Charday Penn/E+ via Getty Images

By Jeff Spiegel

THE NEXT FOOD REVOLUTION

Lab-to-table for a healthier future

Food innovation and AgTech solutions can bridge the food production and consumption gap, while combatting climate change and food insecurity.

Unsustainable production and consumption practices have pushed global food systems to the brink. Global food production failed to nourish 811 million people in 2020,1 while contributing 34% to global carbon emissions.2 Farmers have experienced extreme weather causing crops to wither and incomes to dwindle, while consumers lament soaring prices.

Meanwhile, feeding the growing population is a critical issue. The global population is expected to reach 9.7 billion by 2050,3 while the middle class is expected to grow to more than half of the world’s population by 2030, driving increased consumption.4 Can the world feed that many people? It is imperative that our food systems of the future evolve to keep pace with growing populations and a rising middle class that demands more well-rounded diets and nutrient-rich foods. At the same time, food production needs to become more resilient and efficient to withstand climate events and inflationary pressures.

Fortunately, there’s precedent. From the 1960s to the 1990s, the first “food revolution” transformed global agriculture. Over that period, rice and wheat yields in Asia doubled and the population increased by 60%, but grain prices remained low.5

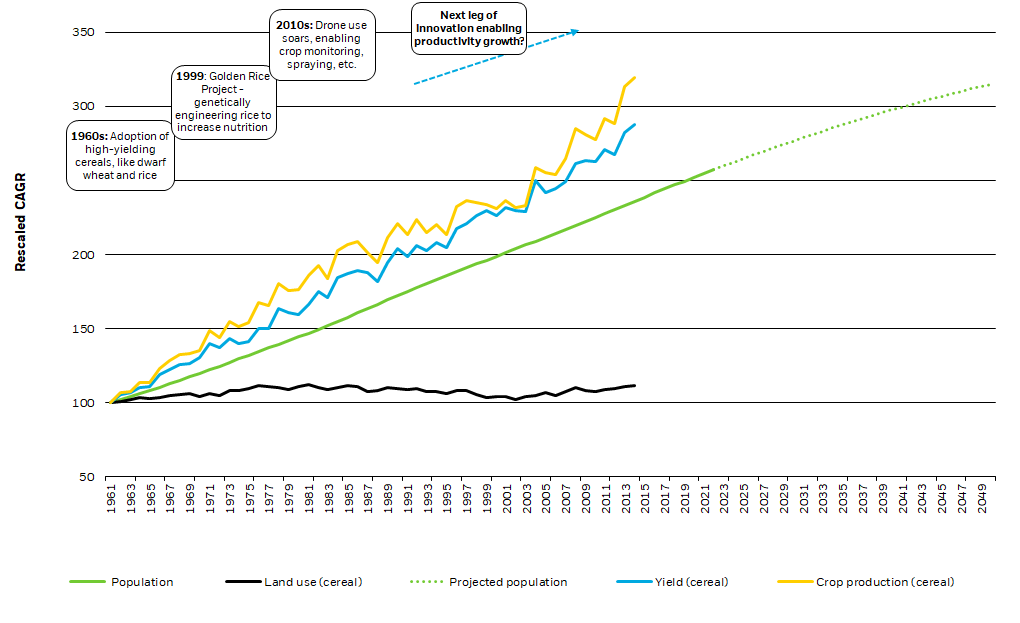

Can future crop production keep pace with population growth?

Population growth and crop production, yield, and land use over time

Population growth and crop production, yield, and land use over time (Source: Our World in Data based on World Bank, Food and Agriculture Organization of the United Nations. Accessed on 9/8/2022.)

|

Compound annual growth rates are rescaled to a starting value of 100. Cereals are generally of the gramineous family and, in the FAO concept, refer to crops harvested for dry grain only, including include wheat, rice, maize, barley, oats, rye, millet, sorghum, buckwheat, and mixed grains. Crop production measured by tonnes. Land use measured by hectares.Yield measured by tonnes per hectare. Chart description: Line chart showing historical and projected global population growth and crop production, yield, and land use over time. Growth is rescaled to a starting value of 100. The chart shows how land use has been relatively constant over time, while crop production and yield have been able to keep pace with rising population growth. |

But a new revolution is needed, leveraging disruptive technologies to drive the next leg of productivity growth – technologies that might just nourish the planet, keep costs low and reduce food’s environmental impact.

