Leon Neal/Getty Images News

Price Action Thesis

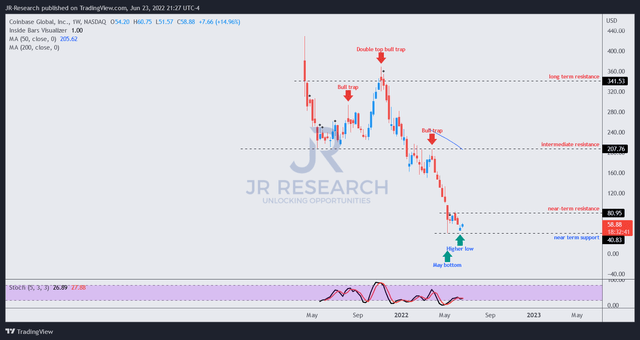

We follow up on our May article with a detailed price action analysis on Coinbase Global, Inc. (NASDAQ:COIN) stock, as there have been noteworthy developments in its price action structure.

We urged investors to be wary of adding COIN back in May, as we anticipated a deeper crypto freeze. Notably, Bitcoin (BTC-USD) suffered another rapid liquidation in June, as it continued to linger just above 20K (at writing). However, COIN stock held its May bottom firmly, absorbing further selling pressure even as BTC was pummeled.

Moreover, it formed another higher low last week (June 13 week) and attempted to mount a near-term recovery. Therefore, we believe the opportunity for a speculative counter-trend exposure has arrived. Notwithstanding, COIN remains deeply mired in its bearish bias. Therefore, any counter-trend add should be accompanied by appropriate risk management strategies to minimize outsized drawdowns.

Our reverse cash flow valuation model indicates that COIN seems reasonably valued at its current levels. Therefore, it adds another layer of support to its price action structure.

As such, we believe it’s appropriate to revise our rating on COIN stock from Hold to Speculative Buy, with a price target (“PT”) of $70. It implies a potential upside of 19%.

COIN – Held Firmly Despite Bitcoin’s June Swoon

COIN price chart (TradingView)

Investors can glean how elegant price charts are in helping unveil significant price action structures as delineated by bull/bear traps.

Such structures represent the significant rejection of selling pressure (bear traps) or significant rejection of buying momentum (bull traps). The most potent of them all: the double top bull traps or double bottom bear traps. The double top bull trap often highlights an early warning sign of a potentially significant reversal in its bullish bias.

COIN met with a double top in early November 2021, which also corresponded with BTC’s double top. Therefore, the correlation should have informed investors that a significant moment of reckoning could be arriving to hit COIN, forcing significant downside moves.

As seen above, the trend reversal occurred rapidly in November. Then, another noteworthy bull trap formed in March, after the market used an astute distribution phase from January to March, drawing in dip buyers as COIN hit a new low back then. Therefore, investors are urged to pay particular attention to these traps, as price action is forward-looking.

Of course, what happened in May is now history, as Coinbase highlighted significant challenges in meeting its revenue and profitability estimates in Q1. The market has already set up the steep decline well ahead of time.

However, in case it seems too gloomy, we need to emphasize several noteworthy developments in its price action since its May bottom.

COIN has not broken to new lows despite the recent swoon in BTC. Therefore, further selling pressure has been absorbed by the market. Also, we noted that COIN attempted to form a higher low last week, lending support to its May lows. Therefore, we believe the price action is constructive as COIN outperformed BTC over the past month, highlighting the resilience of its recent bottom.

COIN Valuation Is Less Aggressive Now

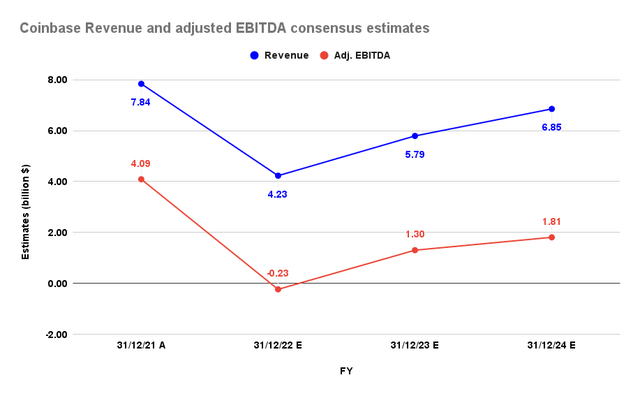

Coinbase revenue and adjusted EBITDA consensus estimates (S&P Cap IQ)

