FactoryTh

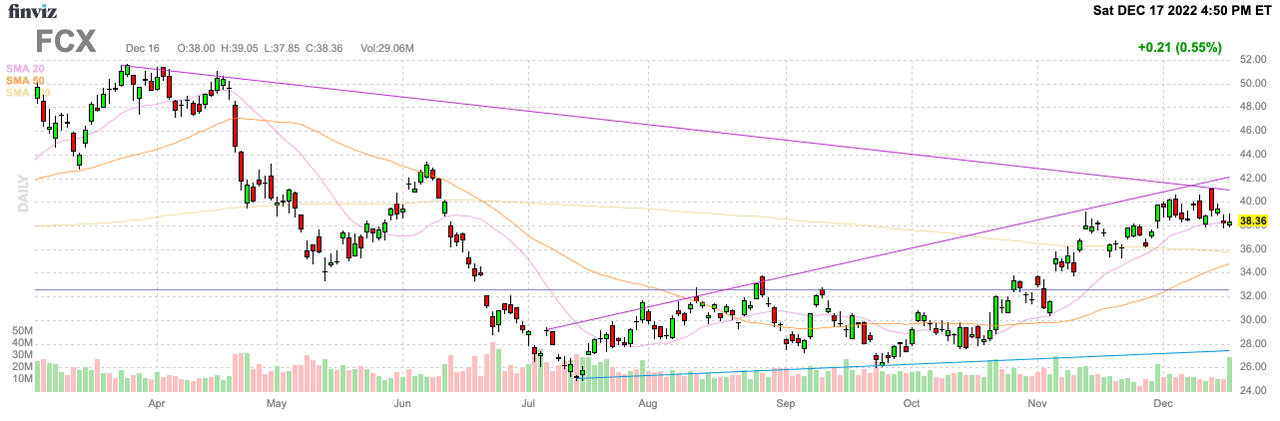

With China heading towards a full reopening from covid lockdowns, copper is likely headed towards a breakout. Freeport-McMoRan (NYSE:FCX) remains one of the best ways to play a copper rebound due to huge EV demand ahead along with natural Chinese demand. My investment thesis remains Bullish on the stock below $40.

Source: FinViz

Next Level Up

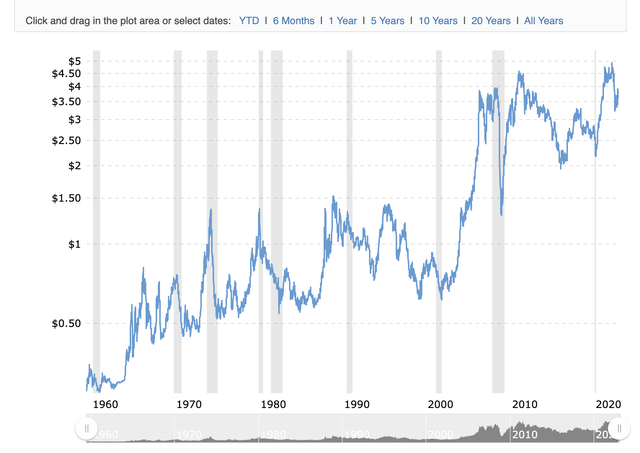

Since just after 2000, copper prices took the next level higher after several decades of trading around $1/lb. Copper has been spent since the mid-2000s trading above $2/lb when the red metal previously would collapse to just $0.50/lb during recessions.

Understanding that copper has trended higher over time is key to realizing that $3/lb is far more sustainable than most thought. In fact, the red metal hasn’t spent much time below $2.50/lb over the last 15+ years.

If anything, the opportunity exists for the surging demand from renewable energy and EV production to push copper prices above $4/lb in the decade ahead. The investment thesis for Freeport-McMoRan dramatically shifts when understanding that copper prices above $3/lb and even above $4/lb become more sustainable.

