Francesco Scatena

Investment Summary

Portfolio construction in FY22 ideally should mirror the distribution of potential outcomes for the US and global economy. This includes searching for a ~20% margin of safety to absorb another 20% decline in forward US earnings in the equity risk budget.

Alas, we demonstrate Neogen Corporation (NASDAQ:NEOG) displays a loose affinity to the desirable characteristics forming the systematic investment process in FY22. Its Q4 FY22 and FY22 full-year earnings were reasonable, however investors are seeking far more from companies this year than just revenue growth, and are focused on bottom-line fundamentals instead. With that in mind, whilst there’s potential upsides from valuation, the case seems muted and we rate NEOG neutral with a PT of $27.

Q4 earnings illustrate headwinds on display

Fourth quarter sales actually came in reasonably strong with 10% growth at the top to ~$140 million. This printed FY22 revenue of $527 million for the company, a record result and 13% YoY growth. Gross margins lifted by ~130bps YoY to 46.4% in Q4 and ~20bps YoY to 46.1% for FY22. Management attribute the decompression to a shift toward higher-margin offerings in the product mix. It wasn’t immune to headwinds plaguing the industry such as heightened freight and shipping costs, cost inflation and labor shortages all compounding on a 12–18 month basis.

OPEX came in ~26 percentage points higher in Q4 and 31% higher for the year. Much of the uplift in spend comes down to the fees related to the transaction of 3M’s (MMM) Food Safety Business. The transaction will see the Food Safety Business combine with NEOG The deal is structured under a Reverse Morris Trust – whereby NEOG retains 49.9% of its own equity, and shareholders receive ~50.1% of the combined company. NEOG partly financed the transaction – understood to be valued at $5.3 billion – by underwriting a $350 million offering paying a floating 8.6% via its subsidiary SpinCo. The unsecured notes are priced with a tenor to 2030. Management stated it expects the transaction to settle in Q3 FY22 on the earnings call.

Moving down the P&L, NEOG brought this down to net income of $15 million and $0.14 in earnings, a slight down step from Q4 FY22’s $0.15. However, the company booked expenses related to the 3M transaction as expenditures versus capitalizing them, effectively compressing net profit. Backing these out of the equation, then earnings came in at $0.18 per share, a ~20% YoY gain. Meanwhile, full-year net income printed $48 million or $0.45/share. Applying the same methodology (ex-3M transaction) we see EPS lift to $0.57/share.

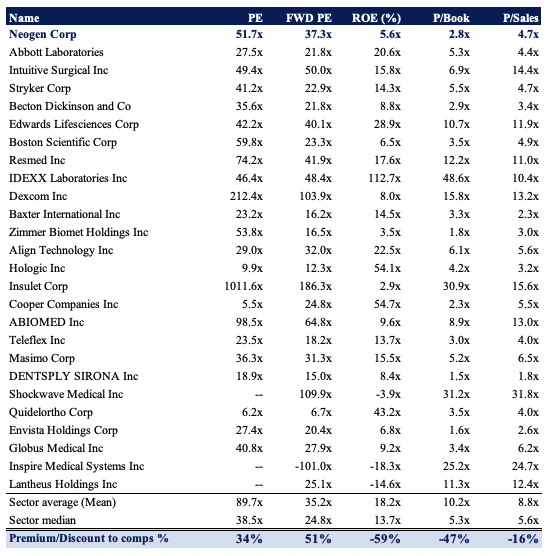

Exhibit 2. NEOG Quarterly Value Flow FY16–FY22

Management noted that it is seeing some accretion to the top and bottom line from its recent acquisitions. Organic sales were up 8% for Q4. However, food and safety revenues climbed 500bps YoY and 11% for the year, despite lockdowns in China from Covid-19. Breaking down the food safety segment further, general sanitation was the standout with ~1,200% gain YoY, underscored by sales of the AccuPoint reader. NEOG continues to see good traction in this product. It also saw a 9% gain in Allergen test kits, and booked another 6% in natural toxin tests to coincide with the Brazilian corn harvest. Meanwhile, the Listeria Right now offering came in with an above market growth of 25%, illustrating the company’s strength across product segments.

