VioletaStoimenova

Donegal Group Inc. (NASDAQ:DGICA) is an insurance holding company that offers property and casualty insurance in 24 Mid-Atlantic, Midwestern, New England, Southern, and Southwestern states.

From 2006 onwards, the annual net premium earned by the company has increased consistently with a compound annual growth rate of 6.5%. The growth is majorly attributed to increased business expansion in the existing market, where the company faces relatively lower competition than its peers.

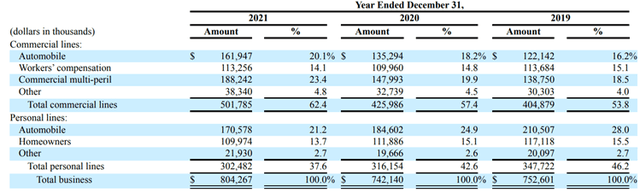

revenue segment (annual report)

Over the period, Donegal has focused on providing commercial and personal line insurance in the secondary or underserved market. As a result, the company could diversify its product mix and focus on high-margin products.

Recently, management has taken vital actions to shift the product mix towards a higher proportion of commercial business, which is expected to provide higher returns along with the opportunity for growth; that is the reason why in the last few years, underwriting revenues from the commercial segment have been increasing.

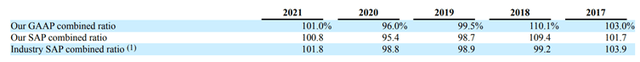

combined ratio (annual report)

Also, to make underwriting results profitable, insurance operators must manage a combined ratio below 100. But in the last few years, due to uncertain conditions, Donegal’s combined ratio has remained at a significantly higher level, which has been bringing significant underwriting losses to the company.

Also, note that the increase in combined ratio might be attributed to the industry headwinds, but it might also show that the underwriting is inefficient in driving profitability.

Furthermore, it should be appreciated that despite significant volatility in the profitability and various economic fluctuations, the stock price remained stable for a very long period.

But due to its slow growth, fairly valued stock price, and significant underwriting losses, the stock might not produce any desirable returns from this price point. However, it can bring considerable risk due to the overall combined ratio rising consistently.

Historical performance

In the last ten years, revenue has increased from $514 million in 2012 to about $816 million by FY 2021, along with that net profit increased from $23 million in 2012 to approximately $52 million by 2020 but again dropped in the last year to about $25 million, also note that over the period net profit margins have been very much volatile; as a result, over the period stock has not generated any significant returns for the shareholders. Along with its slow growth, outstanding shares have been diluted significantly in the last few years, resulting in a considerable reduction in EPS.

Furthermore, the company has to face significant losses over the period due to the higher combined ratio. Still, the company could translate underwriting losses into net profits due to stable and consistent earnings from its investment operations.

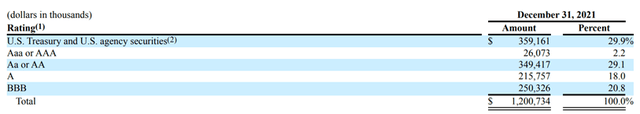

investment securities (annual report)

Also, a large number of Donegal’s funds are invested in the highest-rated investment securities, which provide consistent earnings with a very low risk of capital loss. Therefore, the investor can expect those assets to provide consistent earnings for a very long time, which can help the company to compensate for losses generated from underwriting results.

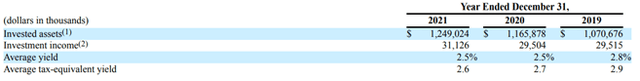

investment returns (annual report)

Although the earnings from investment segments are consistent, the overall yield has remained considerably low compared to various long-term investment securities. Such results might turn out to be unsatisfactory during high inflationary conditions.

The company’s historical performance has remained very much subdued, and has not seen any significant improvements in the business model despite various initiatives led by the management.

Strength in the business model

Although various factors have been impacting the company’s growth, there is a considerable strength in the business model, which is why, despite significant fluctuations in profitability, the stock price remained intact for a very long time.

High shareholdings

The company is led by Donegal Mutual Insurance Company, which holds about 42% of outstanding Class A common stock and approximately 84% of our outstanding Class B common stock. As a result, Donegal Mutual gets about 71% of the combined voting power. And over the period, a significant number of shares have been bought by the management, which shows that management believes in the company’s business model and is working to create long-term value.

Strong ratings

In the insurance business, the company must maintain high FSR ratings to negotiate with reinsurers and insurance holders. As the company is expanding its operations in the commercial segment, where insurance premiums used to be higher, FSR rating matters the most.

Also, due to its long history of operations and significant cash flows, Donegal has got A.M. Best rating of A (Excellent), which shows that the business model is substantially robust. Such an attractive rating gives the business model a competitive advantage over its peers.

Risk factors

Although currently I do not see any significant risk factors apart from the current rise in the combined ratio, there are various concerns that the investors should consider.

As per the management, the company operates with strict underwriting policies and could produce significantly stronger underwriting profits. However, if we look at the loss ratio, the loss has increased dramatically compared to its peers.

Also, the prices of insurance offered by Donegal’s group are considerably lower, and the company could not increase its market share in the existing markets. As a result, the company needs to change its product mix towards commercial insurance.

Recent events

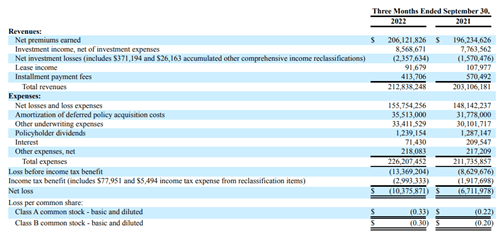

quarterly results (quarterly report)

In the recent quarter, the net premium has seen modest growth, which grew by 4.7% compared to last year, contributing primarily to a higher retention rate and an increase in premium rate.

The overall profitability in the quarter is impacted significantly by severe weather activities and higher claims for fire losses, which greatly increased the loss ratio resulting in a significant loss despite higher investment income. But due to the adequately managed reinsurance policies, the company has maintained its losses at adequate levels.

The business has not seen any significant improvement in the last ten years, despite various initiatives led by the management. Due to the consistently higher combined ratio, which has been bringing huge losses to the business, profitability might not be sustained. Furthermore, the stock price seems fairly valued, and the investment may not yield significant returns for the investors. Therefore, I assign a sell rating to the stock.

Be the first to comment