Luis Alvarez

SolarWinds Corporation (NYSE:SWI) offers information technology (IT) management software as a solution to service providers. Over the years, it has been switching new and existing customers over to a scalable and profitable recurring revenue business model. Although SWI has a solid business model backed by high-end, on-premise and cloud-based technology, it has yet to deliver robust results this year. In 2020, SWI was heavily scrutinised for a severe security breach. This year has also been abysmal for stocks within the technology industry. Looking at the stock year trend, we can see losses of 43.21% for investors.

Stock Trend (SeekingAlpha.com)

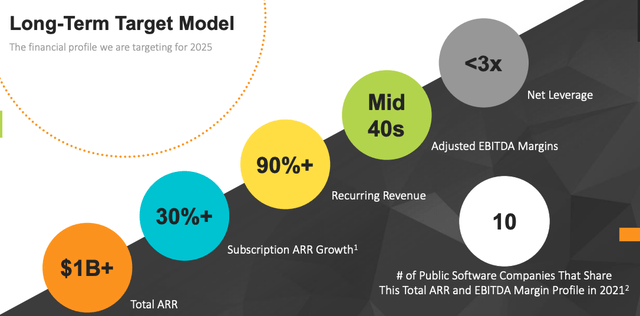

Although the stock is trending downward, this unprofitable company has an uphill road to better times. In the long term, the company has a severe business model and significant and long-term customers, whereby, for now, I would advise investors to hold the stock as the company continues to onboard new customers and switch existing customers to its more profitable subscription-based model, with a long term goal of $1 billion in annual recurring revenue.

Overview

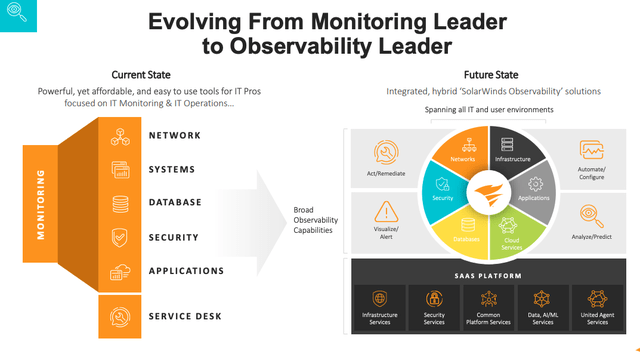

SWI, previously known as SolarWinds Parent, Inc., was founded in 1999 in Austin, Texas. It provides on-premise and cloud-based IT management solutions to over 300,000 customers in the USA and globally. The company’s broad portfolio includes technology professionals with a unified platform to manage, monitor and optimise all IT-related things. The company directly offers data, infrastructure, applications, security, and web and service management solutions to technicians. It is moving from tool-based offerings to an integrated, hybrid solution to cover all aspects of the environment as a software as a service (SaaS) platform to address modern-day customer needs better.

Transitioning to observability SaaS platform (Investor Presentation 2022)

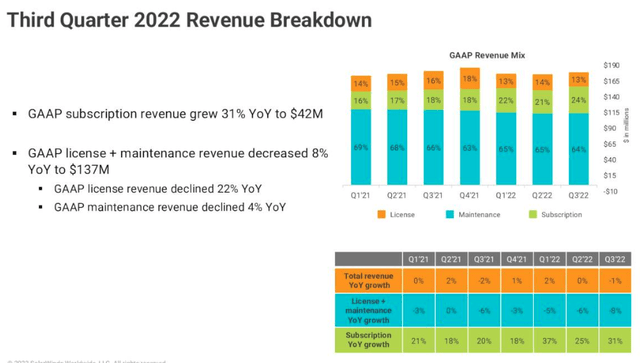

SWI has three main revenue streams. Primarily its goal is to generate recurring revenue from subscriptions to its SaaS solutions. Secondly, the periodic maintenance revenue is connected to products with perpetual licenses that usually need on-premise updates and maintenance. Thirdly there is the non-recurring license revenue from the sale of perpetual licenses. Below is a breakdown of the revenue in the third quarter of 2022.

Revenue Stream Breakdown (Investor Presentation 2022)

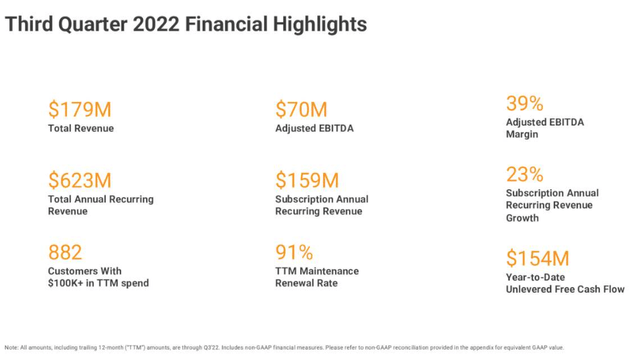

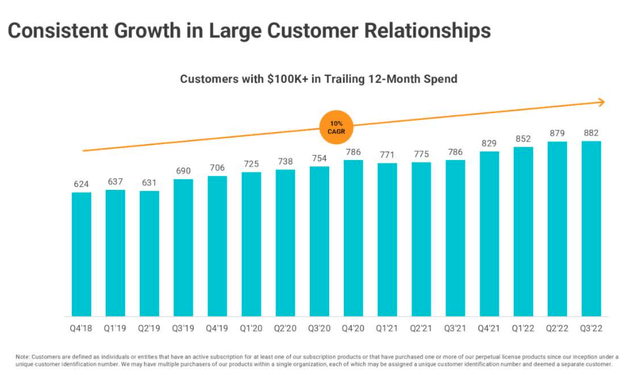

The acceleration of the company’s digital transformation is a big reason to remain positive because this advancement means an increase in larger customers and deal sizes, which is what we are already seeing with a 12% year-on-year increase in customers that spend more than $100,000 over twelve months.

Third Quarter Results

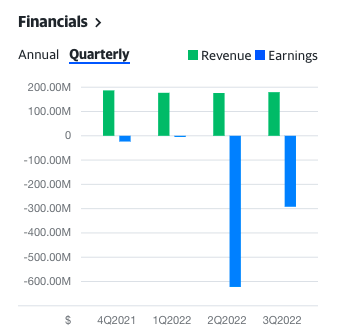

On November third SWI announced its third quarter results in which it missed revenue expectations by $2.7 million to reach $179.4 million, and it had an in-line Non-GAAP EPS of $0.20 per share. Recurring revenue from both maintenance and subscriptions represented 87% of the third quarter’s revenue. The adjusted EBITDA for Q3 was $70.3 million, which indicated a 39% margin. Below we can see the four past quarterly financial performances.

Financials per quarter (Finance.Yahoo.com)

The company had a net loss of $292.2 million for this past quarter, a large part of the expenses were connected to impairment charges. In the image below we have a good overview of the Q3 financial results.

Financial Highlights (Investor Presentation)

We can see that although the company has over 300,000 customers, 882 customers have a significant performance impact by spending over $100,000 in the last twelve months. This is an increase of 12% year on year. This number has also increased, which is a promising sign for future value growth.

Customer value growth (Investor Presentation 2022)

Over the last three years, the stock has declined 53%. On the other hand, the company continues to invest profits at increasing rates of return. However, its rate of return of 3.3% is under the software industry average of 10%. The company has a broad portfolio and a large untapped addressable market.

The company’s balance sheet shows a net debt of $1.1 billion. In September, it proactively paid $300 million in debt prepayment. Investors should be cautious that the debt matures in February 2024. The company also has high net leverage of 3.9 over a twelve-month adjusted EBITDA period, and its cash was $493 million at the end of Q3.

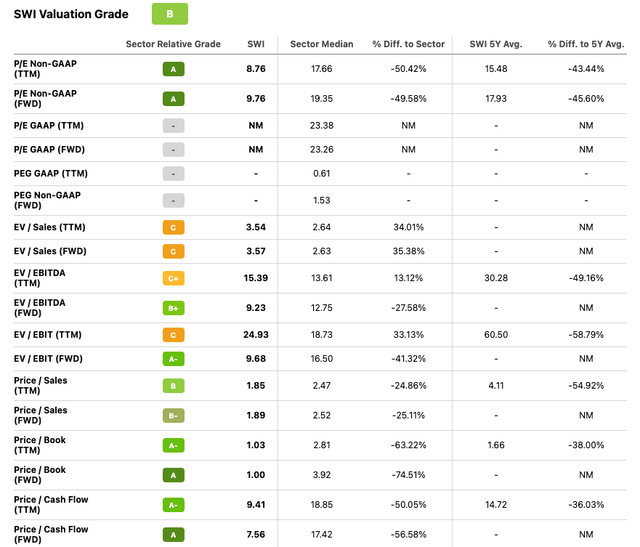

The company has made twenty-four acquisitions; the most recent was Monalytic in January 2022. It raised $532.5 million in funding and IPO-ed in October 2018 at $15 per share. Zacks Ranking and Yahoo Finance analysts give the stock a Hold rating. Below we can see that relative to the extensive IT sector, it has a low price-to-earnings ratio of 8.76 versus the median of 17.66.

Valuation relative to Information Technology Sector (SeekingAlpha.com)

Final Thoughts

Although there may be better times to invest in SolarWinds, as it still has high debt, the stock price continues to trend downwards, revenues are not increasing at significantly high rates, and there are no high expectations regarding year-end results. Holding on to this stock may be worthwhile if you look at the long term. Technology advancements are allowing this company to take on more significant customers, which can be seen in the impressive 12% year-on-year growth in customers spending over $100,000 over twelve month period. Recurring revenue accounts for 87% of total income, which is good news for investors as it provides us with a more predictable future revenue due to the long-term contracts these customers are on. Furthermore, growing the business through its scalable SaaS solution is more accessible. It has a long-term target of $1 billion in annual recurring revenue, which the company has the technology to achieve as it is cloud-based and scalable. For this reason, my recommendation is a Hold.

Long term business model (Investor Presentation 2022)

Be the first to comment