Roman Tiraspolsky/iStock Editorial via Getty Images

In an increasingly uncertain macroeconomic environment, Toronto-Dominion Bank (NYSE:TD)(TSX:TD:CA) is an appealing play in the banking sector due to its strong credit quality, diversified business model and limited exposure to capital markets activity. Its balance sheet is also notably asset sensitive, making it better placed to benefit from rising interest rates than its Canadian peers.

Q3 Results

TD delivered better than expected third quarter results on August 25, as robust loan growth and improved margins was more than enough to offset the rise in loan loss provisions that was driven by the deterioration in the macroeconomic outlook. Adjusted EPS for Q3 2022 was 6% higher than the year-ago quarter, and 3% above than Q2 2022, at C$2.09 (~$1.52).

Its Canadian retail banking business, the most significant contributor to the group’s earnings, demonstrated resilience in a number of key performance metrics.

“Our Canadian Retail segment earned $2.3 billion, with record revenue of $7 billion in the quarter. The Personal Bank performed well. We saw industry-leading market share gains in non-term deposits, contributing to 8% growth in personal deposits year-over-year. In our real estate secured lending business, volumes were up 3% from Q2 – a second quarter of very good sequential loan growth, demonstrating momentum from our investments across front-line sales channels, operations, and account management. We remain confident in the quality and mix of our RESL book, supported by prudent underwriting practices…In Business Banking, TD again achieved double-digit loan growth, driven by strength across Canada in verticals including commercial real estate, agriculture, middle market, dealer financing and small business.”

Chief Executive Officer Bharat Masrani, TD Q3 Earnings Call

The performance at its US Retail Bank also held up well, following healthy commercial loan volumes and robust personal loan growth. Importantly, margins in the US business have been improving more quickly in the US than in Canada, reflecting the differences in the business mix between the two segments. NIM increased by 41 basis points on the previous quarter to 2.62% in the US, compared to an 8 basis point improvement in Canadian Retail over the same period.

On the downside, costs are rising, particularly with respect to wages. Non-interest expenses were also higher because of increased investment relating to organic and inorganic growth initiatives, including acquisition and integration-related charges for First Horizon. Moreover, the bank’s strategy to mitigate interest rate volatility to capital on closing of the acquisition resulted in a net loss of C$678 million (~$496 million) for the quarter.

Deteriorating Macroeconomic Outlook

Driven by the deterioration in the macroeconomic outlook, provision for credit losses for the quarter rose to C$351 million (~$256 million) – its highest level since Q4 2020.

Looking ahead, provisions could trend higher still, as concerns mount on the risk of a hard landing for the economy. Aggressive monetary tightening has heightened recessionary risks in both countries, in addition to the likelihood of a housing market correction, particularly in Canada.

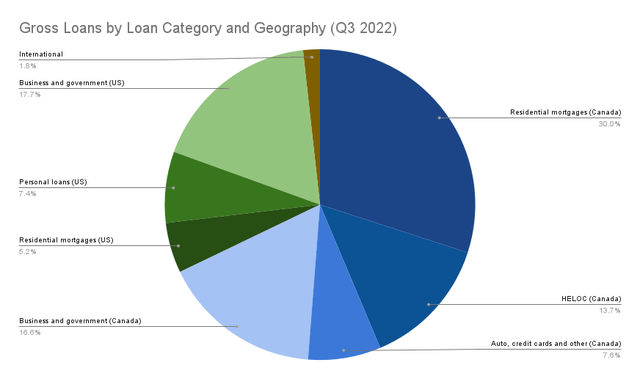

TD Investor Relations (Q3 2022 Supplementary Financial Information)

The risks are, however, partly mitigated by its conservative loan underwriting and diversification in the loan book, in terms of both geography and across loan categories.

“Today we find ourselves relatively well positioned already for a moderate recession. As you know, we’re holding C$1.6 billion (~$1.2 billion) in reserves over pre-COVID levels. What occurred this quarter is that on our base and our downside there was quite a bit of change on the macro side.”

Chief Risk Officer Ajai Bambawale, TD Q3 Earnings Call

TD’s business mix attractively positions the bank against near term risks, particularly with respect to slowing mortgage lending and refinancing activity. What’s more, its relatively low exposure to capital markets means that the bank will be less vulnerable to a slowdown in dealmaking activity and bond issuances, due to rising interest rates.

Rising Net Interest Income

An increase of 100 basis points in interest rates across the curve is expected to result in a C$1.3billion (~$1.0 billion) increase in net interest income over a 12-month period, assuming a constant balance sheet. That’s equivalent to a boost to NII of more than 5% and add more than 9% to its annual earnings.

With the Fed Funds Rate expected to reach 4.4% by the end of this year, and the Bank of Canada forecast to raise its policy rate by nearly as much, to 4.0%, the improvement to NII would be very substantial. And unlike growth achieved by business expansion, there are no additional operating expenses to consider, meaning the benefit would translate directly to its bottom line.

“An important driver of a deposit’s value and NII sensitivity is the portion of deposits that are non-term; over 80% of TD’s total deposits and approximately 90% of its personal deposits are non-term.”

Regulatory Risks

Other than the macroeconomic outlook, regulatory uncertainty is the biggest downside risk, especially as US regulators consider potential new rules for big regional banks. Amid concerns for the increasing size of a number of regional lenders, the Fed and OCC are looking at whether big regional banks should hold more long-term debt to help absorb losses in the event that they become insolvent. The introduction of new capital requirements could push up the cost of funding, and reduce the competitiveness of lenders caught up by the new rules.

Growing regulatory concern about the impact to financial stability from big regional banks has also been seen on the M&A front. US Bancorp’s acquisition of MUFG Union Bank has been delayed amid increased scrutiny over the systemic risks posed by bank mergers and market consolidation in general.

The likelihood that TD’s two US acquisitions – First Horizon and Cowen – could be held up in similar fashion has increased too. Although management remains confident in closing the transaction within its pre-disclosed timeframe, analysts seem increasingly unsure and worry that regulators may demand additional requirements to win approvals.

Final Thoughts

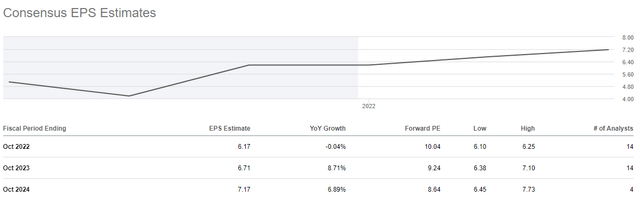

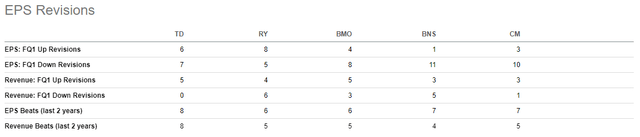

TD’s business mix attractively positions the bank to benefit from rising interest rates, despite growing concerns of a hard landing for the economy. The consensus EPS forecasts show the group is on course to see the best earnings growth among its Canadian domestic peers over the next three years.

Seeking Alpha Earnings Estimates

The bank has also had more positive earnings surprises over the past two years than its ‘Big 5′ domestic peers – following beats in each of the last eight quarters on analysts’ expectations for both revenues and adjusted EPS.

Be the first to comment