Spencer Platt

Though the market has been rallying over the past two months after the doom-and-gloom narrative earlier in the year, there can be no doubt that the bull market in the economy is entering a frostier period. Rising rates have pulled back enterprise spending; layoffs and hiring freezes have consumers on edge; and in turn consumer spending is also pulling back.

Allbirds (NASDAQ:BIRD), the wool-based sneaker manufacturer, is just now starting to feel the impacts of this downturn. Earlier in the year it had sold investors on its story of aggressive store expansions and product category additions, but now the company is signaling a more cautious tone.

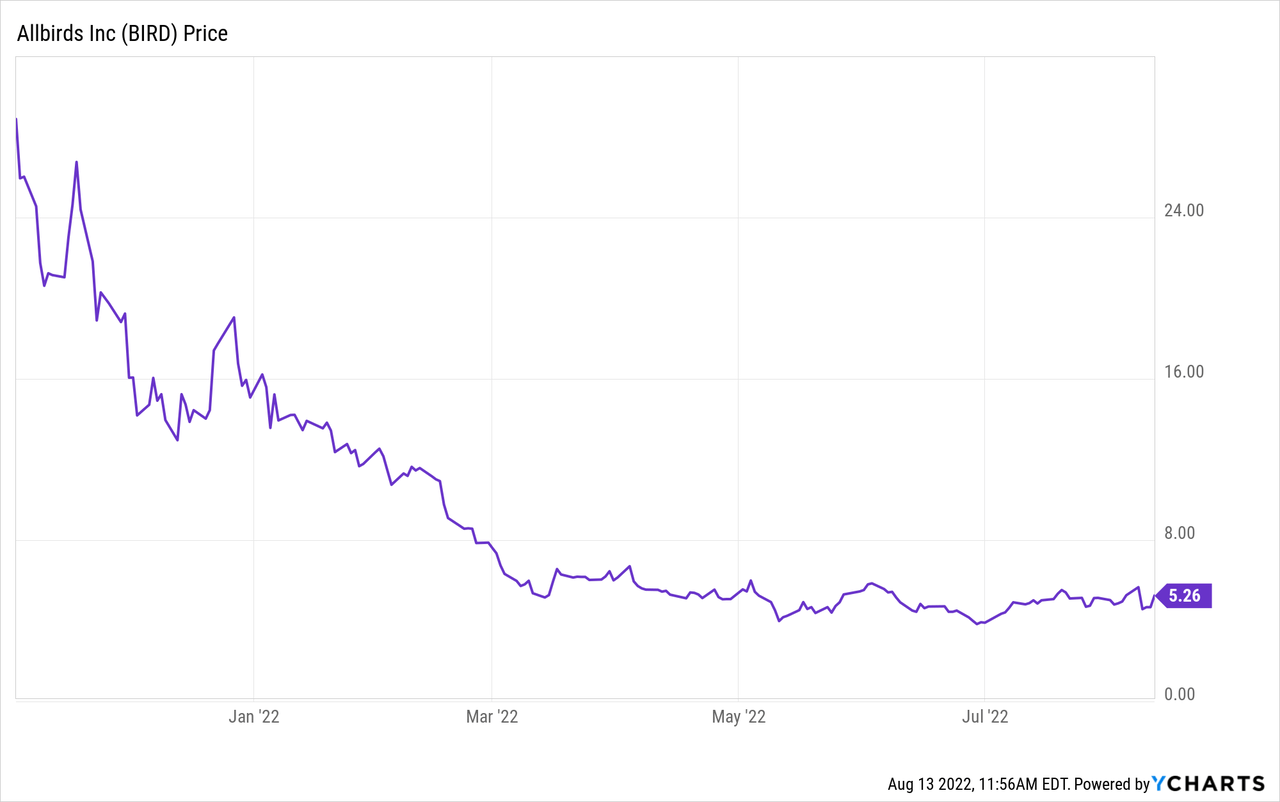

In early August, Allbirds released fiscal second-quarter results and restated its guidance for the year. Though the stock is now off its post-earnings lows, Allbirds remains down more than 65% year to date.

