Stephen Brashear/Getty Images News

The Intro

Starbucks (NASDAQ:SBUX) is a strong brand company with unique products. In North America, you have a few options when it comes to coffee. You can buy generic coffee from Dunkin’, Tim Hortons (QSR), or McDonald’s (MCD), or you can buy specialty coffee from local cafes or Starbucks. Starbucks offers the widest range of specialty coffees and is constantly introducing new products to stay ahead of the competition. With sugary and caffeinated contents, this is an addictive product, not unlike the great brand Coca-Cola (KO). This unique advantage has allowed Starbucks to outpace inflation, raising its prices by 6.8% per annum over the past 5 years.

Starbucks is no longer just a coffee shop as its brands are hitting grocery stores and gas stations throughout the world. Starbucks is partnering with Nestle (OTCPK:NSRGY) to address a global market. Nestle reported:

“Nestlé and Starbucks Corporation today announced a new collaboration to bring Starbucks Ready-to-Drink (RTD) coffee beverages to select markets across Southeast Asia, Oceania and Latin America. The companies will work to quickly bring these coffee beverages to consumers as of 2022.”

As Starbucks benefits from its many growth engines, we project returns of 10% per annum.

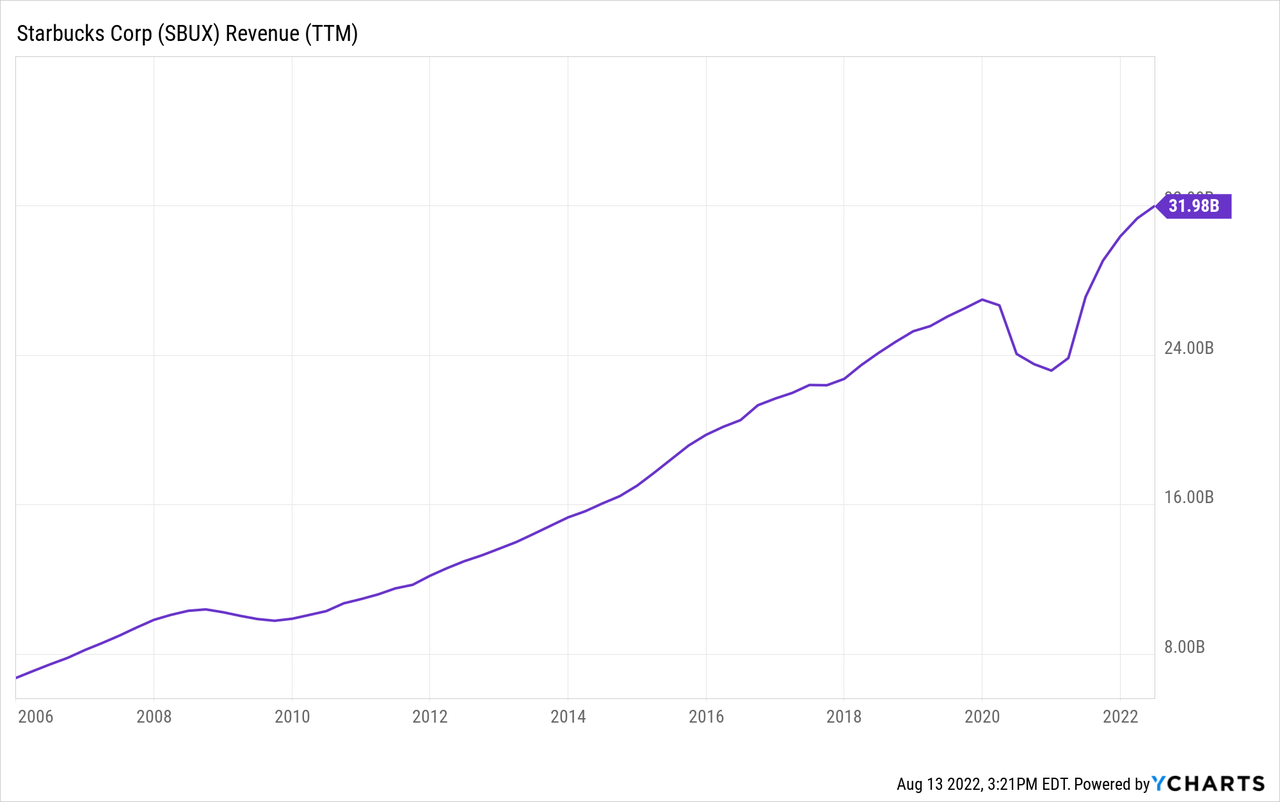

The Growth Trajectory

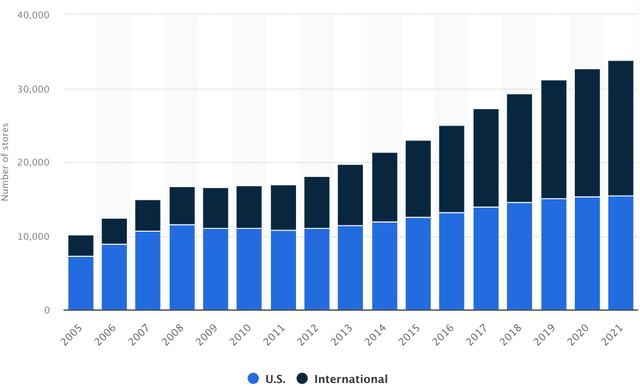

Starbucks is growing its store count at an extraordinary pace of nearly 8% per annum. This is a very healthy clip for any chain restaurant. Here’s the recent growth of Starbucks’ global store count:

Starbucks’ Global Store Count (Statista)

As you can see, Starbucks is reaching saturation in North America, but is still growing at a rapid pace internationally. If Starbucks can continue to grow its store count and packaged goods footprint, earnings will follow. On top of this, Starbucks can raise its prices with inflation so long as consumer demand remains strong. Luckily for the company, Starbucks has very loyal consumers.

The Marketing Genius

Starbucks’ customer loyalty is in part due to its marketing genius and in part due to its personalized service. On Starbucks’ loyalty program, Formation reported:

“The Starbucks Rewards program awards customers with “stars.” As they earn stars, customers receive free coffee and products. In addition to celebrating their birthday with a free treat, there are also bonus rewards like double star days and access to exclusive games and offers.”

Customers have a variety of ways to change the contents of their drink to fit their needs, whatever they may be. This is a headache for baristas, but customers love it.

Starbucks focuses a lot on ESG, and it does so strategically. Being environmentally friendly attracts high-spend target customers who are willing to pay-up for anything that’s sustainably sourced.

Lastly, Starbucks collects data on its customers. They know who you are, and they know what you want. This gives them a huge edge over the competition.

