Editor’s note: Seeking Alpha is proud to welcome ThinkValue as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Mario Tama/Getty Images News

Fisker (NYSE:FSR) is an undervalued, affordable electrical vehicle (EV) underdog that’s riding the wave of government incentives. The company is working with an asset-light model, production partnerships for rapid scaling, and is focused on designing two vehicle models in order to capture different market segments. Our analysis indicates that the market is currently unaware of the scaling capacity of the company and is approaching the stock as if it will gradually build plants – e.g., what we would historically expect from an auto manufacturer. We believe that this is a mismatch with the potential of the company and see professional investors being reluctant to make an investment call, which creates an opportunity even a year after the IPO.

In our analysis, we will discuss why we estimate that the stock is undervalued, and why investors might want to form a strategy before the initial delivery rounds in November 2022.

Valuation Thesis

Fisker is a pre-production EV company. The company has $1b in cash to fund its operations, and our valuation analysis suggests that investors are not comfortable with taking on the risk of this SPAC-EV stock. However, if the company’s vision starts materializing, it is poised to be one of the key brands that benefit from affordable EV consumer demand backed by government incentives around the world.

The main risk factor for Fisker is customer satisfaction after the wheels actually hit the road. If people like the product, then the company is well positioned to cater to 300k+ customers annually after 2025.

Fisker’s business model is flexible enough to change with the times, as the company is design-focused instead of being production-focused. This means that the company will concentrate on designing EVs while their partners take care of production. With this approach, Fisker initially sacrifices margins but allows for high-capacity production without the need to build plants, like Lucid (LCID), Tesla (TSLA), etc.

Fisker is also a founder-led company, as opposed to being led by professional managers. This has both benefits and downsides, as founders usually have more dynamism in the beginning of a company’s life cycle, but might fail to course-correct in later stages.

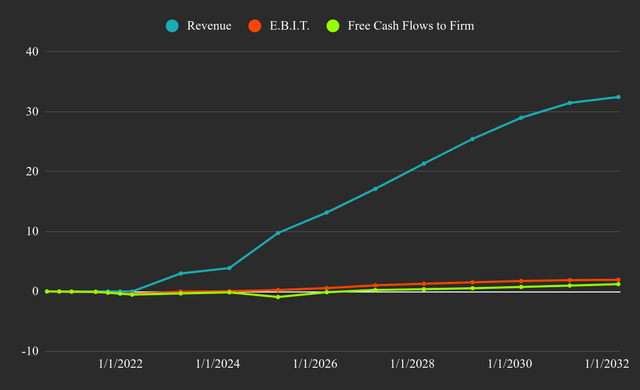

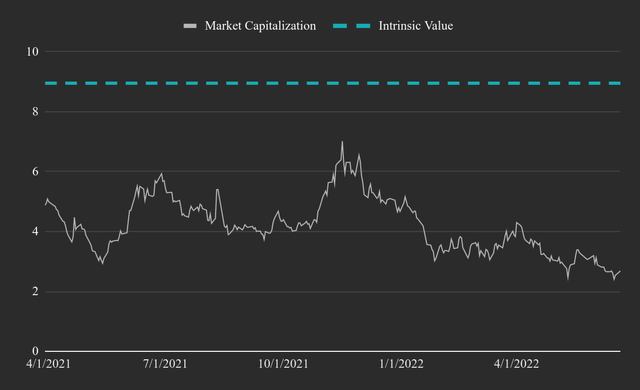

We used a free cash flow to the firm/discounted cash flow (FCFF/DCF) model to valuate Fisker. Our DCF valuation for Fisker yielded an $8.9b intrinsic value, or $30.5 per share, with a target price of $33 per share – 260% upside from today.

In our view, the company will make around $32b in 2032 and will have a 6% EBIT margin. Their SAM share might reach up to 20%, or 600k produced units annually. The higher free cash flow to the firm will come significantly later in the life cycle, around 2030-31.

We expect Fisker to produce excess value with a cost of capital of 8.3% vs. a return on invested capital of 20% in 2032. The stock is high risk, and probably should not make up a majority holding in a portfolio. In the following analysis, we will discuss the basis for our valuation for Fisker; you can view the full workbook calculations for the model here.