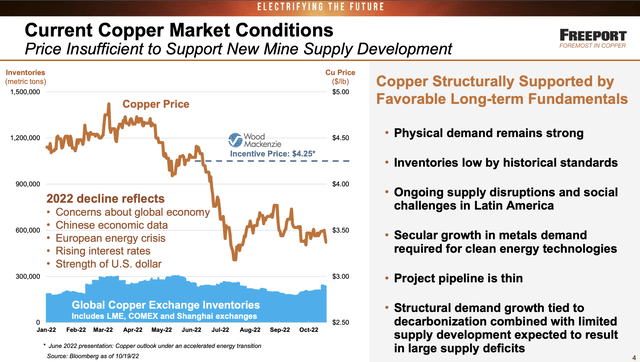

Wood Mackenzie forecasts that copper miners need an incentive price above $4.25/lb to ramp up copper supplies. Not to mention, a lot of the current copper mines are in unstable areas in South American and Africa with constant supply disruptions.

Source: FCX Q3’22 presentation

Even during the weak 2022 with China in covid lockdowns, copper exchange inventories have slumped. Goldman Sachs predicted last year that copper incentive prices needed to reach $4.54/lb, a level at which copper has hardly traded in history.

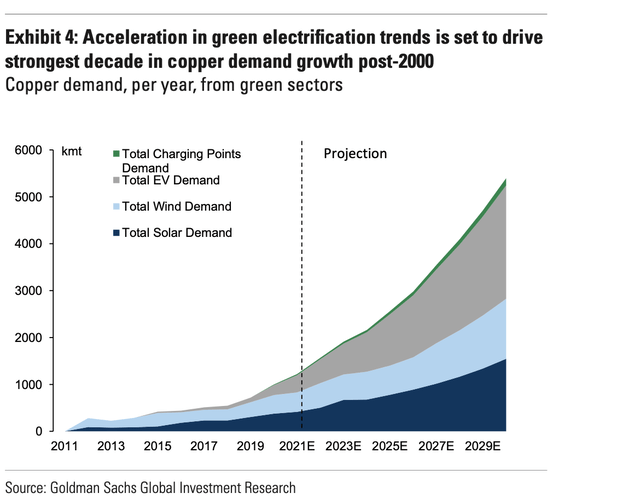

Across EVs, wind, solar, and battery technology, Goldman Sachs predicted copper demand by 2030 will grow nearly 600% to 5.4Mt in the base case and 900% to 8.7Mt in the case of hyper adoption of green technologies. Said another way, the transition to green energy requires a substantial increase in copper supplies.

The case for higher copper prices is very clear. Freeport-McMoRan isn’t valued based on higher copper prices.

$5 Copper Appears Inevitable

The large copper miner makes a ton of money with copper exceeding $3/lb. Freeport-McMoRan forecast cash costs around only $1.55/lb leaving a wide profit margin for the miner.

As discussed above, copper prices have a clear path to reach $4/lb and one should expect prices to top $5/lb in the near future. Freeport-McMoRan forecasts a 2023/24 EBITDA sensitivity of $425 million for each $0.10 change in the price of copper.

Just the jump from $4/lb to $5/lb for copper would produce $4.25 billion in additional EBITDA with a corresponding $3.35 billion boost in operating cash flows. Remember, Freeport-McMoRan only forecasts spending $2.7 billion in capex in 2022 and a $1/lb boost in copper prices would provide the operating cash flows alone to cover those capex costs.

In total, the copper miner is looking at $5/lb copper producing $12+ billion in EBITDA and $10 billion in operating cash flows. Freeport-McMoRan has predicted spending up to $3.3 billion in capex in 2023 with $1.0 billion assigned to discretionary amounts easily cut during a recession.

Even with the booming green energy demand in the decade ahead, the company isn’t aggressively looking to expand capex. Freeport-McMoRan has seen the market cap jump back to $55 billion, but with limited debt the stock only trades at ~4.5x EBITDA for $5/lb copper.

Copper prices definitely aren’t guaranteed to rally to record highs. If not, the stock could face the outcome of the prior decade where the stock price regularly fell to $5 or lower based on collapsing copper prices.

At this point though, investors shouldn’t fear the dire outcomes of the prior decade due to Freeport-McMoRan having minimal net debt of $2.1 billion and knowledge ultimate demand for copper will only explode in the next decade. Regardless, macroeconomic weakness has typically hit copper prices and eventually the stock price of copper miners.

Takeaway

The key investor takeaway is that Freeport-McMoRan is cheap considering the prospects for $5/lb copper considering the price needed to incentivize additional mining supply. The stock faces the risk copper prices fall during a global recession in 2023, but investors should buy Freeport-McMoRan now and load up on any major dips knowing the long-term demand for green energy will pull up copper prices in the future.

Be the first to comment