imaginima

In my last article on Vermilion Energy (NYSE:VET), I explained why the stock is attractive and the stock price increased by 24% since then. Due to a strong 2Q 2022 financial report, I raised my stock valuation to $47-$49 per share. Because of geopolitical tensions, European natural gas import prices skyrocketed in 2022. As a result, VET’s 2022 estimated realized gas price is C$19/MMBtu higher than the Canadian benchmark AECO of C$6/MMBtu. Also, despite the recent decrease in the oil prices, Vermilion sells its crude oil at a premium to the Canadian light oil benchmark (MSW) due to western countries’ sanctions on Russian oil. Overall, the stock is a strong buy.

2Q 2022 highlights

In its 2Q 2022 financial results, VET reported fund flows from operations (FFO) of $453 million, or $2.68 per diluted share, compared with 1Q 2022 FFO of $390 million ($2.32 per diluted share) and 2Q 2021 FFO of $173 ($1.05 per diluted share). The company’s petroleum and natural gas sales increased from $810 million in 1Q 2022 to $859 million in the second quarter of 2022. VET reported 2Q 2022 net earnings of $363 million, compared with 1Q 2022 and 2Q 2021 net earnings of $284 million and $451 million, respectively.

The company reported total production of 84868 boe/d, compared with 1Q 2022 and 2Q 2021 total production of 86213 and 86335 boe/d. On the other hand, VET’s average realized price for crude oil and condensate increased from $79 per barrel (in 2Q 2021) and $120 per barrel (in 1Q 2022) to $139 per barrel in the second quarter of 2022. Also, the company reported an NGLs average realized price of $52 per barrel in 2Q 2022, compared with $25 and $47 in 2Q 2021 and 1Q 2022, respectively. Finally, VET’s natural gas average realized price increased from $5 per mcf in 2Q 2021 to $17 in 2Q 2022. Compared with 1Q 2022, VET’s natural gas average realized price did not change significantly. “Global commodity prices continued to strengthen through the second quarter, driving another quarter of record fund flow from operations and free cash flow for Vermilion,” the company announced. The company reported a net debt of $1.6 billion in 2Q 2022. “We remain on track to achieve our next debt target of $1.2 billion by the end of 2022, and with this clear line of sight we are pleased to outline our formal return of capital framework which will see an increasing proportion of FCF returned to shareholders as debt levels decrease,” the company explained.

The market outlook

In my last article on VET, I explained that due to the ongoing war in Ukraine and Gazprom’s plan to cut its natural gas flow to Europe, VET’s average realized prices will increase in the following quarters. Also, I predicted that VET will not increase its production significantly; however, its FFO will soar. I said that the company can pay down more debt and bring more returns for shareholders. European Union natural gas import price increased from $1.752 per MMBtu on 30 June 2020 to $10.30 per MMBtu on 30 June 2021 and to $34.35 per MMBtu on 30 June 2022. Europe consumes 45-50 Bcf/d of natural gas, with Russia supplying about 40% in 2021. However, due to the Russia-Ukraine war, Russia has decreased its natural gas exports to the European Union.