The Business

First, it is important to note that at this stage Fisker is working with an asset-light model. This practically means that the company doesn’t have a production plant, but is focused on the design, engineering, regulatory procedures, distribution, and sales of the EVs. In a way, this reminds us of the initial business model from Nio (NIO), which, until recently, didn’t have plans to produce vehicles and outsourced the process to a manufacturer in China.

Currently, Fisker is focused on developing two models:

- Ocean, targeting Q4 2022 production in the U.S. and EU

- Pear, targeting Q1 2024 production

In the chart below, we can see the expected timeline of vehicle production start milestones:

Fisker aims to produce high-quality and low-cost vehicles. The first model, Ocean, is set to have a price range between $37k and $69k as part of the luxury EV category. The average price per unit is estimated at around $50k, along with a gross profit margin per EV of about 20%.

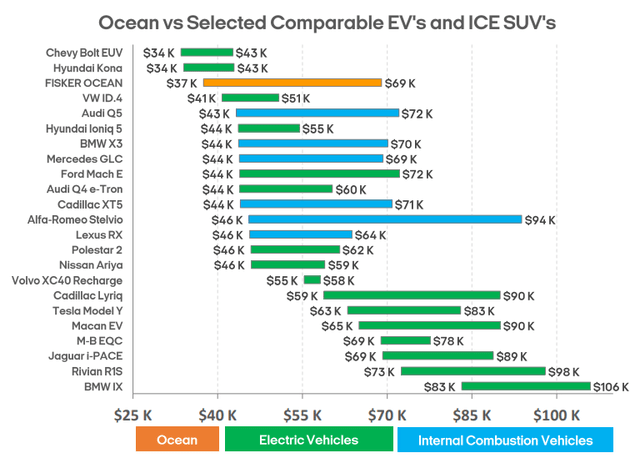

We can see how the Ocean ranks in terms of pricing compared to a select group of peers in the chart below:

Fisker Ocean Price Range vs Peers

This puts the Fisker Ocean model at the lower end of the luxury EV pricing category. Fisker intends to move even further down in affordability and is developing their model called Pear, which is aimed to be priced below $30k before incentives.

In order to produce both models, Fisker has a separate arrangement with two partnering companies that will be in charge of production, while Fisker focuses on the design and distribution. Fisker’s partners are Magna (MGA), assigned to the Ocean production, and Foxconn (OTCPK:HNHPF), assigned to the Pear production.

Magna Partnership (Ocean Production)

Fisker has an arrangement with Magna to build its Ocean SUVs. This gives the company flexibility in designing and getting vehicles on the road at a much faster pace. Conversely, Magna holds a 6% equity stake in Fisker, which connects the success of both companies. Using this approach, Fisker managed to arrange for a EV to enter the market with less than a $2b investment.

Currently, the production capacity is estimated at 5k units per month, or 60k annually. Assuming customer satisfaction and max demand, the annual revenue for Ocean can reach the following:

Targeting 60,000 units * (average price of $50k before incentives) = $3b annually.

Note that the Fisker Ocean has four main price points, and our calculation assumes an average $50k income. Management is also considering expansion options since the Ocean reservations increased to 50k in June from 20k in January 2022.

The first EVs are expected to produce in November 2022 in Magna’s production plant in Austria, and Fisker is currently preparing the vehicles with some last-minute testing. The initial delivery will likely be a news catalyst and a heavily promoted event. Investors who consider this stock might want to formulate a strategy in advance of the media spotlight.

Considering that EVs are popular and driven by incentives, it could be reasonable to assume that the company will be demand constrained if the product is well adopted.

Foxconn Partnership (Pear Production)

Fisker is partnered with Foxconn in order to produce the second EV model “Pear.” Foxconn recently completed the acquisition of an operational 6.2 million square foot vehicle manufacturing facility in Ohio, which will be used to produce the Pear.

The Pear is targeted to be priced at a substantially lower level, around $30,000, and currently has around 3,200 reservations. Production is expected to start around Q1 2024. The company expects to lower costs by utilizing carryover parts and software from Ocean to Pear.

