Drew Angerer

Hopes of a dovish pivot are becoming more and more unlikely. The more stocks rally heading into the Wednesday FOMC meeting, the lower the odds the Fed will change its policy path. If anything, the stock market actions over the past week provide further evidence why the Fed can’t show any signs of walking anything back.

Just look at what has happened in one week since that WSJ article dropped the morning of October 21. The S&P 500 has risen by almost 7%, while the Dow Jones Industrial Average has risen by nearly 9%. The only reason the Nasdaq hasn’t gone parabolic was due to horrible earnings and guidance from the technology-heavy mega-caps.

Back To The Basics

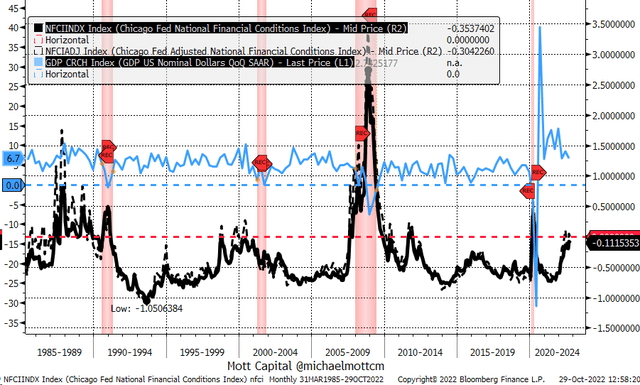

Everything goes back to the basics, financial conditions. The Fed needs to transmit monetary policy through financial conditions. The Fed needs financial conditions to be restrictive if the Fed has any hope of cooling demand and bringing inflation down. The Chicago Fed National Financial Conditions Index (NFCI) and adjusted NFCI are around the neutral region, just below 0. When the reading is above 0, it indicates that financial conditions are restrictive on the economy, and when they are below 0, they are accommodative and support the economy.

The data shows that tightening financial conditions leads to slower nominal GDP growth while easing financial conditions leads to faster nominal GDP growth. The data shows that it can take several months of tight financial conditions to slow nominal GDP growth. Financial conditions have not been restrictive long enough to have a material downshift on economic growth. The third quarter nominal GDP data shows the economy is growing at a 6.7% seasonal adjusted annualized rate, a very high nominal growth rate compared to the past decade.

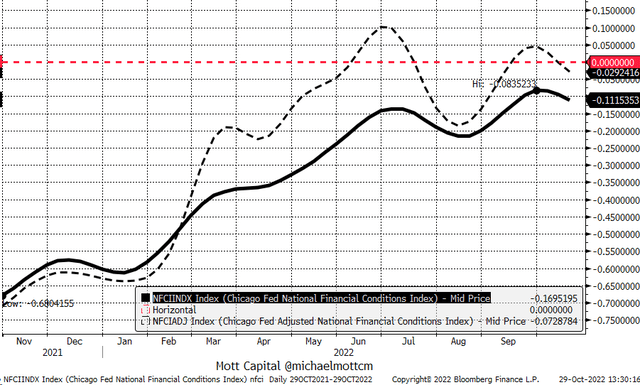

Conditions Are Already Easing

At this point, the Fed cannot risk conditions easing and slipping back into accommodative positioning, and there are signs that conditions are easing already. The CDX Markit High Yield Index has dropped back to the same level it was on August 26 at the time of the Jackson Hole meeting. Meanwhile, the index rose, heading into Jackson Hole versus falling today.

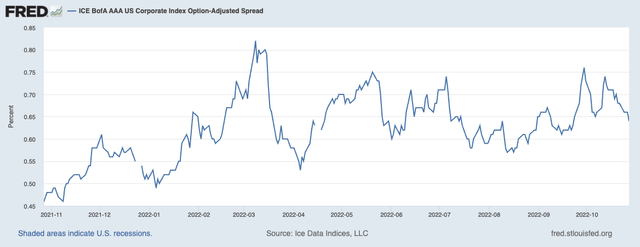

Additionally, the ICE BofA AAA US Corporate Index Option Adjust Spread has fallen since the middle of October, and that move has only accelerated lower in recent days.

These are just a few signs of some easing financial conditions just in this past week, which would suggest that if the Fed should signal a change in policy stance at this juncture, it is likely to result in further easing in financial conditions. This, in turn, means that the Fed’s job to rein inflation will only get more complex and take longer.

The Chicago Fed’s NFCI and adjusted NFCI has seen easing recently. Coupled with the bond market spread data above indicates there was likely further easing this week.

A Dangerous November Meeting

The most dangerous part of this November FOMC meeting is that there is no summary of economic projections accompanying it. That leaves the Fed with nothing to provide the market with for an outlook on where the Fed sees rates going next year. If the Fed signals a slowing in the pace of rate hikes starting in December at the November meeting, it could suggest the Fed is close to the end of its rate hiking cycle. That may prove more damaging than helpful because it would likely result in higher equity prices, lower volatility, and further easing of financial conditions.

In July, when the Fed signaled it believed it was at the neutral rate, the equity market reacted strongly with a big August rally because the market thought the Fed was close to the end of its rate hiking cycle.

The ideal situation would be to not give the markets any leeway at this November meeting and to keep the market guessing. Signal that nothing has changed since Jackson Hole and that rate hikes of similar size may be warranted. If there is to be a shift in the pace of hikes, let it come at the December meeting. The Fed can counter the signal for smaller hikes in the future with its “dot plot.” At that point, the Fed can raise its terminal rate projections on the “dot-plot” for 2023, too, say, 5%, and enforce that effort by holding the rate there in 2024 to drive it home.

It will send a clear message to the markets that slower rate hikes do not mean fewer rate hikes or eventual rate cuts.

Hopefully, the Fed has learned from its July error.

Be the first to comment