stockcam

Thesis

Spotify (NYSE:SPOT) continues to take market share in nicely growing market – and the company’s Q3 results highlight that macro concerns are not slowing the global expansion of music streaming industry. CEO and founder Daniel Ek predicted: (emphasis added):

From everything I see, I believe that over the next decade, we will be a company that generates $100 billion in revenue annually and achieves a 40% gross margin and a 20% operating margin.

If Spotify’s ambitions are realized, then the Swedish tech company is likely to x10 revenues by 2030 (with revenue expansion being a function of x2.5 MAU growth and x4 ARPU).

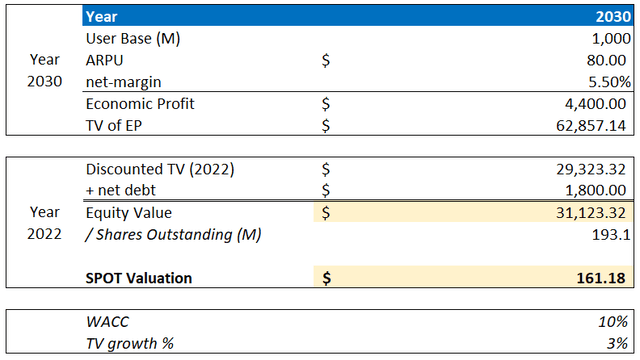

SPOT shares are currently trading at a one-year forward EV/Sales of approximately 1.10. Reflecting on the company’s strong growth potential, such a valuation appears very low — too low. In my opinion, Spotify should be fairly valued at $161.18/share. I anchor my thesis on a valuation framework based on management commentary, a 10% cost of equity and a 3% terminal growth rate post 2030.

For reference, Spotify has strongly underperformed the market YTD, being down as much as 67% versus a loss of only 15% for the S&P 500 (SPY).

Ambitions To 10x Revenues By 2030

In June 2022 Spotify presented a vision to 10x revenues by 2030. And to achieve this target, the global music streaming leader anchors on two growth pillars: First, Spotify is aiming to more than double the business’ user base, reaching a MAU of more than 1 billion. Second, management said that ARPU is poised to quadruple, to $100. Although Spotify’s growth targets appear excessively ambitions (judging by the number), they are not necessarily unreasonable.

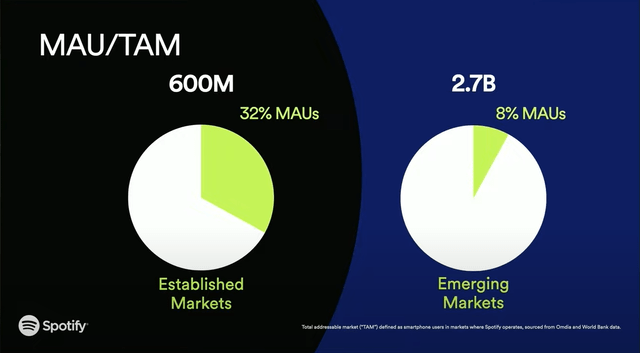

Let us analyze the user expansion first. As of mid-2022 (JUNE), Spotify achieved a MAU/TAM penetration of approximately 32% in what the company defines as ‘established markets’ (Nordics, AUNZ, Western EU and North America). Although this percentage is considerable, investors should consider that the nature of networks effects, whereby more users attract more creators and vice versa, could likely push this metric well above 50%.

But even more interesting than the ‘established markets’ penetration is the opportunity provided by ’emerging markets’ (Eastern EU, LATAM, South East Asia, Other Asia, Africa and Middle East). In these markets, which cumulatively account for over 2.7 billion users, Spotify currently reports only 8% MAU/TAM penetration.

Spotify Investor Presentation, 2022, TAM/MAU

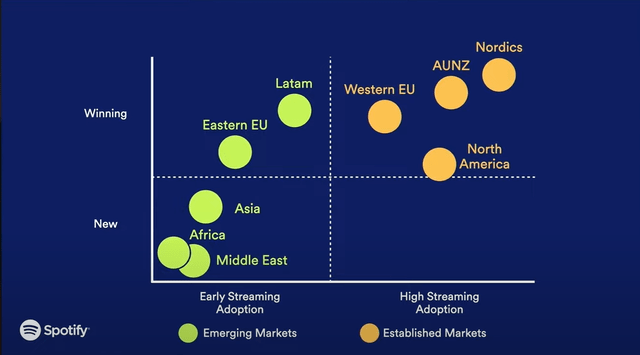

Spotify is already the leading music streaming service in Eastern EU and LATAM, while the brands favorable recognition in Asia is accelerating.