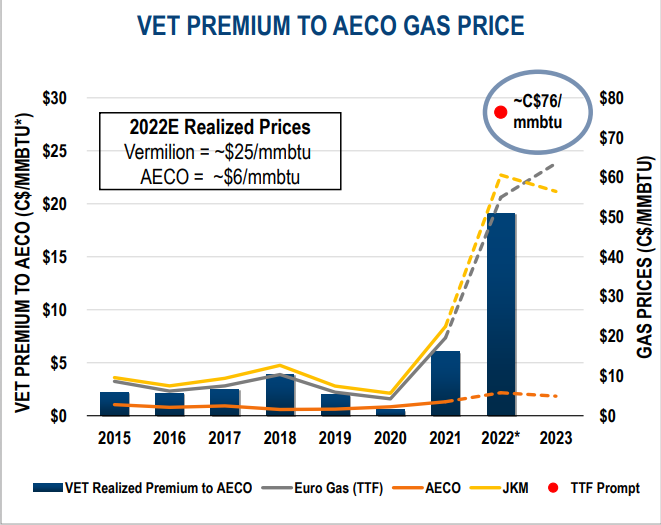

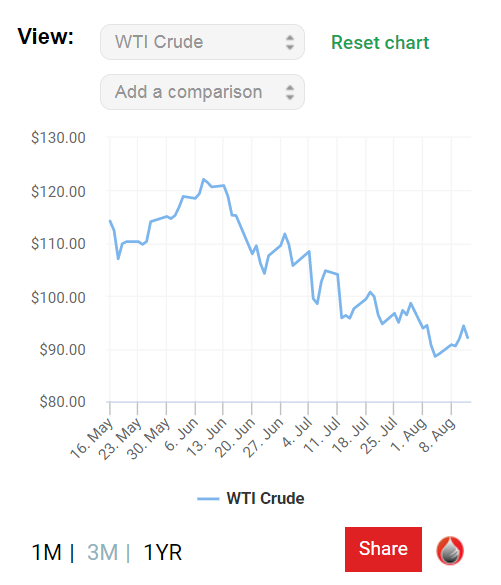

Furthermore, Gazprom has announced that due to sanctions on Moscow, delivery of a turbine needed to keep gas flowing to Europe via the Nord Stream 1 pipeline is impossible. Overall, because of geopolitical tensions in Europe, low domestic storage capacity in the region, declining European domestic production, global competition for LNG, and increasing European carbon pricing, VET is able to sell its products at a significant premium to the North American benchmarks. According to Figure 1, Vermilion’s 2022 estimated realized gas price is four times the Canadian gas price benchmark AECO. Also, VET expects European gas prices to increase to C$75/MMBtu in the second half of 2022. VET sells its crude oil at a premium to the Canadian light oil benchmark. As Western countries banned Russian oil imports, Vermilion can even sell its crude oil at a higher premium to MSW in the second half of 2022. It is worth noting that according to Figure 2, WTI crude oil price decreased from more than $120 per barrel in mid-June to $92 per barrel on 12 August 2022. However, oil prices are still higher than in 2Q 2021.

For the full year of 2022, VET maintains its previous production guidance of 86000 – 88000 boe/d, excluding the Corrib acquisition volumes. In the first half of 2022, VET’s total production was 85535 boe/d. Including Corrib acquisition volumes, the company’s total production in 2022 will increase to more than 95000 boe/d. The company forecasts a pro forma 2022 FFO of $2.4 billion and FCF of $1.8 billion. Also, the company expects its net debt to decrease to $1.2 billion by the end of 2022. Including the Corrib acquisition, VET’s 2022 estimated FFO per share will increase from $11.6 to $14.8, up 28%. With WTI crude oil price and European gas price of more than $85 per barrel and $70/MMBtu, respectively (in the second half of 2022), I predict that Vermilion is able to report a 2022 FFO of more than $2.4 billion.

