BlackJack3D

Aker BP (OTCPK:DETNF) is a Norwegian oil E&P company operating rigs with interests they own in major Norwegian Continental Shelf reserves. The price of oil has supercharged results, but things get even better because the company has latent capacity coming online in Q4. Earnings should continue to rise, and with the prospects of oil being pretty good given the geopolitical and strategic considerations around oil, Aker BP looks to be dirt cheap. However, we still have an even cheaper option with Japan Petroleum Exploration (OTCPK:JPTXF) which we continue to prefer.

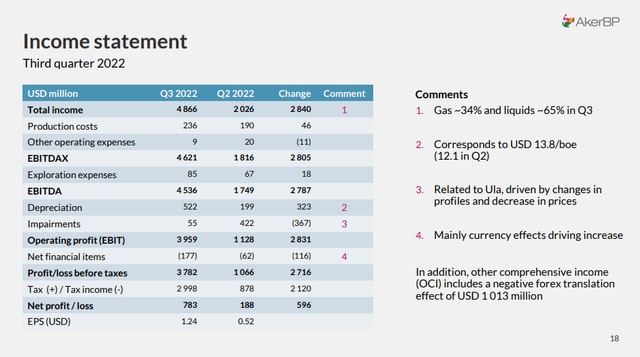

Key Q3 Notes

Net income 7x’ed YoY due to both production and price increases.

Income Statement (Q3 2022 Pres)

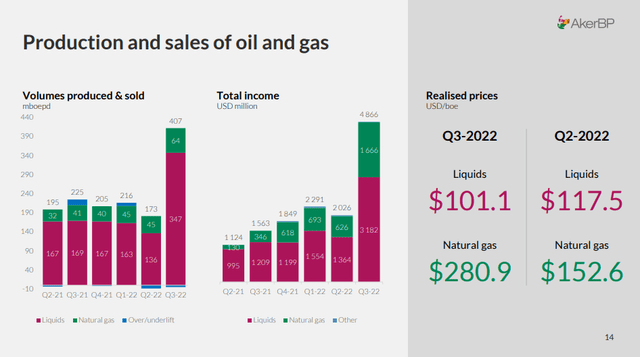

Operating income grew massively on a sequential basis as well, but this was driven primarily by massive growth in volumes produced from assets not the price, which had already reached high levels.

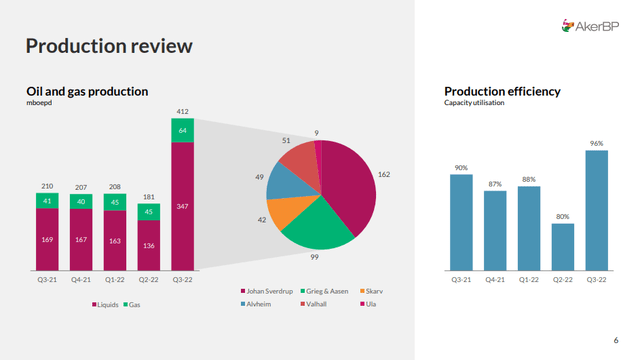

The current increases in volumes are coming from high pump rates in order to meet European demand but are mostly coming from the merger that was closed on the 30th of June with Lundin Energy, which ups their Johan Sverdrup ownership to 30%, and also adds lots of E&P capacity to their business. But there are more latent volumes that will be coming online starting in Q4 that will meet the structurally higher demand for non-Russian oil in the West. Phase 2 of Johan Sverdrup is going to mean a substantial increase in the barrel per day capacity of the Aker BP assets. The next phase of the development of Johan Sverdrup will increase its extraction rate by about 50%. Since Johan Sverdrup represents a pretty substantial proportion of Aker BP’s interests, we should see almost 30% growth in volumes for Aker BP. Current incomes could graduate into a level between 20-30% higher than their current level given current oil prices.

Production Review (Q3 2022 Pres)

Bottom Line

This volume growth may not be reflected in the Aker BP price. The multiple is exceedingly low even on current earnings. EV/EBITDA is 2x on 2022 EBITDA. This is not including the next 20-30% increase we might see in EBITDA driven by evolving Johan Sverdrup volumes, which would compress the multiple further. According to the Seeking Alpha stats, the average energy multiple, which is dominated by the E&P players, is around 2.5x EV/EBITDA, so on a relative basis, Aker BP is trading at a discount.

What are the considerations as far as oil goes? From the supply side, there isn’t much left in spare capacity to move the needle for oil and gas, so it comes down to demand. Declines in demand have already been speculated upon, and we’ve seen declines in the oil price. And the declines have come in ever since the rate hiking cycle started.

WTI Price (cnbc.com)

We agree that a recession is coming and the cyclicality in oil is why multiples are so low now, but the structural complexity of oil trading right now means intermediation takes a bigger cut, and there are going to be pretty high prices as the market is bisected. Prices of oil should remain high, especially for producers within the Western bloc like Aker BP. Incremental declines will come as the recession deepens in the US, but Europe is already feeling the recession’s bite and China is still seeing economic trouble from COVID-19, and that just spring loads them for a recovery at some point when COVID-zero policies can come to an end. Declines in oil prices could come, but NCS producers have breakeven points below $20 per barrel. We are going to be at least twice that over a secular horizon with the issues on the supply side, and the low likelihood for oil companies to start increasing CAPEX for new potentially stranded assets. Despite the prices, rational play is likely to persist and oil producers still play a game of managed declines.

While Aker BP is cheap, we continue to prioritise Japan Petroleum Exploration, which may be the cheapest E&P stock on the global market. It dominates any other prospect, even Aker BP, which is cheaper compared to oil averages.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment