Scharfsinn86

Investment Thesis

The Hyliion Holdings Corp. (NYSE:HYLN) story is interesting, but there are better companies for investment. HYLN may eventually turn a profit, but the risks are too high for the potential reward as they move towards the capital-intensive delivery of their first 200 trucks by the end of 2024.

Hyliion Holdings Corp.

Hyliion Holdings Corp. provides electrified powertrain solutions for the commercial vehicle industry. The Company is focused on reducing the transportation sector’s carbon intensity and greenhouse gas emissions by delivering electrified powertrain solutions for Class 8 commercial vehicles. It utilizes its battery systems, control software, and data analytics, combined with fully integrated electric motors and power electronics, to produce electrified powertrain systems.

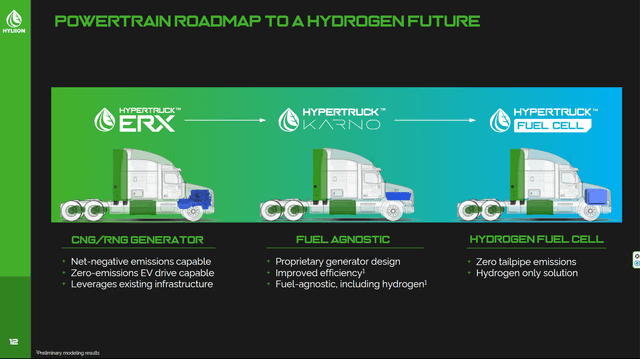

They offer a Hybrid system, designed as an add-on to the trucks’ electric powertrain, which can augment power needs. They also provide the Hypertruck, a complete powertrain option that is fully electric drive and uses an onboard generator to recharge the batteries as the vehicle is in operation.

www.hyliion.com/

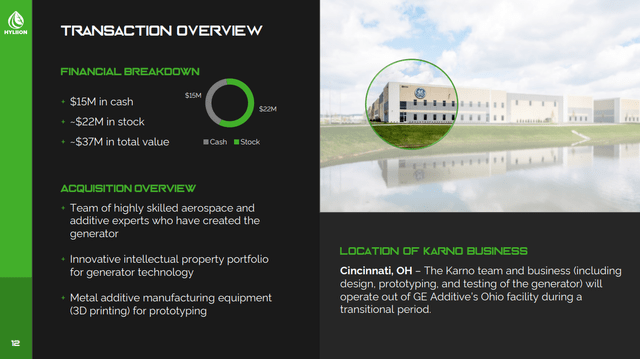

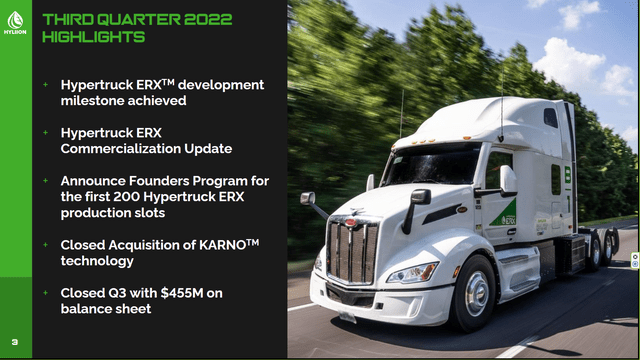

HYLN acquired hydrogen and fuel-agnostic generator technology from GE for $15M in cash and $22M in stock.

www.hyliion.com/

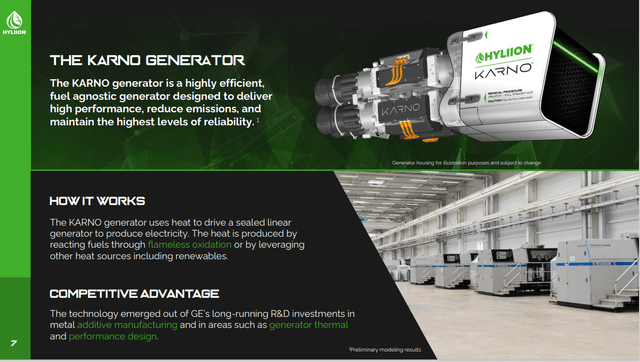

The Karno generator uses heat to produce electricity.

www.hyliion.com/

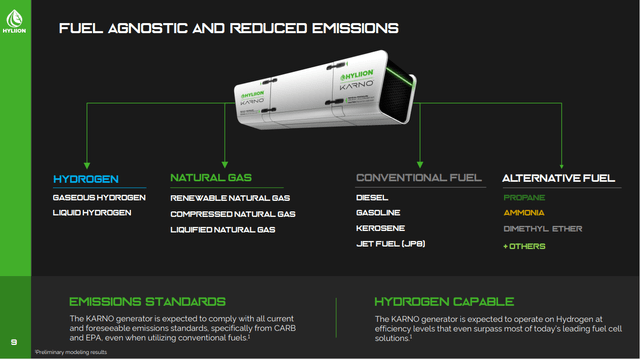

This generator can operate with a variety of different fuels.

www.hyliion.com/

With an in-house battery lab, Hyliion intends to design, develop and sell advanced battery systems to customers for use in their own applications.

www.hyliion.com/

HYLN generated only $500K in revenue from hybrid and full truck sales in the third quarter with 200 employees. They are 32.9% owned by institutions, with 9.5% short interest. Their return on equity is -34.0%, and they have a -33.5% return on invested capital. The free cash flow yield per share is -25.4%, and their buyback yield per share is 0%. Their Piotroski F-score is two, indicating a weak company. They have a price-to-book ratio of 1.1. They have $455 million of cash and marketable investments, but their net income is -$153M for the trailing twelve months.

Q3 Quarterly Results & Full-Year Outlook

HYLN announced third-quarter results in its press release.

Third-quarter revenue was $0.5 million from Hybrid and full truck sales, with approximately $1.3 million in a backlog of Hybrid systems. They updated full-year 2022 guidance to include revenue of roughly $2 million and operating expenses of about $130 million.

The executive commentary on the conference call included the following:

“We reached multiple milestones in the third quarter, including the start of controlled fleet trials for the Hypertruck ERX and our acquisition from GE Additive of the KARNO generator technology, a revolutionary hydrogen and fuel-agnostic generator that will be central to our long-term product roadmap,” said Thomas Healy, Hyliion’s founder and chief executive officer. “Additionally, trucks with the Hypertruck ERX system are now fully eligible under the Inflation Reduction Act, which became law in August, for a 30% tax credit of up to $40,000. Incentives like this can reduce up-front customer costs and enable an easier transition to electrification technology.”

“We now have filled our Founders Program and have committed orders for our first 200 production slots. Additionally, we have nearly 2,000 reservations in the backlog. As we move towards commercialization, we anticipate starting production in late 2023 and plan to have all 200 of these first trucks delivered to fleets by the end of the first quarter of 2024.”

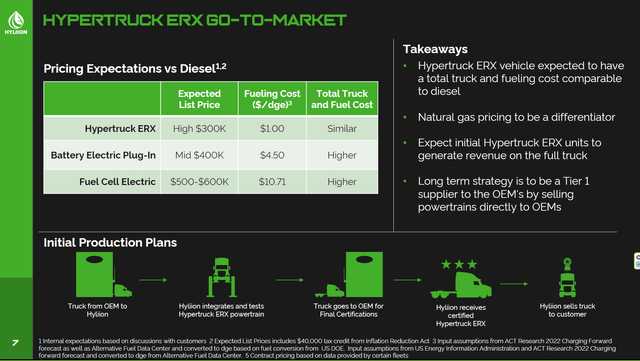

www.hyliion.com/

Initially, powertrains will be installed at the Company’s Austin, Texas, facility and modification centers near OEM factories. As sales volumes increase, Hyliion’s strategy is to be a powertrain company, selling solutions directly to OEMs who integrate them into their production lines. The Company expects initial pricing, including the Inflation Reduction Act tax credit, for a truck with a Hypertruck ERX system to be in the high $300,000 range, less expensive than battery and fuel cell electric trucks. As such, buyers are expected to realize a total cost of ownership benefit over other electrified solutions and one that is comparable to a diesel truck when considering the truck purchase price and the cost of fuel. Truck availability continues to be a supply chain hurdle.

www.hyliion.com/

Technical

Some poor investors paid as much as $55 per share back in 2020. The current floor is $2.30, but it could go lower.

Schwab StreetSmart Edge

The most accurate analyst lowered his one-year price target to $2.25, indicating an 18% potential downside from the December 7th closing price of $2.76. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates or at least headed in the right direction. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

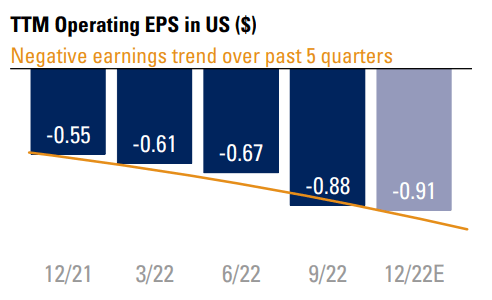

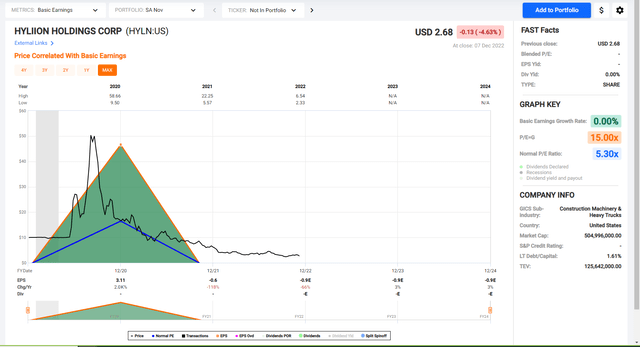

Trends in Earnings Per Share

HYLN has a negative earnings trend. No profit is expected for at least the next two years.

www.tdameritrade.com

The black line shows HYLNs stock price for the past three years. Look at the chart of numbers below the graph to see that HYLN earnings were $3.11 in 2020 and -$0.60 in 2021, and they are expected to lose -$0.90 in 2022, 2023, and 2024.

FastGraphs.com

Takeaway

HYLN may eventually turn a profit, but the risks are too high for the potential reward as they move towards the capital-intensive delivery of their first 200 trucks by the end of 2024. I suggest looking at some of my other Seeking Alpha articles for better places to invest.

Be the first to comment