AscentXmedia/E+ via Getty Images

When I assess an investment prospect, I do so with a longer-term investment horizon in mind. Having said that, from time to time, a company will increase or decrease in value significantly faster than I anticipated. When this does come to pass, I’d like to revisit the firm and see if the fundamental outlook has changed for the better or worse. A great example of this in action can be seen by looking at Columbia Sportswear Company (NASDAQ:COLM), a firm that’s focused on designing, developing, marketing, and distributing outdoor, active, and everyday lifestyle apparel, footwear, accessories, equipment, and other related goods. Driven by robust sales and improved profits and cash flows, shares of the company have continued to rise in recent months. Add on top of this the fact that shares don’t look unrealistically priced at this moment, and I would make the case that, while the easy money has certainly been made, there probably is still some profit potential on the table.

Mr. Market loves Columbia Sportswear

Back in late August of this year, I wrote an article that took a favorable stance on Columbia Sportswear. In that article, I talked about the company’s operating history, which included a general incline in revenue and profitability over the prior few years. At that time, however, the company was demonstrating some weakness for the 2022 fiscal year. But that was based on results covering only two quarters of the year. Despite these issues though, I felt as though shares were fundamentally attractive, particularly when it came to cash flows. I ultimately concluded that the company made for a modest ‘buy’ prospect, meaning that I felt it was an opportunity that would outperform the broader market for the foreseeable future. Since then, the firm has exceeded my own expectations. While the S&P 500 is down by 3.9%, investors in Columbia Sportswear have generated upside of 16.5%.

Given that we have only seen one additional quarter’s worth of data, the cause for this increase seems to be baked in those numbers. Overall for the quarter, revenue for the company came in at $955.1 million. That’s 18.7% higher than the $809.7 million reported the same quarter last year. Had it not been for foreign currency fluctuations, sales would have been even higher at $984.6 million. The greatest growth for the company came from its hallmark Columbia brand name, with sales they are jumping by 19% from $651.5 million to $799.9 million. On a percentage basis, the SOREL brand fared even better, jumping by 28%. But with sales there accounting for only 11.8% of the company’s overall revenue, the upside from a dollar perspective was rather small.

Interestingly, the greatest growth for the company came not from its direct-to-consumer operations but, instead, from its wholesale business. Revenue there jumped by around 24% year-over-year compared to the 8% seen in the direct-to-consumer category. And when it comes to specific product category, the real driver involved footwear, with sales jumping in that category by 25%. According to management, overall sales for the quarter were really driven by higher consumer demand. Unfortunately, management has not offered all that much additional data.

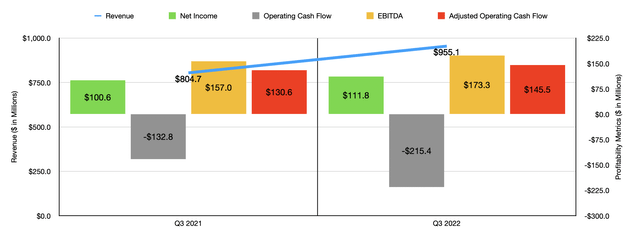

On the bottom line, the picture for the company has also improved. Net income of $111.8 million beat out the $100.6 million reported the same time last year. This is not to say that every profitability metric fared better. Operating cash flow, for starters, Fell from negative $132. 8 million in the third quarter of 2021 to negative $215.4 million the same time this year. But if we adjust for changes in working capital, it would have risen from $130.6 million to $145.5 million. And over that same window of time, EBITDA also increased, climbing from $157 million to $173.3 million.

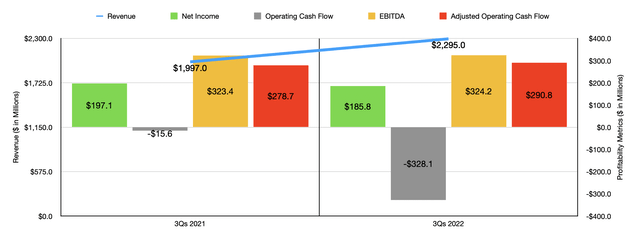

This robust quarter was instrumental in pushing top line results up for the company for the 2022 fiscal year as a whole so far. Revenue in the first nine months of the year, for instance, came in at just under $2.30 billion. This compares favorably to the $2 billion reported the same time last year. At the same time, however, net income has still struggled, declining from $197.1 million to $185.8 million. Just as was the case in the third quarter alone, operating cash flow has been problematic. In the first nine months of the 2021 fiscal year, cash flow came in negative to the tune of $15.6 million. That number the same time this year is negative to the tune of $328.1 million. But if we adjust for changes in working capital, it would still be up slightly, having risen from $278.7 million to $290.8 million. A similar trajectory can be seen when looking at EBITDA, with the metric inching up from $323.4 million to $324.2 million.

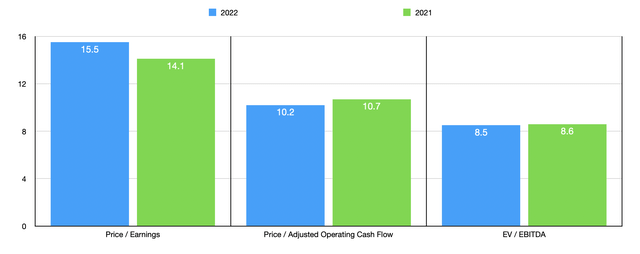

For 2022 as a whole, management expects revenue to come in at between $3.44 billion and $3.50 billion. At the midpoint, that would represent an 11% increase over what the company saw in 2021. Earnings per share, meanwhile, should be between $5 and $5.40. Using midpoint figures here, that would translate to net income for the enterprise of $323.5 million. Meanwhile, if we just annualize results experienced so far this year for the rest of the profitability metrics, we would get adjusted operating cash flow of $489.9 million and EBITDA totaling $568.5 million. Based on these figures, the company is trading at a forward price to earnings multiple of 15.5, at a forward price to adjusted operating cash flow multiple of 10.2, and at a forward EV to EBITDA multiple of 8.5. As you can see in the chart above, shares have gotten cheaper in two of the three ways being looked at. The only way in which they worsened was from a price-to-earnings perspective. As part of my analysis, I did compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 4.6 to a high of 30.7. Ultimately, four of the five companies are cheaper than our target. Meanwhile, using the price to operating cash flow approach, the range was between 7.3 and 68.6. And for the EV to EBITDA approach, the range was between 4.1 and 10.2. In both of these scenarios, three of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Columbia Sportswear Company | 15.5 | 10.2 | 8.5 |

| PVH Corp. (PVH) | 4.6 | 7.3 | 4.1 |

| Under Armour (UAA) | 30.7 | 34.2 | 10.2 |

| Hanesbrands (HBI) | 6.8 | 9.8 | 8.9 |

| Gildan Activewear (GIL) | 8.6 | 10.0 | 7.5 |

| Carter’s (CRI) | 11.4 | 68.6 | 7.2 |

Takeaway

At this moment, I would say that Columbia Sportswear is performing exceptionally well. Having said that, there is some likelihood that bottom line results could worsen, particularly if economic conditions worsen. Relative to similar firms, shares of the enterprise look to be closer to fair value, while on an absolute basis they seem to offer some additional upside. Given the company’s robust performance in these markets, and how affordable shares look on an absolute basis, I would rate the company a very soft ‘buy’ for now.

Be the first to comment