Our Valuation

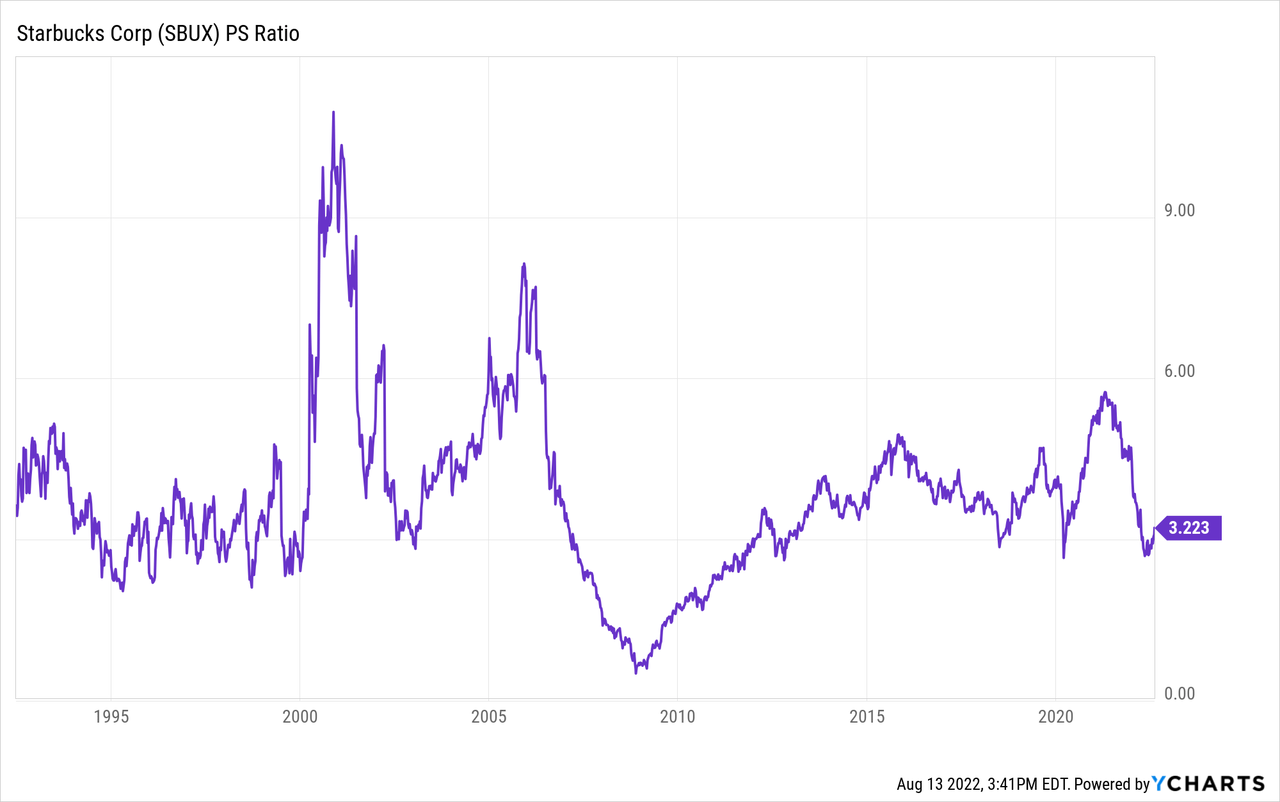

Starbucks’ price to sales ratio has come down to a more reasonable level of late:

Starbucks is also cheap in comparison to McDonald’s when you consider its growth opportunity:

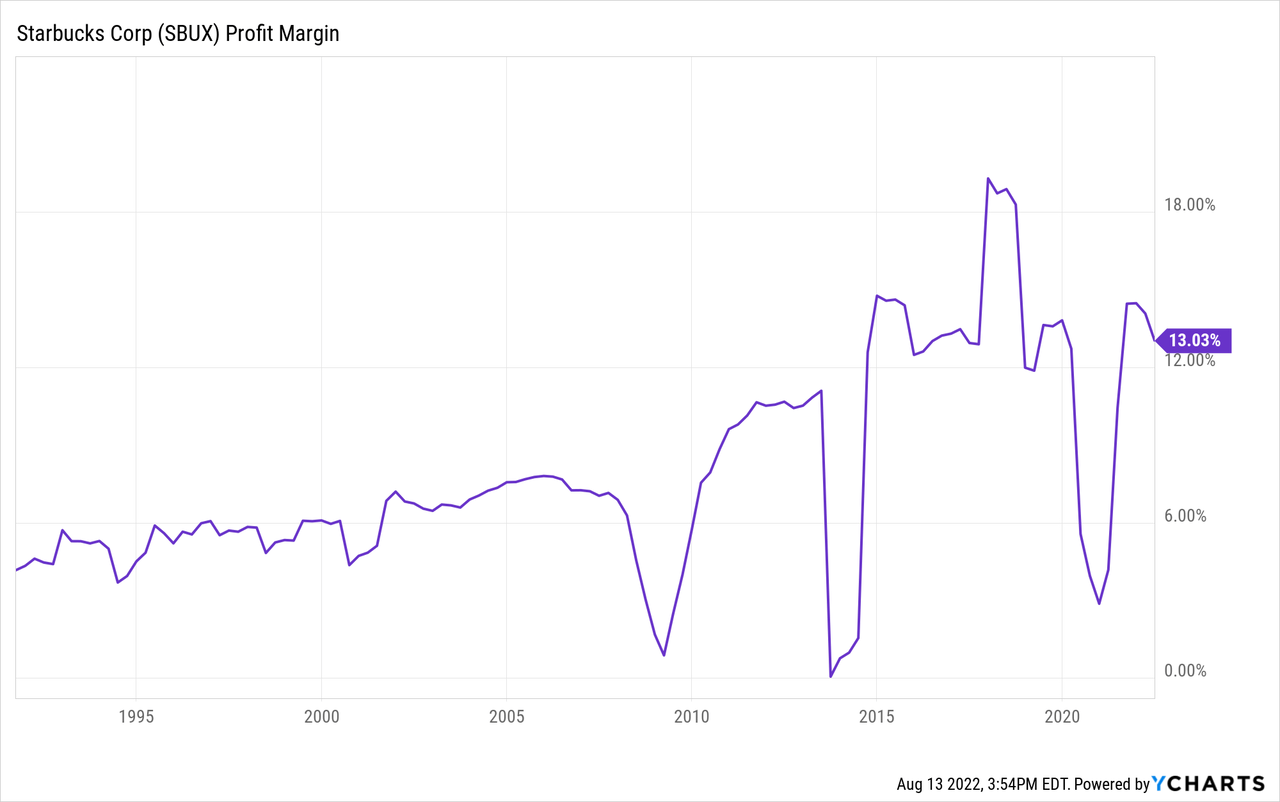

Below, we can see the business is enjoying peak profit margins. This could be sustainable as competition is quite weak.

Our 2032 price target for Starbucks is $176 per share, implying returns of 10% per annum with dividends reinvested.

- Barring geopolitical threats, we believe Starbucks can grow its EPS at 11% per annum on the back of an increasing store count, incremental price hikes, the globalization of packaged goods, and buybacks. This gives us EPS of $10.08 per share in 2032. We’ve applied a terminal multiple of 17.5x earnings.

An Uncertain World

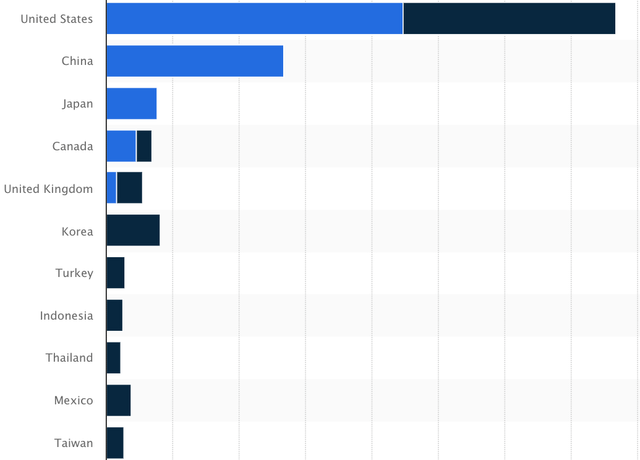

Upon Russia’s invasion of the Ukraine, Starbucks suspended all of its operations in Russia. Now, China’s military is surrounding the island of Taiwan, prompting the Taiwanese to claim it’s practice for invasion. Starbucks has significant exposure to China, which is probably its largest growth driver. Here are Starbucks’ stores by location:

Starbucks Stores By Country (Statista)

China is both a risk and a tailwind for Starbucks. Its Chinese locations have struggled amid COVID-19 lockdowns, but could rebound sharply as the country re-opens. There is plenty of room to grow in China so long as U.S., China relations remain manageable.

Then you have the emergence of inflation and potential for a weakening U.S. consumer. In a weak economy, consumers may switch to cheaper options. This is not a long-term risk, but Starbucks’ revenue flatlined from 2009-2011 in the face of economic weakness:

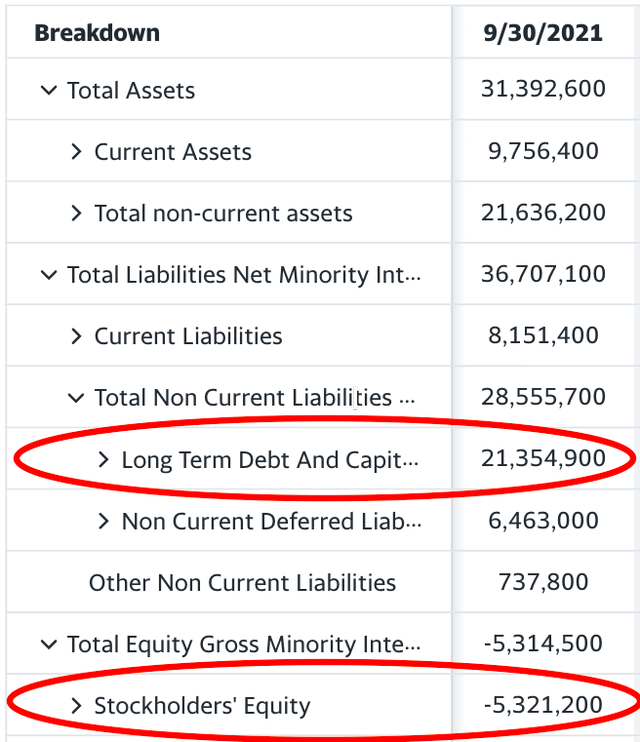

Turning to the balance sheet, Starbucks has deeply negative shareholder’s equity and tangible book value. So, you’re relying on the cash flows to be consistently positive and growing. The company also has a fair amount of long-term debt and capital lease liabilities:

Starbucks Balance Sheet (Yahoo Finance)

The unionization of workers, and the emergence of imitation competition, are microeconomic risks for the company. Dutch Bros (BROS) has been growing rapidly in the United States.

Conclusion

Several risks have surfaced for Starbucks, but it appears to have presented an opportunity to buy an industry-leading brand with a long growth runway. Starbucks has a simple formula for increasing EPS: Increase the store count, buyback shares, hike prices alongside inflation, and benefit from the globalization of packaged goods. This should lead Starbucks to outpace the market, but keep an eye on the myriad of risks we highlighted here. In the decade ahead, we project returns of 10% per annum, and have a “buy” rating on the shares.

Be the first to comment