The key question for investors now: is this a “buy the dip” moment for Allbirds? While I was previously a proponent of picking up shares of Allbirds during this downturn, the latest news from Allbirds’ second-quarter release has me far more hesitant on the stock. I’m shifting my opinion on Allbirds to neutral.

At the moment, I see Allbirds as a more balanced bag of positives and negatives. On the bright side for this name:

- Allbirds continues to gain market share. Its mid-teens growth rate (which at one point was in the mid-20s) indicates much stronger growth than the broader footwear industry. Note as well that Allbirds is still very much a domestic (if not even regional) company, whose market largely sits in its West Coast home base. There’s plenty of room here for expansion in its brand recognition, especially with the company’s sustainability ethos that resonates well with many younger consumers.

- Product expansion. The company just recently released its latest generation of Tree Flyer running shoes, and cited that performance running shoes now make up 24% of its revenue. Expansion into different shoe styles will continue to broaden Allbirds’ appeal.

At the same time, however, we do have to be wary of the following:

- Gross margin decay. Allbirds’ products aren’t expensive, but they’re not cheap either. The company has already increased the price of its base “Tree Runner” model from $95 to $105; it may not have much more room to pass on rising costs to customers without sacrificing sales. But the reality is that raw materials as well as logistics costs are squeezing Allbirds’ margins, and its planned opex reductions may not be enough to salvage its profitability.

- Relatively limited liquidity. As of the end of Q2, Allbirds has $207 million of cash on its balance sheet, and $40 million of unused capacity on its revolving line of credit. FCF burn in the first six months of FY22, meanwhile, was -$81 million. Allbirds may find itself in a position of needing to raise additional capital soon, just as capital markets are tightening.

The bottom line here: there’s far more risk now in the Allbirds story, and I’m no longer confident in the stock’s ability to outperform the S&P 500 easily. Given the already sharp declines in the stock post-earnings, and that the market has already adjusted to the reset in expectations, I don’t see much further downside risk, but neither do I see any meaningful catalysts that can spark a rally.

Q2 recap and the guidance cut

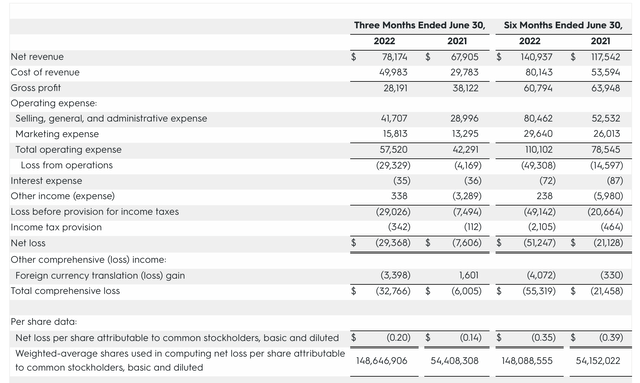

Let’s now go into more details on the news that Allbirds shared in its second-quarter update. First, take a look at the Q2 earnings summary below:

Allbirds Q2 results (Allbirds Q2 earnings release)

Allbirds’ revenue grew only 15% y/y to $78.2 million, slightly beating Wall Street’s $77.8 million expectations but decelerating dramatically versus 27% y/y growth in Q1. This is in spite of opening seven net-new retail locations in Q2 (versus four openings in Q1), five in the U.S. and two internationally, bringing the company’s total base up to 46 retail locations.

Here’s some additional commentary from CEO Joey Zwillinger on the market dynamics that management is seeing:

Across our industry, elevated inventory and promotional levels have begun to impact digital and retail traffic trends. Our customer tends to have higher-than-average income and hence there was a lag on the impact of inflation, but this trend became notable in the US beginning in the back half of June.

One of the greatest advantages of our business model is that our sophisticated data platform and our direct relationship with our customer allows for rapid visibility into changes in demand signals. As a result, we are likely seeing this slowdown before many others in our industry and therefore, have been able to pivot sooner.

