Leonidas Santana/iStock via Getty Images

Brazil-based Banco do Brasil (OTCPK:BDORY) gave investors reason for optimism at this year’s ‘BB Day’ event, laying out the path to continued ROE outperformance via a renewed agricultural push and enhanced “phygital” capabilities, as well as improved governance. The latter is key – Banco do Brasil has proven its ability to balance efficiency gains and digital transformation across its products and channels, but its state ownership has always been a key overhang. In the meantime, the Brazil macro backdrop looks much better with inflation on the decline, while on the fiscal side, Congress-approved tax reductions and social benefits (via Auxilio Brasil) should boost growth and asset quality. All in all, the stock offers compelling value at a ~30% discount to book despite maintaining healthy capital ratios through the cycle and best-in-class ROEs.

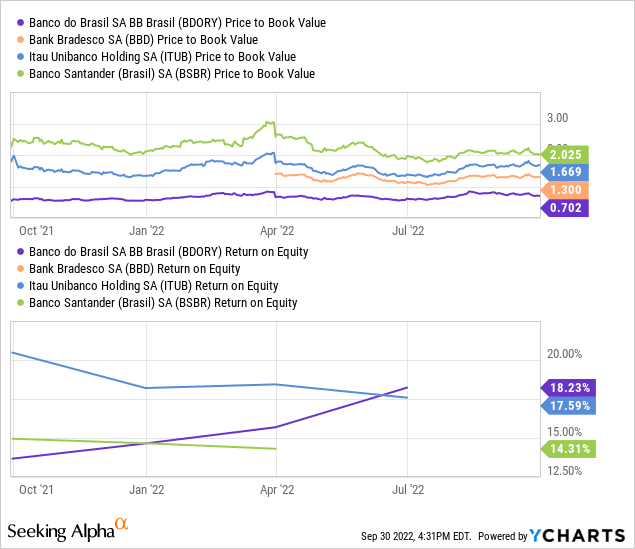

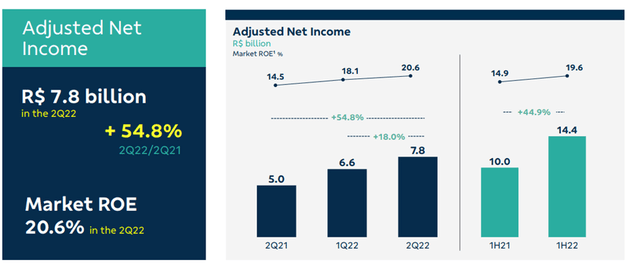

Sustaining the Positive RoE Trend

The key takeaway from the presentation was management’s emphasis that the recent increase in the bank’s ROE (to >20% as of Q2 2022) is structural. The bank has various initiatives in the pipeline (across all verticals) aimed at further increasing profitability while also maintaining solid client engagement metrics (+11% YoY). For instance, Banco do Brasil is actively shifting its credit portfolio mix toward credit card and personal loan growth (previously on hold due to COVID) to expand its client base beyond the typical public employee demographic. The UBS Group (UBS) partnership is another key revenue driver, having already generated >R$350bn in volumes since inception (mostly in fixed income). Given the bank’s goal to leverage the partnership into a leading investment banking franchise in Brazil, the JV contribution will be worth keeping an eye on, particularly as capital markets activity picks up in the coming years.

Agriculture as the Growth Engine

Agriculture remains at the center of the bank’s credit growth story – in particular, its ability to offer solutions across the full length of the agribusiness value chain stands out. In addition to the typical financing options for production and investment, Banco do Brasil also offers machinery and equipment financing to producers, as well as capital markets financing. YTD, the bank has already raised a massive ~R$23bn through agribusiness securities (e.g., CPR, CDCA, CRA, and FIAgro). The two first months of the July crop have also panned out well, with loan disbursements up ~40% YoY mainly on stronger commercial activity.

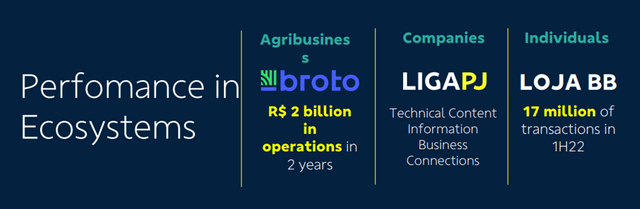

Going forward, the aim is to tap into new market opportunities within the space by becoming “a bank for each client” through its various new initiatives and platforms. Out of the three ecosystems (Broto, Liga PJ, and Banco do Brasil’s fast-growing retail marketplace), Broto, the agriculture-focused marketplace connecting suppliers and farmers, has been the key highlight. ~R$2bn has already been sourced across different products and services in the last two years, with ample runway remaining. In the meantime, non-performing loans (NPLs) could come under pressure as the bank looks to advance on non-current account clients, but higher net interest income should offset any headwinds and boost overall profitability.

Stepping Up on Digital

A core part of the bank’s mid-term objectives is to incorporate a data-driven approach and match the digital transformations its private peers have already achieved. As part of its digitalization efforts, the bank will continue to invest in the personalization of the ‘phygital’ (physical + digital) experience across the branch, web banking, and app levels. Acquisitions will accelerate the digital push across demographics as well – by acquiring Yours bank (a digital bank for teens), for instance, Banco do Brasil has better positioned itself to meet the rapidly evolving needs of the younger generation.

Alongside its expanded digital presence, customer satisfaction has improved – per management, the net promoter score has seen an ~8pts increase, placing the bank in the ‘excellent’ range. With the bank’s current base at ~26m active clients in digital channels and ~8m clients accessing its app daily, there remains ample growth potential from here.

Positive Corporate Governance Changes

The emphasis on corporate governance was a step in the right direction as well. Key changes include for career employees to fill positions at or below the executive director level and for two independent Board members to participate in internal committees. There will also be a five-year strategic planning process that the bank will execute against – this ensures a more long-term oriented decision-making process and better protects the bank from potential interferences. Governance has always been a sore point for the bank, so the announcements were reassuring and emphasized an intent to boost the bank’s value perception among investors. Success here should go a long way toward narrowing the persistent valuation gap to privately owned peers, as will management’s continued commitment to improving corporate governance practices going forward.

An Unfairly Discounted Brazilian Bank

All in all, this year’s ‘BB Day’ validated the bulls. Given the growth opportunities in the pipeline and the sustainability of Banco do Brasil’s ROE following the Q2 outperformance, the current valuation seems overly punitive. While election concerns are likely top of mind at this juncture (Banco do Brasil is state-owned), the outcome should ultimately have a limited impact on the bank’s operations, particularly with the renewed corporate governance push. Thus far, the stock has outperformed its private peers Bradesco (BBD), Itau (ITUB), and Santander Brasil (BSBR) on positive earnings revisions, yet a multiple re-rating has yet to materialize. As the election overhang clears and the bank executes on its new medium-term plan, expect more upside from here.

Be the first to comment