Vincent Besnault

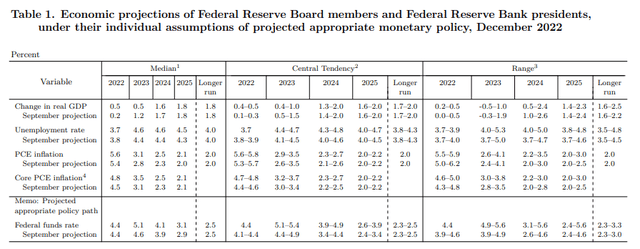

As expected, the Fed raised rates by 50 basis points yesterday bringing short-term interest rates up to a range of 4.25-4.5%. What was unexpected was the lack of acknowledgement in progress on bringing down the rate of inflation over the past two months. Instead, the Fed’s official statement was virtually unchanged from what was released the month before, suggesting that “ongoing increases in the target rate will be appropriate.” The update to its Summary of Economic Projections revealed that members see an additional 75 basis points of rate increases, with some expecting one percentage point or more.

They raised their expectations for economic growth this year from what was expected in September but lowered them for next year, while lowering projections for unemployment this year and raising them for next year. They also increased inflation expectations for both this year and next. Most importantly, the consensus now sees a higher terminal rate for Fed funds, which is up from 4.6% to 5.1%. Despite the hawkish denial of any pivot in policy, the stock market finished the day relatively unscathed. Granted, the major market averages were lower on the day, but they are well above where they started at the beginning of the week.

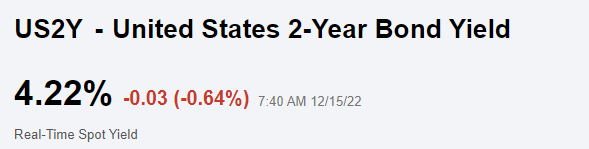

Better yet, the bond market completely snubbed the Fed in terms of 2-year Treasury yields finishing the day unchanged and still down some 20 basis points from the highs the day before. The stock and bond markets are not buying the Fed’s outlook for monetary policy. The Fed is playing poker from the standpoint that members do not want to show investors their hand. If they were to acknowledge the progress made and reflect that in a more dovish projection of policy, it could further loosen financial conditions and undermine that progress. Therefore, they must bluff in order to manage expectations. If I were to buy into their updated projections, I would fold my hand and sell risk assets. I am certainly not.

SeekingAlpha

Following the Fed’s meeting and Chairman Powell’s press conference, consensus expectations for additional rate increases fell from 75 basis points to 50 basis points in the Fed funds futures market. That also runs counter to the Fed’s outlook. I think we will see a third consecutive month of meaningful progress on the inflation front in January, as well as a further loosening of labor conditions, which will reduce rate-hike expectations and give the Fed enough reason to pause on February 1. This should be reflected in stable bond yields and a stock market that refuses to retest its lows.

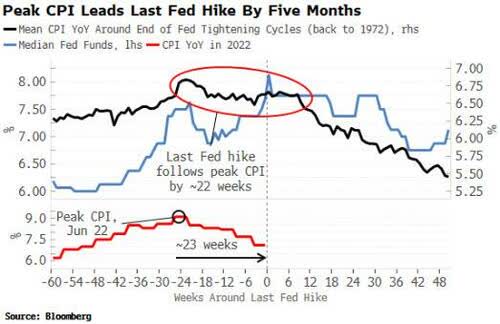

The pictorial of the historical precedent below was forwarded to me by a regular reader of mine, and I thought it to be so compelling that I needed to share it. Since 1972, the Fed has hiked rates for an average of 22 months after the rate of inflation peaked for a cycle. Yesterday’s rate increase was right in between 22 and 23 weeks since the rate of inflation peaked at 9.1% in June of this year. Is that a coincidence?

Bloomberg

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment