koto_feja

Thesis

The Advent Claymore Convertible Securities & Income Fund (NYSE:AVK) is a closed end fund focused on high yield and convertible securities. The vehicle has total return as its main objective. The fund has a 12% yield which is unsupported, and a long term total annual return closer to 5.4%. The fund has been pummeled this year, being down over -30%. With a high leverage ratio of 40% and a substantial sensitivity to interest rates and equity prices, the CEF has experienced a degrading of all pricing risk factors in 2022.

If we look at the main pricing components for convertibles, we get the following concise piece from FinCad:

A convertible bond gives the holder the option to exchange (convert) the bond for a specified number of shares in the underlying company. The number of shares for which the bond can be exchanged is given by the conversion ratio, which is usually stated at bond issuance. While the investor holds the bond and does not exercise their option to convert, they will receive periodic payments at the stated coupon level. In essence, a convertible bond can be thought of as a regular bond with an embedded equity call option. Convertible bonds can also be issued with other embedded features such as time varying issuer calls and investor puts. As the underlying share price increases, the bond will behave more like an option.

Source: FINCAD

The phrase to be remembered from the above paragraph is “In essence, a convertible bond can be thought of as a regular bond with an embedded equity call option”. If equity prices go up the option is worth more (i.e. there is a higher probability the bond can convert into shares), hence the price of the convertible security goes up. From a fixed income angle, convertible securities lose value when interest rates go up. This year has seen both risk factors hit, with equity prices down and interest rates up.

The high leverage the fund runs makes it volatile, with the 5-year standard deviation for AVK at 19.8. We see a constrained 2022 followed by a recovery in 2023 for this CEF, albeit with significant volatility in-between. If you are already a holder of this name then Hold until the end of 2023, while new money looking to enter the convertibles space would do well to look at the Calamos funds, which are better performers in the space.

Holdings

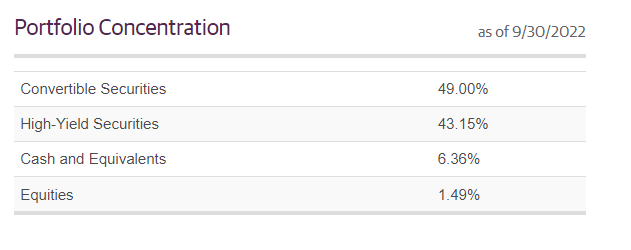

The fund is a convertibles vehicle:

Asset Class (Fund)

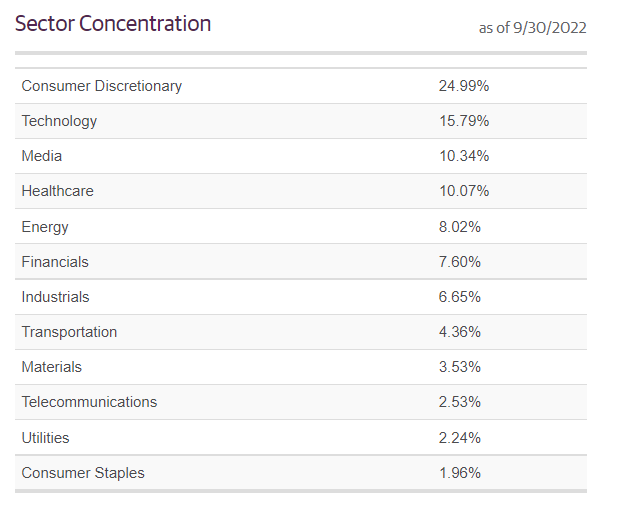

Around 50% of the portfolio is invested in convertibles, with 40% dedicated to high yielding bonds. The fund focuses on consumer discretionary and technology names:

Sectors (Fund)

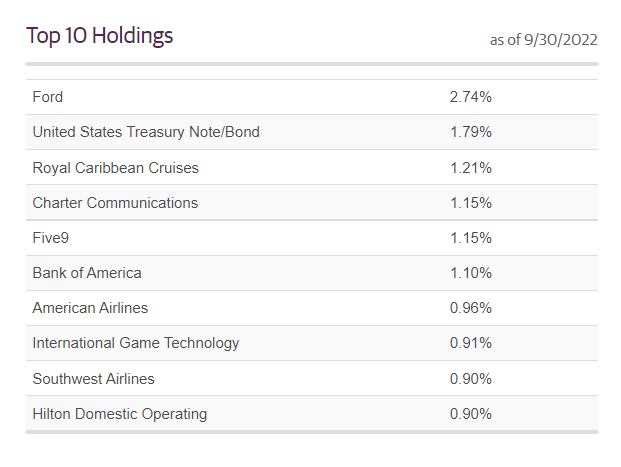

From a granularity perspective, the fund is well-built, with no issuer concentration buckets:

Top Holdings (Fund Fact Sheet)

The largest fund exposure is sub 3%, while all the other names are under 2%.

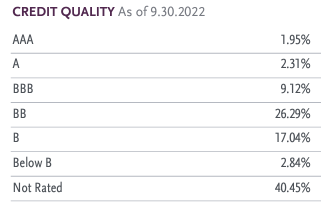

The majority of the fund’s portfolio is below investment grade:

Credit Quality (Fund Fact Sheet)

Performance

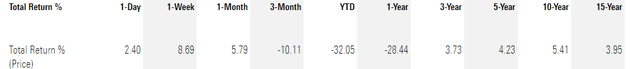

The fund is down over -30% in 2022:

YTD Total Return (Seeking Alpha)

Given the underperformance of equities and high yield, and the fact that AVK is leveraged, the vehicle is down substantially in 2022.

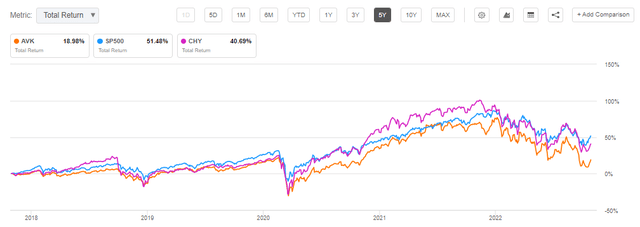

The fund underperforms on a 5-year time frame as well:

5Y Total Return (Seeking Alpha)

We can see that Calamos Convertible & High Income Fund (CHY) has a total return performance much more aligned with the S&P 500 index versus AVK. A well run fund with a high leverage (with no unwinding during the Covid crisis), should have posted robust results coming out of Covid. AVK lagged, so we are guessing there were some unwinds at low prices.

The fund has a very uneven historical performance, with annualized total returns which are fairly low:

Total Returns – Table 1 (Morningstar) Total Returns (Morningstar)

If you are a true buy and hold investor, expect an annualized return close to the long term average of 5.4%. The current dividend yield is not supported, as we analyze it in the distributions section.

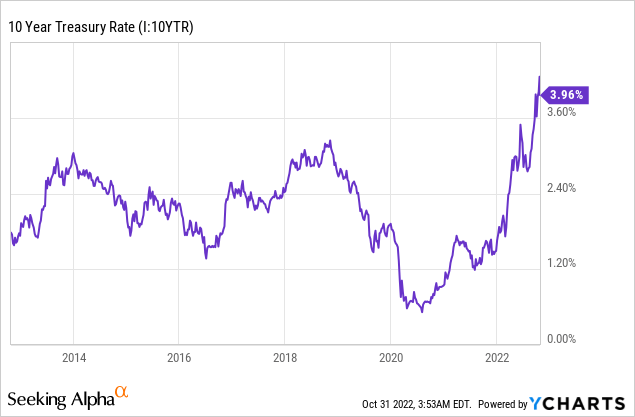

From an annual return standpoint, we can see the fund’s correlation with the overall equities markets as well as rates. The vehicle was down in 2015 and 2018 with the wider markets, but surprisingly down as well in 2014 when the S&P 500 was up over 13%. The fund was down due to the rise in yields:

10-year yields were up substantially in 2014, generating loses for some fixed income instruments.

Premium / Discount To NAV

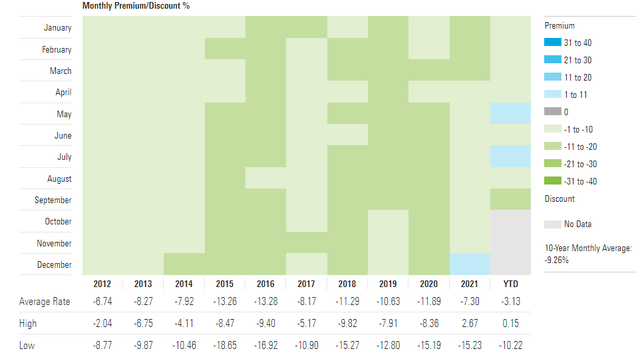

The fund has historically traded at substantial discounts to net asset value:

Premium/Discount to NAV (Morningstar)

We can see from the above table that the CEF usually trades at an average discount to NAV of around -10%.

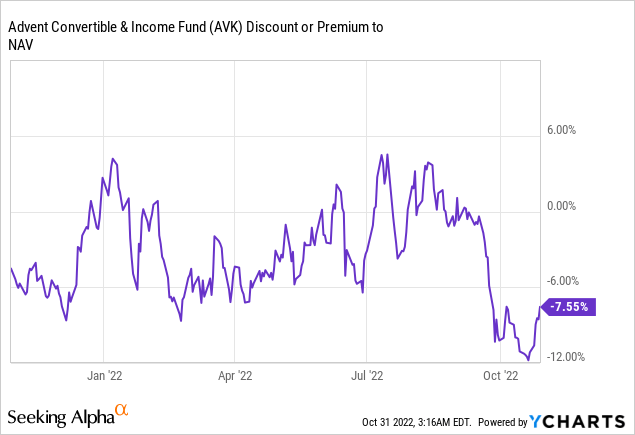

It is interesting to note the fund’s discount performance in the past year:

We can observe the low correlation the fund has to risk-on / risk-off market wide moves. Generally we see many CEFs, especially in the high yield or equities space, exhibit a correlation of 1 to market risk events. As the wider market rallies, their discounts narrow. Less so for AVK, which has had a fairly well behaved discount that has traded in the -6% to 0% band.

Distributions

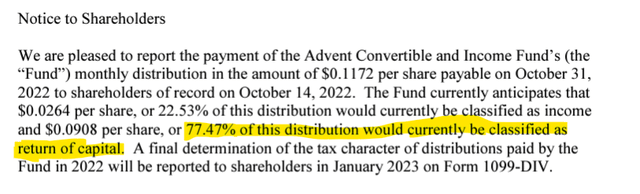

Due to its lack of a positive performance in 2022, the CEF is using a high amount of ROC to cover its distributions:

We can see that as of the October payment date, over 77% of the distributed amount represented a return of principal to the shareholders, rather than true income.

Conclusion

AVK is a high yield bonds and convertible securities CEF. The vehicle is highly leveraged, with a ratio above 40%. Its sensitivity to interest rates and equity prices have caused the fund to post a total return exceeding -30% in 2022. The fund is volatile, with a 5-year standard deviation of 19.8. The fund’s dividend yield of 12% is unsupported, the vehicle currently using more than 77% of ROC for its distributions. A long term investor should expect an annualized return of 5.4% here, with substantial volatility yearly. If you are already a holder of this name then Hold until the end of 2023, while new money looking to enter the convertibles space would do well to look at the Calamos funds, which are better performers in the space.

Be the first to comment