Pear’s design concept has been signed off on and consists of at least three derivatives estimated to be able to reach 1 million units a year by 2027. However, this is a classic management “forward-looking statement” and is far from realization. The actual target production is about 250k vehicles per year after expansion efforts and business traction. Foxconn and Fisker are co-investing in a dedicated plant, which will produce vehicles exclusively with the Fisker brand.

Again, assuming full demand by 2025, we can estimate a yearly revenue as follows:

250,000 units * $30,000 (average price) = $7.5b

This estimate is harder to justify, as the high number of units sold will also depend on customer adoption, marketing campaign success, and overall brand power. On the other hand, the affordable pricing might allow Fisker to reach a demographic that has not been able to participate in the market.

Distribution Strategy

Fisker will focus on a digital direct-to-consumer approach for its distribution strategy. The concept eliminates the need for local dealerships, which, in turn, cuts company expenses. A minimal number of car saloons will be maintained mostly for marketing.

In essence, most of the purchases should be made online, where customers can configure their vehicle in Fisker’s design studio. The drawback is that consumers will not be quite able to “feel” the vehicle before purchasing, but this can be offset with different temporary usage packages, return policies, or Virtual Reality drive experiences, such as the ones developed by Pinterest (PINS).

It seems wise for a startup to cut both the costs and management strains on as many elements of the business as possible. These elements (plants, dealerships, etc.) can be later introduced as the needs and financial capacities develop.

A note on ESG (environmental, social, and governance): Fisker aims for 100% climate-neutral products by 2027 (no purchased offsets). This is not a commitment per se, but the statement seems to be somewhat unrealistic and could be a reflection of the personal worldview of the co-founders. While it’s great to strive for a clean future, it would be better if the claims were more grounded in reality or had a route to fulfillment.

To summarize, Fisker aims to produce quality and affordable EVs. Their Ocean model is expected to sell 50k vehicles annually after 2023, and the Pear target production is 250k vehicles annually after 2025. By using average price calculations, the company is expected to make between $10b and $13b in revenues by FY2025. Their direct-to-consumer distribution strategy helps cut costs and the vehicles will be produced by partners, not their own plants. This speeds up the production process but investors may expect lower margins.

Market Analysis

Fisker appears to be targeting a certain demographic, primarily within the U.S. and EU markets. The psychographic tags for someone who would like to own a Fisker are: working to middle class, environmentally conscious, requires flexible baggage space, EV enthusiast, couple/family owned, lower price range, contrarian/early adopter, and commuter.

In general, Fisker is carving out its market share for people who want an affordable but well-designed EV, and are OK with being early adopters. Additionally, it might attract people who want to differentiate themselves, seek novelty, and are environmentally conscious. This approach attempts to differentiate Fisker as a new-generation EV. It aims to position the product away from EV brands like Tesla, Lucid and Rivian (RIVN) based on pricing, and away from traditional brands based on style and environmental signaling.

EV Market Capacity

Looking at Fisker’s total addressable market share (TAM) and serviceable addressable market share (SAM), we can see that the company estimates to be within a 19m units car + SUV yearly market. The company is targeting a market share of around 5%, which amounts to 950k vehicles. In order to see if this is reasonable, we will look at the top-down U.S. and European vehicle sales numbers.

We will look at two projections to get our SAM value – the U.S. and European EV unit projections:

- For the U.S. we see that in 2022 there are 767k EVs estimated to sell in 2022, and this is expected to increase to 2.1m EVs in 2027.

- Europe already has 2.5m EVs expected unit sales in 2022, and this number is expected to rise to 5.5m vehicles in 2027.

In total, the combined TAM for Europe and the U.S. seems to be 7.6m EV units by 2027, which should grow more than 15% annually as countries substitute traditional vehicles for EVs. Medium cars and small SUVs currently account for about 40% of the vehicle market, which is where we can currently fit the Fisker auto class. This gives us a possibly more realistic SAM of about 3 million units by 2027.

Next, we need to analyze what percentage of market share Fisker will be able to attain between 2027 and 2032.

