jetcityimage

Yes, the title is a bit bombastic but not far off from the truth that Tesla, Inc. (NASDAQ:TSLA) shareholders have every right to feel ripped off by Elon Musk’s Twitter distraction. What started out as a distraction merely on his time (and brain) is now severely hurting Tesla investors with constant selling pressure added by the man himself, on top of the pressure faced due to China, COVID, inflation, and general supply chain issues.

To get the obvious out of the way, Musk is completely within his rights and legalities to offload his Tesla shares. But if you you’ve lost count of his sales this year, don’t blame yourself for it. The general noise around his sales, the actual number of sales, and total volume of sales can be quite overwhelming for most of us to keep up. But here is a recap:

Musk Sales Recap

- A poll Musk himself organized at the end of 2021 made clear his intentions to sell shares, although the context was different (tax avoidance). The irony of this in hindsight is that the poll was conducted on Twitter and most of the respondents said “Yes” to the poll question. Little did we know back then that Twitter, the company, and not Musk’s tweets will end up being the (very costly) distraction.

- $4B Billion sale reported in April 2022

- $4 Billion sale reported in November 2022

- And here is the latest $3.6 Billion installment, making the headlines on Seeking Alpha this morning

- Net result? A total of nearly $40 Billion being sold that directly contributed heavily to (a) Tesla losing 60% of its market value and (b) Musk losing his position as World’s richest person. I am quite sure he doesn’t care about the latter but his investors sure do care about the former. When will this carnage stop?

Expect More Selling

Here is the problem as well as the silver-lining for Tesla longs. The short- to medium-term problem is that Musk is still the largest shareholder and Twitter is nowhere close to being on its own without Musk. That means only one thing. Expect more sales in the future. And the silver-lining? That Musk is still the largest shareholder and if and when the Twitter distraction is over, he should be back doing what he does best: creating products that make a difference.

As reported by Fortune:

“Musk’s recent sales shrink his stake in the company to roughly 13%, according to Bloomberg data. Musk, who has been Tesla’s CEO since 2008, is still the largest shareholder. As of Wednesday’s close, he was worth $160.9 billion, ranking No. 2 on the Bloomberg Billionaires Index after France’s Bernard Arnault. His fortune has dropped by $109.4 billion this year.”

What Next?

My long-term conviction in Tesla stays, but the short- to medium-term sentiment is extremely negative. And therein lies the opportunity for the long term. Stocks tend to overshoot in both directions. I did add a little to my position yesterday, but it is going to be bumpy. For those who have a lesser appetite for risk and bumps, I offer the following:

- The stock is already trading at a forward multiple of 37. I don’t mean to repeat myself but need to state the facts. In what world does it make sense for The Clorox Company (CLX) and Tesla to almost trade at the same forward multiple?

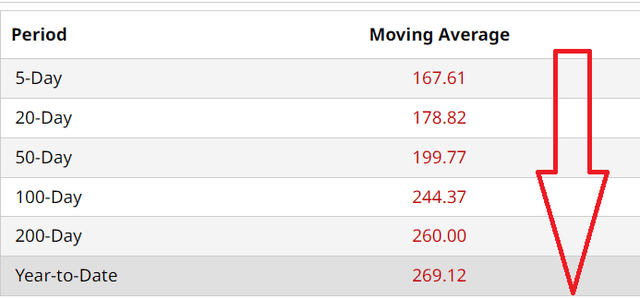

- In fact, it won’t be a surprise to see Tesla trade at lower multiple than Clorox in the next few days given the fundamental and technical pressure faced by the stock. As shown below, the stock is making lower lows continuously as each of the 5-, 20-, 50-, 100, and 200-Day averages are progressively lower. That means a stock under tremendous selling pressure.

TSLA Moving Average (Barchart.com)

- I expect end-of-year tax selling to add further pressure as the year draws to a close. Who would have thought Tesla would be a front runner to be on the tax-loss harvesting list?

- Tesla is still expected to grow at a 48%/yr for the next five years. While competition is undoubtedly catching up, Tesla still has plenty of growth left. For example, Tom Zhu, who led Tesla’s Shanghai factory to become the world’s largest EV plant, is now in charge of the Austin Gigafactory. In case you forgot, it took just a year for the Shanghai plan to go from construction stage to production. If Zhu is able to replicate even partial, if not full, Shanghai success in Austin and other plants down the road, Tesla is unlikely to face production related issues. Supply issues are not in their control though.

- Using the forward multiple of 37 and the expected growth rate of 48, we arrive at PEG ratio of 0.77, which suggests Tesla stock undervaluation. Even if estimates are revised lower as I expect, the ongoing stock sell off is likely to offset that (meaning the undervaluation thesis will likely remain true for some more time).

- From a technical front too, Tesla has breached the oversold zone as shown by a RSI of 29.94 as of this writing.

- Lastly, we may ridicule Cathie Wood all we want, but she has been right about Tesla more often than not. She is taking advantage of the selloff as reported by Seeking Alpha here.

Conclusion

“Buy when there is blood on the street” is an adage frequently used in the investing world. But blood is not something all of us are comfortable with. Some faint on seeing blood. I don’t. Tesla’s stock has seen nothing but blood in the past year and unfortunately, the man who made Tesla what it is today has quite a lot of blood in his hands. Love him or hate him, you cannot ignore him or count him out. It’d be foolish to write Tesla’s eulogy when things look so bleak. That’s when Musk is at his best.

I averaged down on my position yesterday and will likely continue doing so for each 10% low that Tesla makes. Tesla enters 2023 as one of the best Growth at Reasonable Price (“GARP”) stocks that I am tracking.

Be the first to comment