The iShares 3-7 Year Treasury Bond ETF (NYSE:IEI) with $9 billion in current assets under management is the largest and most liquid exchange-traded fund that tracks the performance of this particular segment of intermediate-term treasury bonds. With an average maturity of 4.7 years and an effective duration of 4.5, IEI has moderate interest rate risk compared to more conservative short-term Treasury funds. The tradeoff here compared to longer-maturity bond funds is a smaller appreciation potential in a scenario where rates trend lower. In our view, the exposure offered by IEI is on the sweet spot of the treasury curve that can serve a variety of roles in a portfolio in different market environments for the long run.

(Source: iShares)

Treasury Bonds Background

With hundreds of different bond ETFs, it’s important to recognize that IEI’s purpose is to track a very specific segment of U.S treasuries. There are various funds by iShares and other ETF sponsors that target everything from “ultra-short” duration treasury bills (BIL) to 20+ year long-dated Treasury bonds (TLT) and everything in between. Across the universe of fixed income and bond ETFs, the main considerations will depend on particular preferences between yield, appreciation potential, and the risk profile. A bond fund that is very low risk will typically have a lower total return potential and vice-versa.

One standardized measure of bond risk and volatility is the effective duration that measures the sensitivity to changes in interest rates. The idea here is that longer-dated bonds have a corresponding higher duration and interest rate risk as small changes in the market interest rate imply a greater impact on its pricing based on the net present value of the bond’s cash flows till its maturity.

The risk here is that interest rates climb higher and the bond price falls. For every point of duration, a bond is expected to lose that duration figure in percentage terms for a 1% increase in the market interest rate. As an example, a bond fund with an effective duration of 10.0 would lose 10% of its value for a 1% climb in interest rates, all else equal. Conversely, a bond with an effective duration of 10.0 would gain 10% with a corresponding 1% drop in interest rates.

The Risk And Return Tradeoff

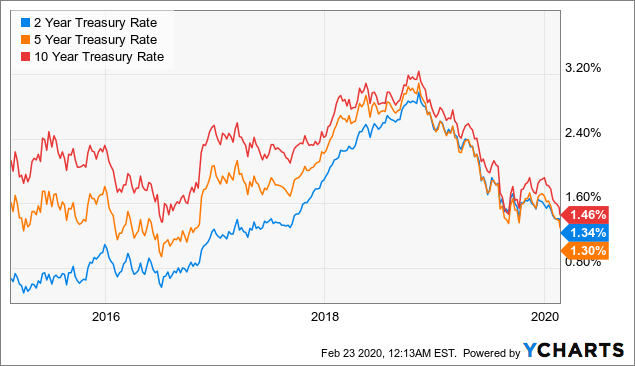

IEI’s effective duration of 4.51 is related to the average maturity of the underlying treasury bond portfolio between 3 and 7 years. Over the past year, IEI has returned 7.43% on a total return basis considering its yield and price performance. This is in the context of interest rates moving lower considering Fed rate cuts in 2019 and the market trends. The 5-year Treasury Rate at 1.3% is down from 2.5% this time last year.

Data by YCharts

Data by YCharts

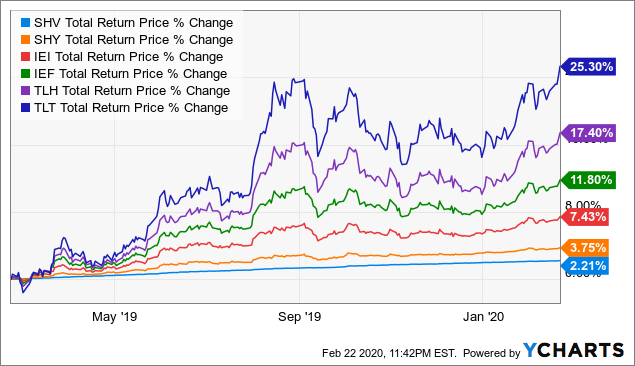

There is always uncertainty in the market and if investors knew that rates would have declined as they did over the past year, the more optimal trade would have been longer-dated bond funds like the iShares 20+ Year Treasury Bond ETF (TLT) with an effective duration of 18.0. Indeed, TLT has returned 25.3% over the past year. The table below highlights various iShares Treasury Bond ETFs with exposure to different segments of the yield curve.

