bjdlzx

Unit Corporation (OTCPK:UNTC) appears capable of ending up with around $21 per share in cash on hand by the end of 2022, and could end up with around $29 per share in cash on hand by the end of 2023 based on current strip prices. This does not include further spending on share repurchases though.

Between Unit’s substantial cash position and the value of its various (drilling, midstream and upstream) divisions, I believe that it could end up being worth $80+ per share.

Cash Position

Unit increased its cash position from $88 million at the end of Q1 2022 to $116 million at the end of Q2 2022, despite spending $13 million on repurchasing shares during the quarter. Thus Unit essentially generated $41 million in positive cash flow in Q2 2022.

Unit also closed on the sale of its Gulf Coast assets for cash proceeds of $43.7 million on July 1. Proforma for the closing of its Gulf Coast asset sale (and further share repurchases after quarter end), Unit had around $156 million in cash on hand, while its outstanding share count has been reduced to approximately 9.76 million.

Due to the combination of the divestiture of its Gulf Coast assets and lower oil prices (compared to Q2 2022), Unit’s quarterly free cash flow will likely be lower in the second half of 2022 than in Q2 2022. I can still see Unit ending up with around $200 million to $210 million in cash on hand at the end of 2022, before the impact of any further spending on share repurchases. This would be around $21 per share in cash on hand.

Hedges

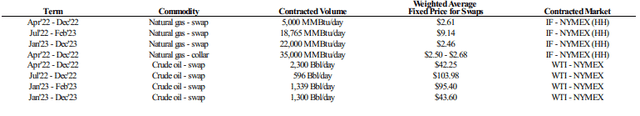

Unit’s hedges will likely have significantly negative value in 2023 as well, although it did add some hedges at high commodity prices for July 2022 to February 2023.

At current strip of approximately $73 WTI oil and $5.45 NYMEX gas for 2023, Unit’s 2023 hedges have around negative $34 million in estimated value. At last report, Unit was unhedged for beyond 2023.

2023 Results With Flat Production

It is uncertain at this point how much development Unit will do in the future. It may focus on maximizing cash flow and drawing down its PDP reserves, or it may do some development to keep production relatively stable given favorable commodity prices.

I’ve assumed a scenario where it largely keeps production from continuing operations stable. In this scenario, Unit may be able to generate $335 million in revenues after hedges at current 2023 strip prices.

| Type | Barrels/Mcf | Per Barrel/Mcf | $ Million |

| Oil | 1,095,000 | $71.00 | $78 |

| NGLs | 2,135,250 | $24.00 | $51 |

| Natural Gas | 22,447,500 | $4.70 | $106 |

| Hedge Value | -$34 | ||

| Contract Drilling | $134 | ||

| Total | $335 |

This would allow it to generate around $77 million in positive cash flow in 2023.

| $ Million | |

| Oil and Gas Operating Costs | $87 |

| Contract Drilling Operating Costs | $104 |

| Cash G&A | $22 |

| Capital Expenditures | $45 |

| Total | $258 |

Unit’s cash position at the end of 2023 in this scenario may be around $280 million to $285 million. As well, there is the potential for Unit to start receiving some distributions again in 2023 from its 50% interest in Superior Pipeline.

Notes On Valuation

Unit may thus have around $29 per share in cash on hand by the end of 2023. It also mentioned that its 14 BOSS drilling rigs are now being fully utilized and its drilling division produced approximately $8 million EBITDA in Q2 2022. The stronger commodity environment leads me to believe that its drilling and midstream (50% share) divisions may have a combined value of around $200 million now.

This is significantly higher than the $70 million to $120 million estimated value mentioned in Unit’s disclosure statement during its 2020 bankruptcy proceedings. The current environment is much more favorable than in mid-2020 though. At that time, the US active rig count was dropping quickly, eventually bottoming out at 244 in August 2020. The rig count is now stable at around 765.

Thus Unit’s cash (at the end of 2023) and its drilling and midstream division value may be worth around $49 to $50 per share. This is already close to Unit’s current $53 share price and doesn’t include the value of its upstream division.

Unit’s upstream assets (excluding its divested Gulf Coast assets) had a PDP PV-10 of approximately $700 million at mid-January strip prices. Current strip prices are similar for oil and significantly higher for natural gas. It is uncertain how much Unit will replenish its PDP reserves through development, but I believe that Unit could be worth $80+ per share (including the value from its upstream assets) if it properly manages its assets.

Conclusion

Unit Corporation is generating a fair amount of cash and may end up with around $29 per share in cash by the end of 2023. Unit’s drilling assets are also benefiting from the much improved environment for drilling services compared to when it restructured in 2020. I believe that Unit is significantly undervalued based on its projected cash position and the value of its various business units and could be worth $80+ per share.

Be the first to comment