FOOD INNOVATION: ALTERNATIVE PROTEINS AND LAB-GROWN MEAT

I can’t believe it’s not meat

Growing populations, the rising middle class and corresponding increased demand for high nutrient foods like meat and dairy are occurring at a time when natural resources are diminishing and demand is climbing. Furthermore, raising livestock is resource-intensive, requiring significant crops, land and water consumption. This makes animal products, like meat and dairy, expensive and susceptible to supply chain disruptions.

One solution is plant-based and alternative proteins, which can be more resource efficient and limit climate impact. The production process for plant-based alternatives is currently too expensive to fully implement at scale, but costs still declined 99% in recent years.6 Coming off a 2020 that saw plant-based food sales reach $7 billion in the U.S., rising 27% year-over-year (YoY),7 we expect costs will continue to decrease to the point where mass adoption is viable.

Much of this segment’s growth can be attributed to sustainability-minded consumers. In a 2021 Nielsen study, more than almost 70% of global consumers were willing to pay a premium for healthier food.8 This comes amid heightened awareness and accessibility of organic and plant-based alternatives. Moreover, concerns around the safety and sustainability of animal protein have fueled the dramatic surge in plant-based protein sales.9

Traditional proteins offer only a fraction of the calories they take in before reaching dinner tables, while generating 14.5% of global emissions.10 Dairy and protein alternatives skip this inefficiency altogether. As more consumers demand healthier options, multiple benefits emerge: not just reduction in obesity and heart disease, but also additional resources that could feed the growing population and drastically reduce emissions.11 Plant-based meats can help reduce carbon emissions, water consumption and land usage by 75%.12

Another option that is gaining traction is lab-grown meat. Recent advances in biotechnology, or should we say biogastronomy, can produce a restaurant-quality steak in a laboratory. Cost competitiveness and adoption are the primary obstacles for lab-grown meat. However, we expect costs will be driven down by technological advancements, heightened demand and the need to mitigate food insecurity. Already, lab-grown meat is 30,000 times cheaper than when first engineered, costing $12 to produce every 4 ounces.13 It still tastes, looks, and feels just like the real thing. While lab-grown meat is still in its infancy, we expect today’s challenges to accelerate its development.

WHAT IS AGRICULTURAL TECHNOLOGY (AGTECH)?

And on that farm, he had some… robots?

American agriculture underwent a transformation in the 20th century. Early 20th century agriculture was labor intensive, and it took place on many small, diversified farms. By the turn of the 21st century, production became concentrated on a smaller number of large, specialized farms, which produced more crops with fewer workers. Technological advancements, like tractors, made this possible, playing a critical role in improving yields and reducing human labor in agriculture when they took to the fields in the 1920s. In fact, since the beginning of the 1900s, agricultural employment dropped from 40% of the total global workforce to just 2% today.14

As we look to the future, disruptive technologies, such as precision agriculture and agricultural robots, can affect meaningful change toward more sustainable production and consumption. AgTech makes it possible to produce more food on less land, with significantly less water, in more locations. The resulting efficiency gains and lower food production costs will be game-changing.