| 1YR Total Return | Div Yield | Effective Duration | |

| iShares Short Treasury Bond ETF (SHV) | 2.21% | 2.14% | 0.47 |

| iShares 1-3 Year Treasury Bond ETF (SHY) | 3.75% | 2.09% | 1.88 |

| iShares 3-7 Year Treasury Bond ETF (NASDAQ:IEI) | 7.43% | 1.95% | 4.51 |

| iShares 7-10 Year Treasury Bond ETF (IEF) | 11.80% | 1.95% | 7.59 |

| iShares 10-20 Year Treasury Bond ETF (TLH) | 17.40% | 2.15% | 12.38 |

| iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) | 25.30% | 2.05% | 18.00 |

(Source: Data by YCharts/table by author)

The current dynamic in the market is the observed yield curve flattening as rates have converged to similar yields at all maturities. This is reflected in a similar dividend yield for all the different Treasury bond ETFs around 2%. A 2-year Treasury bond yields the same as a 10-year bond. The choice between each of these funds today is a decision based on interest rate expectations and acceptable risk tolerance.

For investors that are confident that interest rates will collapse lower, potentially based on a deterioration of the global growth outlook, a longer-dated Treasury bond fund like TLT may best capture such expectation. At the other end, the iShares Short Treasury Bond ETF (SHV) with an effective duration of 0.47 is a very-conservative fund that is essentially an alternative to simply holding cash. Regardless of what interest rates do, SHV’s total return over an entire year will be based almost entirely on its dividend yield which represents the interest income of the underlying Treasury holdings. From the graph below, the returns performance history for SHV is nearly a straight line with minimal volatility. As expected, the longer-dated Treasury funds have presented higher returns over the past year.

Data by YCharts

Data by YCharts

The Value In IEI

Recognizing that diversification is just as important for bonds as with equities, what we like about IEI as an intermediate bond fund is its moderate risk profile. The duration positioning here represents a cautiously bullish view on bonds with an expectation that rates should move lower, but more limited risk compared to longer-term bond funds.

The risk we are talking about here is not that rates will necessarily surge higher, but more so in terms of interest rate volatility from current levels. With the 10-year yield approaching an all-time low, even a moderate pullback or bounce in the yield from here over the coming months could lead to a material loss in a fund like TLT.

What About Corporate-Bonds Fund?

The allure of Treasuries is that they are recognized for having no credit risk or otherwise no risk of default since they are backed by the U.S. government. That being said, investment-grade corporate bonds with a similar maturity and duration profiles as a corresponding Treasury bond should benefit from a larger yield all else equal. By accepting some level of credit risk, investors in corporate bonds funds receive a higher yield while facing a similar level of interest rate risk to a treasury bond with the same duration.

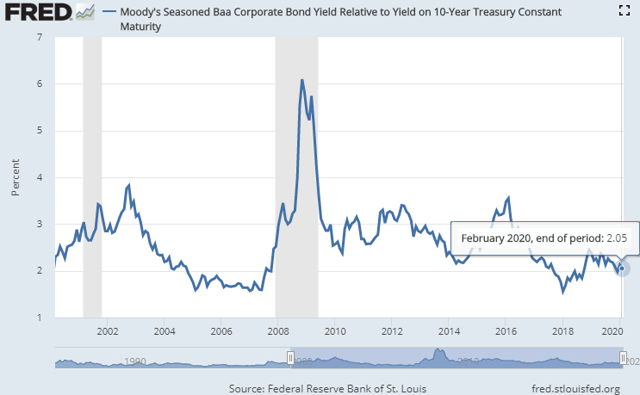

Often investors may take for granted the credit risk and credit spread risk when investing in investment-grade corporate bonds. This dynamic becomes particularly important during a recessionary type of environment as the credit spread even among the highest-rated investment-grade corporates can widen over Treasuries leading to losses even if market interest rates decline.

