Marco Di Lauro/Getty Images News

Investment Thesis

KBR, Inc.’s (NYSE:KBR) book-to-bill ratio was 2.1x in the recent quarter due to the strong bookings which led to a healthy order backlog. The near term looks solid as the company has secured 90% of the work under contract to deliver the revenue for the second half of FY22. In the long term, the company’s order backlog should benefit from the increased defense budget, investments in a clean and green future, higher energy prices, and increased military actions in Europe. The company’s margin should benefit from the higher-margin projects, restructuring initiatives, and an improved mix of contracts with its joint venture with Venture Global.

KBR’s Q2 FY22 Earnings

KBR recently reported mixed second quarter FY22 financial results, with lower than expected revenue and better than expected earnings. The revenue in the quarter increased 5% Y/Y to $1.62 bn (vs. the consensus estimate of $1.64 bn). The adjusted EPS grew 31% Y/Y to $0.76 (vs. the consensus estimate of $0.65). The revenue growth in the quarter was primarily due to increased activity in the European command related to the war in Ukraine, partially offset by the exit from the Middle East contingency operations in 2021. The adjusted EBITDA margin was up 130 bps Y/Y to 11.5% due to the growth in adjusted EBITDA in the quarter. The adjusted EPS in the quarter benefited from the growth in EBITDA, favorable Y/Y taxes, and the benefit of foreign exchange translation through hedging actions.

Revenue Growth Prospects

The Government Solutions (GS) segment’s revenue grew 7% Y/Y due to increased activity with the European command, organic growth in the Australia business, and healthy performance from the Frazer-Nash business. The revenue of Sustainable Technology Solutions (STS) was flat Y/Y in the quarter due to the timing of certain projects and the shutdown of business in Russia. The bookings in the quarter across both segments were strong, leading to a book-to-burn ratio of 2.1x. The total backlog and options in the quarter grew 3.5% Y/Y to $19.2 bn. The backlog in the GS segment grew 1% Y/Y to $11.7 bn, whereas in the STS segment it grew 54% Y/Y to $3.7 bn. However, the awarded options in the quarter declined 16% Y/Y to $3.8 bn.

The outlook for the Government Solutions segment remains solid in the U.S. and internationally. In June, the U.S. Senate approved an incremental increase of $45 bn to the President’s proposed budget for FY23. This adds up to a total of $817 bn for DoD in FY23, which represents an ~6% increase over the proposed budget levels and should help KBR. The company is experiencing strong trends in defense modernization, space, Intel, cyber, and LOGCAP (Logistics Civil Augmentation Program) given the situation in Europe. LOGCAP is a program administered by the U.S. Army to provide contingency support to its army structure across the globe. The company is also seeing some of the task orders coming in from NATO related to the situation in Ukraine. The current military situation in Europe is proving beneficial for the company. The Government Solutions segment has almost 95% of the work under a contract that it requires to deliver for its FY22 revenue target, along with a healthy backlog and options of $15.5 bn.

KBR has been working towards expanding its GS International business organically and inorganically. In Q2 FY22, the company reshaped its portfolio by divesting some of its non-core investments and invested cash in digital transformation skills and customers through the acquisition of the VIMA Group. VIMA Group delivers solutions across a number of large-scale, high-priority digital transformation programs to support its clients’ businesses. This acquisition should benefit KBR in expanding its advisory, consulting, and transformation solutions in the international market.

In the STS segment, KBR’s energy transition solutions business is benefiting from the move towards a green future, which is further fueled by strong energy prices and energy security investments. Energy security investments were boosted post the Russia-Ukraine war. Recently, Venture Global entered into a sales and purchase agreement for the sale of LNG from Venture Global’s Plaquemines and CP2 facilities, over the next 20 years with a German company, EnBW. Zachry Group and KBR are developing the first phase of the Plaquemines LNG export facility, and I expect a move away from Russian natural gas will benefit investment in projects like these.

The book-to-bill ratio of the STS segment was strong in Q2 FY22, leading to a healthy order backlog. The STS segment has over 85% of its work under contract for FY22. The STS segment is also set to benefit from the Inflation Reduction Act as approximately $370 bn of funding in it is focused on dealing with the climate change crisis. Additionally, chemical companies are expanding their investments in olefins as the demand remains strong given its uses in the petroleum industry.

KBR has 90% of the work secured under contract to deliver the rest of FY22 revenue, which gives us confidence that it should be able to easily achieve its revenue guidance range of $6.4 bn to $6.8 bn for FY22. Beyond the current year, there are multi-year secular drivers, as discussed above, which make me optimistic about the company’s growth prospects.

Margins

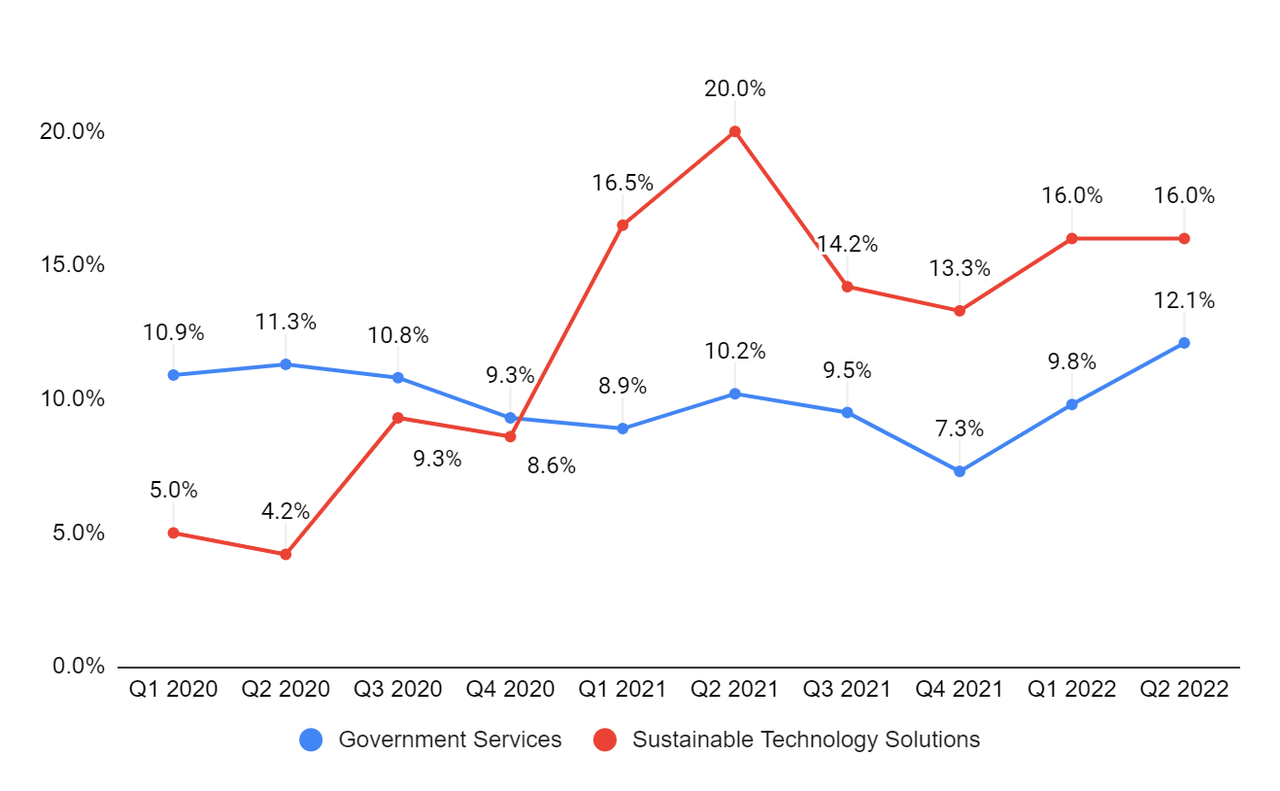

In Q2 FY22, the adjusted EBITDA margin in the GS segment was up 190 bps due to a favorable international mix, strong project execution, and core revenue growth. The margin in the STS segment was down 400 bps due to difficult comparisons as last year’s Q2 had some favorable net closeouts which spiked margins by about five percentage points.

KBR’s segment-wise adjusted EBITDA margin (Company’s data, GS Analytics Research)

Looking forward, the company is winning high-margin projects, which should benefit both segments. KBR has been focusing on improving its STS margin since 2020. The company restructured its business by exiting all the lump-sum EPC projects and commoditized services, which benefited the segment’s margin. Furthermore, the mix of contracts coming from the contracts with Venture Global should benefit the company’s margin expansion plans. In FY22, the company is targeting an EBITDA of $200 mn and is targeting an EBITDA of $300 mn by the end of FY25.

Valuation & Conclusion

The stock is currently trading at 20.34x FY22 consensus EPS estimate of $2.59 and 17.04x FY23 consensus EPS estimate of $3.10. The company’s long-term growth prospects are encouraging, and the sell-side is modelling strong EPS growth over the next few years. KBR’s strong order backlog and the trends across its end markets, such as the increased defense budget, the move towards a green future, the increase in energy prices, the Inflation Reduction Act, etc., should benefit the company’s revenue growth. The margins of the company should improve with the inclusion of higher-margin projects and a mix of contracts. Hence, I have a buy on the stock.

Be the first to comment