Figure 1 – VET premium to AECO gas price

2Q 2022 presentation

Figure 2 – WTI crude oil price

oilprice.com

VET performance outlook

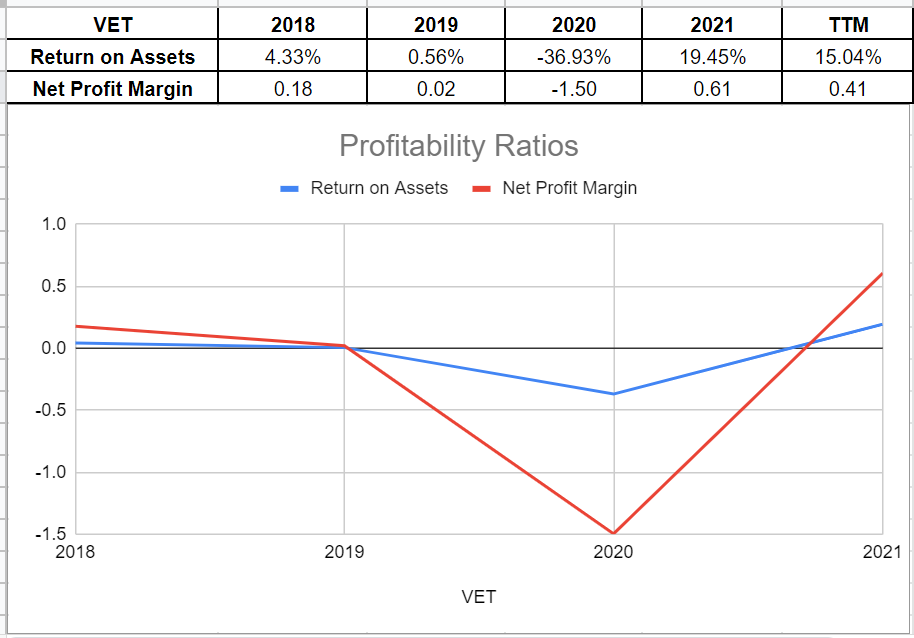

VET’s net profit margin showed impressive growth and sat on 0.61 at the end of 2021 compared with its amount of (1.50) in 2020 when the pandemic started, and we all remember the following plunge in oil prices. Meanwhile, its TTM amount decreased by 32% to 0.41. Moreover, across the board of return on assets, the ROA ratio in TTM shows that 15% of the company’s net earnings is related to its assets. Vermilion Energy’s return on assets boosted impressively during 2021 and sat on 19.45% versus its previous level of (36.93)% at the end of 2020. Both net profit margin and ROA amounts in TTM are well above the amounts before the pandemic started. Thus, Vermilion Energy’s profitability ratios provide a good capture of its ability to generate income relative to the revenue and assets (see Figure 3).

Figure 3 – VET profitability ratios

Author (based on SA data)

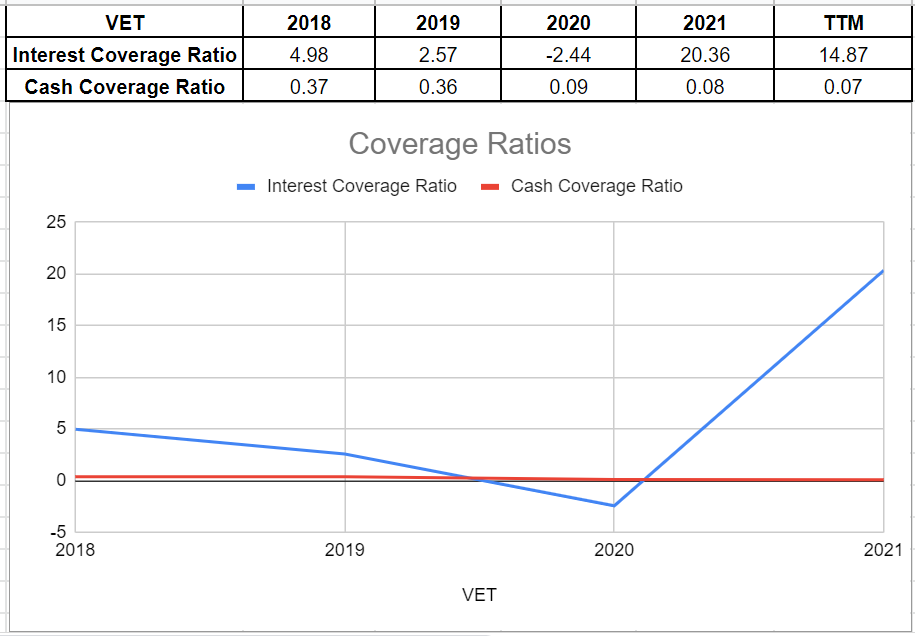

Furthermore, we can analyze VET’s coverage ability across the board of its interest-coverage ratio and cash-coverage ratio. Its ICR in TTM indicates that 14 times the company can pay its interest expenses on its debt with its operating income. However, VET’s interest coverage ratio in TTM has been weakened compared to its amount of 20.3 at the end of 2021. Also, as a conservative metric to compare the company’s cash balance to its annual interest expense, VET’s cash-coverage ratio in TTM has been 0.07, which is in the same line as the amount of 2021. In sum, thanks to the company’s improving free cash flow, there may not be concerns about VET’s ability to cover its obligations (see Figure 4).