In addition, Soleris sales gained 4% YoY whereas it Megazyme sales expanded ~600bps over the year, its first year of integration. Animal Safety turnover also increased 15% YoY for Q4 and 14% for FY22. Underpinning the growth here was a 35% gain in veterinary instruments as it took share from a market competitor in detectable needles. Insecticides were up 32%, backed by a 16% YoY gain in animal care products for the quarter. Management said the Botulism B vaccine for horses was a key driver of growth.

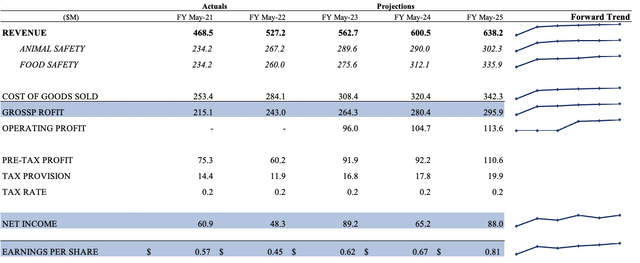

In the coming 3-year period, we envision NEOG to reach sales of $562 million for FY23, stretching up to $638 million by FY25. Our models project similar growth across both food and animal safety. We expect this to come through to $0.81 in EPS by FY25 after a period of lumpy net income growth, as seen in the table below.

Exhibit 3. NEOG Earnings Forward Estimates

Food Safety continues to standout

Food safety continues to be the focal point for NEOG and it saw particular strengths in its aflatoxin, T1, DON and flue medicine kits last quarter. Herein lies a potential catalyst for the company. Grain inventories have become more valuable across the globe, particularly in FY22. A wave of macroeconomic crosscurrents, including a tightening of Black Sea grains supply, has resulted in wide volatility across grains markets this year. Using wheat as an example, as seen below, even before the geopolitical/macroeconomic pressures, wheat prices had embarked on an upward trajectory since January FY21.

Exhibit 4. Grain markets continue to evaluate a plethora of risks – as grains increase in value, so too does the value of ensuring safe consumption

As such NEOG noted its One Broth One Plate (“OBOP”) detection method for salmonella spp has recognized growth and that adoption is accelerating throughout the UK and US. The product has simplification benefits by utilizing a single-step enrichment followed by plating to a selective/differential, chromogenic agar. Findings from Alles et al. (2021) illustrated its effectiveness in detecting salmonella across a range of foods from salmon, chocolate and pet food to name a few.

Hence, as grain and food supplies become more valuable, so too does the methodology of ensuring their safe consumption. If the company can continue driving adoption of the OBOP segment we believe there is good chance the market will gravitate to ensuring safe consumption of food, not only from a safety standpoint, but to ensure the nutrient profile is delivered to those in need.

Management also outlined that sales of the AccuPoint Advanced Next Generation handheld ATP sanitation monitoring system (“AccuPoint”) also stole market share from competitors. The system measures for the presence of adenosine triphosphate (“ATP”) after cleaning of a surface/facility has been completed. This is done to measure and verify the effectiveness of the clean, as pathogens and microbium utilize ATP in their energy production cycle. NEOG builds out the revenue stream as the AccuPoint connects to the Neogen Analytics Platform. Where the Analytics Platform has been installed, NEOG has recognized a 38% gain in ancillary product sales.

Effectively, users can maintain and potentially improve food safety compliance with the platform. Management note there’s been a 95% contract renewal rate from users of the Analytics software. The AccuPoint unit is priced at US$3,412 per device and this will need to be tracked to observe management’s pass-thru of costs onto the end-market. Ultimately, NEOG’s value proposition is to prevent catastrophic risk of product recall or widespread illness from food safety, and is therefore a value add to food and manufacturing plants.