Spotify Investor Presentation, 2022, Growth Opportunities

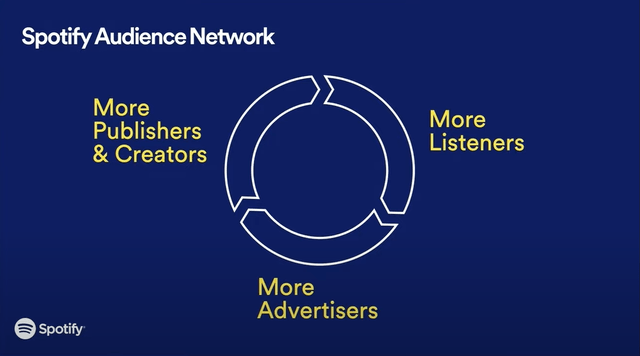

Network effects, as illustrated below, are likely to considerably push MAU/TAM expansion.

Spotify Investor Presentation, 2022, Network Effects

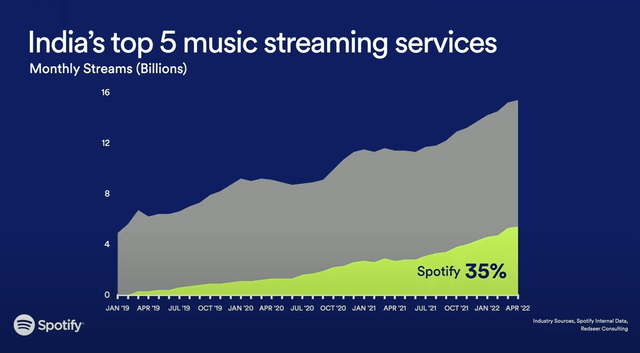

I estimate that in India alone, which has an addressable market size of more than 1 billion users, Spotify is likely to attract a user base of more than 250 million (which would be a penetration of less than 25% versus the addressable market, and thus the metric in 2023 would be lagging the respective ‘established markets’ metric by 2022). Note, since 2019 Spotify has consistently taken market share in India.

Spotify Investor Presentation, 2022, India

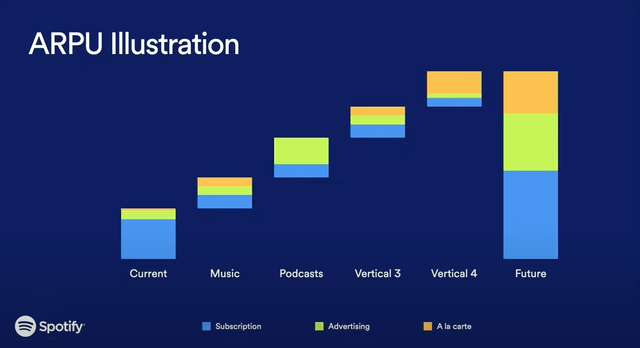

The second argument of Spotify’s growth story is anchored on ARPU expansion. Or in other words, the monetization of the user base. Spotify management has voiced confidence that the monetization through premium subscription could double by 2030, while advertising is poised to quintuple.

Spotify Investor Presentation, 2022, ARPU Expansion

Revenue Growth Likely Supported By Margin Expansion

A somewhat weak gross margin, which currently fluctuates around 25%, has for a long time been a major investor concern. But during the 2022 investor conference, management has voiced confidence that this metric is likely to expand to 2030 in the long term.

The belief was reiterated in late October, when CEO and founder Daniel Ek commented about the firm’s Q3 results: (emphasis added)

We’ve been transparent that 2022 was going to be an investment year, which would result in a drag on our gross margin in the short term. This quarter is case in point. But it shouldn’t come as a surprise that nothing really has changed with our fundamentals. Our business is strong. We are heading into 2023 with more cost certainty, stronger product and a better user proposition. So this is all playing out largely as we expected despite the macro environment.

Our confidence in our ability to meet our long-term goals and the ambitions we laid out at the Investor Day remains unchanged. And based on the strong demand for our platform amongst consumers and creators this quarter, I believe we will deliver.

If Spotify can deliver on the x10 revenue estimate, as well as on the 600 basis point margin expansion, then Spotify is poised to generate a gross margin of approximately $30 billion to $35 billion by 2030.

Strong Q3 Results Add Confidence

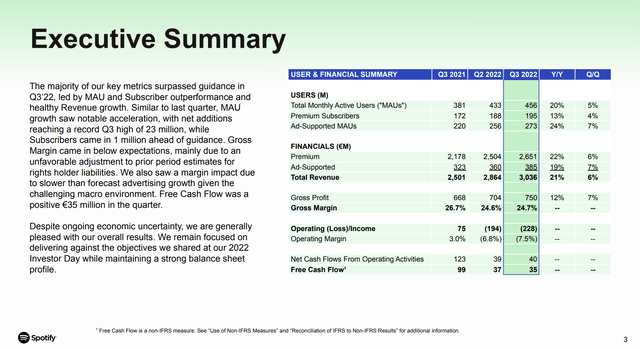

Spotify’s strong Q3 results – in light of multifaceted macro concerns – give confidence that the music streaming business is supported by secular tailwinds.