Figure 4 – VET coverage ratios

Author (based on SA data)

VET stock valuation

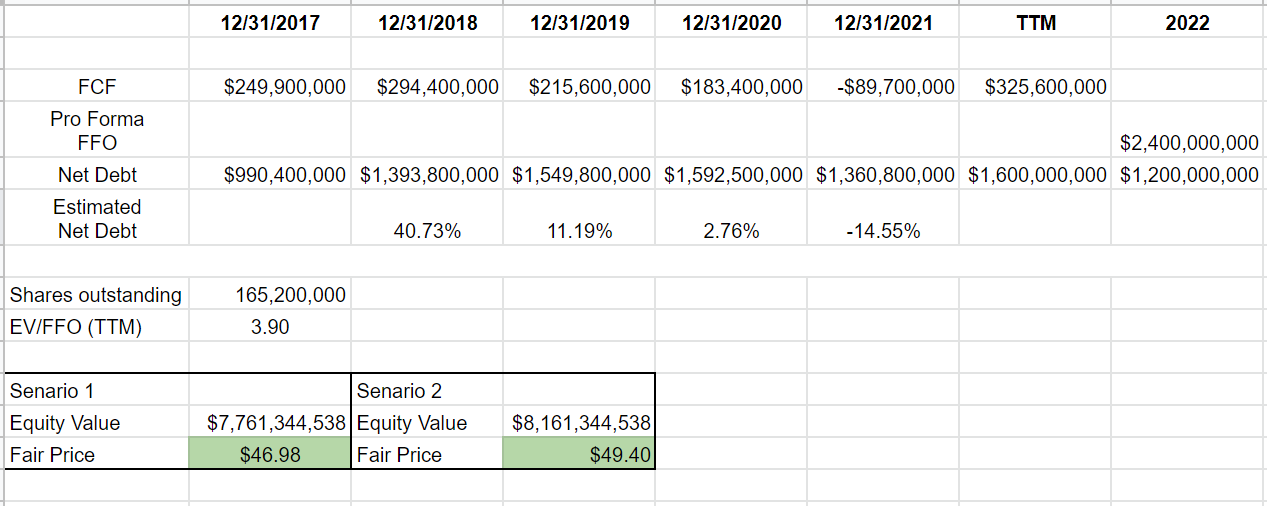

To estimate Vermilion Energy’s fair value, I investigated its free cash flow growth during the last five years. The company’s FCF grew impressively in recent years. VET management estimated a $2.4 billion pro forma FFO for 2022, which is not surprising based on the company’s well-performed performance. Furthermore, they predicted to reduce their net debt to $1.2 billion at the end of 2022, which shows a 25% decrease versus its $1.6 billion net debt in TTM. Thus, assuming that the company’s net debt amount is going to be between $1.2 billion and $1.6 billion in 2022, and according to the EV/FFO ratio (TTM), Vermilion Energy’s fair value is between $47 and $49 per share (see Table 1). As it is mentioned in Table 1, Scenario 1 is based on $1.6 billion net debt (TTM), and Scenario 2 is based on the company’s predicted net debt at the end of 2022. In both scenarios, the stock is undervalued.

Table 1 – VET stock valuation

Author

Summary

Vermilion benefited from the market condition driven by the high commodity prices in 2022. I predict that Vermilion can report a 2022 FFO of more than $2.4 billion. By the end of 2022, the company expects its net debt to decrease to $1.2 billion. Moreover, the company’s Corrib acquisition will increase its 2022 total production to more than 95000 boe/d. The stock is worth more than $47 per share. VET is a strong buy.

Be the first to comment