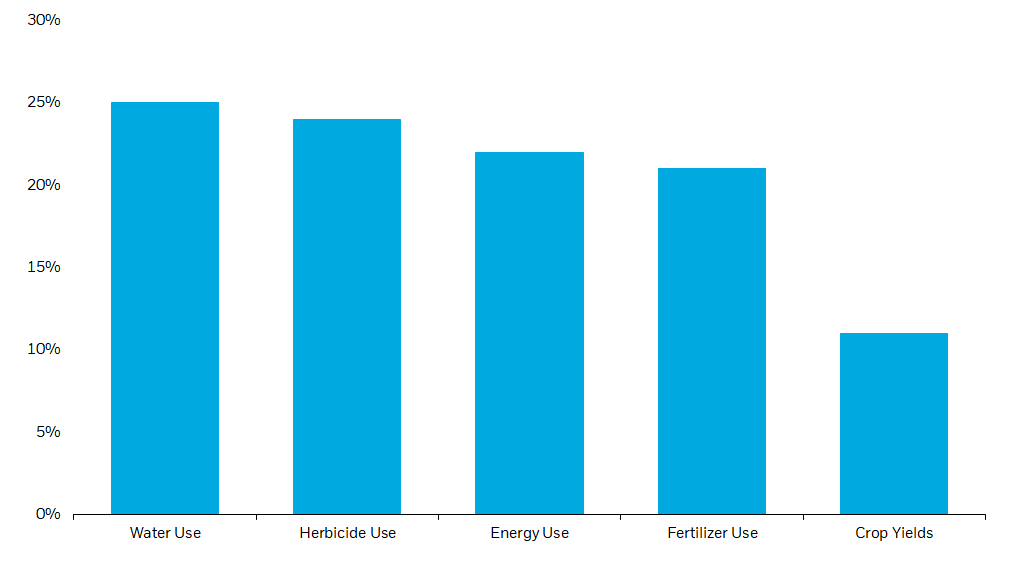

Precision agriculture maximizes crop yields and reduces input requirements

Precision agriculture efficiency gains vs. traditional farming methods (%)

Precision agriculture efficiency gains vs. traditional farming methods (%) (Precision agriculture efficiency gains vs. traditional farming methods (%))

| Chart description: Column chart showing efficiency improvements in agricultural inputs and outputs precision agriculture technologies offer versus traditional farming methods. The chart shows how precision agriculture can dramatically reduce agricultural inputs, while maximizing outputs. |

Smart-crop monitoring, for example, uses real-time sensors and imaging to deliver water and nutrients within a farm system to where they are most needed, helping produce more food with less. It enables increased yield through more efficient use of natural resources and inputs, and improved land and environmental management. Agricultural producers are already turning to technology to drive growth. The global market for precision agriculture reached an estimated $7 billion in 2021.15 By 2030, precision agriculture sales are expected to reach $21 billion, growing at a 12.8% compound annual growth rate.16

Controlled environment agriculture (CEA) companies could similarly benefit. CEA takes place in enclosed growing structures like greenhouses and warehouses, which provide protection from outdoor elements and maintain optimal growing conditions. CEA makes it possible to produce food year-round in urban environments that are closer to consumers. Imagine walking into your local grocery store on a snowy winter morning to pick up freshly harvested lettuce, juicy tomatoes, and sweet blackberries – all of which were harvested in your home city just a few hours prior. Vertical farming makes this possible, because it allows farmers to grow crops indoors at scale, in stacked layers, year-round. Produce grown in indoor vertical farms travels just 43 miles on average to reach grocery store shelves, compared to 2,000 miles for conventionally cultivated products.17

But innovation is not limited to growing food in the big city – a fleet of robots is marching across rural areas. And not just one type of robot: drones overhead that monitor crop health, robots in the field automatically watering plants, and autonomous tractors driving themselves – all working around the clock. While adoption is still nascent, commercial agricultural robots are helping forward-thinking farmers and agribusinesses to produce more food on less land with fewer chemicals.

SENSORS, SUPPLY CHAIN TRACKING AND PACKAGING

Track it, snap it, seal it, store it

Today’s food systems are wasteful. Almost one-third of food produced goes unconsumed.18 Yet food waste reduction technologies and sustainable packaging alternatives can help limit food loss and improve food safety.

About half of all food waste occurs during distribution, storage, and packaging.19 Food supply chains lose ~$400 billion worth of product to improper transportation and storage annually.20 Technologies, like the Internet of Things ((IoT)) and blockchain, can help reduce these losses, remedying food waste by identifying when and where food spoils. Imagine: A device the size of a quarter is inserted inside a crate of strawberries, monitoring the condition and temperature of the fruit in real time. IoT-based perishable food sensors, like this one, monitor the fruit as it moves from harvest through packaging, shipment, and consumption. Utilizing this data can reduce waste and ensure freshness. Blockchain can complement tracking efforts by logging a unique pallet identifier when the strawberries are harvested. Then, those data points are stored on a distributed ledger, bringing full transparency to food traceability.