Market Share

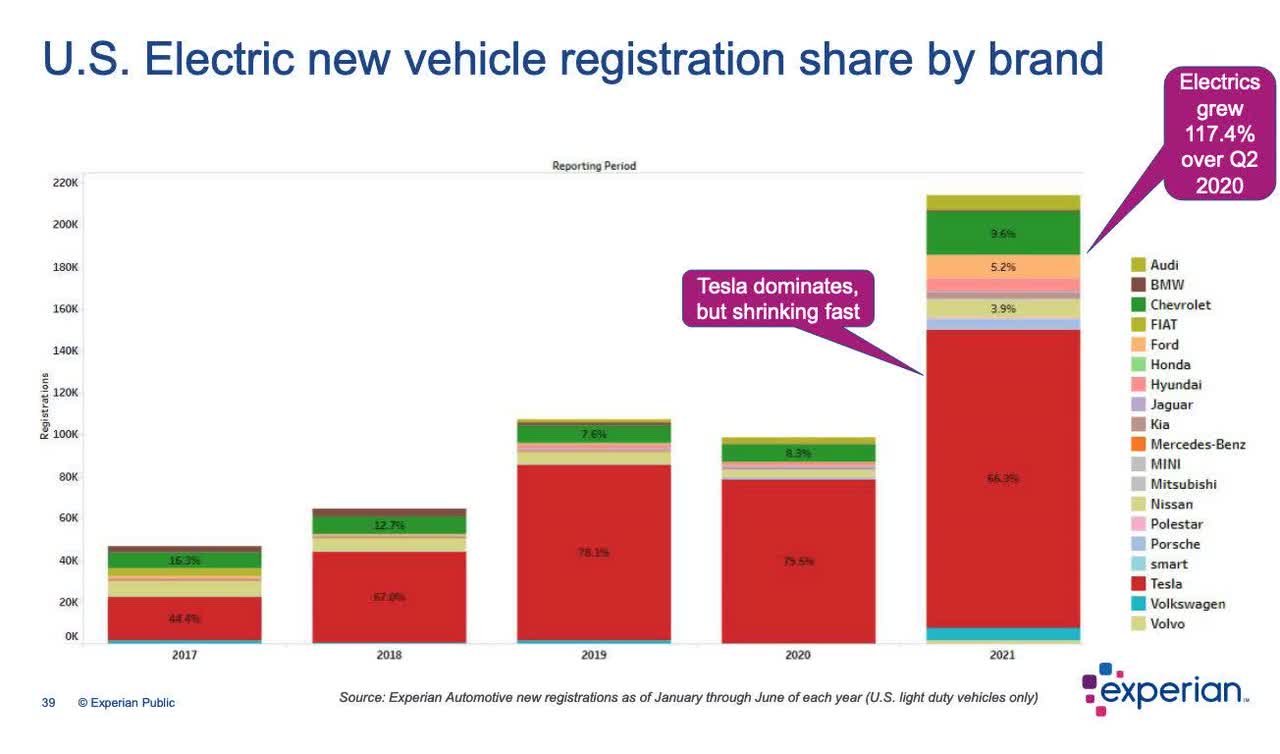

The chart below shows the distribution of market share, and the penetration of traditional manufacturers in the EV space.

U.S. Electric Vehicle Registrations by Brand – EV Market Share by Company

As traditional vehicle manufacturers enter the EV space, they will leverage their production capacities, engineering teams, access to debt financing, recognizable brand names, and other competitive advantages. This will make the landscape much more volatile and the picture might be a lot different with no clear winner currently in sight.

A 20% market share from our 3m estimated SAM market value comes out to 600k+ annual vehicle sales. Note that if we were to estimate the TAM instead, the market share would be about 8%.

This is a high number, as competition from traditional and new EV companies is expected to increase. But given their fast production process, the company might be able to reach the estimated value. This also reveals a key risk factor for the company – while initially it might be production constrained, later on it will need to have a sufficiently diverse product portfolio to attain the large projected market share, as well as high customer satisfaction with their vehicles. Otherwise, demand might fall, leading to margin pressures.

Risks and Opportunities

We will start with the opportunities in the industry. There is a good push for EV adaptation both by governments with incentives and the changing taste of consumers toward EVs having intensified in recent years. Even though most speculate that consumers prefer EVs because of the environmental conservation aspects, there is a good argument to be made for comfort and practical use. EVs are like a skateboard powered by batteries, which opens up a lot of luggage or seating room, giving riders more comfort. They are also easier to operate both with or without AI assistance.