In our international markets, FX headwinds have intensified since May. In China, while COVID restrictions have eased they are persistent and translating to lower consumer spending now. And sentiment in Europe, continues to be negatively impacted by the ripple effects from the Ukraine crisis.

As it pertains to our 2022 guidance target, we are taking a conservative view of demand in the second half and proactively managing our business with the assumption, that these headwinds will continue through the remainder of 2022. We anticipate that the most significant impact of this change, since our last call, will come from the US.”

Now, there are several pieces of good news here. The first is that when compared to 2020, revenue is up 55% – so the business has at least rebounded dramatically since the pandemic. Secondly, the company’s price increases in March played out “in line with expectations”, with revenue upside offsetting any volume decreases.

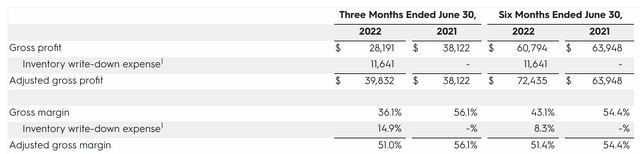

In spite of this, however, gross margins still slipped. As seen in the chart below, adjusted gross margins dropped to 51.0%, 510bps weaker than 56.1% in the year-ago Q2 (and far worse than that when accounting for a one-time inventory write-off).

Allbirds gross margins (Allbirds Q2 earnings release)

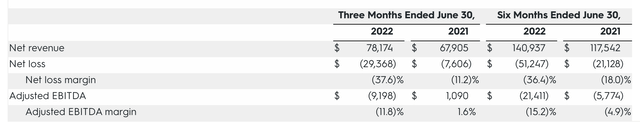

This weakness bled into adjusted EBITDA margins as well, which dropped to a -11.8% loss margin – despite a slight profit in the year-ago Q2:

Allbirds adjusted EBITDA (Allbirds Q2 earnings release)

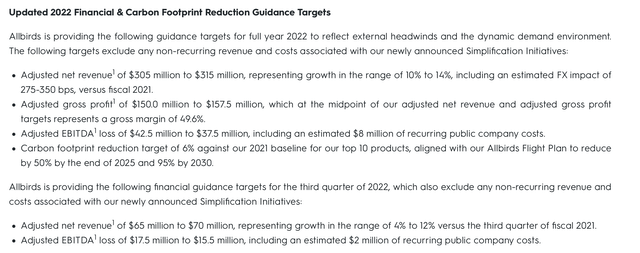

In response to all these headwinds, Allbirds enacted a big resetting of expectations. It’s cutting its revenue guidance for the year to $305-$315 million (10-14% y/y growth), which is a significant 9% drop versus a prior $335-$345 million outlook (23% y/y growth). It’s also now calling for a midpoint adjusted EBITDA loss of -$40 million (-13% margin) versus -$23 million (-7% margin) previously.

Allbirds guidance update (Allbirds Q2 earnings release)

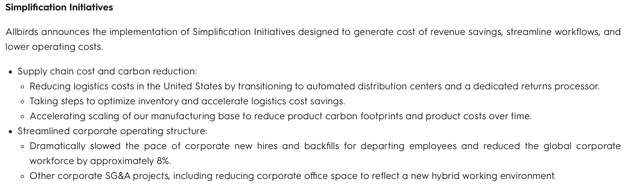

Anticipating the rocky road ahead, the company is also planning to shave 8% off its headcount, while also shrinking office real estate, with the hope of generating $13-15 million in annual savings:

Allbirds cost-saving plan (Allbirds Q2 earnings release)

Key takeaways

Now, the good news here: Allbirds remains cheap. At current share prices near $5, Allbirds trades at a market cap of just $772 million. After we net off the $207 million of cash on its balance sheet, Allbirds’ resulting enterprise value is $565 million, which represents a 1.8x EV/FY22 revenue multiple – a reasonable bargain for a company still growing revenue in the mid-teens and generating a relatively high 50%+ adjusted gross margin.

That being said, momentum is hard to regain for growth stocks once it’s lost. I don’t see any meaningful catalysts that can re-spark enthusiasm for Allbirds. Don’t expect a quick rebound here.

Be the first to comment