Technology can also help reduce waste downstream at grocery stores, which throw away 43 billion pounds of food per year.21 Sensors that record data on freshness can inform AI technology, in turn providing more dynamic pricing on perishable foods and reducing overstocking. The associated savings could improve profitability and incentivize producers, logistics providers, and retailers to invest in these innovations and therefore reduce their share of food waste.

Packagers are also rethinking materials and design, driven by regulatory developments and consumer demand for food safety, hygiene, and sustainable alternatives. According to the Eco-Friendly Food Packaging Global Market Report, the global sustainable food packaging market is expected to grow from $210 billion in 2022 to over $280 billion by 2026.22 Some examples include sustainable food packaging made with cornstarch, popcorn, and mushrooms, as well as biodegradable cutlery, plates, and containers made with agro-industrial waste, such as avocado pits.

HOW TO INVEST IN FOOD INNOVATION AND AGRICULTURAL TECHNOLOGY?

Investors looking for exposure to innovation in food production and consumption via public equities may consider looking at ETFs invested in companies that could drive material net profit increases from their exposure to the following areas:

- Agricultural technology: Solutions that could enhance yield potential, improve efficiency, or achieve waste reduction

- Alternative proteins: Food, beverages, or ingredients offering protein sourced from non-animal origins

- Sustainable food and packaging: Sustainable food production practices or sustainable packaging solutions for food and beverage

- Nutritional innovation and safety: Technologies that reduce preventable nutrition-related death and disease via innovation or food safety practices

CONCLUSION

Unsustainable production and consumption have pushed global food systems to the brink, but the next revolution in food is on the horizon. In our view, people looking to invest in food innovation may want to consider ETFs that provide exposure to pure-play stocks across the theme’s value chain.

|

1 Food and Agriculture Organization of the United Nations, “The State of Food Security and Nutrition in the World 2021,” 2021. 2 United Nations, “New FAO Analysis Reveals Carbon Footprint of Agri-Food Supply Chain,” November 2021 3 United Nations, “World population to reach 8 billion this year, as growth rate slows,” July 2022. 4 The Brookings Institution, “The Unprecedented Expansion of the Global Middle Class,” May 2021. 5 National Geographic, “The Next Green Revolution,” September 2013. 6 Bloomberg, “Meat Grown in Israeli Bioreactors Is Coming to American Diners,” June 2021. 7 Good Food Institute, “Plant-based food retail sales grow 27 percent to reach $7 billion in 2020,” 2021. 8 Nielson, “How consumers from around the globe aspire to live healthy lives,” October 2021. 9 NielsonIQ, “Growing demand for plant-based proteins,” September 2021. 10 UCDavis, “Cows and Climate Change,” June 2019 11 Nature Food, “Dietary change in high-income nations alone can lead to substantial double climate dividend,” January 2022. 12 Earth.org, “Adopting a plant-based diet would reduce agricultural land use by ¾,” March 2021. 13 Futurism, “Lab-Grown Meat is Healthier. It’s Cheaper. It’s the Future.,” February 2017 14 Our World in Data, “Employment in Agriculture,” accessed September 2022. 15 Grand View Research, “Precision Farming Market Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Application (Yield Monitoring, Weather Tracking, Field Mapping, Crop Scouting), By Region, And Segment Forecasts, 2022 – 2030,” 2022. 16 Ibid. 17 EIT Food, “Is vertical farming really sustainable?,” August 2018. 18 Agronomy, “Consumption and Production Patterns for Agricultural Sustainable Development,” April 2021. 19 FAO, “Food loss and waste must be reduced for greater food security and environmental sustainability,” September 2020. 20 Ibid. 21 The Grocery Store Guy, “What Happens to Unsold Food in Supermarkets?,” 2021. 22 The Business Research Company, “Eco-Friendly Food Packaging Global Market Report 2022,” March 2022.

|

|

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Technology companies may be subject to severe competition and product obsolescence. This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision. This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”). The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above. Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license. © 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners. iCRMH0922U/S-2420716 |

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment