John M Lund Photography Inc

Thesis

Leading internally-managed net lease REIT Spirit Realty Capital, Inc. (NYSE:SRC) is scheduled to release its Q3 earnings on November 8. Despite its discount against its peers, SRC posted a YTD total return of -16.4% as investors parsed the reward-to-risk profile of its yields.

SRC has understandably been battered despite its robust tenant portfolio. In Q2, 85% of its annualized base rent (ABR) consists of tenants with an annualized revenue of at least $100M (65% with more than $1B in annualized revenue). Coupled with an occupancy rate of 99.8%, SRC investors can continue to count on the visibility of its AFFO.

Despite that, we gleaned that SRC’s 10Y total return CAGR of 7.6% suggests its share price gains have been relatively lackluster. Moreover, the 10Y mean of its NTM dividend yields (6.8%) indicates that its dividend yields have primarily driven its total return CAGR.

Therefore, Spirit Realty investors focusing on total return may have been disappointed with the REIT’s ability to drive better share price gains to supplement its distributions.

Notwithstanding, we gleaned the potential for investors to partake in a mean-reversion opportunity seems relatively interesting at the current levels. We discuss why we assess that the reward-to-risk is favorable, although we don’t consider SRC undervalued.

Also, investors should remain poised for a worse-than-expected recession, which would cause value compression but improve its reward-to-risk profile tremendously. Despite that, its price action remains constructive, even though the recovery surge last week could face some digestion in the coming weeks. So, if you are not in a hurry, you can consider waiting for a potential pullback before adding more positions.

We rate SRC as a Buy.

Spirit Realty Could Find It Tough To Shake Off Its Lower Relative Valuation

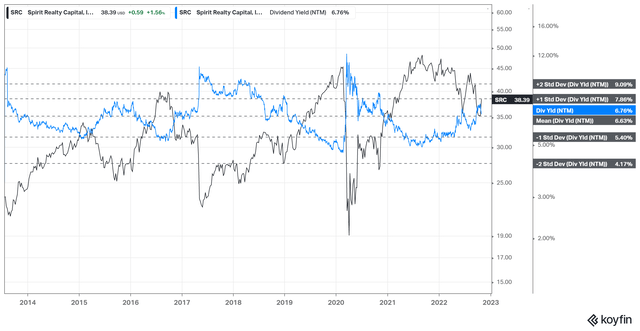

SRC NTM Dividend yields % valuation trend (koyfin)

SRC last traded at an NTM dividend yield of 6.76%, in line with its 10Y mean of 6.63%. Therefore, we don’t consider SRC as undervalued in this aspect.

However, SRC’s NTM AFFO per share multiple of 10.7x is discernibly below its 10Y mean of 12.7x. Hence, the market has already de-rated SRC, which is also implied in its YTD total return.

SRC’s AFFO per share multiple trades at a discount against its peers’ set (according to S&P Cap IQ data). Accordingly, its peers’ median AFFO per share multiple of 13.7x is markedly higher than SRC’s. SRC’s relative discount was also noted by management in its previous earnings call, as Spirit Realty CEO

accentuated: “But I would tell you like you know where our equity multiple is and it’s not great.”

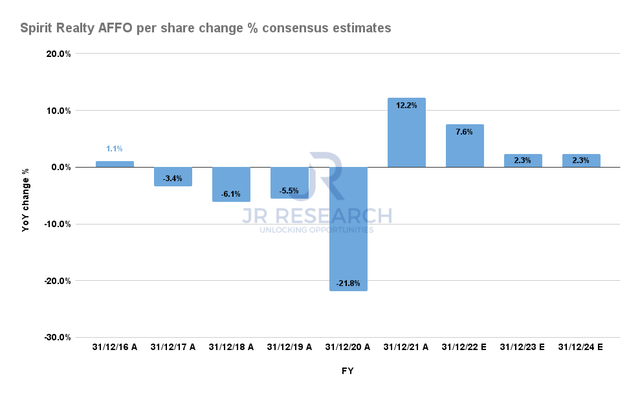

Spirit Realty AFFO per share change % consensus estimates (S&P Cap IQ)

We assess that Spirit Realty’s lower multiples could be attributed to its relatively poor AFFO per share growth performance over time. Hence, we postulate that the market will unlikely re-rate SRC in line with its peers unless the REIT can improve the consistency of its results.

However, the revised consensus estimates (bullish) suggest that Spirit Realty’s AFFO per share growth could slow through FY24. Hence, a material re-rating is unlikely in the near term.

Furthermore, SRC’s markedly lower multiples could place it at a disadvantage in the market when raising equity financing without diluting its holders significantly more than its peers at higher multiples.

As a result, Spirit Realty may need to rely more on debt financing to fund its investment activity, which was also projected to slow down in H2’22. Therefore, we urge investors to continue paying attention to management’s commentary on the revisions to its investment cadence.

Furthermore, reliance on debt financing with an aggressive Fed could further add to its interest expense, reducing the accretion to its AFFO.

Is SRC Stock A Buy, Sell, Or Hold?

With these near-term headwinds, investors could find it challenging to assess whether there are appropriate opportunities to capitalize on the recent pessimism in SRC.

We assess that its valuation has likely reflected a mild-to-moderate recession but not a severe one. Moreover, management’s previous commentary did not suggest that it sees a severe recession as the base case. Hence, investors should glean significant clues to management’s updated macro outlook in the upcoming earnings.

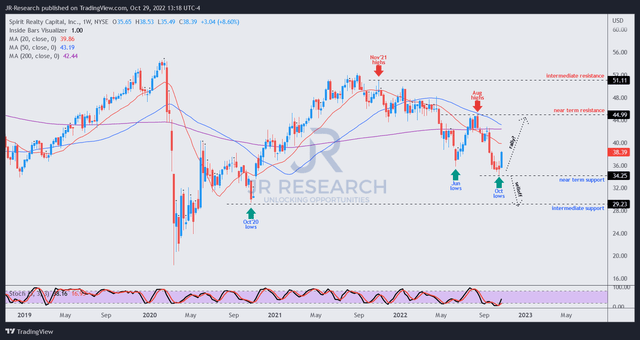

SRC price chart (weekly) (TradingView)

We observed a potentially significant bottoming signal, which was validated in October. The massive down move from its August highs has likely shaken out investors who tried to pick its June lows.

Coupled with the bullish reversal last week, we assess that the reward-to-risk profile pointing to further medium-term upside looks favorable. However, investors should keep some spare ammunition to prepare for potential value compression if the market anticipates a worse-than-expected recession moving ahead.

Our assessment indicates that its intermediate support looks like a possible bottoming zone in such a scenario, which corresponds to the significantly undervalued zone according to its average dividend yields (two standard deviation zone above its 10Y mean).

Hence, we assess that if the market anticipates a moderate recessionary scenario to play out, SRC seems to have bottomed out decisively at the current levels.

We see a potential rally heading to the $40 level before meeting stiff resistance, implying a potential price upside (not including dividends) of more than 30% from the current levels.

As such, we rate SRC a Buy. However, investors who do not want to buy into last week’s surge can consider waiting for a pullback first before adding.

Be the first to comment