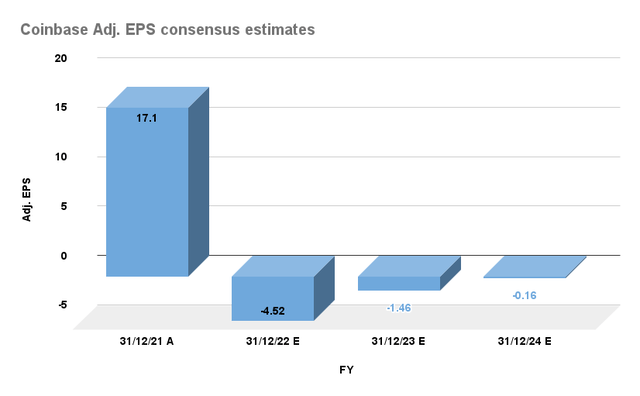

Coinbase adjusted EPS consensus estimates (S&P Cap IQ)

We also observed significantly revised consensus estimates as Coinbase navigates its most severe crypto winter since the previous significant BTC top in 2017/18. Furthermore, Coinbase’s efforts have been hampered by a potential recession, necessitating its recent layoffs. As a result, investors should expect considerable volatility when coupled with a revenue model that’s still mainly predicated on retail transaction revenue (95.3% of FQ1 revenue).

Therefore, we are not stunned as the Street revised its revenue and adjusted EBITDA estimates markedly. In February, we indicated that the inherent volatility in its crypto revenue model makes holding COIN stock as a long-term investor risky. As a result, investors must apply significant discounts to their valuation model when considering adding COIN as a long-term exposure.

Notwithstanding, the Street’s analysts (Bullish, 17/26 analysts with Strong Buy/Buy ratings) modeled that COIN could emerge from its crypto freeze by FY23. However, its adjusted EPS is estimated to remain unprofitable through FY24, which could impact a material re-rating in COIN stock.

| Stock | COIN |

| Current market cap | $13.07B |

| Hurdle rate (“CAGR”) | 25% |

| Projection through | CQ2’26 |

| Required FCF yield in CQ2’26 | 6.5% |

| Assumed TTM FCF margin in CQ2’26 | 25% |

| Implied TTM revenue by CQ2’26 | $8.3B |

COIN reverse cash flow valuation model. Data source: S&P Cap IQ, author

As mentioned, we don’t fancy holding COIN on a long-term basis, given the challenges inherent in its current revenue model. But, we believe the market is forward-looking.

Its constructive price action dynamics have informed us that the market seems to be looking past its current struggles, even as BTC fell into another rapid liquidation in June.

Therefore, we believe a valuation analysis is appropriate to understand the market’s perception of its current valuation. Consequently, we used a reverse cash flow model to capture market dynamics better.

Applying an above-market hurdle rate of 25%, we also used a free cash flow (“FCF”) yield of 6.5%. Notably, the market formed its May bottom as COIN’s FCF yield reached 7.4%. Therefore, it gives us confidence that the market considers the 7.4% level attractive. But, since we used a relatively high hurdle rate, we could cut COIN some slack, requiring a slightly lower yield but still well above its 1Y mean of 3.39%.

Our model suggests COIN needs to deliver a TTM revenue of $8.3B by CQ2’26. The consensus estimates indicate that it could post revenue of $6.85B in FY24. Therefore, we believe that Coinbase could potentially reach our revenue target if it can execute its recovery plan successfully from FY23.

Consequently, we believe the market is currently modeling that confidence in CEO Brian Armstrong & team.

Is COIN Stock A Buy, Sell, Or Hold?

We revise our rating on COIN from Hold to Speculative Buy, with a PT of $70, implying a potential upside of 19% (from June 23’s close).

However, we urge investors to apply appropriate risk management strategies, given its dominant bearish bias and the ongoing crypto winter. In addition, the inherent volatility in its revenue model could materially impact its revenue estimates, affecting its valuation significantly.

Our price action analysis shows that COIN stock held its May bottom firmly and is trying to stage a recovery. However, we believe it could continue to face significant selling pressure at its near-term resistance of $80. As a result, investors considering holding it past our PT should use appropriate trailing stops to protect gains.

Be the first to comment