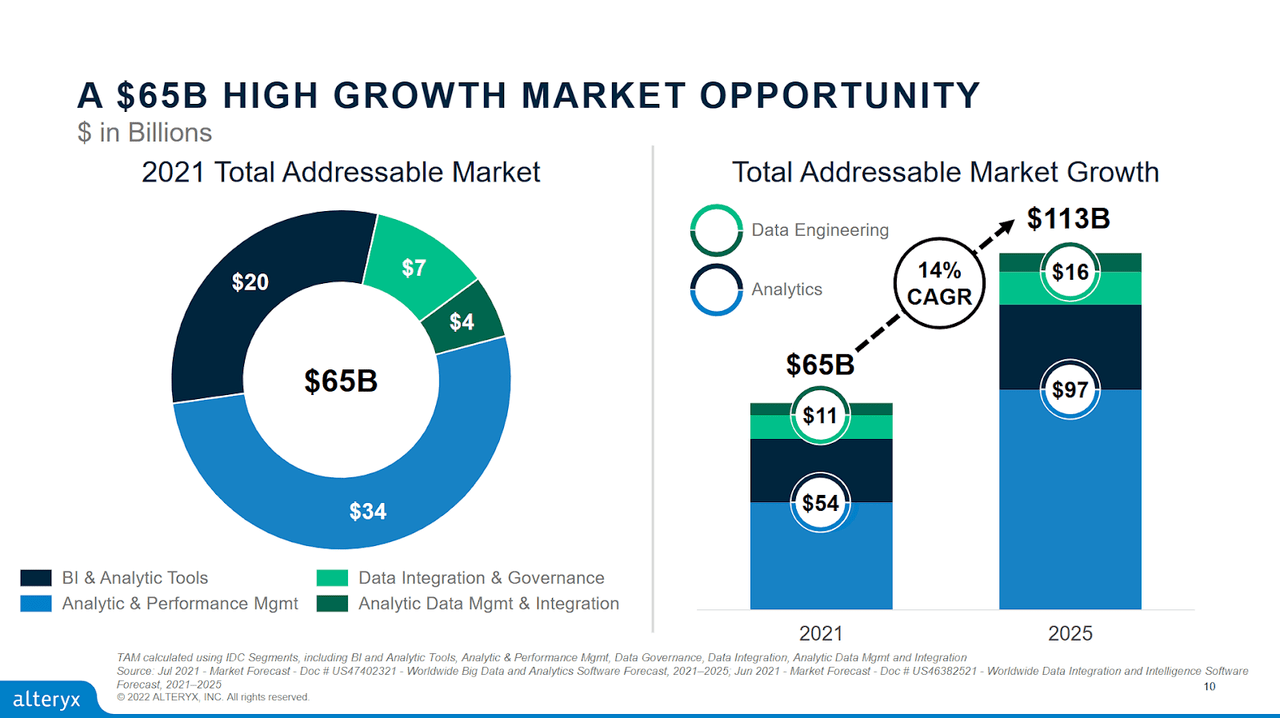

Growing TAM

One of the value-adding catalysts for Alteryx is its efforts to expand. In fact, it finished the acquisition of Trifacta early this year. The management aims to enhance its cloud-based data analytic capabilities and especially enhances its Alteryx Designer Cloud service. As a result, I believe AYX is in a better position to capitalize opportunities in its growing total addressable market, as shown in the image below.

AYX: Growing TAM (Source: Investor Presentation )

Additionally, AYX ended the quarter winning a multiyear contract, providing newly acquired customers with its competitive analytics and machine learning services.

We won two seven-figure deals during the quarter with a significant cloud element, one of which was with a Fortune 100 auto manufacturer. This multiyear Alteryx customer not only meaningfully expanded its designer and server license count, but also signed on for several thousand designer cloud licenses to enable cloud-native access to data in Google BigQuery. In addition, by leveraging a cloud ELA, this customer can engage with machine learning and Auto Insights as they move forward with cloud transformation.

…

In Q3, they significantly expanded their multi-thousand user license agreement with more designer seats as well as cloud. Designer Cloud will provide this customer with greater flexibility and agility in expanding their usage of Alteryx in coming years. Source: Q3 Earnings Call Transcript

It is no surprise that experts expect AYX to earn $1.31 billion in revenue in FY ’25. However, the company’s valuation remains unattractive based on management’s growing weighted-average basic outstanding shares outlook compared to its 67.1 million reported in FY ’21.

Finally, we expect non-GAAP loss per share to be in the range of $0.37 to $0.32, an improvement from the prior outlook for $0.56 to $0.46. This assumes 68.5 million basic shares outstanding and an effective tax rate of 20%. Source: Q3 Earnings Call Transcript

Conclusive Thoughts

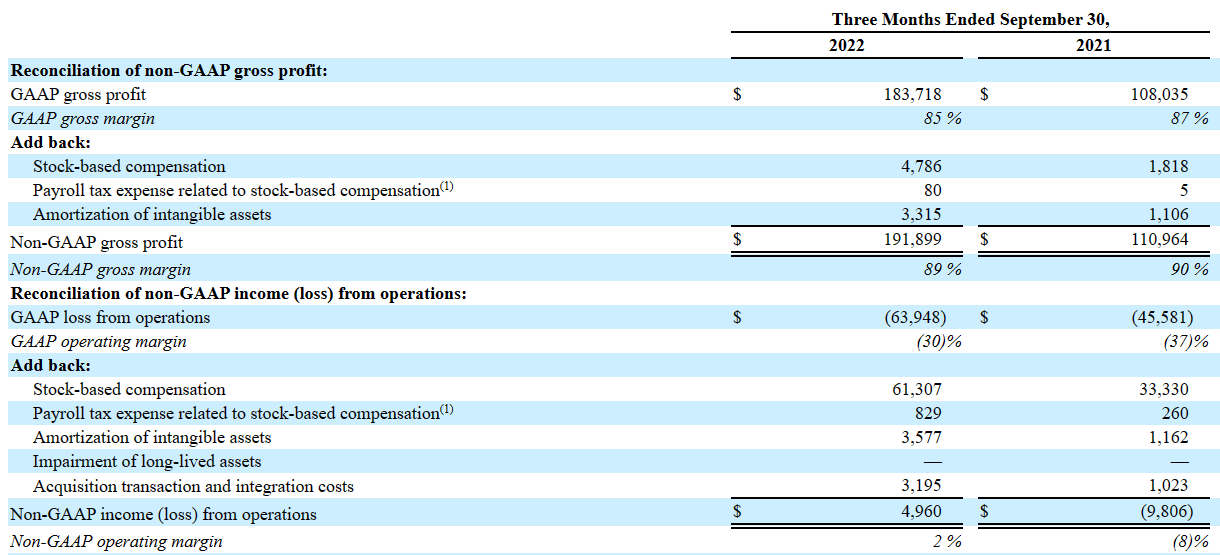

Source: Q3 ‘22 Report

Looking at Alteryx’s Non-GAAP figures, it maintains a declining gross margin of 89%. However, its Non-GAAP operating margin produced a positive 2% after excluding its $61.3 million stock-based compensation expense. Despite growing stock-based compensation, Alteryx, Inc. started to produce a negative trailing cash flow from operations amounting to -$73.9 million. Finally, it recorded the highest total debt figure, amounting to $963 million for the past 3 calendar years, which snowballed to its deteriorating debt-to-equity ratio of 6.16x compared to its 3-year average of 1.84x. Overall, I believe Alteryx, Inc. is an unattractive investment as of this writing.

Thank you for reading and good luck to us all!

Be the first to comment