Exhibit 5. AccuPoint Device

Data: Neogen

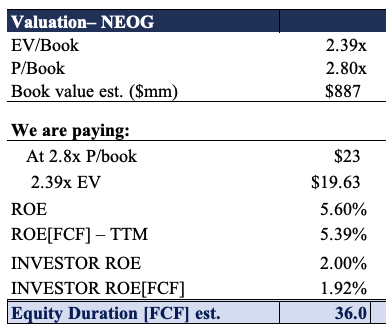

Valuation

Shares are richly priced at ~52x tailing P/E and trade at a substantial premium to the GICS Industry peer group on this level. However, the market looks to be expecting big things from the company at 37x forward P/E, itself a circa. 50% premium to the group. Should the market have it correct, it implies NEOG would trade at a premium to peers over the coming 12 months. Shares are also priced at ~3x book and 4.7x sales, each double-digit discounts to peers. At the discount to the industry’s book value, this could present a value opportunity.

Exhibit 6. Multiples and Comps

Data: HB Insights

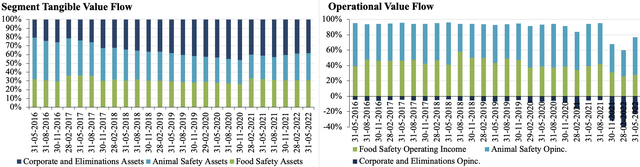

Analyzing further, we see there could be a dislocation in pricing to the upside with the stock trading at ~2.4x enterprise value (“EV”) to book value. As a cleaner measure of corporate value, we see that we’d theoretically pay $19.6 per share for NEOG, suggesting it could be undervalued by ~17%. Hence, we price NEOG at $27 for its fair value.

However, investor return isn’t as attractive. NEOG printed a ROE of $5.6% and FCF ROE of 5.4% on TTM values. However, that’s NEOG’s return on equity – we paid 2.4x equity value, and hence our FCF ROE is just ~2%, widening the equity duration on the investment substantially.

Exhibit 7.

Data: HB Insights Estimates

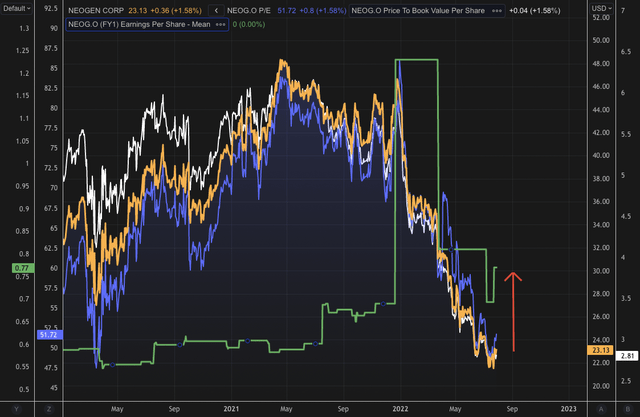

Adding to the valuation front, we see that shares have been diverging from the bottom-line fundamentals, as seen in Exhibit 8 below. Observe how consensus earnings estimates have pulled away from the NEOG share price, which could result in a bullish reversal should the stock re-rate to the upside. We’d be looking for a convergence of share price and multiples towards bottom-line forecasts as an indication of buyers in the market.

Exhibit 8. Shares and multiples diverging away from bottom-line earnings estimates

In short

Despite a period of growth and successful M&A integrations over both Q4 FY22 and FY22 full, our neutral stance remains unchanged on NEOG. Investors have priced in a substantial slowdown in the stock with it down 48% YTD and looking to de-rate further. There are upsides in valuation and a potential disconnect in price to bottom-line growth, however, this is offset by thin investor ROE that suggests the equity duration on NEOG is lengthy and unattractive. Overall, these are qualities that investor’s aren’t paying for in FY22. On the balance of factors presented here, we rate shares Neutral with a PT $27.

Be the first to comment