A summary of the industry opportunities can described as:

- Regulatory agencies are incentivizing EVs.

- Sustainability is a factor in self-reported purchase decisions. But use caution here, as this might be a result of signaling or preference falsification.

- Applicable U.S. $7.5k tax credit + $10 for every EPA certified driving range for vehicles priced $55k or less.

- In the EU, manufacturers are penalized for excessive fleet-wide emissions. Fisker might be able to monetize the ZEV technology through fleet emissions pooling arrangements with car manufacturers – peers might enter into partnerships.

- The EV market is expected to experience high growth in the next decade. While competition is present, there aren’t too many competitors as compared to the traditional vehicle market.

On the other hand, we must take into account some risk factors as they pertain to Fisker:

- The two co-founders hold about 90% of the voting power, which ensures dual held control. For investors, this means that they must have assurance that the co-founders are focused on maximizing long-term value (free cash flows), and that they can function productively. If the co-founders prioritize a stakeholder business model in the long term, then it really makes no sense for equity investors to participate.

- Production development relies on parts that might not always be available as needed, and initial production can experience delays and rough progression before it is streamlined.

- Larger and traditional auto manufacturers might produce similar products and leverage their ability to scale up faster than Fisker. The competitors might wait to see if a startup’s approach is garnering demand and then attempt to enter in a similar manner.

- Fisker will have an undiversified product portfolio for the first decade. This poses a significant risk to product adoption. Conversely, Tesla has been successfully utilizing a similar approach.

- Fisker has a core and expanding team, but their success will also depend on quality talent attraction.

- The Fisker app is the first point of execution we are able to asses for ourselves, and it clearly needs a lot of work.

- Management might have developed a product mismatch between their worldview and the preferences of their target audience. Do lower-income customers really want a car interior from recycled ocean waste and fish nets, while paying $30k/around two years of labor for it?

Fisker might be able to produce between 500k and 700k vehicles annually around 2032. The bigger problem will be selling them, as there are no good indicators of market demand aside from unlocking the demographic – which needs EVs at a lower price point. The company will require large investments despite the efficient business model, primarily because it’s in an early stage of the life cycle. This will push down initial profit margins to the mid-single digits.

DCF – Valuation

Up to fiscal year 2023, Fisker will book no revenues and we must include that into our model, since we are interested to see what the company is worth today.

Model properties:

- Revenue in 2032: $33.5b

- EBIT margin in 2032: 6%

- Cost of capital 8.3%

- Return on capital in 2032: 20%

This yields the following future model:

Future Income Model for FIsker FSR

This results in the following valuation:

- Present value of the terminal value: $7.965b

- Present value of cash flows over the next 10 years: $860.7m

- Sum of present value: $8.8b (before adjustments)

- Intrinsic value of equity in common stock: $8.9b or $30.5 per share

- 12 month target price: $33, 260% upside from today

- Target price at maturity: $60, 550% upside from today

Fisker FSR Intrinsic Value Line

The model (linked to in the introduction above) should be valid for about a quarter, and some of the price metrics auto-update.

Model Details

We valued the outstanding options at $50m and subtracted it from the final equity value in common stock. The company will rely on outsourced production for the most part – thus, the reinvestment rates are low. However, this trades off for smaller margins in the next decade (capped at 6%).

The model has built in a 10% risk of company failure, which is appropriate as the company is still at a young and very risky stage. Net loss carried over shields the company from taxes in the next three years.

Possible Investment Approach

Fisker is a young, risky company with a volatile stock price. The stock should probably not make up a majority stake in any portfolio, and ideally should be less than 10% of your holdings. In a bear market, a periodic/continuous investment strategy might make more sense vs. lump-sum investing.

The stock is in the pre-discovery phase and has very low current coverage. Investors should ideally make decisions before “hype” events, including the start of production for Fisker Ocean in November 2022 and Q1 2023 results from initial production efforts.

Investing in the company likely entails a long, five-year-plus investment horizon before the stock reaches mature returns. The initial years will likely be volatile, with the current stock standard deviation at 71.4%.

Be the first to comment