koto_feja

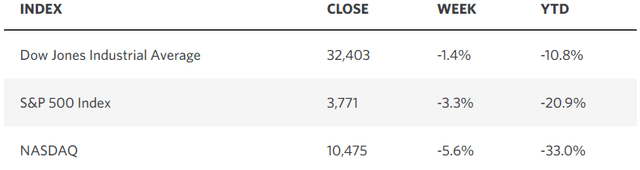

After the huge gains recorded in October, stocks were looking for an excuse to pause and refresh last week, which Jerome Powell provided on Wednesday afternoon. The Fed’s policy statement that accompanied the 75-basis-point rate increase was surprisingly dovish, as it acknowledged that rate increases work with a lag and that their cumulative effect must be taken into consideration moving forward. Risk asset prices rallied following the release of the statement, which may have prompted Chairman Powell to curb the enthusiasm. During his press conference, he advised that the peak in short-term interest rates was likely to be higher than what the committee determined after their September meeting. That brought an end to the rally with the major market averages finishing sharply lower on the day, yet he was simply falling in line with the consensus outlook.

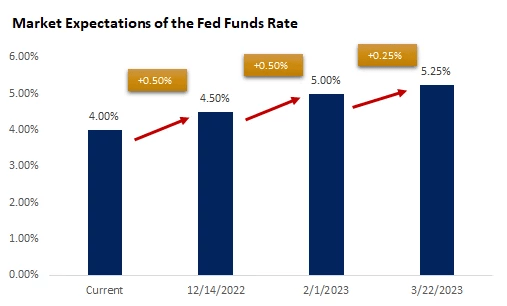

The Fed saw rates peaking at 4.6% after its September meeting, so Powell’s update should not have been surprising, as it simply fell in line with current market expectations. The consensus now sees a peak of 5.25% in the Fed funds rate by March of next year as the highest probability, which is 25 basis points higher than before the meeting. Ultimately, the terminal rate will be determined by the incoming data, which I still think will allow the Fed to end its rate-hike campaign by year-end. That would be a significant tailwind for risk asset prices.

Edward Jones

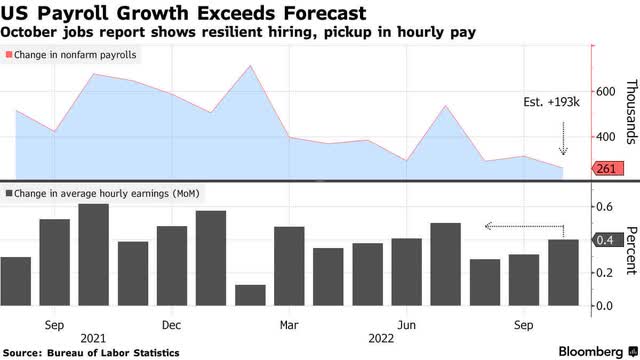

Friday’s jobs report for October gave us the best of both worlds, as there were signs of softening, which the Fed wants to see, but not to the extent that it is undermining the expansion. The economy added a greater-than-expected 261,000 jobs, but that was the weakest number since December 2020 and a sharp deceleration from the 407,000 per month we have averaged this year. The household survey of employment, which is far more volatile and includes small-business start-ups, actually showed a loss of 328,000 jobs. The unemployment rate rose from 3.5% to 3.7%, which was due to a drop in participation. Meanwhile, average hourly earnings rose 4.7% over the past year, which is down from 5% in September. For a Fed that still has its eye on a soft landing, I think this report was right on target. The rates of change are all moving in the right direction.

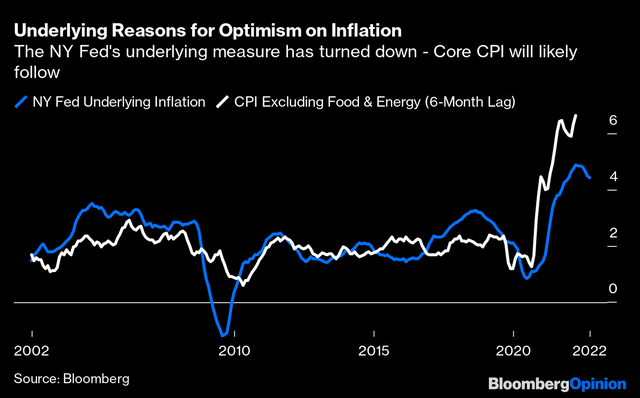

Speaking of rates of change, I am looking for more improvement on that front in this week’s Consumer Price Index report for October. There are a growing number of signs that the deceleration in price increases could be as rapid as the acceleration was over the past 18 months. The year-over-year price comparisons for commodities are growing increasingly difficult, which should result in outright declines in 2023. The prices that supply managers are paying in the manufacturing sector are also in retreat, as evidenced by the ISM Prices Paid index falling below 50 last month and into contraction territory. Furthermore, the NY Fed’s “underlying” inflation index, which leads the CPI and includes additional macro variables, has clearly rolled over. Again, we are moving in the right direction.

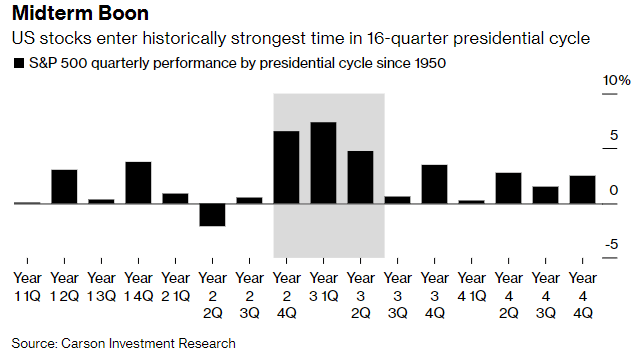

This couldn’t be happening at a better time of the year, as we enter the seasonally-strongest period for stock market performance. This comes in combination with the midterm elections, which has historically been another powerful tailwind for the market.

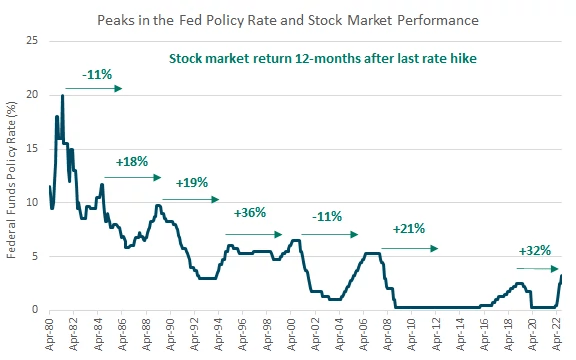

Bloomberg

While there are still plenty of reasons to be negative today from a macroeconomic perspective, I see most of them factored into a market that wants to look forward. Once we do reach the peak in the Fed funds rate, which should be over the course of the next couple-to-several months, the market has another favorable precedent. We will need all of these tailwinds between now and the end of the year, as the S&P 500 is gradually revalued based on higher interest rates, margin compression, and lower earnings expectations for 2023. Therefore, investors should be focusing opportunistically on stocks that present good value rather than a stock market that is still adjusting to today’s new higher interest rate environment.

Edward Jones

Be the first to comment