On the backdrop of strong growth in the company’s ’emerging market’ regions, in Q3 Spotify’s MAUs grew 20% year over year, to 456 million. This represents a record net additions of new users of approximately 23 million. The company’s premium subscriber base expanded 13% year over year, to 195 million. Total revenue jumped 21% versus the same period in 2021, to €3.0 billion. Spotify’s subscription revenue grew 22% year over year, while ad-supported revenue grew 19% respectively (now accounts for 13% total revenue).

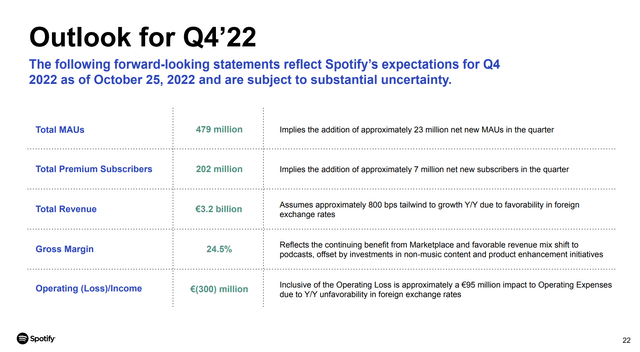

With reference to Q4, Spotify guided for a 479 million MAU and for €3.2 billion of revenues.

Spotify has ended Q3 with a very strong balance sheet, unlike many other growth names. As of late September, Spotify had $3.6 billion of cash and cash equivalents, against total debt of ‘only’ $1.8 billion — resulting in a net cash position of $1.8 billion.

Moreover, investors should consider that Spotify’s annual cash from operations was consistently positive since 2016. For the trailing twelve months Spotify generated free operating cash flow of $230 million.

Valuation

Trading at a one-year forward EV/Sales of about x1.15, SPOT stock looks very cheap in relation to the business’ potential. But to derive a more precise estimate of a company’s fair implied valuation, what would be a reasonable valuation anchor for Spotify? Without a doubt, different analysts will value SPOT differently, and price target will vary significantly. But here is how I would approach the task.

First, I want to acknowledge that Spotify is a high-growth company. And accordingly, I want to base my analysis not on current numbers, but on what I believe could be achieved in 2030.

That said, for the base-case I anchor my valuation on an estimated 1 billion user base in 2030, and APRU of $80 (below company target). Furthermore, I assume a net-profit margin of 5.5%, which is anchored on an approximate 30% gross margin.

Based on this, I calculate a $146.25 billion annuity, with a present value equal to $62.9 billion. This number discounted back to 2022, assuming a 10% rate and adding a $1.8 billion of net cash, gives an equity value of $31.1 billion, or $161.18/share.

Author’s Assumptions; Author’s Calculations

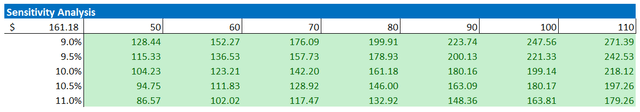

What if we vary the discount rate and ARPU? I have enclosed a sensitivity table that shows the result of different combinations.

- Upside case $271/share +300% gain

- Downside case $86/share +10% gain

Author’s Assumptions; Author’s Calculations

Risks

Reflecting on SPOT’s solid Q3 results and management commentary, I do not see any material risk to the company’s near/ mid term fundamentals and/ or competitive positioning. But investors should consider that much of Spotify’s share price volatility – like for many other stocks – is currently driven by investor sentiment towards risk and growth assets in general. Thus, investors should expect price volatility even though Spotify’s business outlook remains unchanged.

Moreover, while I do not want to comment on politics on Seeking Alpha, I would like to point out that in the recent past, Spotify has slipped into a few political/ social sensitive topics. And given the nature of art (which music most certainly is), such controversial press is likely to accumulate.

Conclusion

Reflecting on Spotify’s strong network effects, brand value and value proposition, I have confidence that the Swedish music streaming company can achieve a tenfold revenue growth by 2030, supported by a x2.5 MAU expansion and a x4 ARPU expansion.

In light of such growth targets, SPOT shares are currently trading too cheap to ignore – priced at a one-year forward EV/Sales of approximately 1.10. In my opinion, Spotify should be fairly valued at $161.18/share. I anchor my thesis on a valuation framework based on management commentary, a 10% cost of equity and a 3% terminal growth rate post 2030.

Be the first to comment