The real advantage in Treasuries comes down to the credit-spread dynamic particularly in an environment of market stress. During the last recession between 2008 and 2009, the ‘BBB’ rated (Baa on the Moody’s scale) corporate bond yield relative to treasuries surged above 6%. The graph below from the Federal Reserve Bank of St. Louis highlights this dynamic for the 10-year Treasury rate but a similar dynamic would have been present across all parts of the yield curve. For investors that are concerned about a potential recessionary environment, a rotation into Treasuries may make sense as they should outperform corporate bonds.

(source: Federal Reserve Bank of St. Louis)

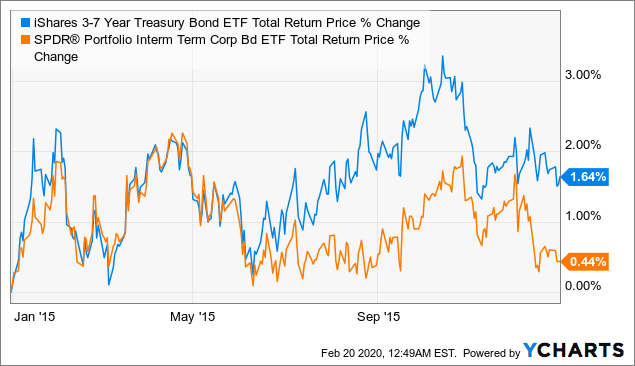

We’ll contrast IEI with the SPDR Portfolio Interm Term Corporate Bond ETF (SPIB) which has an average maturity of 4.97 years and an effective duration of 4.34 which is comparable to IEI. A standard deviation of daily returns over the past 5 years at 0.16% for IEI and 0.18% implies both funds have similar levels of daily average volatility. The difference here, as the name implies, is that SPIB only holds corporate bonds with the credit profile being about 50% in ‘BBB’ rated issuers and the rest ‘A’ rated or better.

SPIB offers a full percentage point in higher yield at 2.96% compared to 1.95% for IEI. SPIB has also returned a higher 9.6% over the past year compared to 7.4% for IEI. This is in the context of several Fed rate cuts in 2019 and generally lower interest rates over the period which has continued into 2020.

| iShares 3-7 Year Treasury Bond ETF (IEI) | SPDR Portfolio Interm Term Corporate Bond ETF (SPIB) | |

| Avg. Maturity | 4.7 | 4.97 |

| Effective Duration | 4.44 | 4.34 |

| Standard Deviation of Daily Returns 5-years | 0.16% | 0.18% |

| Credit Risk | 100% ‘AAA’ – U.S. Gov. | ~50% ‘BBB’/ ~42% ‘A’/ 8% ‘AA’ |

| Yield | 1.96% | 2.96% |

| 1-Year TR | 7.4% | 9.6% |

| 3-Year TR | 10.0% | 14.8% |

| 5-Year TR | 12.1% | 20.4% |

(Source: Data by YCharts/table by author)

Our point here is that there are scenarios where IEI and Treasuries can outperform corporate bond funds. In 2015, for example, IEI returned a relatively modest 1.6% that year compared to just 0.4% for SPIB in a year that was defined by a widening of investment-grade credit spread which is visible in the graph mentioned above. It’s expected that a deteriorating economic outlook should lead to a widening of credit spreads making Treasuries the only true safe-haven within fixed-income.

Data by YCharts

Data by YCharts

Takeaway

Intermediate-maturity bond funds often get overshadowed by more actively traded and aggressive long-maturity funds. We think IEI serves an important function by targeting a moderately conservative segment of the Treasury curve representing a cautious outlook for interest rates. In the current environment of greater economic uncertainty and Treasury yields trading at or near all-time lows, we think IEI is well-positioned to offer attractive fixed income returns while limiting the risk should yields exhibit increasing volatility.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment